Mexico Wood Plastic Composites Market Size, Share, Trends, and Forecast by Type, Application, and Region, 2025-2033

Mexico Wood Plastic Composites Market Overview:

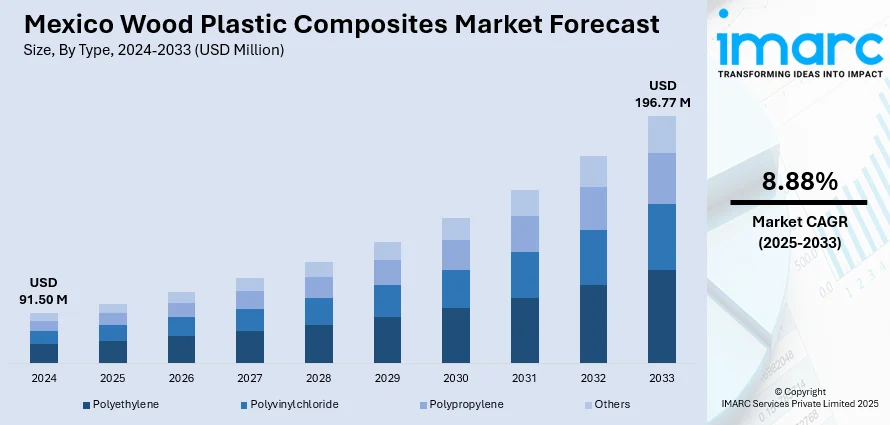

The Mexico wood plastic composites market size reached USD 91.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 196.77 Million by 2033, exhibiting a growth rate (CAGR) of 8.88% during 2025-2033. The increasing demand for sustainable, durable, and low-maintenance materials in construction and automotive sectors, stringent environmental regulations, rapid urbanization, and the need for cost-effective alternatives to traditional wood are some of the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 91.50 Million |

| Market Forecast in 2033 | USD 196.77 Million |

| Market Growth Rate 2025-2033 | 8.88% |

Mexico Wood Plastic Composites Market Trends:

Rising Demand for Sustainable Construction Materials

The construction sector in Mexico is undergoing a significant shift toward sustainability, with a growing focus on environmental efficiency. Wood plastic composites (WPCs), which blend wood fibers with thermoplastics, have become a popular choice over traditional wood due to their eco-friendliness, durability, and low maintenance. This shift is driven by Mexico’s commitment to reducing its carbon footprint through international agreements like the Paris Climate Accord, prompting stricter building codes that favor sustainable materials. WPCs offer excellent resistance to rot, pests, and moisture, making them ideal for applications like decking, fencing, and interior panels, particularly in humid regions such as Veracruz and Tabasco. Moreover, local manufacturers are incorporating recycled plastics and agricultural residues, such as rice husk, into WPC production, further supporting the circular economy. Companies like MexyTech and Ekomposit are leading these innovations.

Automotive Industry Integration for Lightweight and Durable Components

Mexico is a leading automobile manufacturing hub in the Americas, with its automotive sector increasingly turning to advanced materials to meet global efficiency and emission standards. Wood plastic composites are gaining popularity in automotive applications due to their lightweight nature, design flexibility, and superior mechanical properties. These composites are being used for non-structural components such as door panels, seat backs, dashboards, and interior trims, reducing vehicle weight, improving fuel efficiency, and helping automakers comply with Mexico’s evolving environmental regulations, such as the NOM-163-SEMARNAT emission standard. In 2024, Mexico produced 3,989,403 automobiles, a 5.56% increase from 2023, with over 95% of production consisting of light (passenger) vehicles. As the fourth largest vehicle exporter globally, Mexico attracts investment from automakers like Volkswagen, General Motors, and BMW, who are prioritizing greener vehicle designs.

Mexico Wood Plastic Composites Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Polyethylene

- Polyvinylchloride

- Polypropylene

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes polyethylene, polyvinylchloride, polypropylene, and others.

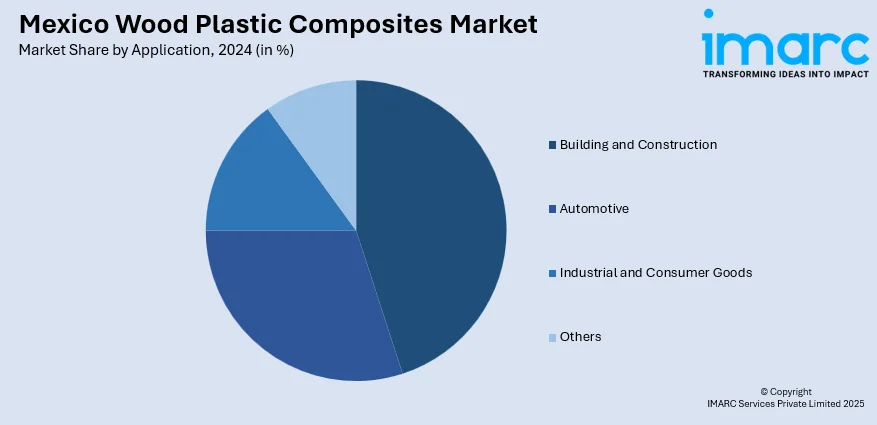

Application Insights:

- Building and Construction

- Automotive

- Industrial and Consumer Goods

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes building and construction, automotive, industrial and consumer goods, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Wood Plastic Composites Market News:

- January 2025: PPAA completed Mexico's first building constructed entirely with cross-laminated timber (CLT) in Querétaro. This growing interest across Mexico in eco-friendly materials also highlights the potential of wood plastic composites (WPCs). WPCs, combining recycled wood and plastics, offer complementary sustainability benefits in construction, especially for outdoor and non-structural applications.

Mexico Wood Plastic Composites Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyethylene, Polyvinylchloride, Polypropylene, Others |

| Applications Covered | Building and Construction, Automotive, Industrial and Consumer Goods, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico wood plastic composites market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico wood plastic composites market on the basis of type?

- What is the breakup of the Mexico wood plastic composites market on the basis of application?

- What is the breakup of the Mexico wood plastic composites market on the basis of region?

- What are the various stages in the value chain of the Mexico wood plastic composites market?

- What are the key driving factors and challenges in the Mexico wood plastic composites market?

- What is the structure of the Mexico wood plastic composites market and who are the key players?

- What is the degree of competition in the Mexico wood plastic composites market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico wood plastic composites market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico wood plastic composites market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico wood plastic composites industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)