Mexico Waste to Energy Market Size, Share, Trends and Forecast by Technology, Waste Type, and Region, 2025-2033

Mexico Waste to Energy Market Overview:

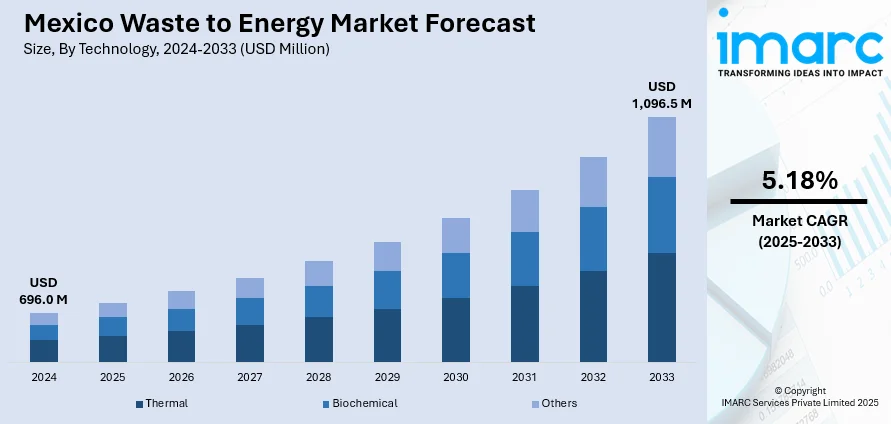

The Mexico waste to energy market size reached USD 696.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,096.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. With increasing urbanization activities, cities are generating significantly larger volumes of municipal solid waste, which is propelling the market growth. The rising awareness about environmental issues is further motivating citizens and authorities to adopt more sustainable urban living habits. Besides this, the ongoing shift towards greener energy systems is enhancing investments in innovative debris treatment methods, thereby contributing to the expansion of the Mexico waste to energy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 696.0 Million |

| Market Forecast in 2033 | USD 1,096.5 Million |

| Market Growth Rate 2025-2033 | 5.18% |

Mexico Waste to Energy Market Trends:

Rising urbanization activities

The growing urbanization activities are positively influencing the market. As more people are moving to urban areas, cities are generating significantly larger volumes of municipal solid waste. According to the World Data Atlas, the urban population of Mexico rose by 0.34%, increasing from 81.6% in 2023 to 81.9% in 2024. This rise in waste production is creating a need for effective and sustainable waste management solutions. Waste to energy technologies offer a practical way to reduce landfill usage while simultaneously generating electricity or heat. Urban areas are demanding more power and cleaner energy sources, making waste to energy an attractive option. The limited space for landfills in the growing cities is further supporting the requirement for waste conversion facilities. Local governments are wagering on modern infrastructure to manage urban challenges, and waste to energy plants are becoming part of these long-term strategies. These facilities help reduce greenhouse gas emissions by diverting waste from traditional landfills. Urbanization activities are also encouraging public-private partnerships in the energy and waste sectors, leading to increased investments and innovations. With the rising awareness about environmental issues, citizens and authorities are supporting cleaner and more sustainable urban living. Urbanization leads to better waste segregation practices, making it easier to process suitable materials for energy generation.

To get more information of this market, Request Sample

Growing adoption of renewable energy

The rising adoption of renewable energy is fueling the Mexico waste to energy market growth. As the country is focusing more on clean and sustainable power sources, waste to energy is gaining traction as a dual solution for power generation and debris management. Renewable energy goals are enabling authorities to explore alternatives beyond solar and wind, and waste to energy fits well by converting municipal and industrial waste into usable energy. This approach reduces reliance on fossil fuels and supports the national energy transition. It also helps cut down landfill use, lowering methane emissions and environmental hazards. With renewable energy targets in place, waste to energy projects are receiving increasing support from both the public and private sectors. Government incentives, cleaner energy policies, and technological advancements are making waste to energy more feasible and attractive. For example, in 2024, the government revealed its strategy to raise the proportion of renewables in the energy mix to 45% by 2030. As energy demand is rising, especially in urban areas, waste to energy provides a reliable and consistent supply. The ongoing shift towards greener energy systems is increasing investments in innovative waste treatment methods. In this context, waste to energy stands out by offering both environmental and economic benefits, reinforcing its role in Mexico’s renewable energy landscape.

Mexico Waste to Energy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology and waste type.

Technology Insights:

- Thermal

- Incineration

- Pyrolysis

- Gasification

- Biochemical

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes thermal (incineration, pyrolysis, and gasification), biochemical, and others.

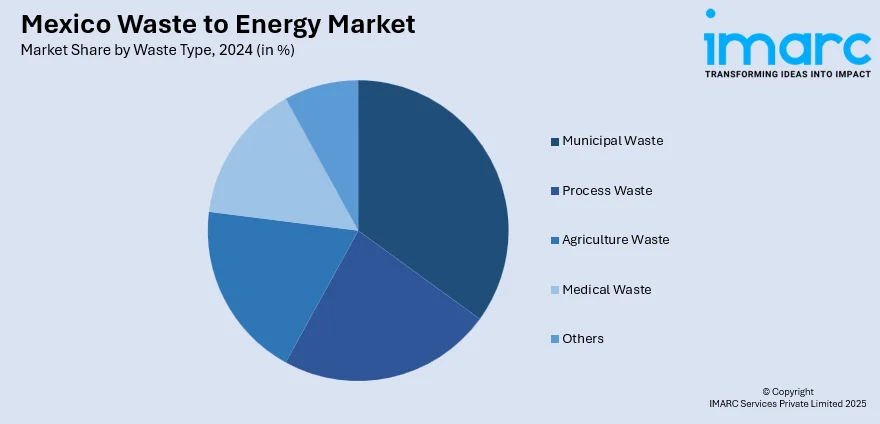

Waste Type Insights:

- Municipal Waste

- Process Waste

- Agriculture Waste

- Medical Waste

- Others

A detailed breakup and analysis of the market based on the waste type have also been provided in the report. This includes municipal waste, process waste, agriculture waste, medical waste, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Waste to Energy Market News:

- In December 2024, UNAM, the Ministry of Energy (SENER), and CFE announced that the initial module of the Hydrothermal Carbonization Plant at Bordo Poniente in Mexico City was finished and in the testing phase. The initiative aimed to manage 72t of organic waste each day, generating 8.7t of hydrochar. This procedure could lower carbon dioxide emissions by 24,600 tons per year, while capturing 9,500 tons of carbon. Situated at Bordo Poniente, the facility will transform wet waste into charcoal, generating hydrochar, nutrient-dense water, and steam. By transforming waste into energy and useful products, the facility was set to aid in fostering a more sustainable future.

Mexico Waste to Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Waste Types Covered | Municipal Waste, Process Waste, Agriculture Waste, Medical Waste, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico waste to energy market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico waste to energy market on the basis of technology?

- What is the breakup of the Mexico waste to energy market on the basis of waste type?

- What is the breakup of the Mexico waste to energy market on the basis of region?

- What are the various stages in the value chain of the Mexico waste to energy market?

- What are the key driving factors and challenges in the Mexico waste to energy?

- What is the structure of the Mexico waste to energy market and who are the key players?

- What is the degree of competition in the Mexico waste to energy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico waste to energy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico waste to energy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico waste to energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)