Mexico Weight Management Market Size, Share, Trends and Forecast by Diet, Service, Equipment, and Region, 2025-2033

Mexico Weight Management Market Overview:

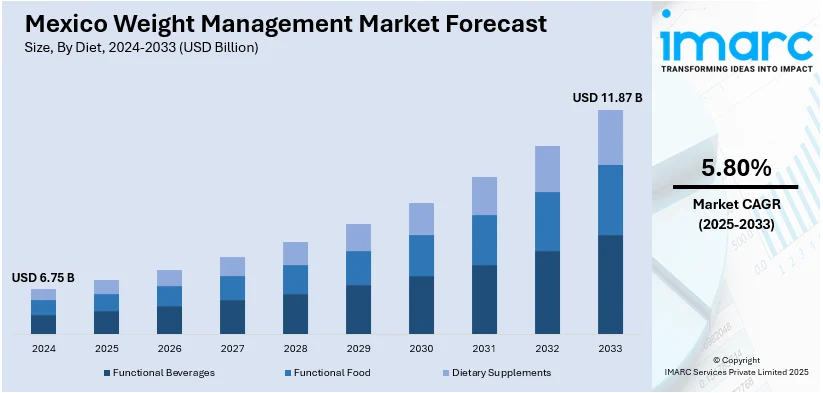

The Mexico weight management market size reached USD 6.75 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.87 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is being driven by rising obesity rates, increasing awareness of lifestyle-related diseases, growing health consciousness among younger demographics, expanding access to weight-loss medications like Mounjaro, and the influence of digital wellness trends, fitness apps, and social media promoting proactive, personalized approaches to fitness and nutrition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.75 Billion |

| Market Forecast in 2033 | USD 11.87 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Mexico Weight Management Market Trends:

Rising Prevalence of Obesity and Lifestyle-Related Health Disorders

Among the most powerful drivers of Mexico's weight management market is the skyrocketing prevalence of obesity and related health conditions. According to the Organization for Economic Co-operation and Development (OECD), Mexico ranks as the second most obese country among its 35 member economies, with 32.4% of its population over the age of 15 classified as obese, just behind the United States, which leads at 38.2%. The high rate of obesity is fueled by a convergence of factors, such as unhealthy eating habits, low physical activity levels, and cultural food preferences for calorie-rich foods. In urban areas, the spread of fast-food outlets and convenience food consumption has replaced home-cooked meals, adding to unhealthy weight gain. These trends in health have resulted in an epidemic of lifestyle diseases like type 2 diabetes, cardiovascular disease, and metabolic syndrome. Mexico has the second highest rate of diabetes in the world, a directly linked condition with obesity. This is placing growing pressure on the healthcare system, leading to government-sponsored programs and public health initiatives encouraging improved diet and physical well-being.

Expansion of the Health and Wellness Culture Among Millennials and Gen Z

The proactive adoption of wellness culture by the younger generations, especially Millennials and Gen Z, is acting as a significant growth-inducing factor. These demographic groups are changing the conversation from simple weight loss to overall well-being, encompassing physical fitness, mental wellness, and healthy lifestyle habits. As opposed to earlier generations, young Mexicans are strongly influenced by international health trends, social media stars, and exercise communities that advocate for body positivity, vegan nutrition, fasting, and exercise. This cultural transformation has created a thriving market for customized wellness services, such as fitness apps, wearable tech, organic meal delivery, and boutique gyms. The younger consumer segment is widely looking for functional foods and beverages that offer health benefits beyond mere nutrition, such as detox teas, superfood mixes, and probiotic snacks. Online platforms and wellness blogs are making these products more accessible, driving a more diversified and digitally integrated market environment.

Mexico Weight Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on diet, service, and equipment.

Diet Insights:

- Functional Beverages

- Functional Food

- Dietary Supplements

The report has provided a detailed breakup and analysis of the market based on the diet. This includes functional beverages, functional food, and dietary supplements.

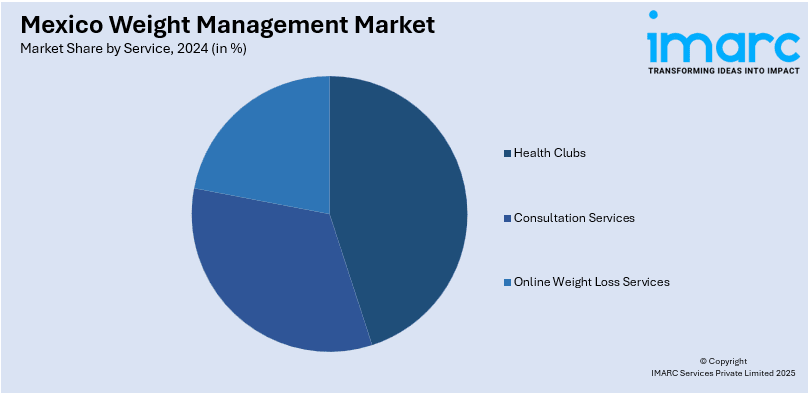

Service Insights:

- Health Clubs

- Consultation Services

- Online Weight Loss Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes health clubs, consultation services, and online weight loss services.

Equipment Insights:

- Fitness Equipment

- Cardiovascular Training Equipment

- Strength Training Equipment

- Others

- Surgical Equipment

- Minimally Invasive/Bariatric Equipment

- Non-Invasive Surgical Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes fitness equipment (cardiovascular training equipment, strength training equipment, and others) and surgical equipment (minimally invasive/bariatric equipment and non-invasive surgical equipment).

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Weight Management Market News:

- March 2025: Eli Lilly announced that it plans to launch its diabetes and weight-loss drug, Mounjaro, in Mexico, India, Brazil, and China by the second half of 2025, targeting approximately 900 million potential patients in these emerging markets. This strategic expansion is expected to significantly boost the weight management market in these respective countries by increasing access to advanced treatments, encouraging competition, and stimulating investment in healthcare infrastructure.

- May 2024: Biocon signed a semi-exclusive agreement with Mexico-based Medix to distribute and commercialize Liraglutide (gSaxenda), a drug for chronic weight management. Biocon will handle regulatory approval, manufacturing, and supply, while Medix will oversee commercialization in Mexico. This collaboration aims to provide affordable obesity treatment options in the country.

Mexico Weight Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Diets Covered | Functional Beverages, Functional Food, Dietary Supplements |

| Services Covered | Health Clubs, Consultation Services, Online Weight Loss Services |

| Equipments Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico weight management market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico weight management market on the basis of diet?

- What is the breakup of the Mexico weight management market on the basis of service?

- What is the breakup of the Mexico weight management market on the basis of equipment?

- What is the breakup of the Mexico weight management market on the basis of region?

- What are the various stages in the value chain of the Mexico weight management market?

- What are the key driving factors and challenges in the Mexico weight management?

- What is the structure of the Mexico weight management market and who are the key players?

- What is the degree of competition in the Mexico weight management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico weight management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico weight management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico weight management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)