Mexico Waterproof Textiles Market Size, Share, Trends and Forecast by Raw Material, Fabric Type, Application, and Region, 2025-2033

Mexico Waterproof Textiles Market Overview:

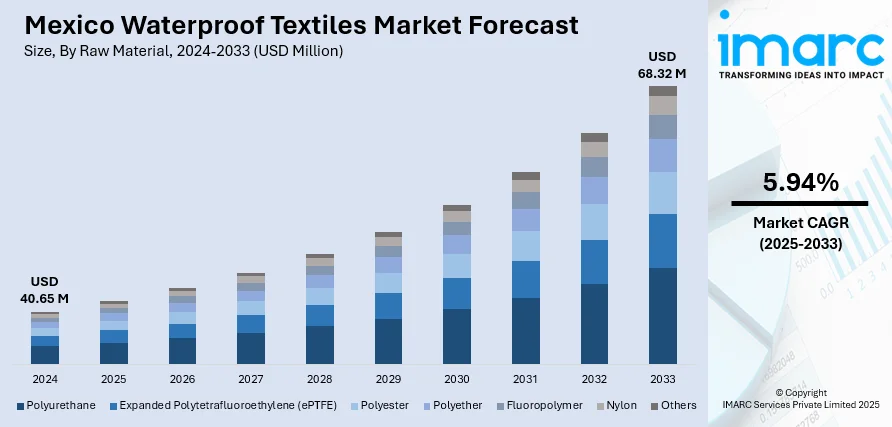

The Mexico waterproof textiles market size reached USD 40.65 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 68.32 Million by 2033, exhibiting a growth rate (CAGR) of 5.94% during 2025-2033. At present, healthcare facilities in the nation are using waterproof solutions to comply with stringent health laws, as the focus on patient safety and hygiene is growing. Besides this, the broadening of retail and e-commerce channels is contributing to the expansion of the Mexico waterproof textiles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.65 Million |

| Market Forecast in 2033 | USD 68.32 Million |

| Market Growth Rate 2025-2033 | 5.94% |

Mexico Waterproof Textiles Market Trends:

Increasing applications in healthcare sector

Rising applications of waterproof textiles in the healthcare sector are propelling the market growth. Hospitals and clinics are employing waterproof textiles in bedding, mattresses, surgical gowns, drapes, and furniture covers to prevent fluid penetration and maintain cleanliness. These textiles help reduce the risk of infections by acting as barriers against blood, urine, and other bodily fluids. With an increasing focus on patient safety and hygiene, healthcare facilities in Mexico are adopting waterproof solutions to meet stringent health standards. Waterproof textiles also offer comfort, breathability, and resistance to frequent washing and disinfecting, making them suitable for daily use in medical environments. In addition, the rising aging population and the broadening healthcare infrastructure are creating the need for long-lasting and moisture-resistant fabrics in both public and private hospitals. As reported by the UNAM’s Institute of Social Research, the number of Mexican people aged over 65 requiring care is set to increase threefold to reach 7.3 Million by 2050. Medical equipment manufacturers are also incorporating waterproof textiles into products to ensure reliability and ease of maintenance. As healthcare services are expanding across urban and rural regions, the demand for advanced textile solutions continues to rise.

Growing vehicle production

Increasing vehicle production is impelling the Mexico waterproof textiles market growth. According to industry reports, during Q1 2024, vehicle sales in the country rose by 2.7%, equating to 359,810 units. As more vehicles are being manufactured, automakers continue to seek quality materials for seat covers, carpets, and roof linings that can withstand moisture, spills, and wear. Waterproof textiles help improve vehicle durability and comfort, making them essential for both commercial and passenger vehicles. Manufacturers also prefer these textiles for their easy maintenance and resistance to mold and mildew, which is important in humid conditions. Additionally, waterproof textiles contribute to aesthetic appeal and enhanced customer satisfaction. The thriving automotive sector in Mexico, supported by local and foreign investments, is encouraging suppliers to innovate and offer advanced waterproof fabric solutions.

Expansion of e-commerce portals

The expansion of e-commerce sites is increasing the accessibility and visibility of a wide assortment of waterproof clothing, footwear, and outdoor gear. As more people are shopping online, they are exploring different products that suit their needs for travel, sports, and workwear. E-commerce platforms offer detailed product descriptions, reviews, and competitive pricing, which help customers make informed decisions. This convenience is motivating people to buy waterproof textiles for both functional and lifestyle purposes. Retailers are also benefiting by reaching wider audiences without needing physical stores, which reduces overhead costs and allows better inventory management. Additionally, targeted marketing and seasonal discounts online aid in attracting buyers. Consequently, e-commerce acts as a key distribution channel that assists in driving the demand and supply of waterproof textiles in the Mexican market. As per the IMARC Group, the Mexico e-commerce market is set to attain USD 176.6 Billion by 2033, exhibiting a growth rate (CAGR) of 14.5% during 2025-2033.

Mexico Waterproof Textiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on raw material, fabric type, and application.

Raw Material Insights:

- Polyurethane

- Expanded Polytetrafluoroethylene (ePTFE)

- Polyester

- Polyether

- Fluoropolymer

- Nylon

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes polyurethane, expanded polytetrafluoroethylene (ePTFE), polyester, polyether, fluoropolymer, nylon, and others.

Fabric Type Insights:

- Dense Woven

- Laminated or Coated Woven

- Others

A detailed breakup and analysis of the market based on the fabric type have also been provided in the report. This includes dense woven, laminated or coated woven, and others.

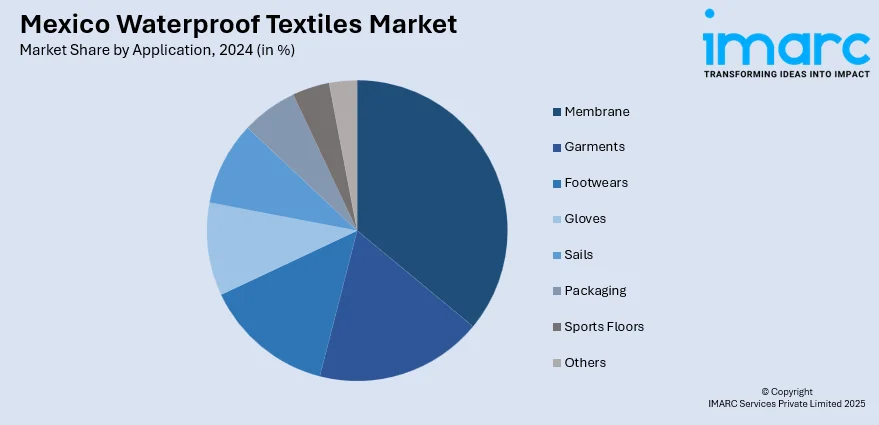

Application Insights:

- Membrane

- Garments

- Jackets

- Waterproof Jackets

- Leisurewear

- Others

- Footwears

- Gloves

- Sails

- Packaging

- Sports Floors

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes membrane, garments (jackets, waterproof jackets, leisurewear, and others), footwears, gloves, sails, packaging, sports floors, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Waterproof Textiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Polyurethane, Expanded Polytetrafluoroethylene (ePTFE), Polyester, Polyether, Fluoropolymer, Nylon, Others |

| Fabric Types Covered | Dense Woven, Laminated or Coated Woven, Others |

| Applications Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico waterproof textiles market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico waterproof textiles market on the basis of raw material?

- What is the breakup of the Mexico waterproof textiles market on the basis of fabric type?

- What is the breakup of the Mexico waterproof textiles market on the basis of application?

- What is the breakup of the Mexico waterproof textiles market on the basis of region?

- What are the various stages in the value chain of the Mexico waterproof textiles market?

- What are the key driving factors and challenges in the Mexico waterproof textiles market?

- What is the structure of the Mexico waterproof textiles market and who are the key players?

- What is the degree of competition in the Mexico waterproof textiles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico waterproof textiles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico waterproof textiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico waterproof textiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)