Mexico Wood Pulp Market Size, Share, Trends and Forecast by Type, Grade, End Use Industry, and Region, 2026-2034

Mexico Wood Pulp Market Summary:

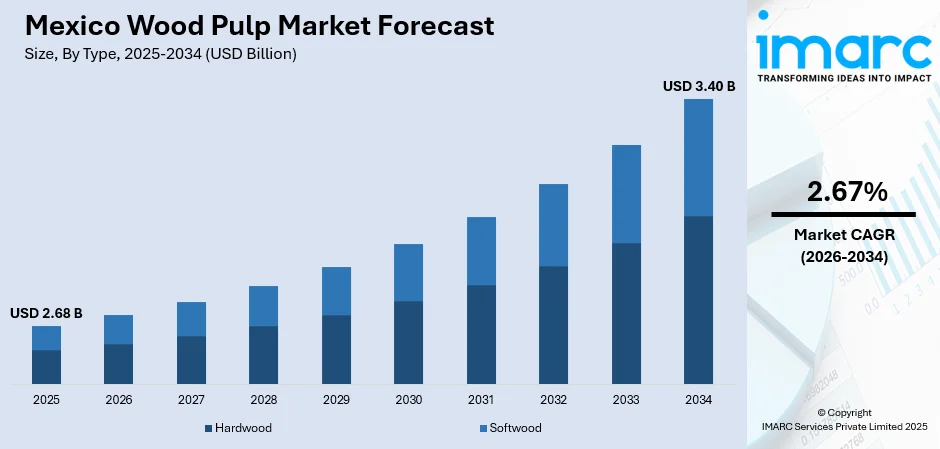

The Mexico wood pulp market size was valued at USD 2.68 Billion in 2025 and is projected to reach USD 3.40 Billion by 2034, growing at a compound annual growth rate of 2.67% from 2026-2034.

The Mexico wood pulp market is experiencing steady expansion driven by increasing demand for sustainable packaging solutions across multiple industries. Growing regulatory pressure to replace single-use plastics with biodegradable alternatives is accelerating adoption of paper-based packaging materials derived from wood pulp. The expanding e-commerce sector continues to fuel demand for corrugated packaging and containerboard products. Additionally, nearshoring trends bringing manufacturing operations from Asia to Mexico are stimulating industrial packaging requirements throughout the Mexico wood pulp market share.

Key Takeaways and Insights:

-

By Type: Hardwood dominates the market with a share of 65% in 2025, attributed to its superior fiber properties for producing smooth printing paper, tissue products, and premium packaging materials requiring enhanced surface quality.

-

By Grade: Chemical leads the market with a share of 54% in 2025, driven by the kraft pulping process that delivers stronger fibers with higher tensile strength essential for durable packaging applications.

-

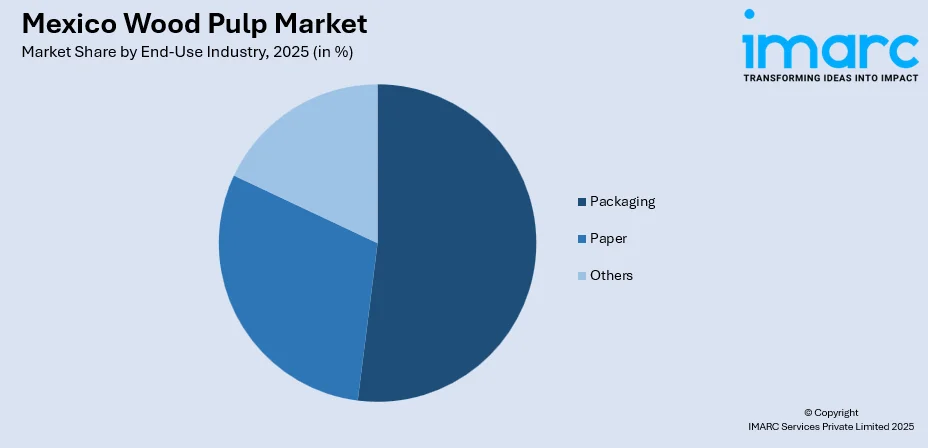

By End Use: Packaging represents the largest segment with a market share of 52% in 2025, fueled by expanding e-commerce logistics requirements and regulatory shifts favoring paper-based alternatives over plastic packaging.

-

Key Players: The Mexico wood pulp market exhibits a moderately consolidated competitive landscape, with multinational paper and packaging corporations maintaining significant market presence alongside established regional manufacturers. Market participants are actively investing in capacity expansion and sustainable production technologies to meet evolving environmental compliance requirements.

To get more information on this market Request Sample

The Mexico wood pulp market represents a critical component of the country's broader paper and packaging industry, which employs a substantial workforce across numerous manufacturing plants distributed throughout multiple states. Mexico maintains a significant trade deficit in pulp products, importing considerable volumes primarily from the United States, which serves as the leading supplier of wood pulp to the Mexican market. The market is characterized by growing vertical integration among leading manufacturers who are investing in sustainable fiber sourcing and closed-loop recycling systems. In 2024, Bio Pappel recycled 1.7 million tons of paper and cardboard through its Urban Forest program, positioning the company as the principal recycling paper company in Latin America. This commitment to circular economy principles reflects the broader industry transformation toward environmental sustainability while addressing raw material supply challenges.

Mexico Wood Pulp Market Trends:

Accelerating Shift Toward Sustainable Packaging Solutions

The Mexico wood pulp market is witnessing substantial transformation as regulatory frameworks increasingly mandate sustainable packaging alternatives. Mexico City's comprehensive single-use plastic ban, implemented in phases beginning January 2020, has prohibited plastic bags, cutlery, straws, plates, and containers, compelling businesses to adopt paper-based solutions. This regulatory environment has prompted 135 companies in Mexico City alone to secure authorization for commercializing compostable products. The expansion of similar restrictions across states including Durango, Quintana Roo, Zacatecas, and Michoacán is amplifying demand for wood pulp-derived packaging materials throughout the country.

E-Commerce Driven Corrugated Packaging Expansion

The rapid growth of online retail is fundamentally reshaping wood pulp consumption patterns across Mexico. E-commerce penetration is driving unprecedented demand for corrugated boxes, protective mailers, and cushioning systems. Food delivery platforms generated over 300,000 tons of packaging waste in 2024, highlighting both the scale of demand and the opportunity for sustainable paper-based alternatives as regulatory enforcement intensifies against plastic packaging in the foodservice sector.

Industrial Modernization and Capacity Enhancement

Major industry participants are undertaking significant capital investments to modernize production infrastructure and expand manufacturing capacity throughout Mexico. In July 2024, ABB secured a landmark contract to modernize Smurfit Kappa's Paper Machine 5 at its Cerro Gordo corrugated cardboard mill near Mexico City, implementing advanced distributed control systems and drive technologies to optimize operational efficiency. This modernization initiative follows Smurfit Kappa's broader investment strategy that has deployed over USD 350 Million in Mexican operations since 2018, reflecting sustained confidence in the market's long-term growth trajectory.

Market Outlook 2026-2034:

The Mexico wood pulp market outlook remains positive through the forecast period, supported by fundamental demand drivers including continued urbanization, rising hygiene awareness among consumers, and the broader transition toward circular economy practices across diverse industries. The ongoing enforcement of single-use plastic restrictions across multiple Mexican states will sustain strong momentum for paper-based packaging substitution, while accelerating nearshoring manufacturing trends continue to position Mexico as an increasingly attractive production hub serving North American supply chains. The market generated a revenue of USD 2.68 Billion in 2025 and is projected to reach a revenue of USD 3.40 Billion by 2034, growing at a compound annual growth rate of 2.67% from 2026-2034.

Mexico Wood Pulp Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Hardwood |

65% |

|

Grade |

Chemical |

54% |

|

End Use Industry |

Packaging |

52% |

Type Insights:

- Hardwood

- Softwood

The hardwood dominates with a market share of 65% of the total Mexico wood pulp market in 2025.

Hardwood pulp derived from species including eucalyptus, birch, oak, and maple delivers shorter fibers that produce smoother paper surfaces with superior printability characteristics. These properties make hardwood pulp essential for manufacturing fine printing paper, coated papers, tissue products, and premium packaging materials where surface quality significantly influences end-product performance. The growing demand for high-quality tissue paper and facial tissues driven by increasing hygiene awareness continues to reinforce hardwood pulp consumption across Mexican manufacturing facilities.

The Mexico tissue paper market size reached USD 932.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,423.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. Mexico's participation in this expanding market is supported by hardwood pulp's inherent softness and absorbency characteristics that meet consumer expectations for premium personal care products. Regional manufacturers are increasingly sourcing certified hardwood pulp to satisfy both quality requirements and sustainability certifications demanded by environmentally conscious consumers and evolving regulatory frameworks governing sustainable material sourcing.

Grade Insights:

- Mechanical

- Chemical

- Semi-Chemical

- Others

The chemical leads with a share of 54% of the total Mexico wood pulp market in 2025.

Chemical wood pulp, predominantly produced through the kraft pulping process, delivers superior fiber strength by effectively removing lignin while preserving cellulose integrity. This process creates pulp with exceptional tensile strength and durability characteristics essential for manufacturing corrugated packaging, containerboard, and high-performance paper products. The kraft process can accommodate diverse fiber sources including softwood and hardwood species, providing production flexibility that supports consistent supply chain operations across Mexican manufacturing facilities.

Chemical pulp imports into Latin America demonstrate the grade's market dominance, with chemical wood pulp comprising the vast majority of total pulp imports into the region. Mexico's position as a leading importer of chemical pulp within Latin America underscores the critical role this grade plays in supporting domestic paper and packaging manufacturing capacity. The ongoing expansion of kraft liner and containerboard production facilities throughout Mexico reinforces the sustained demand trajectory for chemical pulp.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Food and Beverages

- Pharmaceutical

- Personal Care and Cosmetics

- Automotive

- Others

- Paper

- Newspaper

- Books and Magazines

- Tissues

- Others

- Others

The packaging exhibits clear dominance with a 52% share of the total Mexico wood pulp market in 2025.

The packaging segment encompasses corrugated boxes, folding cartons, paper bags, and specialty packaging applications serving diverse industries from food and beverages to pharmaceuticals and consumer goods. Mexico's packaging industry commands a substantial share of the country's total packaging market, with paper projected to achieve the fastest growth through the forecast period as plastic substitution accelerates. Food and beverage applications represent the primary demand driver, leveraging wood pulp-based materials for protective shipping containers, retail displays, and consumer product packaging.

The Smurfit Kappa-WestRock merger established Latin America's largest packaging producer, demonstrating the strategic importance of the Mexican market for global packaging manufacturers. Major investments including Smurfit Kappa's significant upgrade of its Nuevo Laredo plant, which considerably expanded production capacity while substantially reducing carbon emissions, exemplify the strong industry commitment to expanding sustainable packaging manufacturing capabilities throughout Mexico. These developments reflect growing confidence in the market's long-term growth potential.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents a strategic growth corridor for the wood pulp market, benefiting from its proximity to the United States border and the accelerating nearshoring trend bringing manufacturing operations from Asia. The region between Monterrey and Tijuana has emerged as a prime destination for global companies establishing production facilities, driving substantial demand for industrial packaging and corrugated materials. Smurfit Kappa's investment in the Nuevo Laredo corrugated plant exemplifies the strategic importance of this region.

Central Mexico, anchored by the Mexico City metropolitan area, constitutes one of the largest consumer markets for wood pulp-derived products. The region hosts major paper and packaging manufacturing facilities including Smurfit Kappa's Cerro Gordo mill, which is undergoing significant modernization through ABB's advanced control system implementation scheduled for completion in 2025. Central Mexico's stringent single-use plastic bans have created a regulatory environment that strongly favors paper-based packaging alternatives.

Southern Mexico presents emerging opportunities for wood pulp market expansion, particularly in agricultural packaging applications serving the region's substantial farming sector. The area's developing industrial base and improving infrastructure connectivity are gradually attracting investment in packaging manufacturing capacity to serve regional agricultural exports and domestic consumer markets.

Market Dynamics:

Growth Drivers:

Why is the Mexico Wood Pulp Market Growing?

Regulatory Mandates Driving Plastic Substitution

Government regulations restricting single-use plastics across Mexican states are creating substantial structural demand for wood pulp-based packaging alternatives. Mexico City's comprehensive ban on plastic bags, followed by prohibitions on disposable cutlery, straws, plates, and containers, established a regulatory precedent that is expanding to additional states including Durango, Quintana Roo, Zacatecas, and Michoacán. The enforcement mechanism has generated numerous fines in Mexico City alone, demonstrating regulatory commitment that provides market certainty for paper packaging investments. This policy framework aligns with broader sustainability initiatives as Mexico works toward circular economy principles, creating favorable conditions for sustained wood pulp market expansion.

E-Commerce Expansion Fueling Corrugated Demand

The rapid expansion of online retail throughout Mexico is fundamentally transforming wood pulp consumption patterns, driving unprecedented demand for corrugated packaging, protective materials, and shipping solutions. Mexico e-commerce market size is expected to reach USD 175.8 Billion by 2034, exhibiting a growth rate (CAGR) of 13.92% during 2026-2034, establishing a sustained demand foundation for paper-based packaging materials. Retailers invested substantially in store expansion and workforce growth, generating higher secondary and tertiary packaging volumes across supply chains. The dimensional weight pricing structures employed by logistics providers incentivize lightweight paper-based mailers and cushioning systems, further accelerating the shift from rigid plastics to wood pulp-derived alternatives.

Nearshoring Manufacturing Driving Industrial Packaging Requirements

The strategic relocation of manufacturing operations from Asia to Mexico is generating substantial new demand for industrial packaging and corrugated materials throughout the country. Mexico's advantageous position for accessing the US market, combined with favorable trade agreements and competitive labor costs, has attracted significant manufacturing investment particularly in the northern states between Monterrey and Tijuana. The Mexican economy flourished 1.8% during the first half of 2025, boosted by increased manufacturing investment that directly translates to expanded packaging requirements. Smurfit Kappa's substantial investment in Mexican operations, including recent capacity expansions in Tijuana, Culiacan, and Nuevo Laredo, reflects the scale of opportunity presented by nearshoring-driven industrial growth.

Market Restraints:

What Challenges the Mexico Wood Pulp Market is Facing?

Import Dependency and Supply Chain Vulnerabilities

Mexico maintains substantial import dependency for wood pulp supplies, with domestic production capacity insufficient to meet manufacturing demand. The country's significant pulp trade deficit, characterized by imports considerably exceeding exports, creates exposure to international price fluctuations, currency movements, and supply chain disruptions that can impact production costs and availability for domestic paper manufacturers.

Raw Material Cost Volatility

Fluctuations in wood pulp prices driven by global supply-demand imbalances, energy costs, and environmental regulations create margin pressure for Mexican paper and packaging manufacturers. The highly concentrated nature of Mexico's paper industry, with just 27 companies producing nearly all paper products, limits the market's capacity to absorb price shocks and can result in competitive disadvantages relative to larger international producers.

Environmental and Sustainability Compliance Costs

Increasing environmental regulations and sustainability certification requirements impose additional compliance costs on wood pulp consumers and processors. Meeting standards for sustainable fiber sourcing, water usage, and emissions reduction requires capital investment in upgraded production technologies and certification processes that can challenge smaller market participants while favoring larger, well-capitalized manufacturers.

Competitive Landscape:

The Mexico wood pulp market exhibits a moderately consolidated competitive structure characterized by the presence of multinational paper and packaging corporations alongside established regional manufacturers. The industry is highly concentrated, with major participants commanding significant market positions across packaging, printing, and tissue segments. Market leaders are actively investing in capacity expansion, operational modernization, and sustainable production technologies to strengthen competitive positioning. The merger of Smurfit Kappa and WestRock created Latin America's largest packaging producer, intensifying competitive dynamics throughout the region. Strategic priorities across the competitive landscape include vertical integration, circular economy initiatives, and technological advancement to meet evolving customer requirements and regulatory mandates.

Mexico Wood Pulp Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hardwood, Softwood |

| Grades Covered | Mechanical, Chemical, Semi-Chemical, Others |

| End Use Industries Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico wood pulp market size was valued at USD 2.68 Billion in 2025.

The Mexico wood pulp market is expected to grow at a compound annual growth rate of 2.67% from 2026-2034 to reach USD 3.40 Billion by 2034.

Hardwood held the largest market share of 65% in 2025, driven by its superior fiber properties for producing smooth printing paper, tissue products, and premium packaging materials that meet quality standards demanded by consumers and industrial applications.

Key factors driving the Mexico wood pulp market include regulatory mandates restricting single-use plastics that drive demand for paper-based packaging alternatives, expanding e-commerce sector requiring sustainable corrugated packaging solutions, and nearshoring manufacturing trends attracting industrial investment and packaging demand.

Major challenges include substantial import dependency exposing the market to international price fluctuations, raw material cost volatility affecting manufacturer margins, and increasing environmental compliance costs associated with sustainable sourcing certifications and production technology upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)