Mexico Vehicle Financing Market Size, Share, Trends and Forecast by Vehicle Type, Loan Provider, Vehicle Condition, Purpose Type, and Region, 2025-2033

Mexico Vehicle Financing Market Overview:

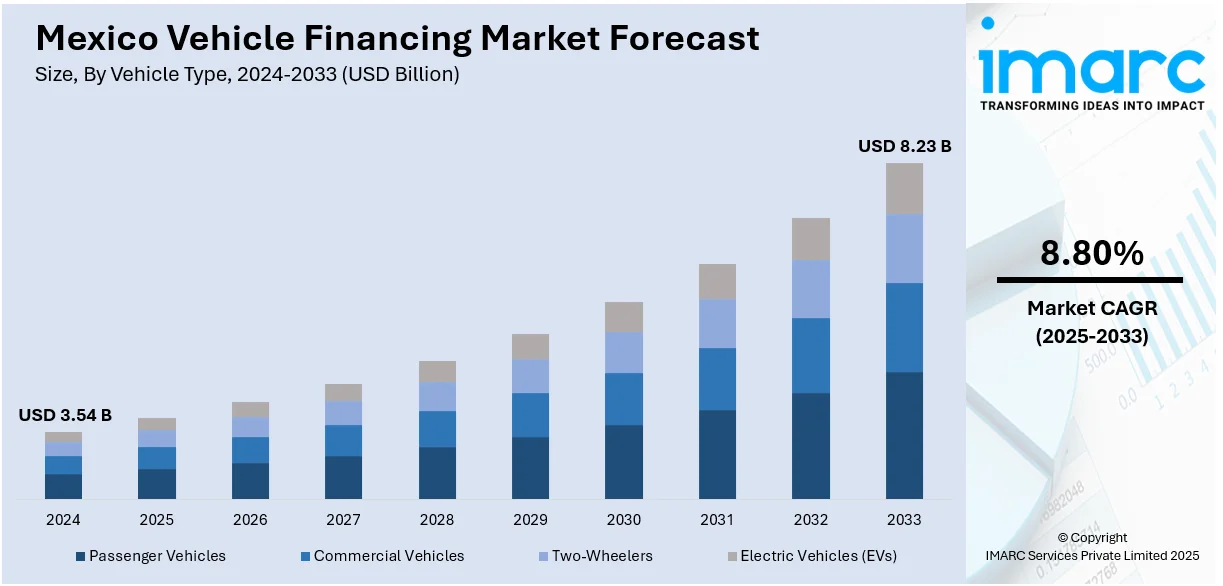

The Mexico vehicle financing market size reached USD 3.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.23 Billion by 2033, exhibiting a growth rate (CAGR) of 8.80% during 2025-2033. The rising penetration of financing solutions for used cars, which are becoming popular among people who are not willing to spend a huge amount is impelling the market growth. This trend, along with the utilization of digital platforms to research, compare, and apply for vehicle loans is contributing to the market growth. Moreover, the implementation of government policies and regulatory framework aimed at enhancing financial inclusion is expanding the Mexico vehicle financing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.54 Billion |

| Market Forecast in 2033 | USD 8.23 Billion |

| Market Growth Rate 2025-2033 | 8.80% |

Mexico Vehicle Financing Market Trends:

Increasing Penetration of Used Vehicle Financing

The market is experiencing growth as a result of the rising penetration of financing solutions for used cars, which are becoming increasingly popular among people who are not willing to spend a huge amount. In a price-sensitive market such as Mexico, most people are turning to pre-owned cars that provide good value for money and satisfy their mobility requirements. Financial institutions are realizing that shift and actively growing their used car loan portfolios by providing competitive interest rates, rapid approval procedures, and little down payment requirements. That trend is especially evident among younger and self-employed individuals who might have difficulty obtaining loans for new cars. Fintech startups and digital platforms are increasingly contributing towards simplifying the documentation and assessment process for financing used cars and making it more accessible and reliable. As the used vehicle ecosystem keeps growing, it is aiding in the extension of the vehicle financing market to a larger extent by addressing an increasing variety of needs.

Strengthening Presence of Digital Financing Platforms

Digitalization is now transforming the vehicle finance landscape in Mexico by facilitating quicker, more streamlined, and customer-friendly lending operations. More people are utilizing digital platforms to research, compare, and apply for vehicle loans, fueled by the rising ubiquity of smartphone ownership and internet penetration. Fintech firms and mainstream banking institutions are investing in digital platforms and mobile applications that offer instant loan approvals, real-time eligibility checks, and artificial intelligence (AI)-based customer service. These technologies not only are improving customer experience but also lowering the cost of operations for lenders. In addition, digital solutions are employed to enhance risk assessment models, thus allowing lenders to offer credit to previously unserved segments. By streamlining application processes and providing greater transparency in loan conditions, online financing platforms are extending the availability of auto loans to rural and far-flung communities. This digital advancement and adoption of fintech solutions are playing a pivotal role in fueling the Mexico vehicle financing market growth. The IMARC Group predicts that the Mexico fintech market is expected to reach USD 65.9 Billion by 2033.

Supportive Government Policies and Regulatory Framework

The vehicle financing sector in Mexico is benefiting from supportive government policies and a progressively strengthening regulatory framework aimed at enhancing financial inclusion. For instance, in 2024, as part of the assignments conferred by President Andrés Manuel López Obrador on Financiera para el Bienestar, the initial phase of Finabien credit distribution was initiated in February, targeting individuals who were recipients of a Tanda para el Bienestar or a Crédito a la Palabra, programs distributed in past years, and those who settled in full. Authorities are continuously promoting credit accessibility through regulatory reforms and incentives that encourage lending to low- and middle-income households. Institutions such as the National Commission for the Protection and Defense of Users of Financial Services (CONDUSEF) are improving transparency and consumer protection, which is instilling greater confidence among borrowers. The government is also collaborating with banks and microfinance institutions to expand financing outreach, particularly in underserved regions. By standardizing credit scoring systems and encouraging fair lending practices, regulators are helping to reduce default risks and ensure long-term sustainability of vehicle loans.

Mexico Vehicle Financing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, loan provider, vehicle condition, and purpose type.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Electric Vehicles (EVs)

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, two-wheelers, and electric vehicles (EVs).

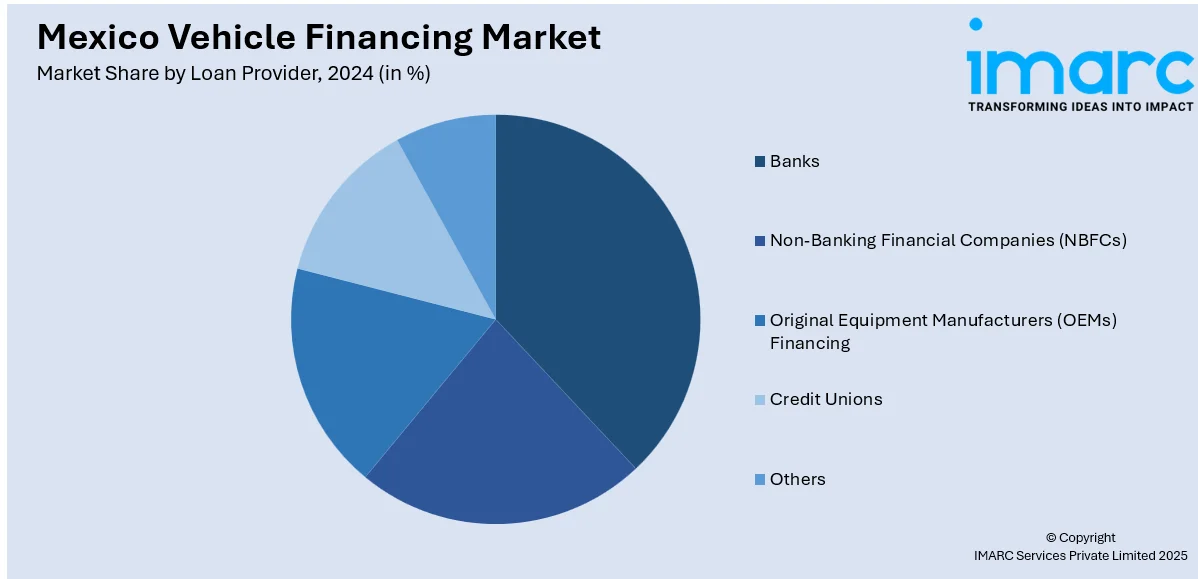

Loan Provider Insights:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Original Equipment Manufacturers (OEMs) Financing

- Credit Unions

- Others

The report has provided a detailed breakup and analysis of the market based on the loan provider. This includes banks, non-banking financial companies (NBFCs), original equipment manufacturers (OEMs) financing, credit unions, and others.

Vehicle Condition Insights:

- New Vehicles

- Used Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle condition. This includes new vehicles and used vehicles.

Purpose Type Insights:

- Loan

- Leasing

A detailed breakup and analysis of the market based on the purpose type have also been provided in the report. This includes loan and leasing.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Vehicle Financing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Electric Vehicles (EVs) |

| Loan Providers Covered | Banks, Non-Banking Financial Companies (NBFCs), Original Equipment Manufacturers (OEMs) Financing, Credit Unions, Others |

| Vehicle Conditions Covered | New Vehicles, Used Vehicles |

| Purpose Types Covered | Loan, Leasing |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico vehicle financing market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico vehicle financing market on the basis of vehicle type?

- What is the breakup of the Mexico vehicle financing market on the basis of loan provider?

- What is the breakup of the Mexico vehicle financing market on the basis of vehicle condition?

- What is the breakup of the Mexico vehicle financing market on the basis of purpose type?

- What is the breakup of the Mexico vehicle financing market on the basis of region?

- What are the various stages in the value chain of the Mexico vehicle financing market?

- What are the key driving factors and challenges in the Mexico vehicle financing market?

- What is the structure of the Mexico vehicle financing market and who are the key players?

- What is the degree of competition in the Mexico vehicle financing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico vehicle financing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico vehicle financing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico vehicle financing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)