Mexico Wireless Power Transmission Market Size, Share, Trends and Forecast by Type, Technology, Implementation, Receiver Application, End-Use Industry, and Region, 2025-2033

Mexico Wireless Power Transmission Market Overview:

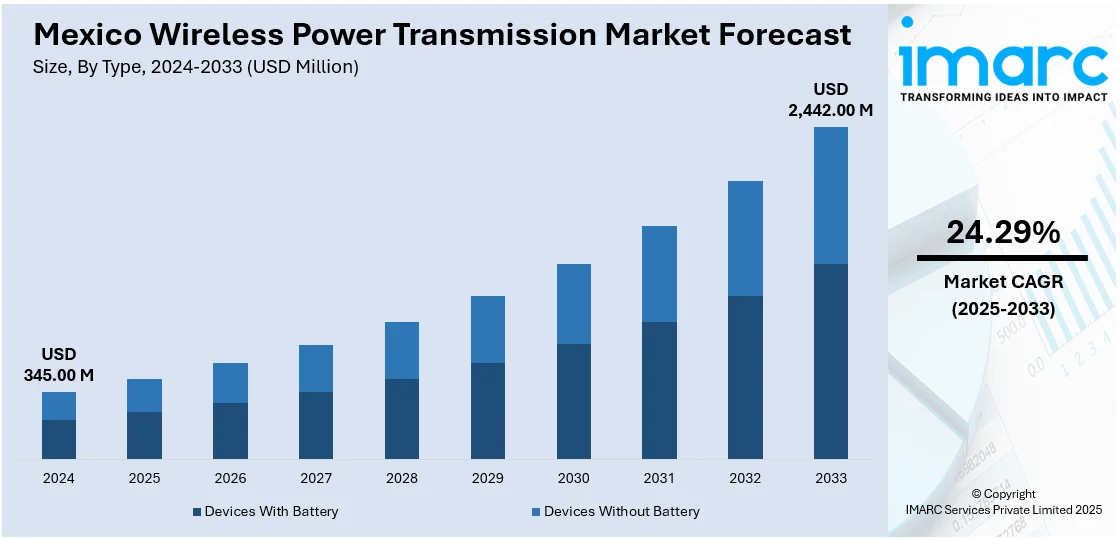

The Mexico wireless power transmission market size reached USD 345.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,442.00 Million by 2033, exhibiting a growth rate (CAGR) of 24.29% during 2025-2033. The market is driven by rising adoption of electric vehicles, growing demand for contactless charging in consumer electronics, government support for clean energy technologies, and advancements in industrial automation. Increasing smart infrastructure projects and R&D investments in wireless energy transfer systems also contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 345.00 Million |

| Market Forecast in 2033 | USD 2,442.00 Million |

| Market Growth Rate 2025-2033 | 24.29% |

Mexico Wireless Power Transmission Market Trends:

Rise in EV Wireless Charging Infrastructure Deployment

Mexico is witnessing a steady increase in the development of wireless charging infrastructure for electric vehicles (EVs), spurred by efforts to modernize transportation and promote green mobility. For instance, as per industry reports, the Saudi government is pushing for widespread EV adoption, aiming for 30% of vehicles in Riyadh to be electric by 2030. Achieving this goal is projected to demand the installation of approximately 30,000 to 34,000 additional charging stations across the city. Wireless charging systems offer convenience, reduce wear on connectors, and support autonomous vehicle integration. Municipal authorities and private operators are testing pilot projects in public and commercial spaces to evaluate long-term scalability. Additionally, cross-border collaborations with North American technology providers are enhancing access to advanced inductive and resonant charging technologies. As EV adoption in Mexico continues to rise, wireless charging is gaining traction as a reliable, low-maintenance alternative to plug-in stations. This trend is further supported by federal incentives and strategic urban planning initiatives focused on sustainable transport and emissions reduction.

Integration of Wireless Power in Consumer Electronics Manufacturing

Mexico’s role as a regional hub for consumer electronics manufacturing has positioned it favorably for the integration of wireless power technologies into high-demand products. For instance, according to recent industry data, the Mexican consumer electronics market is expected to generate USD 17.8 Billion in revenue in 2025. Devices such as smartphones, tablets, and wearables are increasingly incorporating wireless charging features to enhance user convenience and product appeal. Local assembly plants and OEMs are exploring partnerships with global technology developers to embed wireless charging modules into new product lines. This shift is not only enhancing product differentiation but also supporting the evolution of smart home ecosystems, where multiple devices can be charged wirelessly through centralized power units. As consumer preferences tilt toward seamless and cable-free experiences, manufacturers in Mexico are aligning production strategies to accommodate this transition, contributing to steady market expansion.

Mexico Wireless Power Transmission Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on on type, technology, implementation, receiver application, and end-use industry.

Type Insights:

- Devices With Battery

- Devices Without Battery

The report has provided a detailed breakup and analysis of the market based on the type. This includes devices with battery and devices without battery.

Technology Insights:

- Near-Field Technology

- Inductive

- Magnetic Resonance

- Capacitive Coupling/Conductive

- Far-Field Technology

- Microwave/RF

- Laser/Infrared

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes near-field technology (inductive, magnetic resonance, and capacitive coupling/conductive) and far-field technology (microwave/RF and laser/infrared).

Implementation Insights:

- Aftermarket

- Integrated

A detailed breakup and analysis of the market based on the implementation have also been provided in the report. This includes aftermarket and integrated.

Receiver Application Insights:

- Smartphones

- Tablets

- Wearable Electronics

- Notebooks

- Electric Vehicles

- Robots

- Others

A detailed breakup and analysis of the market based on the receiver application have also been provided in the report. This includes smartphones, tablets, wearable electronics, notebooks, electric vehicles, robots, and others.

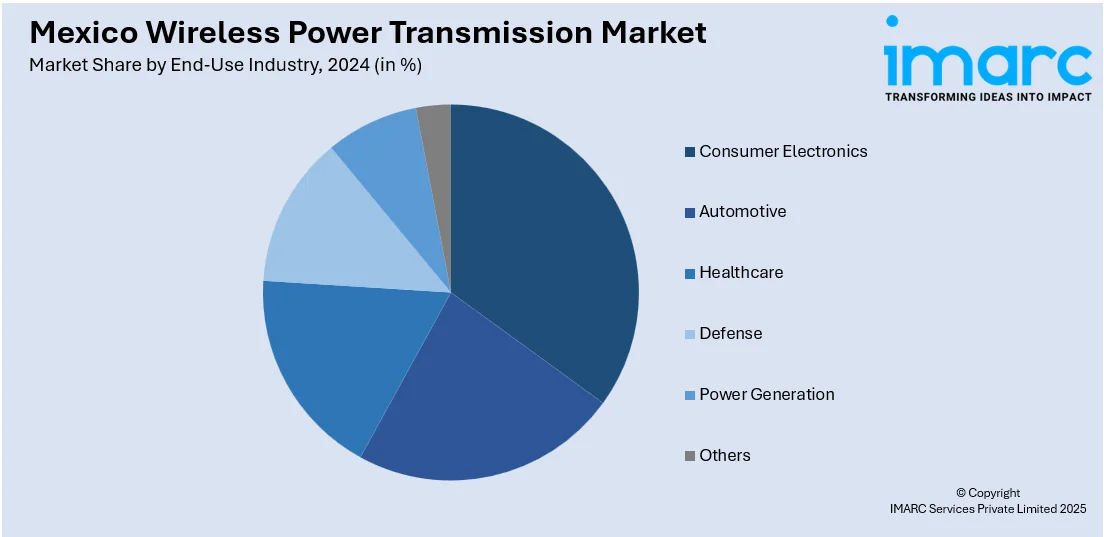

End-Use Industry Insights:

- Consumer Electronics

- Automotive

- Healthcare

- Defense

- Power Generation

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes consumer electronics, automotive, healthcare, defense, power generation, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, and Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Wireless Power Transmission Market News:

- In October 2024, Infineon Technologies partnered with Canada-based AWL-Electricity to advance wireless power transmission using gallium nitride (GaN) semiconductors. Infineon provided its CoolGaN™ GS61008P transistors to support AWL-E’s MHz resonant capacitive coupling systems, enabling efficient and compact wireless energy transfer. The collaboration enhanced system durability, minimized downtime, and removed the need for physical connectors—suitable for automotive, industrial, and consumer electronics applications. Infineon contributed its expertise in sustainable, high-frequency power devices, while AWL-E offered advanced wireless system design. Together, they worked to redefine wireless power transmission capabilities and set new performance standards across multiple industries by leveraging GaN’s efficiency and design flexibility.

- In May 2024, Mexican telecom provider Megacable and Finnish company Nokia successfully conducted a long-distance optical data transmission test, achieving a speed of 1.1 Terabits per second (Tbps)—a first for an active single-operator network in Latin America. The initiative aims to significantly increase Megacable’s network capacity, targeting 38.4 Tbps in long-distance transmission in the future. This test is part of broader efforts to enhance fiber optic interconnectivity between data centers, improve service delivery, and support growing user demand.

Mexico Wireless Power Transmission Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Devices With Battery, Devices Without Battery |

| Technologies Covered |

|

| Implementations Covered | Aftermarket, Integrated |

| Receiver Applications Covered | Smartphones, Tablets, Wearable Electronics, Notebooks, Electric Vehicles, Robots, Others |

| End-Use Industries Covered | Consumer Electronics, Automotive, Healthcare, Defense, Power Generation, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico wireless power transmission market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico wireless power transmission market on the basis of type?

- What is the breakup of the Mexico wireless power transmission market on the basis of technology?

- What is the breakup of the Mexico wireless power transmission market on the basis of implementation?

- What is the breakup of the Mexico wireless power transmission market on the basis of receiver application?

- What is the breakup of the Mexico wireless power transmission market on the basis of end-use industry?

- What are the various stages in the value chain of the Mexico wireless power transmission market?

- What are the key driving factors and challenges in the Mexico wireless power transmission?

- What is the structure of the Mexico wireless power transmission market and who are the key players?

- What is the degree of competition in the Mexico wireless power transmission market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico wireless power transmission market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico wireless power transmission market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico wireless power transmission industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)