Mexico Venture Capital Investment Market Size, Share, Trends and Forecast by Sector, Fund Size, Funding Type, and Region, 2025-2033

Mexico Venture Capital Investment Market Overview:

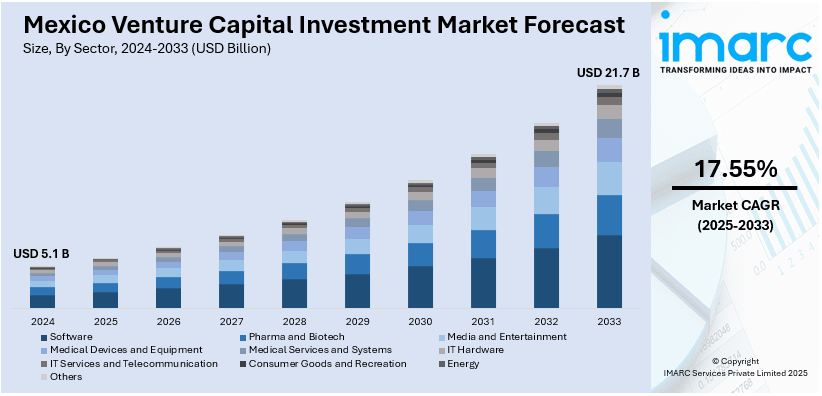

The Mexico venture capital investment market size reached USD 5.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.7 Billion by 2033, exhibiting a growth rate (CAGR) of 17.55% during 2025-2033. A growing startup ecosystem, increased fintech and e-commerce activity, supportive government initiatives, rising internet penetration, a young tech-savvy population, cross-border investor interest, and improved regulatory frameworks fostering innovation and access to early-stage funding are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.1 Billion |

| Market Forecast in 2033 | USD 21.7 Billion |

| Market Growth Rate 2025-2033 | 17.55% |

Mexico Venture Capital Investment Market Trends:

Increased Cross-Border Investment Flow

There has been a noticeable increase in investments flowing into the country's market, driven by enhanced collaboration between neighboring countries. Business leaders from both sides have emphasized the growing importance of regional trade agreements in fostering economic growth. This shift signals greater confidence in the country’s market potential, as strategic trade relationships continue to play a key role in attracting capital. The heightened focus on mutual economic benefits is expected to generate new opportunities, particularly in sectors poised to thrive from these strengthened ties. As investments continue to rise, the country’s role as an emerging hub for innovation and business development becomes more pronounced, with significant growth potential across various industries. This boost in cross-border capital is set to further elevate the country’s competitiveness in the global market. For example, in October 2024, the Mexican president announced USD 20 Billion in new investments during an event with American and Mexican business leaders, emphasizing the importance of the US-Mexico-Canada trade agreement.

Growth in Industrial Real Estate Investment

There has been a notable rise in venture capital investment in Mexico’s industrial real estate sector, with a growing focus on high-quality industrial developments. Institutional investors are increasingly attracted to the country's expanding logistics and manufacturing sectors, driving substantial capital commitments. This investment surge is fueled by Mexico's strategic location, robust trade agreements, and favorable economic conditions. With a steady increase in e-commerce and supply chain demands, the market is witnessing more joint ventures and partnerships between local and global investors. This shift highlights the sector's strong growth potential and its appeal as a key asset class, indicating sustained investor confidence and interest in Mexico's industrial real estate development. For instance, in October 2024, Industrial Gate, TC Latin America Partners' industrial platform, formed a USD 450 Million joint venture with a global institutional investor to develop Class A industrial properties in Mexico.

Mexico Venture Capital Investment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on sector, fund size, and funding type.

Sector Insights:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes software, pharma and biotech, media and entertainment, medical devices and equipment, medical services and systems, IT hardware, IT services and telecommunication, consumer goods and recreation, energy, and others.

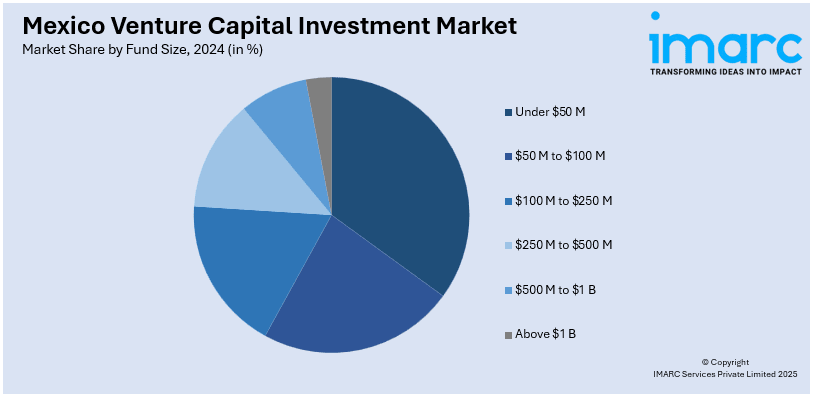

Fund Size Insights:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- $250 M to $500 M

- $500 M to $1 B

- Above $1 B

The report has provided a detailed breakup and analysis of the market based on the fund size. This includes under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, and above $1 B.

Funding Type Insights:

- First Time Venture Funding

- Follow-On Venture Funding

A detailed breakup and analysis of the market based on the funding type have also been provided in the report. This includes first time venture funding and follow-on venture funding.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Venture Capital Investment Market News:

- In November 2024, the Japan International Cooperation Agency (JICA) signed an investment agreement with Dalus Group LLC to support startups in Latin America and the Caribbean, aiming to improve access to finance and promote the startup ecosystem in Mexico.

Mexico Venture Capital Investment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, Others |

| Fund Sizes Covered | Under $50 M, $50 M to $100 M, $100 M to $250 M, $250 M to $500 M, $500 M to $1 B, Above $1 B |

| Funding Types Covered | First Time Venture Funding, Follow-On Venture Funding |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico venture capital investment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico venture capital investment market on the basis of sector?

- What is the breakup of the Mexico venture capital investment market on the basis of fund size?

- What is the breakup of the Mexico venture capital investment market on the basis of funding type?

- What are the various stages in the value chain of the Mexico venture capital investment market?

- What are the key driving factors and challenges in the Mexico venture capital investment?

- What is the structure of the Mexico venture capital investment market and who are the key players?

- What is the degree of competition in the Mexico venture capital investment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico venture capital investment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico venture capital investment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico venture capital investment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)