Mexico Vehicle Leasing Market Size, Share, Trends and Forecast by Type, Mode of Bookings, and Region, 2026-2034

Mexico Vehicle Leasing Market Summary:

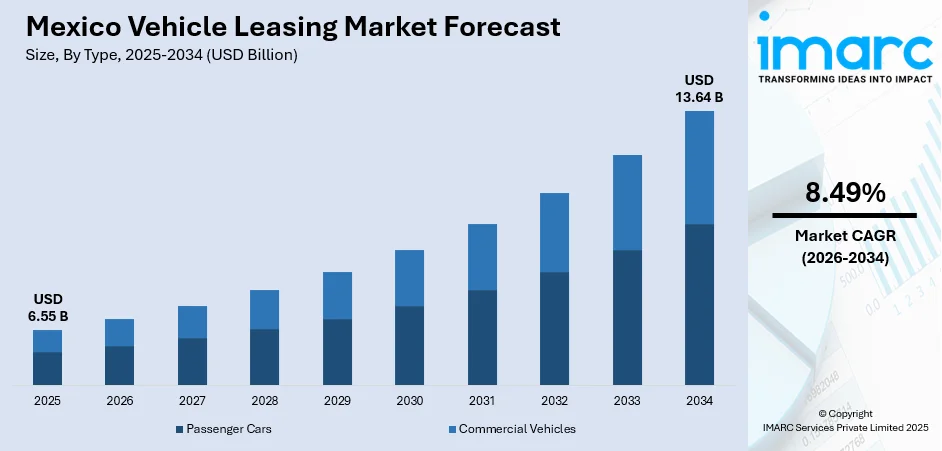

The Mexico vehicle leasing market size was valued at USD 6.55 Billion in 2025 and is projected to reach USD 13.64 Billion by 2034, growing at a compound annual growth rate of 8.49% from 2026-2034.

The Mexico vehicle leasing market is experiencing significant momentum as consumers and businesses increasingly seek flexible, cost-effective alternatives to traditional vehicle ownership. Digital transformation is reshaping the industry landscape, with fintech-driven platforms simplifying leasing processes and attracting tech-savvy customers through online services and tailored offerings. Growing demand for convenience and mobility is encouraging innovative models like vehicle subscriptions that bundle maintenance and insurance. Corporate fleet optimization and the rising gig economy are further propelling demand, collectively strengthening the Mexico vehicle leasing market share.

Key Takeaways and Insights:

-

By Type: Passenger cars lead the market with 68% share in 2025, driven by strong corporate fleet demand, employee benefit programs, and personal mobility preferences across Mexico's expanding urban centers.

-

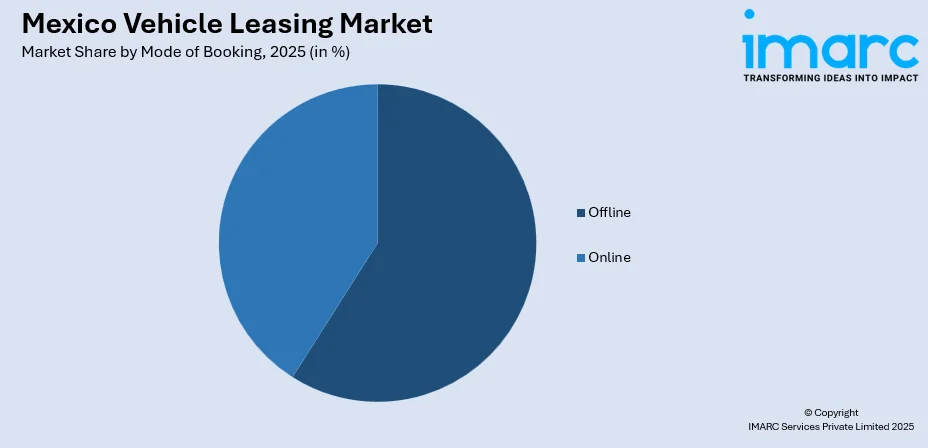

By Mode of Booking: Offline booking dominates with 59% market share in 2025, reflecting the continued importance of traditional dealership relationships and in-person consultations, though digital channels are gaining traction rapidly.

-

By Region: Central Mexico represents the largest share at 38% in 2025, anchored by Mexico City's concentration of multinational corporations, financial institutions, and extensive commercial activity.

-

Key Players: The Mexico vehicle leasing market features established fleet management companies, OEM-affiliated lessors, fintech startups, and nonbank financial companies competing through diversified service portfolios, digital innovation, and strategic partnerships.

To get more information on this market Request Sample

The Mexico vehicle leasing market is advancing as economic shifts, rising interest rates, and changing consumer preferences drive adoption of leasing over traditional ownership. The Mexican Association of Vehicle Distributors (AMDA) reported that leasing companies acquired 28,213 vehicles through credit in the first half of 2023, representing a remarkable 35% growth compared to 20,830 vehicles in the same period of 2021. This transformation is supported by government incentives, including tax deductibility of up to 86% for electric and hybrid vehicles introduced in May 2024, which enhance the value proposition for environmentally conscious lessees and fleet operators seeking sustainable mobility solutions.

Mexico Vehicle Leasing Market Trends:

Digital Transformation and Fintech Integration

The Mexico vehicle leasing sector is undergoing rapid digital transformation as fintech companies and online platforms revolutionize customer experiences. The Mexico fintech market size reached USD 20.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 65.9 Billion by 2033, exhibiting a growth rate (CAGR) of 12.80% during 2025-2033. New market participants are adopting end-to-end digital leasing models that streamline the entire process, from vehicle selection and contract execution to delivery. These platforms are designed to simplify access to leased vehicles, particularly for flexible and short-term users, by offering transparent pricing, bundled services such as maintenance and insurance, and minimal paperwork. Such digitally enabled approaches are improving convenience, reducing onboarding time, and broadening the appeal of vehicle leasing among non-traditional customer segments.

Shift from Ownership to Usership

Mexican consumers are increasingly moving away from traditional car ownership in favor of vehicle leasing, as it offers greater flexibility and improved financial management. Leasing reduces the upfront financial burden, making it easier for individuals to access newer vehicles without committing large amounts of capital. This trend is further supported by a challenging economic environment, where buyers are seeking alternatives to long-term credit obligations. By lowering initial costs and simplifying budgeting, leasing is emerging as an attractive mobility solution for cost-conscious consumers across the country.

Emergence of Vehicle Subscription Models

Vehicle subscription platforms are gaining traction in Mexico as a contemporary alternative to traditional ownership and leasing. According to the industry reports, 46% of Mexican respondents aged 18 to 34 prefer flexible subscription models, surpassing the United States at 44% and Japan at 38%. These platforms provide users the flexibility to change vehicles over time with monthly fees that typically include insurance, servicing, and maintenance, appealing particularly to urban consumers who prioritize convenience.

Market Outlook 2026-2034:

The market growth is expected to be driven by continued digital transformation, expanding corporate fleet demand from e-commerce and logistics sectors, and increasing integration of electric vehicles into leasing portfolios. The market will benefit from government sustainability initiatives, evolving consumer preferences toward flexible mobility solutions, and strategic investments by established players and new entrants alike. The market generated a revenue of USD 6.55 Billion in 2025 and is projected to reach a revenue of USD 13.64 Billion by 2034, growing at a compound annual growth rate of 8.49% from 2026-2034.

Mexico Vehicle Leasing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Passenger Cars | 68% |

| Mode of Booking | Offline | 59% |

| Region | Central Mexico | 38% |

Type Insights:

- Passenger Cars

- Commercial Vehicles

Passenger cars lead the market with 68% share of the total Mexico vehicle leasing market in 2025.

Passenger cars lead the market share in the Mexico vehicle leasing market due to their broad appeal across individual, corporate, and fleet users. Leasing provides an affordable pathway for consumers to access personal vehicles without the high upfront costs associated with ownership, making passenger cars a preferred choice for urban commuters and middle-income households. For businesses, leased passenger cars are widely used for employee transportation, sales operations, and executive mobility, supporting steady demand from the corporate sector.

In addition, rapid urbanization and traffic congestion in major cities increase the need for compact and fuel-efficient passenger vehicles that are easier to operate and maintain. Leasing also allows users to upgrade vehicles more frequently, aligning with growing preferences for newer models equipped with advanced safety, connectivity, and fuel-efficiency features. The availability of flexible lease tenures, bundled services such as maintenance and insurance, and simplified replacement options further strengthens the dominance of passenger cars. Together, these factors make passenger vehicles the most practical and widely adopted segment within Mexico’s vehicle leasing market.

Mode of Booking Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline booking dominates the market with a 59% share of the total Mexico vehicle leasing market in 2025.

Offline booking represents the largest share in the Mexico vehicle leasing market, primarily due to strong consumer preference for in-person interactions when making high-value financial commitments. Many customers value face-to-face consultations to better understand lease terms, pricing structures, and contractual obligations, especially when agreements involve long durations and recurring payments. Physical dealerships and leasing offices also provide opportunities to inspect vehicles, assess quality, and clarify concerns directly with sales representatives, which builds trust and reduces perceived risk.

Additionally, a significant portion of consumers still relies on traditional documentation processes and personalized assistance to navigate eligibility requirements, credit assessments, and compliance procedures. Offline channels also cater effectively to small businesses and fleet operators that prefer negotiated terms and customized leasing solutions. Limited digital literacy among certain consumer groups and inconsistent access to reliable online platforms further reinforce the dominance of offline booking. As a result, established physical networks continue to play a central role in facilitating leasing transactions across Mexico.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico represent the largest market share at 38% of the total Mexico vehicle leasing market in 2025.

Several factors are supporting the growth of the Mexico vehicle leasing market, particularly in Central Mexico, where economic activity and population density are high. Rising living costs and cautious consumer spending have increased interest in alternatives to vehicle ownership, with leasing offering lower upfront commitments and predictable expenses. Urban expansion and higher vehicle usage in major cities are also encouraging individuals and businesses to seek flexible mobility solutions that reduce financial strain while ensuring reliable transportation.

In addition, Central Mexico’s strong concentration of commercial hubs, manufacturing units, and service-sector businesses is driving demand for leased vehicles to support daily operations and logistics. Leasing enables companies to scale fleets efficiently without long-term capital investment. The availability of bundled services such as maintenance, insurance, and vehicle replacement further enhances convenience. Changing mobility preferences, particularly among younger professionals seeking flexibility and access to newer models, are also reinforcing leasing adoption across the region.

Market Dynamics:

Growth Drivers:

Why is the Mexico Vehicle Leasing Market Growing?

Rising Demand for Flexible Leasing Solutions

The Mexico vehicle leasing market is experiencing robust growth driven by increasing demand for flexible lease contracts that accommodate diverse individual and corporate needs. Private and business leases are expanding across customer segments, from personal use to corporate fleets, with flexible terms enabling consumers to respond to changing requirements without the financial burden of vehicle ownership. The Mexican Vehicle Leasing Association (AMAVE) projects fleet leasing could grow by 10% in 2025, driven by increased demand from sectors including pharmaceuticals, retail, cargo, transportation, last-mile delivery, and government. In Q1 2025, AMAVE recorded 330,776 new car registrations, adding more than 8,000 new units compared to Q4 2024, representing 3.5% quarterly growth.

Integration of Electric Vehicles into Leasing Portfolios

The inclusion of electric and hybrid vehicles in leasing portfolios is opening new growth avenues as sustainability gains importance among businesses and individual users. Corporate fleets are increasingly prioritizing low-emission vehicles to meet environmental goals, while consumers are showing greater interest in cleaner mobility options. Supportive policy measures and fiscal incentives are improving the cost attractiveness of leasing green vehicles compared with conventional models. At the same time, expanding charging infrastructure and improved vehicle availability are making electric and hybrid leasing more practical, encouraging wider adoption across major urban markets. The Mexico electric vehicle charging station market size reached USD 253.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,302.8 Million by 2033, exhibiting a growth rate (CAGR) of 30.51% during 2025-2033.

Expanding E-commerce and Gig Economy

The rapid expansion of e-commerce platforms and the gig economy is driving substantial demand for vehicle leasing solutions tailored to delivery and logistics operations. Major e-commerce companies like Mercado Libre and Amazon are expanding their presence in Mexico, requiring flexible vehicle access for their growing logistics networks. Fintech companies are developing innovative leasing products specifically for gig workers, with OCN operating across 22 Mexican states and serving over 25,000 customers with weekly rentals that include maintenance and insurance, along with purchase options after 36 months. This convergence of e-commerce growth and flexible financing solutions is creating new market segments.

Market Restraints:

What Challenges the Mexico Vehicle Leasing Market is Facing?

Deep-rooted Ownership Culture

A strong preference for ownership over usership remains a key barrier to vehicle leasing in Mexico. Many consumers view car ownership as a symbol of status and personal achievement, making leasing less attractive despite financial pressures. This mindset leads buyers to prioritize owning a vehicle even when long-term commitments are demanding, limiting the widespread adoption of leasing as a flexible and practical mobility solution compared with markets where access-based usage is more common.

Economic Uncertainty and Interest Rate Volatility

High interest rates and economic uncertainty continue to impact the affordability and attractiveness of vehicle financing options, including leasing. While leasing can offer lower monthly payments than traditional purchases, volatile economic conditions and currency fluctuations affect pricing and lease terms. Recent spikes in vehicle prices and credit rates have created financial pressures, though these same factors are simultaneously driving some consumers toward leasing as a more manageable alternative.

Limited Consumer Awareness and Education

Insufficient understanding of leasing benefits among potential customers continues to constrain market growth. Many consumers are unfamiliar with the financial advantages, flexibility, and tax benefits that leasing can provide compared to traditional vehicle purchases. Industry stakeholders recognize the need for strategic product planning and consumer education to unlock the significant growth potential that exists in the Mexican market.

Competitive Landscape:

The Mexico vehicle leasing market is characterized by a diverse and competitive landscape, including traditional fleet management firms, OEM-affiliated lessors, bank-backed providers, and emerging technology-driven platforms. Competition is intensifying as digitally focused companies introduce innovative solutions that streamline leasing processes, enhance customer experience, and offer flexible mobility options. Strategic collaborations and integrated service offerings are increasingly important for differentiation, enabling providers to deliver comprehensive solutions such as fleet optimization, consulting, and sustainable mobility options. This evolving competitive environment is driving innovation, improving service efficiency, and expanding the appeal of vehicle leasing across both corporate and individual customer segments.

Recent Developments:

-

September 2025: VEMO secured USD 250 million in funding led by Vision Ridge Partners to accelerate clean mobility expansion in Mexico. The company plans to install more than 20,000 charging connectors in public and private networks and deploy over 50,000 electric vehicles across its ride-sharing and commercial fleet operations in Mexico City, Guadalajara, and Monterrey.

-

June 2025: TIP México and VEMO announced a strategic partnership to accelerate electric fleet adoption in Mexico. The collaboration combines TIP México's fleet leasing expertise with VEMO's clean mobility capabilities to offer operational and technical consulting services for businesses transitioning to electric vehicles.

Mexico Vehicle Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger Cars, Commercial Vehicles |

| Mode of Bookings Covered | Online, Offline |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico vehicle leasing market size was valued at USD 6.55 Billion in 2025.

The market is expected to grow at a compound annual growth rate of 8.49% from 2026-2034 to reach USD 13.64 Billion by 2034.

Passenger cars dominate the market with 68% share in 2025, driven by strong corporate fleet demand, employee benefit programs, and personal mobility preferences across Mexico's expanding urban centers.

Key factors driving the Mexico vehicle leasing market include rising demand for flexible leasing solutions, integration of electric vehicles into leasing portfolios with government tax incentives, expanding e-commerce and gig economy, digital transformation through fintech platforms, and corporate fleet modernization.

Major challenges include deep-rooted ownership culture limiting leasing adoption, economic uncertainty and interest rate volatility affecting affordability, limited consumer awareness about leasing benefits, and competition from traditional financing options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)