Mexico Wireless Connectivity Market Size, Share, Trends and Forecast by Technology, Network Type, End User, and Region, 2026-2034

Mexico Wireless Connectivity Market Overview:

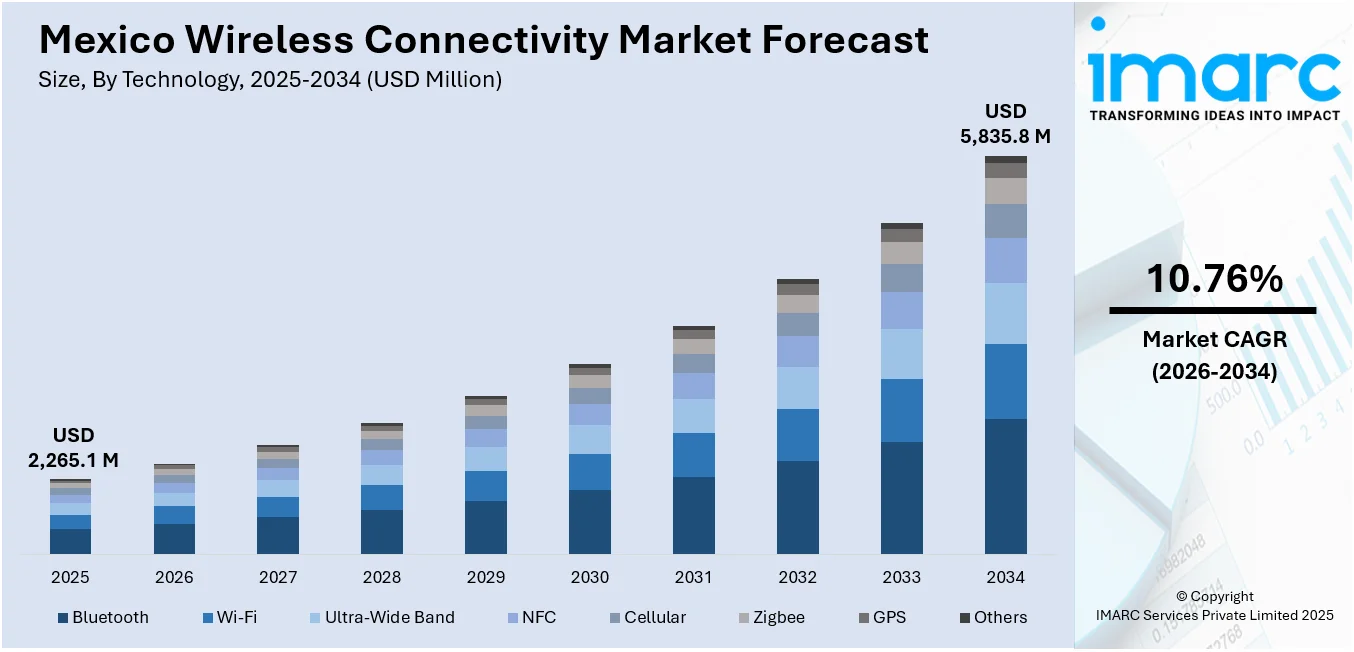

The Mexico wireless connectivity market size reached USD 2,265.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,835.8 Million by 2034, exhibiting a growth rate (CAGR) of 10.76% during 2026-2034. Government digitalization programs, spectrum auctions, public-private partnerships, and national infrastructure initiatives such as Red Compartida are key public sector drivers. Rural broadband subsidies, streamlined tower permitting, and rollout of 4G and 5G networks support expanded coverage and accessibility. Growing mobile data usage, enterprise IoT deployment, LPWAN investment, private LTE adoption, and urban 5G applications are some of the major factors expanding the Mexico wireless connectivity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,265.1 Million |

| Market Forecast in 2034 | USD 5,835.8 Million |

| Market Growth Rate 2026-2034 | 10.76% |

Mexico Wireless Connectivity Market Trends:

National Digitalization Policies and Public-Private Infrastructure Projects

A significant force behind this sector's momentum is the alignment of federal policies with long-term digital transformation objectives. The Mexican government, through programs such as "Internet para Todos," has prioritized expanding wireless access across both urban and underserved rural regions. These initiatives have involved collaborations with telecom operators and technology vendors to establish nationwide 4G and emerging 5G networks. Spectrum auctions and regulatory frameworks have been designed to incentivize competition while ensuring efficient spectrum utilization. In addition, public investment in shared infrastructure, such as Red Compartida, has created a neutral network platform that enables mobile operators to extend services to previously unreachable populations. These efforts are complemented by subsidies for rural broadband deployment and policies that streamline permitting for cell tower construction. As a result, connectivity is reaching more municipalities, reducing the digital divide and improving access to essential services such as telehealth and online education. Infrastructure modernization is also promoting industrial digitalization, especially in logistics and smart city projects. On November 13, 2024, Viasat and Mexican telecom wholesaler Altán launched a first-of-its-kind LTE home and mobile broadband service over satellite, currently active in 13 Mexican states and serving over 150,000 individuals. The initiative uses solar-powered LTE towers and hybrid satellite-wireless infrastructure to connect remote communities where around 38 million people, approximately 30% of the population, still lack broadband access. The service is supported by Viasat's Mexico Ambassador Program, which promotes digital inclusion and literacy, particularly among women in underserved regions. Around the midpoint of this national rollout, Mexico wireless connectivity market growth underscores the central role of policy-led collaboration in expanding access and driving inclusive digital participation.

To get more information on this market Request Sample

Rise in Consumer and Enterprise Demand for IoT and Mobile Applications

The proliferation of connected devices and mobile applications is another major driver reshaping the market landscape. Both consumer and enterprise segments are showing sustained demand for seamless connectivity to support everyday activities, digital services, and remote operations. In the consumer sphere, mobile data consumption continues to increase due to video streaming, e-commerce, and app-based communication, prompting telecom providers to upgrade backhaul and edge infrastructure. On the enterprise side, industries such as manufacturing, energy, and agriculture are deploying wireless networks to support IoT systems, machine-to-machine (M2M) communication, and real-time analytics. These technologies enable predictive maintenance, supply chain automation, and remote monitoring, which are essential for operational efficiency and cost reduction. Device manufacturers and software firms are investing in low-power, wide-area networks (LPWAN) and private LTE solutions to meet niche connectivity needs. The expansion of 5G services in key metropolitan zones further supports latency-sensitive applications in fintech and healthcare. On April 24, 2025, Helium announced a collaboration with AT&T to expand its decentralized Wi-Fi connectivity model across thousands of U.S. locations, with over 62,000 Helium Hotspots already deployed in the U.S. and Mexico. The partnership builds on Helium's ongoing collaboration with Telefónica's Movistar, which is extending service to over 2 million subscribers across 300 sites in Mexico, leveraging community-built infrastructure to improve mobile access in underserved regions. As more organizations integrate wireless infrastructure into core workflows, demand for high-reliability, low-latency connectivity will continue to intensify. This convergence of digital services and wireless systems is transforming how businesses and individuals interact with technology across the country.

Mexico Wireless Connectivity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on technology, network type, and end user.

Technology Insights:

- Bluetooth

- Wi-Fi

- Ultra-Wide Band

- NFC

- Cellular

- Zigbee

- GPS

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes bluetooth, Wi-Fi, ultra-wide band, NFC, cellular, zigbee, GPS, and others.

Network Type Insights:

- Wireless Wide Area Network (WWAN)

- Wireless Personal Area Network (WPAN)

- Wireless Local Area Network (WLAN)

The report has provided a detailed breakup and analysis of the market based on the network type. This includes Wireless Wide Area Network (WWAN), Wireless Personal Area Network (WPAN), and Wireless Local Area Network (WLAN).

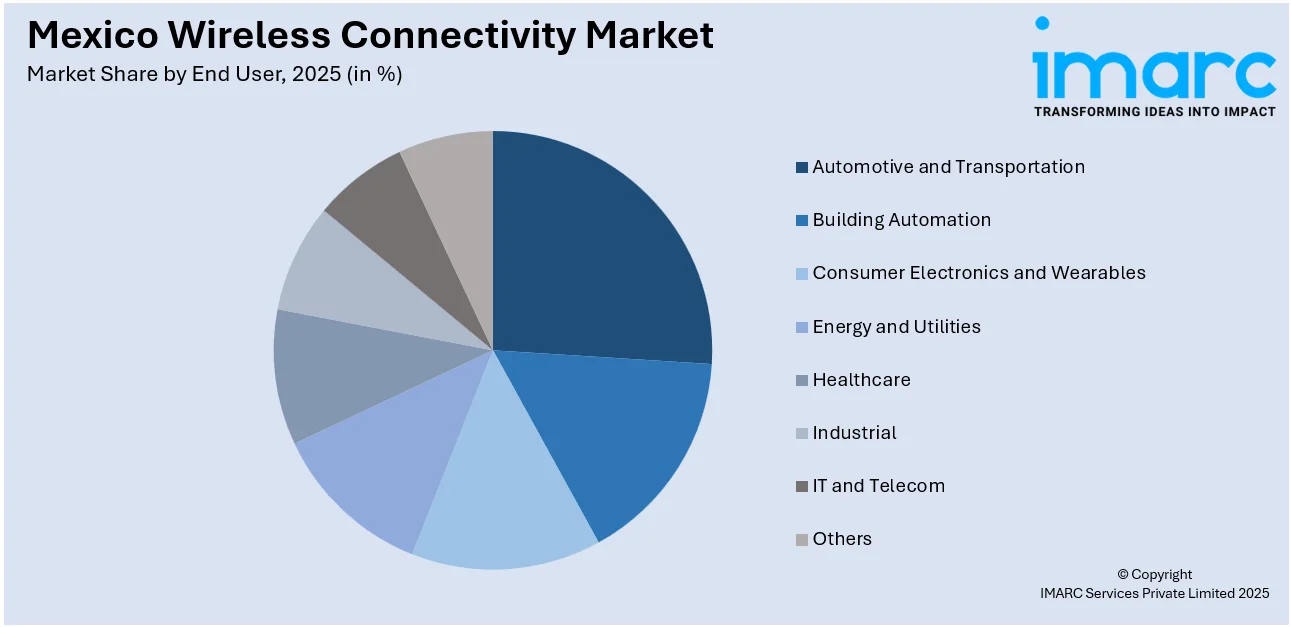

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive and Transportation

- Building Automation

- Consumer Electronics and Wearables

- Energy and Utilities

- Healthcare

- Industrial

- IT and Telecom

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive and transportation, building automation, consumer electronics and wearables, energy and utilities, healthcare, industrial, IT and telecom, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Wireless Connectivity Market News:

- On March 8, 2023, Hughes Network Systems and Mexican telecom firm Stargroup announced the deployment of the Hughes JUPITER™ System and managed satellite broadband to extend LTE backhaul in rural areas under the government’s “CFE Telecomunicaciones e Internet para Todos” program. The rollout uses HT2524 satellite terminals and Ka-band JUPITER 2 high-throughput satellites to power LTE service at speeds of 20–60 Mbps, covering hundreds of remote towers and supporting over 7,200 Community Wi-Fi and internet access sites across Mexico.

Mexico Wireless Connectivity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Bluetooth, Wi-Fi, Ultra-Wide Band, NFC, Cellular, Zigbee, GPS, Others |

| Network Types Covered | Wireless Wide Area Network (WWAN), Wireless Personal Area Network (WPAN), Wireless Local Area Network (WLAN) |

| End Users Covered | Automotive and Transportation, Building Automation, Consumer Electronics and Wearables, Energy and Utilities, Healthcare, Industrial, IT and Telecom, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico wireless connectivity market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico wireless connectivity market on the basis of technology?

- What is the breakup of the Mexico wireless connectivity market on the basis of network type?

- What is the breakup of the Mexico wireless connectivity market on the basis of end user?

- What is the breakup of the Mexico wireless connectivity market on the basis of region?

- What are the various stages in the value chain of the Mexico wireless connectivity market?

- What are the key driving factors and challenges in the Mexico wireless connectivity market?

- What is the structure of the Mexico wireless connectivity market and who are the key players?

- What is the degree of competition in the Mexico wireless connectivity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico wireless connectivity market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico wireless connectivity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico wireless connectivity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)