Mexico Waste Plastic Recycling Market Size, Share, Trends and Forecast by Treatment, Material, Application, Recycling Process, and Region, 2026-2034

Mexico Waste Plastic Recycling Market Summary:

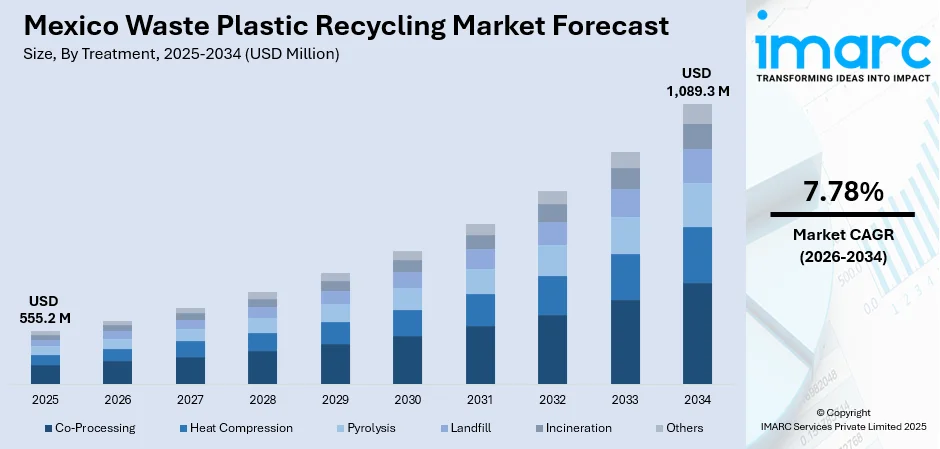

The Mexico waste plastic recycling market size was valued at USD 555.2 Million in 2025 and is projected to reach USD 1,089.3 Million by 2034, growing at a compound annual growth rate of 7.78% from 2026-2034.

The Mexico waste plastic recycling market is experiencing notable growth driven by accelerating environmental awareness and tightening regulatory frameworks promoting circular economy practices. Increasing investments in advanced recycling technologies, expanding end-user demand from packaging and automotive sectors, and corporate sustainability commitments are reshaping the competitive landscape. The convergence of government policy initiatives, private-sector infrastructure investments, and technological innovations is fundamentally transforming waste management practices, creating substantial opportunities for market participants and strengthening the market growth.

Key Takeaways and Insights:

- By Treatment: Landfill dominates the market with a share of 40% in 2025, driven by the predominance of traditional waste disposal methods across municipal systems, limited advanced processing infrastructure in rural regions, and cost considerations that favor conventional approaches over sophisticated treatment alternatives.

- By Material: Polyethylene Terephthalate (PET) leads the market with a share of 30% in 2025, owing to established collection networks, and superior recyclability characteristics enabling bottle-to-bottle processing.

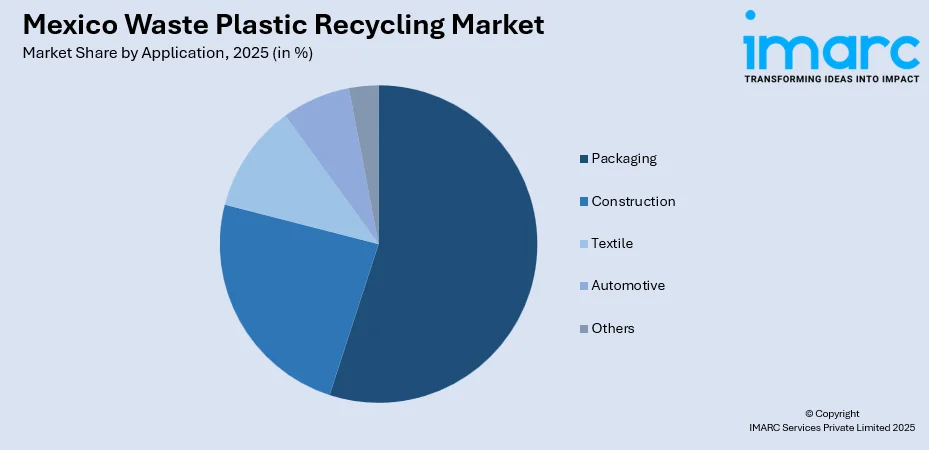

- By Application: Packaging represents the largest segment with a market share of 55% in 2025. This dominance is because of extensive adoption of recycled plastics in food and beverage containers, the growing corporate sustainability commitments from consumer goods companies, and regulatory mandates requiring recycled content in packaging materials.

- By Recycling Process: Mechanical dominates the market with a share of 90% in 2025, reflecting established infrastructure, proven cost-effectiveness, and widespread industry familiarity with conventional processing methods across Mexico's recycling value chain.

- Key Players: The Mexico waste plastic recycling market displays moderate competitive intensity, with domestic recyclers competing alongside international technology providers. Participants are focusing on expanding capacity, adopting advanced recycling technologies, and forming strategic partnerships to enhance their market positions and support growth in the evolving recycling landscape.

To get more information on this market Request Sample

The growth of the Mexico waste plastic recycling market is driven by increasing environmental awareness and the need for sustainable waste management practices. With rising concerns about plastic pollution, both individuals and businesses are seeking solutions to reduce waste and promote recycling. In addition, community recycling initiatives are increasing waste collection efficiency and fostering local participation in sustainable waste management practices, thereby contributing to waste reduction and resource recovery efforts. for example, in 2025, Arca Continental, in collaboration with Coca-Cola Mexico and the Municipality of Saltillo, inaugurated two new community recycling stations in the city. With an investment of nearly 600,000 pesos, the stations will collect various materials, including PET plastic, aluminum, and paper, helping reduce landfill waste. Furthermore, technological advancements in recycling processes, such as improved sorting, chemical recycling, and enhanced efficiency in waste collection, are making plastic recycling more cost-effective and scalable.

Mexico Waste Plastic Recycling Market Trends:

Rise of the Circular Economy Model

The circular economy model emphasizes reducing waste by reusing materials and recycling products at the end of their lifecycle. This approach helps minimize reliance on raw materials, reduces waste generation, and lowers environmental impact. As businesses and governments increasingly adopt this model, recycling processes are improving, enhancing the efficiency of plastic waste recovery and transforming it into valuable raw materials. For instance, in 2025, the Mexican startup Petgas launched an innovative project in Boca del Rio, Veracruz, using pyrolysis to convert plastic waste into valuable fuels like gasoline and diesel. With the capacity to process 1.5 tons of plastic weekly, Petgas contributes to both local energy needs and the circular economy, providing an effective solution for plastic waste.

Technological Advancements in Recycling Processes

Innovations like improved sorting systems, chemical recycling, and more efficient separation techniques are significantly enhancing plastic recycling, making it both more effective and cost-efficient. These technological advancements allow for the recovery of higher-quality plastic, increasing the industry’s capacity to process a wider range of plastic waste. As a result, businesses can now recycle more complex plastic materials, driving the demand for recycling services. For instance, in 2024, IFC and Greenback announced a strategic partnership to advance the circular economy in Mexico. The collaboration aimed to process up to 90,000 tons of plastic waste annually using Greenback's advanced recycling technology, transforming flexible plastics into reusable materials like pyrolytic oil. This project supported sustainability efforts across Mexico and Latin America, fostering both environmental and economic benefits.

Expansion of Recycling Infrastructure

The growth of recycling infrastructure is a critical factor influencing the market, as investments in new and expanded recycling plants enhance material processing capacity, improve efficiency, and create job opportunities. By advancing recycling capabilities, businesses and governments can better address rising waste challenges, reduce landfill contributions, and stimulate local economies. A notable example is PetStar's 2025 expansion of its food-grade PET recycling plant in Toluca, Mexico, with a MXN 2.6 billion investment. This expansion will increase the plant's capacity to 86,000 tons per year, boosting Mexico’s role in global sustainable PET bottle recycling while creating thousands of new jobs.

Market Outlook 2026-2034:

The Mexico waste plastic recycling market is experiencing strong growth, driven by irreversible regulatory trends and increasing corporate sustainability commitments. As environmental concerns rise, both government policies and business initiatives are focusing on reducing plastic waste and promoting recycling. The market generated a revenue of USD 555.2 Million in 2025 and is projected to reach a revenue of USD 1,089.3 Million by 2034, growing at a compound annual growth rate of 7.78% from 2026-2034. This growth reflects the nation's commitment to sustainability and waste reduction.

Mexico Waste Plastic Recycling Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Treatment | Landfill | 40% |

| Material | PET | 30% |

| Application | Packaging | 55% |

| Recycling Process | Mechanical | 90% |

Treatment Insights:

- Co-Processing

- Heat Compression

- Pyrolysis

- Landfill

- Incineration

- Others

Landfill dominates with a market share of 40% of the total Mexico waste plastic recycling market in 2025.

Landfill represents the largest segment, driven by its widespread availability and established infrastructure. Landfill continues to be an essential part of waste management, ensuring efficient disposal of non-recyclable plastics.

Moreover, landfilling plays a key role in managing large volumes of waste while the country develops its recycling infrastructure. As awareness and technological advancements in waste management grow, Mexico is gradually integrating more sustainable practices, such as converting landfill materials into energy or repurposing waste for other uses.

Material Insights:

- Poly Vinyl Chloride (PVC)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

Polyethylene terephthalate (PET) leads with a market share of 30% of the total Mexico waste plastic recycling market in 2025.

Polyethylene terephthalate (PET) dominates the market, because of its widespread use in consumer packaging, particularly for beverages and food products. PET's recyclability and demand for repurposed material in various industries make it a key focus for recycling efforts.

Furthermore, PET's established infrastructure and high recycling rate contribute to its dominance. The growing user awareness and demand for sustainable materials are significantly driving the adoption of PET recycling, a commitment clearly exemplified by the 2024 launch of the "Con Todo Por Favor" recycling program in Monterrey by Arca Continental, Coca-Cola Mexico, and PetStar, which promoted proper PET disposal and feeds into the world's largest food-grade PET recycling plant.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Construction

- Textile

- Automotive

- Others

Packaging exhibits a clear dominance with a 55% share of the total Mexico waste plastic recycling market in 2025.

Packaging leads the market owing to the high volume of plastic packaging materials used in consumer goods. Items like bottles, containers, and wrappers generate significant plastic waste, making packaging the primary target for recycling efforts.

Additionally, the rising adoption of eco-friendly packaging practices and compliance with environmental regulations are effectively driving plastic packaging recycling efforts, which is evident in Mexico's 2025 announcement that it had recovered 34% of plastic packaging in 2024, successfully exceeding its 2025 target. This progress was highlighted in the Fifth Annual Report of the National Agreement for the New Plastic Economy, which included the participation of 77 companies contributing to over half of Mexico's plastic packaging market.

Recycling Process Insights:

- Mechanical

- Others

Mechanical dominates with a market share of 90% of the total Mexico waste plastic recycling market in 2025.

Mechanical represents the largest segment due to its cost-effectiveness and well-established processes. This method involves physically breaking down plastics into smaller pieces, making it an efficient way to recycle various plastic materials, including PET and HDPE.

The widespread accessibility of mechanical recycling facilities in Mexico is being further supported by major industry players focused on innovative solutions, such as ExxonMobil's participation in PLASTIMAGEN MEXICO 2025, where they showcased technologies like Vistamaxx™ and Exxtend™ to enhance both advanced and mechanical recycling processes.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico sees significant adoption of waste plastic recycling due to its established industrial infrastructure. The region’s growing urbanization and manufacturing sectors are catalyzing the demand for recycling solutions, contributing to a higher recycling rate.

Central Mexico, including cities like Mexico City, is witnessing increased recycling efforts as urbanization and individual awareness grow. The region's large population and concentration of businesses encourage the development of recycling programs, boosting waste plastic management and environmental sustainability.

Southern Mexico is gradually adopting waste plastic recycling practices as infrastructure development and environmental awareness expand. The growing governmental and community efforts are improving waste management, driving the demand for better recycling solutions.

Others are seeing steady improvements in waste plastic recycling as rural and suburban areas gain access to better recycling facilities. As awareness and local infrastructure grow, recycling rates are increasing, further supporting sustainable waste management.

Market Dynamics:

Growth Drivers:

Why is the Mexico Waste Plastic Recycling Market Growing?

Increasing Environmental Awareness and Regulations

As awareness about the environmental impacts of plastic waste grows, both individuals and businesses are increasingly supporting recycling initiatives. In response, the governing body is implementing stringent regulations on plastic waste management, encouraging the expansion of the recycling industry. These regulations require businesses to adopt sustainable practices, such as plastic recycling, to reduce landfill waste and minimize pollution. This is driving the demand for recycling services and technologies across the country. A key example is the Mexico Plastics Pact (PPMX), launched in 2024, which brought together 18 stakeholders, including companies, governments, and civil society, to promote a circular economy for plastics and support national policies aimed at plastic waste reduction.

Corporate Sustainability Initiatives

Corporate mandates for sustainability are influencing the market, as businesses in sectors like manufacturing, retail, and packaging strengthen their environmental commitments. These companies are investing in advanced recycling infrastructure and developing eco-friendly packaging solutions to increase the use of recycled materials. This strategic approach not only enhances their environmental credentials but also drives the demand for recycled plastic feedstock. A notable example is Nestlé México, which in 2025 announced that 93.9% of its plastic packaging is now recyclable, nearing its global goal of 95%. This achievement reflects the company’s ongoing efforts to promote a circular economy, driving further growth in Mexico’s waste plastic recycling market.

Industry Collaboration and Knowledge Sharing

The Mexico waste plastic recycling market is propelled by robust industry collaboration and strategic knowledge sharing initiatives. Dedicated conferences and sector-specific events foster essential networking and facilitate the exchange of best practices regarding technological and regulatory advancements. This collective intelligence accelerates innovation and promotes the widespread adoption of sustainable practices across the entire plastics value chain. This crucial interaction was exemplified by the 20th LAPET Circular Plastics Packaging LATAM conference which took place in Mexico City on November 13-14 2024. The event provided valuable insights into the circular plastics value chain like the latest developments in recycling technology and global regulatory frameworks thus strengthening the market through improved industry-wide solutions and strategic partnerships.

Market Restraints:

What Challenges the Mexico Waste Plastic Recycling Market is Facing?

Inadequate Waste Collection and Processing Infrastructure

Infrastructure gaps pose a significant challenge to the growth of the recycling market in Mexico. Despite improvements in collection systems, a large portion of waste, particularly plastic, is not effectively recycled due to inefficiencies in processing and inadequate compliance with regulations. Many disposal sites fail to meet regulatory standards, causing valuable materials to either end up in landfills or be lost, preventing them from entering formal recycling streams and hindering the overall market's development.

Price Gap Between Virgin and Recycled Materials

Economic barriers persist as virgin plastic raw materials remain substantially cheaper than recycled alternatives, limiting broader adoption of recycled content in manufacturing processes. This price disparity undermines recycling economics and discourages investment in processing infrastructure despite the growing environmental awareness. Without regulatory mandates or tax incentives equalizing cost structures, many manufacturers continue favoring virgin material inputs.

Informal Waste Management Sector Integration Challenges

Mexico's substantial informal recycling sector, comprising thousands of waste pickers operating without contracts, insurance, or social protection, presents integration challenges complicating market formalization. Informal collection prevents materials from entering formal recycling systems while exposing vulnerable workers to hazardous conditions. Balancing formalization efforts with livelihood protection requires careful policy design and sustained investment.

Competitive Landscape:

The Mexico waste plastic recycling market exhibits moderate competitive intensity characterized by domestic recycling operators competing alongside international technology providers and multinational corporations expanding regional presence. Market dynamics reflect strategic positioning ranging from large-scale food-grade PET processing facilities to specialized advanced recycling technology deployments. Competition is increasingly shaped by technology partnerships, infrastructure investments, and capability expansion into previously non-recyclable plastic streams. Corporate sustainability commitments from major brand owners are driving demand for certified recycled content, creating opportunities for processors demonstrating traceability and quality assurance capabilities. Strategic alliances between international development institutions and technology providers are introducing advanced recycling solutions while established players expand capacity through facility upgrades and geographic expansion.

Recent Developments:

- In December 2025, Aduro Clean Technologies and ECOCE announced their collaboration to advance recycling of flexible plastic packaging in Mexico. This multi-year partnership aims to evaluate Aduro's Hydrochemolytic™ Technology (HCT) for recycling challenging mixed plastics into valuable liquid hydrocarbons. The project, focused on addressing the growing plastic waste crisis in Mexico, will explore scalable solutions for a circular economy.

- In January 2025, Circulate Capital announced two major investments in Latin America, marking its expansion into Mexico with Omnigreen and strengthening its position in Colombia with Recyclapet. Omnigreen is a leader in flexible plastic recycling, while Recyclapet focuses on producing recycled PET (rPET) to meet growing demand in the Andean and Caribbean regions. These investments underscore Circulate Capital’s commitment to advancing the circular economy and promoting sustainable plastic waste management in the region.

Mexico Waste Plastic Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatments Covered | Co-Processing, Heat Compression, Pyrolysis, Landfill, Incineration, Others |

| Materials Covered | Poly Vinyl Chloride (PVC), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), Others |

| Applications Covered | Packaging, Construction, Textile, Automotive, Others |

| Recycling Processes Covered | Mechanical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico waste plastic recycling market size was valued at USD 555.2 Million in 2025.

The Mexico waste plastic recycling market is expected to grow at a compound annual growth rate of 7.78% from 2026-2034 to reach USD 1,089.3 Million by 2034.

Landfill leads the market with a 40% share in 2025, owing to the prevalence of traditional waste disposal practices in municipal systems, inadequate advanced processing facilities in rural areas, and economic factors that favor conventional methods over more advanced treatment options.

Key factors driving the Mexico waste plastic recycling market include the growth of recycling infrastructure. Investments in new and expanded recycling plants improve processing capacity, efficiency, and create jobs. For example, PetStar’s 2025 expansion in Toluca with a MXN 2.6 billion investment will increase capacity to 86,000 tons annually.

Major challenges include inadequate waste collection and processing infrastructure, price gaps between virgin and recycled materials, informal waste management sector integration difficulties, regulatory compliance gaps at disposal facilities, and limited advanced recycling technology deployment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)