Mexico Video Surveillance Systems Market Size, Share, Trends and Forecast by System Type, Component, Application, Enterprise Size, Customer Type, and Region, 2025-2033

Mexico Video Surveillance Systems Market Overview:

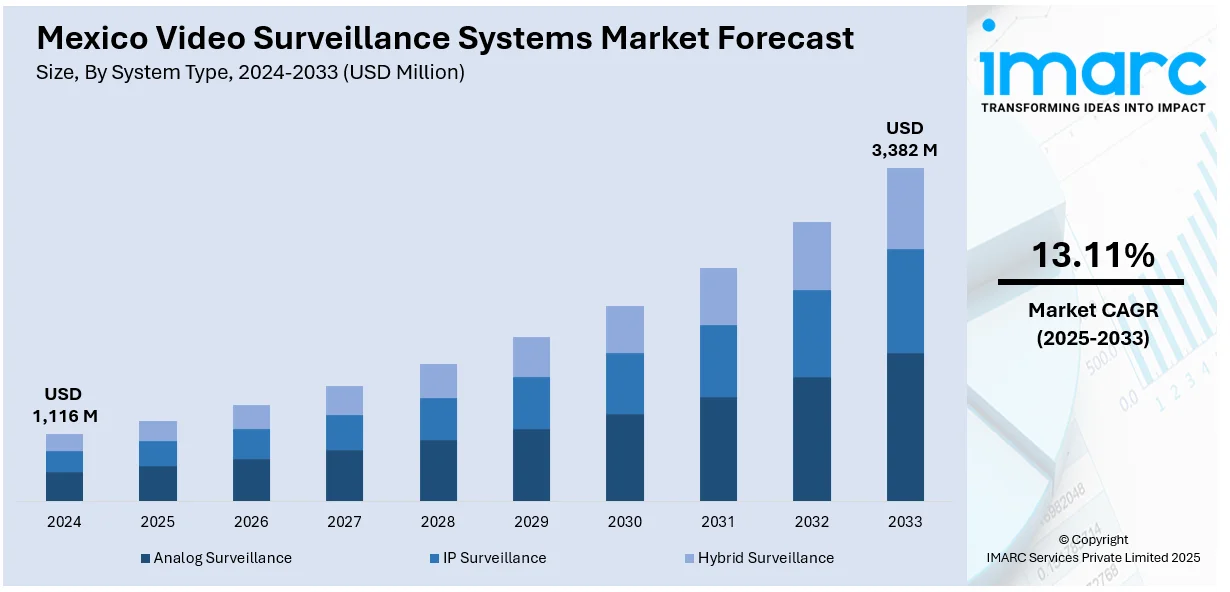

The Mexico video surveillance systems market size reached USD 1,116 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,382 Million by 2033, exhibiting a growth rate (CAGR) of 13.11% during 2025-2033. The market is driven by rising security concerns, increasing crime rates, and government investments in public safety. In addition to this, continual technological advancements, such as AI and cloud-based solutions, smart city initiatives, growing adoption by SMEs and improved internet infrastructure are some of the key factors facilitating Mexico video surveillance market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,116 Million |

| Market Forecast in 2033 | USD 3,382 Million |

| Market Growth Rate 2025-2033 | 13.11% |

Mexico Video Surveillance Systems Market Trends:

Increasing Adoption of AI-Powered Surveillance Systems

With the rise of sophisticated security and operational effectiveness, the market has been showing high demand for AI-based solutions. Private and public organizations are increasingly implementing smart surveillance systems with features such as facial identification, plate recognition, and behavior analysis. Such solutions are enhancing real-time threat detection and reducing dependence on human monitoring making them ideal for high-security locations, including airports, banks, and metropolitan centers. Furthermore, AI integration facilitates predictive analytics, helping organizations deter crimes prior to their occurrence. The rise in smart city initiatives across Mexico, particularly in major urban areas, is further augmenting the Mexico video surveillance market share. Mexico City installed the largest video surveillance system in the Americas in 2023, which included over 64,000 cameras, with a target of increasing it to 80,000 by 2024. The system, which was originally started in 2009 with only 8,000 cameras, has faced a series of criticisms, such as technical failures, wrongful arrests, and privacy issues, among others. Nevertheless, Mexico persists in enhancing its surveillance capabilities, with cities such as Puebla, Guadalajara, and Monterrey also adopting similar measures. As AI technology becomes more affordable and accessible, small and medium-sized enterprises (SMEs) are also adopting these solutions, contributing to market expansion. Vendors are focusing on developing cost-effective, scalable AI surveillance systems to cater to this rising demand.

Shift Toward Cloud-Based Video Surveillance Solutions

Cloud-based video surveillance systems are gaining traction in Mexico due to their scalability, remote accessibility, and cost-efficiency. Traditional on-premise systems require significant upfront investments in hardware and maintenance, whereas cloud solutions offer flexible subscription models with lower operational costs. Businesses, especially in retail, logistics, and healthcare, are increasingly adopting cloud-based surveillance for real-time monitoring and data storage from any location. On January 14, 2025, AWS Relocate Region (Mexico) announced three availability zones for improving the local infrastructure of advanced cloud systems. The region, which spans out to a USD 5 Billion investment over the next 15 years, offers low-latency services and enhanced AI/ML capabilities, such as scalable security and surveillance solution toolkits. This new expansion enables AWS to facilitate Mexico's growing digital economy and meet the rising demand for secure, cloud-managed video surveillance. Moreover, the growing penetration of high-speed internet and 5G networks is further creating a positive Mexico video surveillance market outlook. Additionally, cloud platforms provide enhanced cybersecurity features, such as encrypted data transmission and automated backups, addressing concerns about data breaches. Government regulations promoting digital transformation and public safety investments are also encouraging the adoption of cloud surveillance. As a result, both local and international vendors are expanding their cloud-based offerings, making advanced surveillance more accessible to a broader range of end-users in Mexico.

Mexico Video Surveillance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on system type, component, application, enterprise size, and customer type.

System Type Insights:

- Analog Surveillance

- IP Surveillance

- Hybrid Surveillance

The report has provided a detailed breakup and analysis of the market based on the system type. This includes analog surveillance, IP surveillance, and hybrid surveillance.

Component Insights:

- Hardware

- Software

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and services.

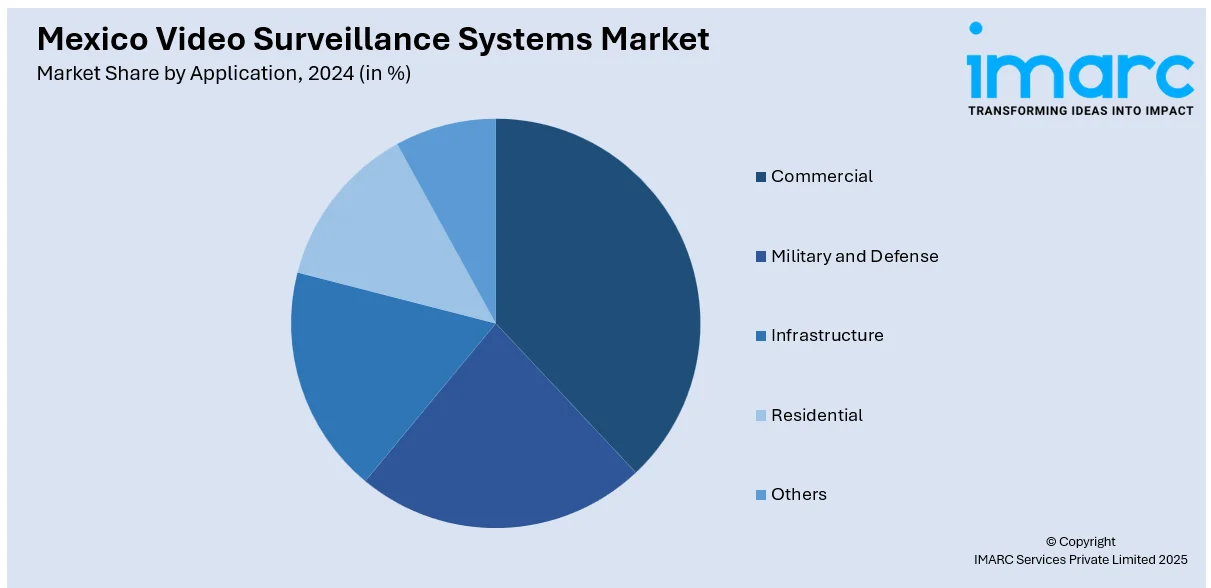

Application Insights:

- Commercial

- Military and Defense

- Infrastructure

- Residential

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, military and defense, infrastructure, residential, and others.

Enterprise Size Insights:

- Small Scale Enterprise

- Medium Scale Enterprise

- Large Scale Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small scale enterprise, medium scale enterprise, and large scale enterprise.

Customer Type Insights:

- B2B

- B2C

The report has provided a detailed breakup and analysis of the market based on the customer type. This includes B2B and B2C.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Video Surveillance Systems Market News:

- September 11, 2024: Motive launched a new AI-enhanced security solution that helps fleet operators in Mexico leverage 360° video surveillance using AI-enabled cameras to combat cargo theft and increase driver safety. It includes real-time alerts and live video streaming, as well as advanced monitoring tools, which aim to combat the rising rates of cargo theft in Mexico, where a transport vehicle is stolen approximately every 38 minutes. Motive has an anti-fog feature that grants the best-quality view, even in moist conditions. At the same time, its cloud-based functionalities can address the rising need for effective and scalable video surveillance in the logistics and transportation market segment in Mexico.

- June 04, 2024: AxxonSoft implemented an advanced unified video management system in the Mexico City International Airport, installing over 3,000 surveillance cameras, including 800 nIP cameras. The system integrates 1,400 existing cameras along with AI-based analytics such as facial recognition and license plate recognition to provide complete, real-time protection of terminals and the airport perimeter. This solution enhances the airport's ability to detect and respond to security threats, addressing Mexico's growing demand for smart surveillance solutions.

Mexico Video Surveillance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Analog Surveillance, IP Surveillance, Hybrid Surveillance |

| Components Covered | Hardware, Software, Services |

| Applications Covered | Commercial, Military and Defense, Infrastructure, Residential, Others |

| Enterprise Sizes Covered | Small Scale Enterprise, Medium Scale Enterprise, Large Scale Enterprise |

| Customer Types Covered | B2B, B2C |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico video surveillance systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico video surveillance systems market on the basis of system type?

- What is the breakup of the Mexico video surveillance systems market on the basis of component?

- What is the breakup of the Mexico video surveillance systems market on the basis of application?

- What is the breakup of the Mexico video surveillance systems market on the basis of enterprise size?

- What is the breakup of the Mexico video surveillance systems market on the basis of customer type?

- What is the breakup of the Mexico video surveillance systems market on the basis of region?

- What are the various stages in the value chain of the Mexico video surveillance systems market?

- What are the key driving factors and challenges in the Mexico video surveillance systems market?

- What is the structure of the Mexico video surveillance systems market and who are the key players?

- What is the degree of competition in the Mexico video surveillance systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico video surveillance systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico video surveillance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico video surveillance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)