Mexico Warehouse Management Systems Market Size, Share, Trends and Forecast by Component, Deployment, Function, Application, and Region, 2025-2033

Mexico Warehouse Management Systems Market Overview:

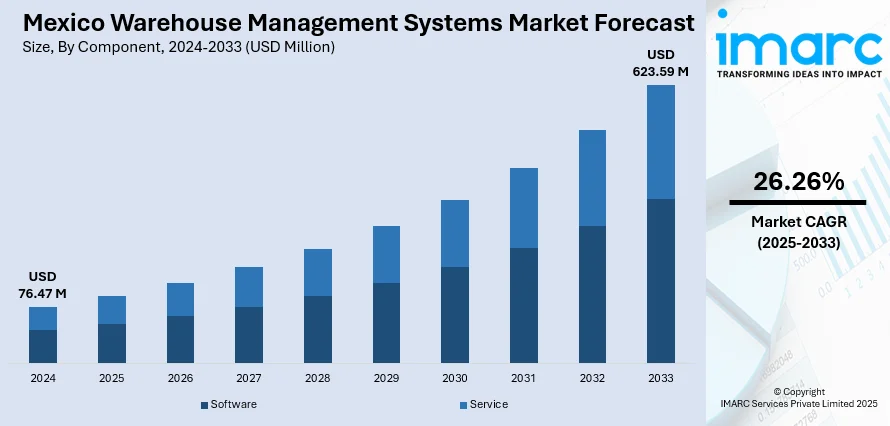

The Mexico warehouse management systems market size reached USD 76.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 623.59 Million by 2033, exhibiting a growth rate (CAGR) of 26.26% during 2025-2033. The market is witnessing significant momentum as businesses in Mexico are implementing automation technologies to program warehouse operations. Moreover, growth in e-commerce activity is constantly changing the face of logistics in Mexico. This, along with the trend of nearshoring and the strengthening of cross-border trade is expanding the Mexico warehouse management systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 76.47 Million |

| Market Forecast in 2033 | USD 623.59 Million |

| Market Growth Rate 2025-2033 | 26.26% |

Mexico Warehouse Management Systems Market Trends:

Adopting Automation and Digital Transformation in Warehousing Operations

The market is witnessing significant momentum at present as businesses in Mexico are increasingly implementing automation technologies to program warehouse operations. Companies are implementing warehouse management systems (WMS) to reduce manual errors, enhance inventory accuracy, and increase overall operational efficiency. With the increasing pressure to deliver orders faster and more accurately, particularly in industries such as retail, e-commerce, and manufacturing, warehouses are implementing automated picking systems, real-time tracking solutions, and artificial intelligence (AI)-based analytics. The trend is driven by the requirement to eliminate labor dependency, reduce turnaround times, and enable multi-channel distribution models. In addition, digital transformation efforts led by private initiatives as well as government-sponsored programs are making it possible for small and medium-sized businesses (SMEs) to upgrade their current systems. Consequently, WMS implementation is becoming a strategic imperative and not an indulgence, assisting organizations to remain competitive in a rapidly changing logistics scenario. In 2024, Locus Robotics, the major firm in autonomous mobile robots (AMR) for fulfillment warehouses, declared a novel implementation with GEODIS, one of the world's leading logistics providers, to introduce enhanced performance, next-generation robotics automation in Mexico to pack ecommerce and retail orders for a large global fashion brand.

Expanding E-commerce and Retail Distribution Networks

The growth in e-commerce activity is constantly changing the face of logistics in Mexico, directly impacting the need for sophisticated WMS. E-commerce giants, domestic marketplaces, and third-party logistics (3PL) companies are expanding their distribution hubs to support increasing volumes of orders and customer demands for fast deliveries. To address this, organizations are implementing WMS solutions to handle high-volume inventory movement, coordinate multi-location warehouses, and improve last-mile delivery capabilities. Retailers are increasingly combining WMS with customer relationship management (CRM) and enterprise resource planning (ERP) setups to achieve real-time visibility and actionable insights. Moreover, the spread of omnichannel retailing is requiring smooth inventory control and returns management, which are well taken care of by contemporary WMS platforms. This expansion is also being supported by infrastructure development in urban and semi-urban areas, allowing for efficient logistics hubs that depend on technologically advanced WMS. In 2024, Symbotic Inc., a market chief in A.I.-powered robotics technology for the supply chain, declared that it has signed commercial contracts with Walmart de México y Centroamérica to roll out Symbotic's best-of-breed warehouse automation systems at two of the retailer's facilities near Mexico City.

Strengthening Cross-Border Trade and Nearshoring Trends

The rising trend of nearshoring and the strengthening of cross-border trade is impelling the Mexico warehouse management systems market growth. As global supply chains are being recalibrated due to geopolitical tensions and rising production costs, multinational companies are relocating manufacturing and assembly operations closer to Mexican markets. This shift is driving demand for sophisticated warehousing solutions capable of supporting complex logistics needs, including just-in-time (JIT) inventory systems and compliance with international trade standards. WMS platforms are increasingly being used to coordinate inbound and outbound logistics, improve customs documentation accuracy, and reduce transit times. In border states such as Baja California and Nuevo León, new warehousing facilities are being equipped with state-of-the-art WMS to handle the influx of goods efficiently. The strategic location of Mexico, coupled with trade agreements like the USMCA, is driving the need for agile and scalable warehouse management infrastructures.

Mexico Warehouse Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment, function, and application.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Insights:

- On-premise

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes on-premise and cloud.

Function Insights:

- Labor Management System

- Analytics and Optimization

- Billing and Yard Management

- Systems Integration and Maintenance

- Consulting Services

The report has provided a detailed breakup and analysis of the market based on the function. This includes labor management system, analytics and optimization, billing and yard management, systems integration and maintenance, and consulting services.

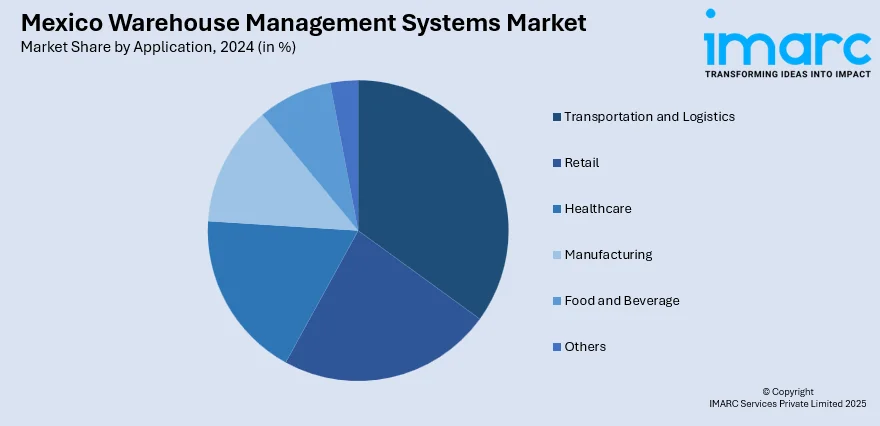

Application Insights:

- Transportation and Logistics

- Retail

- Healthcare

- Manufacturing

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transportation and logistics, retail, healthcare, manufacturing, food and beverage, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Warehouse Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployments Covered | On-premise, Cloud |

| Functions Covered | Labor Management System, Analytics and Optimization, Billing and Yard Management, Systems Integration and Maintenance, Consulting Services |

| Applications Covered | Transportation and Logistics, Retail, Healthcare, Manufacturing, Food and Beverage, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico warehouse management systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico warehouse management systems market on the basis of component?

- What is the breakup of the Mexico warehouse management systems market on the basis of deployment?

- What is the breakup of the Mexico warehouse management systems market on the basis of function?

- What is the breakup of the Mexico warehouse management systems market on the basis of application?

- What is the breakup of the Mexico warehouse management systems market on the basis of region?

- What are the various stages in the value chain of the Mexico warehouse management systems market?

- What are the key driving factors and challenges in the Mexico warehouse management systems market?

- What is the structure of the Mexico warehouse management systems market and who are the key players?

- What is the degree of competition in the Mexico warehouse management systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico warehouse management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico warehouse management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico warehouse management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)