Mexico Vinyl Flooring Market Size, Share, Trends and Forecast by Product Type, Sector, and Region, 2025-2033

Mexico Vinyl Flooring Market Overview:

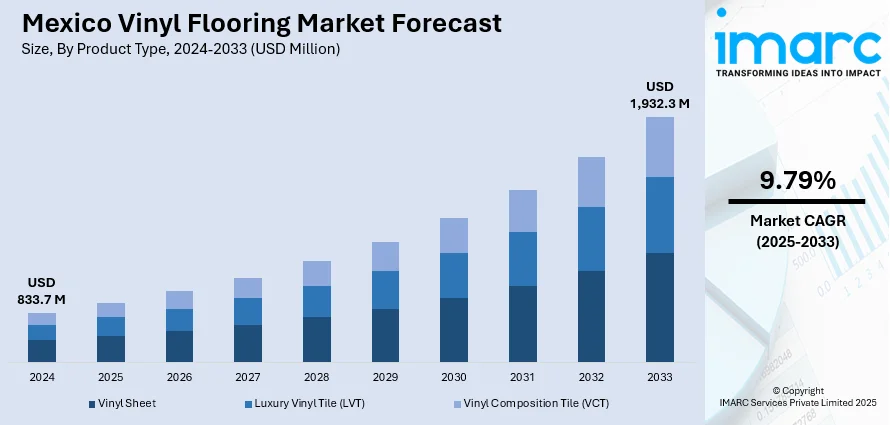

The Mexico vinyl flooring market size reached USD 833.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,932.3 Million by 2033, exhibiting a growth rate (CAGR) of 9.79% during 2025-2033. Expanding residential and commercial infrastructure, rising demand in hospitality and retail sectors, preference for cost-effective flooring, technological innovations in vinyl products, sustainable manufacturing practices, improved distribution networks, and enhanced consumer engagement tools are some of the factors that are influencing the market positively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 833.7 Million |

| Market Forecast in 2033 | USD 1,932.3 Million |

| Market Growth Rate 2025-2033 | 9.79% |

Mexico Vinyl Flooring Market Trends:

Residential and Commercial Infrastructure Development

The market has witnessed substantial demand from the residential and commercial construction segments. A growing number of housing projects supported by federal and state-level initiatives continue to reshape urban infrastructure, particularly in metropolitan areas. Private developers are also playing a critical role in transforming suburban zones into densely populated residential hubs. On November 21, 2024, the International Finance Corporation (IFC) announced a USD 301 Million financing package to support the Vinte Green PCG Project, aimed at expanding access to affordable, energy-efficient housing in Mexico. The investment will enable Vinte to acquire and integrate Javer, a major real estate developer, while scaling up sustainable housing developments aligned with green building standards. This initiative reflects the accelerating pace of residential infrastructure expansion in Mexico, directly contributing to broader development activity. Within this context, the cost-efficiency and low maintenance of vinyl flooring have made it a preferred choice among property developers. Furthermore, the growing preference for modern aesthetics and customizable flooring solutions has increased adoption in high-end housing and luxury apartment complexes. The ability of vinyl flooring to replicate the appearance of natural wood or stone at a significantly reduced cost has also enhanced its attractiveness among middle-income households and property management firms. In the commercial sector, demand is accelerating across office buildings, retail environments, and hospitality venues, driven by renovations and expansions. These industries increasingly value the durability, acoustic insulation, and stain resistance of vinyl flooring, which enables them to maintain high-traffic areas with minimal upkeep. The Mexico vinyl flooring market share has been further supported by procurement policies favoring easy-to-install and water-resistant materials in healthcare facilities, restaurants, and educational institutions. These preferences have encouraged domestic manufacturers to diversify their product offerings across segments.

Technological Advancements and Product Innovations in Flooring Solutions

Innovations in manufacturing processes and product design have significantly reshaped the competitive landscape for vinyl flooring in Mexico. Producers are investing in new technologies such as rigid core vinyl, click-lock mechanisms, and high-definition printing, which enhance product performance and expand aesthetic options. These advancements not only meet consumer expectations for visual appeal but also improve ease of installation, moisture resistance, and surface texture. In parallel, sustainability-driven R&D has led to the creation of environmentally friendly vinyl tiles and planks using recycled materials and low-VOC adhesives, aligning with Mexico’s increasing emphasis on green construction practices. On December 6, 2024, Copenhagen Infrastructure Partners announced that construction will begin within two years on a USD 10 Billion green hydrogen project in Mexico, with the plant expected to be operational by 2028. Backed by the Mexican government, the project is one of the largest clean energy infrastructure investments in the region. This shift in product development continues to differentiate brands in a market where design and sustainability increasingly influence purchasing decisions. The Mexico vinyl flooring market growth has also been reinforced by improved supply chain capabilities, including faster lead times and wider distribution networks. Manufacturers and distributors are collaborating with e-commerce platforms and specialty retailers to improve availability across second- and third-tier cities. Enhanced customer engagement through digital visualization tools and in-store mock-ups has also influenced end-user decision-making. These developments not only help reduce installation errors and post-sale service costs but also strengthen brand loyalty. With evolving buyer preferences and technological integration, vendors are now tailoring offerings by sector, location, and budget requirements, thereby expanding customer reach and market penetration. Mexico vinyl flooring market outlook continues to be shaped by these integrated improvements across design, production, and logistics functions.

Mexico Vinyl Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and sector.

Product Type Insights:

- Vinyl Sheet

- Luxury Vinyl Tile (LVT)

- Vinyl Composition Tile (VCT)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vinyl sheet, luxury vinyl tile (LVT), and vinyl composition tile (VCT).

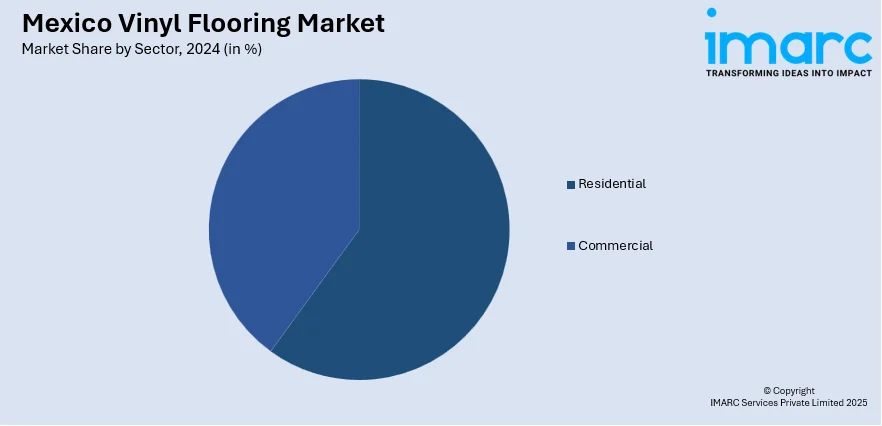

Sector Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the sector. This includes residential and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Vinyl Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vinyl Sheet, Luxury Vinyl Tile (LVT), Vinyl Composition Tile (VCT) |

| Sectors Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico vinyl flooring market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico vinyl flooring Market on the basis of product type?

- What is the breakup of the Mexico vinyl flooring Market on the basis of sector?

- What is the breakup of the Mexico vinyl flooring Market on the basis of region?

- What are the various stages in the value chain of the Mexico vinyl flooring market?

- What are the key driving factors and challenges in the Mexico vinyl flooring market?

- What is the structure of the Mexico vinyl flooring market and who are the key players?

- What is the degree of competition in the Mexico vinyl flooring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico vinyl flooring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico vinyl flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico vinyl flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)