Mexico Water Treatment Chemicals Market Size, Share, Trends and Forecast by Type, End-User, and Region, 2025-2033

Mexico Water Treatment Chemicals Market Overview:

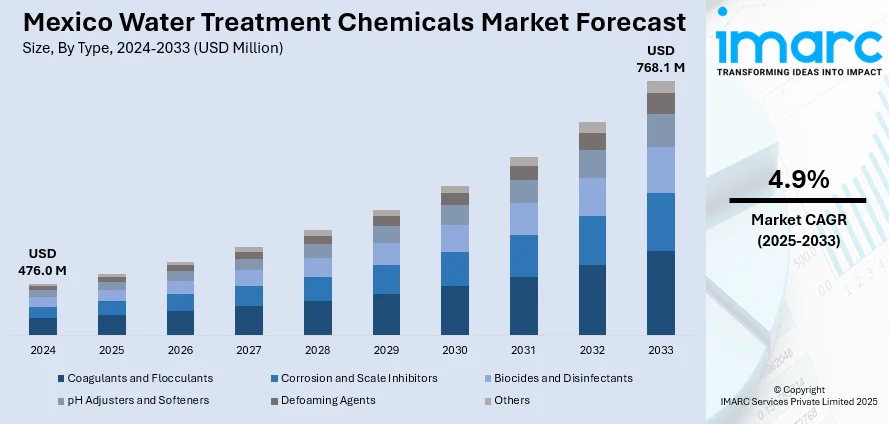

The Mexico water treatment chemicals market size reached USD 476.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 768.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.9% during 2025-2033. Rapid industrialization and urbanization, stringent government regulations, growing agricultural demands, wastewater treatment needs, surging consumer awareness, water recycling initiatives, technological advancements in chemical formulations, and a rising focus on sustainability are some of the factors favoring the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 476.0 Million |

| Market Forecast in 2033 | USD 768.1 Million |

| Market Growth Rate 2025-2033 | 4.9% |

Mexico Water Treatment Chemicals Market Trends:

Industrialization and Economic Growth

Rapid industrialization is one of the key factor for the Mexico water treatment chemicals market growth. The country's efforts to solidify its manufacturing, mining, and energy industry have increased the need for clean, safe water. Industrial processes frequently depend on enormous amounts of water for production and cooling, which leads to the discharge of extensive waste effluent. Industries are investing on water treatment chemicals to meet the need to comply with environmental issues and stringent water quality regulations. They are integral to the purification of water, removing impurities, and ensuring that water is at the required quality standards for industrial applications. According to the Mexico water treatment chemicals market forecast, the demand for effective and sustainable water management solutions is increasing as more industries invest in infrastructure & expand operations, which is supporting the market growth.

Rapid Urbanization and Population Growth

One of the main factors boosting the Mexico water treatment chemicals market share is urbanization. The growing population has been mainly taking place in cities, where people are moving in search of greater job prospects and an overall higher quality of life. This demographic trend adds pressure to existing water supply and treatment infrastructure. Urbanization has compelled the municipal governments to address water quality and wastewater treatment to maintain the health and hygiene of the population. Additionally, the over-exploitation of local water resources by rapidly managing urbanization increases demand for advanced chemical treatment to recycle and reuse water efficiently, which further propels the market expansion.

Government Regulations and Environmental Policies

Government regulations and policies surrounding water quality are a major driver of the water treatment chemicals market in Mexico. The Mexican government has implemented several stringent environmental laws aimed at reducing pollution and ensuring the sustainable use of water resources. For instance, in November 2024, a draft of the General Water Law was introduced in Mexico's Federal Congress. This proposed legislation aims to overhaul water management practices by requiring a "Socio-Hydric Impact Evaluation" for new water concessions, assessing potential social and environmental impacts. The law also seeks to amend existing regulations concerning wastewater discharge processes, indicating a shift towards more comprehensive and sustainable water governance. The legal requirement to treat wastewater before discharge into natural water bodies has further bolstered the market, as industries and utilities are compelled to invest in water purification solutions. Additionally, the government's commitment to environmental sustainability, including the promotion of water conservation and reuse, aligns with the growing demand for water treatment chemicals, which is creating a positive Mexico water treatment chemicals market outlook.

Mexico Water Treatment Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-user.

Type Insights:

- Coagulants and Flocculants

- Corrosion and Scale Inhibitors

- Biocides and Disinfectants

- pH Adjusters and Softeners

- Defoaming Agents

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes coagulants and flocculants, corrosion and scale inhibitors, biocides and disinfectants, pH adjusters and softeners, defoaming agents, and others.

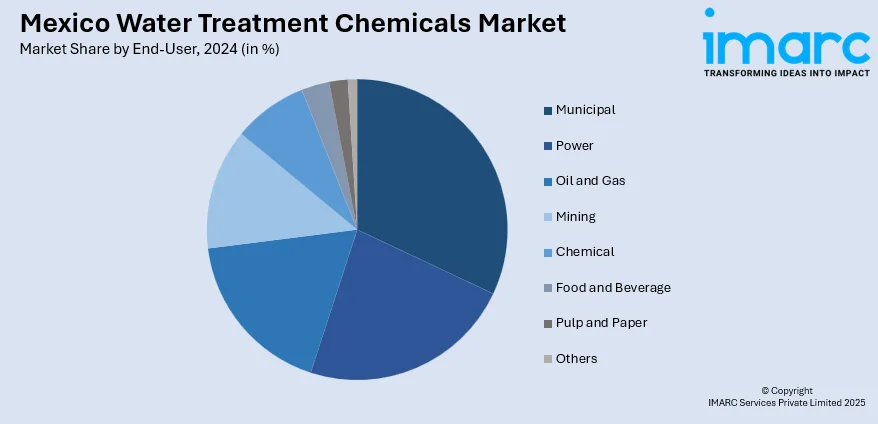

End-User Insights:

- Municipal

- Power

- Oil and Gas

- Mining

- Chemical

- Food and Beverage

- Pulp and Paper

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes municipal, power, oil and gas, mining, chemical, food and beverage, pulp and paper, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Water Treatment Chemicals Market News:

- In 2024, Crown Electrokinetics Corp. announced plans to build and co-own a state-of-the-art reverse osmosis water treatment plant in Cabo San Lucas, Mexico, in partnership with 529 Capital. The facility aims to desalinate water collected from proprietary slant wells, addressing water scarcity in the region. Construction is expected to commence in summer 2025, with operations beginning in 2026.

- In 2024, At Aquatech Mexico, Tetradom presented its innovative water treatment technology that operates without chemicals or electricity. Utilizing ultra-fine oscillation waves, the system alters the physical properties of scale, prevents new scale formation, inhibits microbial growth, and generates an oxidation layer to prevent rust, offering an eco-friendly solution for industrial water treatment.

Mexico Water Treatment Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coagulants and Flocculants, Corrosion and Scale Inhibitors, Biocides and Disinfectants, pH Adjusters and Softeners, Defoaming Agents, Others |

| End-Users Covered | Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico water treatment chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico water treatment chemicals market on the basis of type?

- What is the breakup of the Mexico water treatment chemicals market on the basis of end-user?

- What is the breakup of the Mexico water treatment chemicals market on the basis of region?

- What are the various stages in the value chain of the Mexico water treatment chemicals market?

- What are the key driving factors and challenges in the Mexico water treatment chemicals market?

- What is the structure of the Mexico water treatment chemicals market and who are the key players?

- What is the degree of competition in the Mexico water treatment chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico water treatment chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico water treatment chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico water treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)