Mexico Wi-Fi Market Size, Share, Trends and Forecast by Component, Density, Location Type, Organization Size, Industry Vertical, and Region, 2025-2033

Mexico Wi-Fi Market Overview:

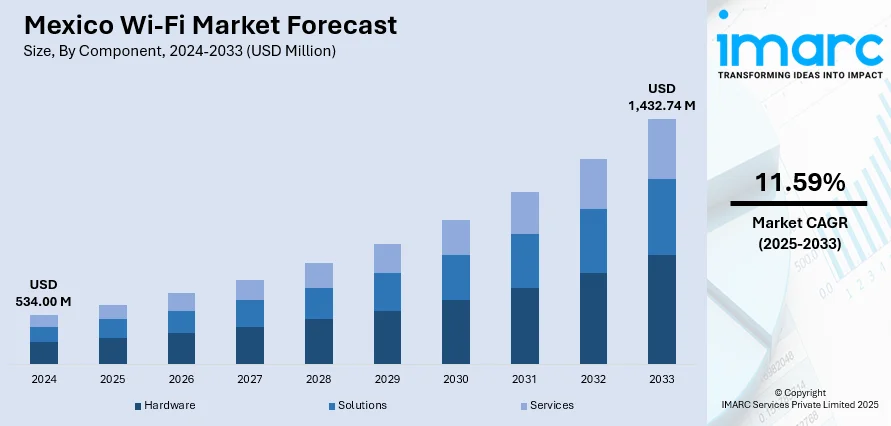

The Mexico Wi-Fi market size reached USD 534.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,432.74 Million by 2033, exhibiting a growth rate (CAGR) of 11.59% during 2025-2033. The market is driven by growing demand for high-speed internet, the expansion of smart devices, the escalating need for seamless connectivity in both urban and rural areas, and supportive government initiatives promoting digital infrastructure, e-commerce, and remote work.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 534.00 Million |

| Market Forecast in 2033 | USD 1,432.74 Million |

| Market Growth Rate 2025-2033 | 11.59% |

Mexico Wi-Fi Market Trends:

Adoption of Advanced Wi-Fi Technologies

Mexico is rapidly embracing next-generation Wi-Fi technologies, notably Wi-Fi 6 and the upcoming Wi-Fi 7, to fulfill the rising need for fast and dependable internet access. Wi-Fi 6 improves speed, capacity, and efficiency, making it perfect for congested contexts such as cities, workplaces, and public places. Wi-Fi 6 improves device power management and network efficiency with technologies such as Orthogonal Frequency Division Multiple Access (OFDMA) and Target Wake Time (TWT), allowing for an expanding number of connected devices in both households and businesses. The next Wi-Fi 7, based on the IEEE 802.11be standard, offers significantly better speed and reduced latency, which are critical for advanced applications like augmented reality (AR) and virtual reality (VR). The widespread adoption of these technologies is being driven further by the growing presence of Internet of Things (IoT) devices in sectors like smart homes, healthcare, and industrial automation, enabling seamless communication and creating more connected, efficient environments.

Investments in Digital Infrastructure and Public Connectivity

Significant investments in digital infrastructure are driving the expansion of Wi-Fi access across Mexico. Microsoft has committed USD 1.3 billion over three years to enhance its cloud computing and artificial intelligence infrastructure, aiming to improve connectivity and foster AI adoption among small and medium-sized businesses (SMBs). This initiative is expected to benefit 5 million Mexicans and 30,000 SMBs. Additionally, Microsoft has partnered with Viasat to extend internet access to over 150,000 Mexicans without cellular connectivity by the end of 2025. At the same time, Mexico's government is focusing on expanding public internet access, particularly in areas not covered by private telecom providers. The government plans to implement a sustainable national telecommunications policy to improve connectivity in the medium to long term. These combined efforts from both the private sector and government are key to bridging the digital divide, enhancing Wi-Fi accessibility, and promoting a more inclusive digital economy in Mexico.

Mexico Wi-Fi Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, density, location type, organization size, and industry vertical.

Component Insights:

- Hardware

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, solutions, and services.

Density Insights:

- High-Density Wi-Fi

- Enterprise-Class Wi-Fi

A detailed breakup and analysis of the market based on the density have also been provided in the report. This includes high-density Wi-Fi and enterprise-class Wi-Fi.

Location Type Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the location type. This includes indoor and outdoor.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

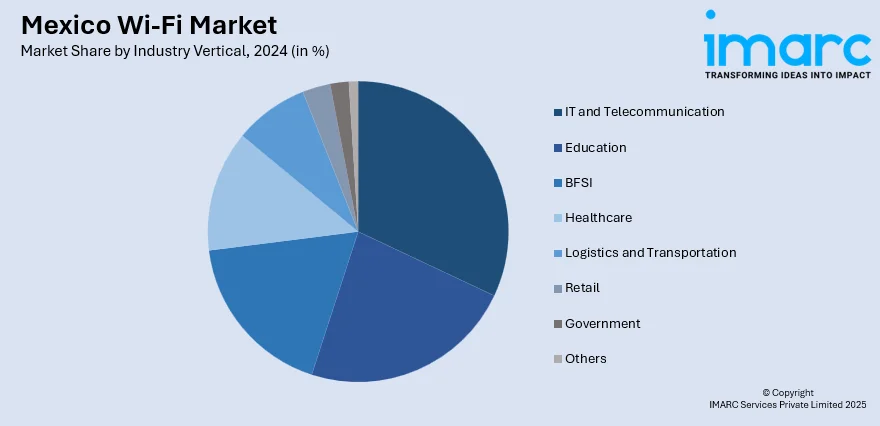

Industry Vertical Insights:

- IT and Telecommunication

- Education

- BFSI

- Healthcare

- Logistics and Transportation

- Retail

- Government

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes IT and telecommunication, education, BFSI, healthcare, logistics and transportation, retail, government, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Wi-Fi Market News:

- March 2025: Starlink announced that it would offer free satellite internet to compatible smartphones in Mexico starting July 2025. It aimed to provide connectivity in areas with limited or no mobile coverage, enabling users to send text messages, share locations, access emergency services, etc.

- November 2024: Viasat and Altán partnered to launch an LTE home and mobile broadband service over satellite, aiming to extend high-speed internet access to underserved regions. This service integrated Viasat's satellite capabilities with Altán's Red Compartida network, delivering reliable Wi-Fi connectivity to remote areas across Mexico.

Mexico Wi-Fi Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Solutions, Services |

| Densities Covered | High-Density Wi-Fi, Enterprise-Class Wi-Fi |

| Location Types Covered | Indoor, Outdoor |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | IT and Telecommunication, Education, BFSI, Healthcare, Logistics and Transportation, Retail, Government, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico Wi-Fi market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico Wi-Fi market on the basis of component?

- What is the breakup of the Mexico Wi-Fi market on the basis of density?

- What is the breakup of the Mexico Wi-Fi market on the basis of location type?

- What is the breakup of the Mexico Wi-Fi market on the basis of organization size?

- What is the breakup of the Mexico Wi-Fi market on the basis of industry vertical?

- What are the various stages in the value chain of the Mexico Wi-Fi market?

- What are the key driving factors and challenges in the Mexico Wi-Fi market?

- What is the structure of the Mexico Wi-Fi market and who are the key players?

- What is the degree of competition in the Mexico Wi-Fi market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico Wi-Fi market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico Wi-Fi market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico Wi-Fi industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)