Micro Battery Market Report by Type (Thin Film Battery, Printed Battery, Solid State Chip Battery, Button Batteries), Capacity (Below 10 mAh, Between 10 mAh to 100 mAh, Above 100 mAh), Rechargeability (Primary Battery, Secondary Battery), Application (Consumer Electronics, Medical Devices, Smart Packaging, Smart Cards, Wearable Devices, Wireless Sensor Nodes, and Others), and Region 2025-2033

Global Micro Battery Market

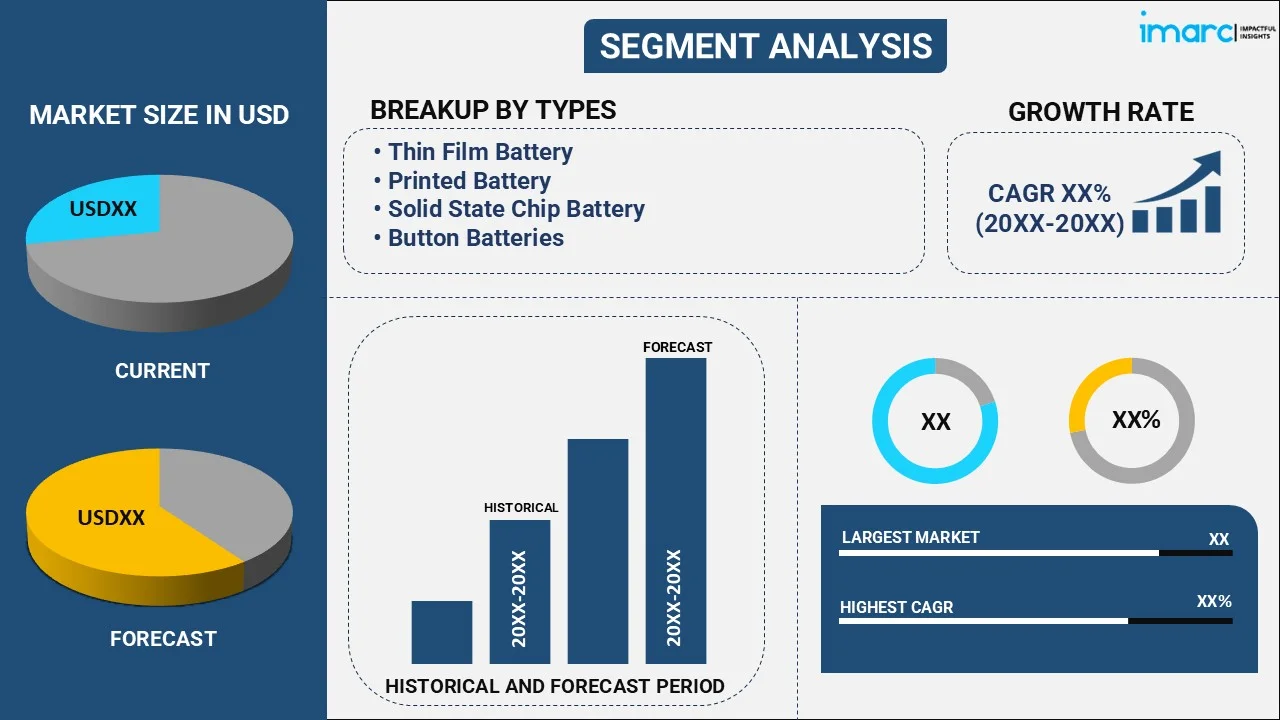

The global micro battery market size reached USD 594.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,651.7 Million by 2033, exhibiting a growth rate (CAGR) of 18.08% during 2025-2033. The sudden shift towards miniaturization of consumer electronic devices, rising application in medical devices, rapid technological advancements, growing environmental concerns, favorable government initiatives and the increasing demand for portable and compact devices are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 594.4 Million |

| Market Forecast in 2033 | USD 2,651.7 Million |

| Market Growth Rate (2025-2033) | 18.08% |

Micro Battery Market Analysis:

- Major Market Driver: One major driver for the micro battery market is the increasing demand for compact and lightweight power sources in portable electronic devices such as smartwatches, fitness trackers, and medical devices.

- Key Market Trends: The increasing demand for compact and lightweight power sources in electronics such as wearables, IoT devices, and medical implants represent some of the significant trends propelling the market growth.

- Geographical Landscape: According to the micro battery market report by IMARC, Asia Pacific accounted for the largest market share. Asia Pacific is leading the micro battery market as the region is home to several of the world's leading consumer electronics manufacturers. Countries like China, Japan, and South Korea are powerhouses in producing smartphones, wearables, and other tech gadgets that extensively utilize micro batteries.

- Competitive Landscape: Some of the leading micro battery market companies include Duracell Inc. (Berkshire Hathaway), ITEN, Maxell Ltd., Murata Manufacturing Co. Ltd., Panasonic Corporation, Renata SA (The Swatch Group), Seiko Instruments Inc. (Seiko Group Corporation), TDK Corporation, Ultralife Corporation, and Varta AG (Montana Tech Components), among many others.

- Challenges and Opportunities: The micro battery market faces challenges related to the limited energy capacity and power output of current micro battery technologies, which can restrict their use in high-energy applications. However, micro battery market recent opportunities include the development of advanced materials and manufacturing techniques that could enhance the performance of micro batteries, making them more suitable for a wider range of applications.

Micro Battery Market Trends:

Increasing Miniaturization of Electronic Devices

The increasing trend of miniaturization in electronic devices is one of the most significant drivers propelling the market growth. Additionally, the relentless push to make gadgets smaller, lighter, and more portable without sacrificing their performance is providing a considerable boost to the market growth. Moreover, various key market players are extensively investing in the development of micro batteries with increased battery life, improved design and weight, and enhanced performance to cater to the increasingly changing technology. This may lead to an increase in the micro battery market recent price. For instance, in October 2023, Tdk launched thin film solar cells. It is light and thin, which means it can stand up to dropping, and is flexible and has excellent formability characteristics. The film solar cells being light, thin, and flexible make them durable and suitable for micro batteries. Additionally, various battery manufacturers are also partnering with electric vehicle manufacturers to produce customized miniature batteries for them. For instance, in December 2022, Panasonic Holdings concluded an agreement to supply lithium-ion batteries to electric vehicle (EV) maker Lucid Group. Furthermore, the growing consumer preference for portability and convenience is anticipated to propel the micro battery market share in the coming years.

Rising Advancements in the Medical Sector

Ongoing advancements in medical devices and implants are catalyzing the micro battery market growth. Additionally, the increasing innovations in medical technology result in devices like compact cochlear implants, insulin pumps, and pacemakers that are increasingly being utilized to ensure patient comfort and surgical implantation ease. For instance, in October 2020, Murata Manufacturing Co., Ltd. launched High Drain silver oxide batteries (SR) and alkaline manganese batteries (LR). Silver oxide batteries (SR) and alkaline manganese batteries (LR) are used in medical devices for dosing devices, insulin pumps/pens, and capsule endoscopes. Moreover, the rising prevalence of chronic diseases such as cardiovascular diseases, cancer, and respiratory diseases, which require surgeries as treatment, is also driving the micro battery market demand. According to GLOBOCAN 2020, 2,281,658 new cancer cases were diagnosed in the United States in 2020, with 612,390 fatalities. Similarly, according to the American Cancer Society updates from January 2021, it was estimated that 250 new cases of cervical cancer were diagnosed in 2021. Considering this, various medical device manufacturers are developing and launching miniature implants and diagnosing devices that can provide accurate diagnosis and treatment to the patient. For instance, in January 2024, researchers at MIT developed a urine-based point-of-care test using inhaled aerosolized nano sensors that are delivered to patients by an inhaler or nebulizer. If the sensors encounter cancer-linked proteins in the lungs, they produce a signal that accumulates in the urine, which can be detected with a simple paper test strip. These nano sensors work on micro batteries, thereby propelling the market growth.

Rapid Technological Innovation

As per the micro battery market statistics by IMARC, technological advancements in materials science, nanotechnology, and electrochemistry are driving innovations in micro battery design and capabilities. Moreover, the expanding semiconductor industry across the globe is also bolstering the market for micro batteries. In addition to this, the government authorities of various nations are taking initiatives to support the semiconductor industry. For instance, China has continuously introduced policies to support the localization of the semiconductor industry. The "Made in China 2025" initiative has provided a clear roadmap for the localization of semiconductor equipment production. According to SEMI, in recent years, many new 12-inch fab projects have been announced, started construction, or are in the ramp-up stage in China, including UMC in Xiamen, TSMC in Nanjing, PSC in Hefei, GLOBALFOUNDRIES in Chengdu, as well as YMTC in Wuhan and Nanjing. Besides this, the emerging preference for nanotechnology, since it helps in the development of highly efficient and precise products in various fields, from medicine to electronics, is also contributing to the market for micro batteries. Moreover, continuous advancements in the nanotechnology field, for instance, researchers reporting in the American Chemical Society (ACS) Nano developed a self-powered nano sensor, named triboelectric nano sensor (TENS), using an array of mercury-sensitive tellurium nanowires, are creating a positive outlook for the overall market. According to researchers, these nano sensors can discover small amounts of mercury ions in water or food and report the result immediately. Such innovations are projected to propel the micro battery market revenue in the coming years.

Micro Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global micro battery market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, capacity, rechargeability and application.

Breakup by Type:

- Thin Film Battery

- Printed Battery

- Solid State Chip Battery

- Button Batteries

Solid state chip battery dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes thin film battery, printed battery, solid state chip battery and button batteries. According to the report, solid state chip battery represented the largest segment.

Solid-state chip batteries have distinct characteristics that make them highly desirable for various applications. These batteries offer high energy density, making them extremely efficient for their size, particularly important for applications that require compact, lightweight power sources. Moreover, these batteries often use materials that are less harmful to the environment, making disposal easier and less impactful. Additionally, as per the micro battery market overview, numerous industries are increasingly adopting solid-state batteries for their devices and machinery. For instance, in April 2024, Samyang in South Korea signed a ₩3bn ($2.2m, €2.06m) deal to supply lithium sulphate electrolytes for solid state batteries.

Breakup by Capacity:

- Below 10 mAh

- Between 10 mAh to 100 mAh

- Above 100 mAh

Between 10 mAh to 100 mAh hold the largest share in the market

A detailed breakup and analysis of the market based on the capacity has also been provided in the report. This includes below 10 mAh, between 10 mAh to 100 mAh and above 100 mAh. According to the report, between 10 mAh to 100 mAh accounted for the largest market share.

Batteries with a capacity between 10 mAh to 100 mAh constitute the largest market segment as they offer an optimal balance between size and energy storage. Moreover, this capacity range is versatile and suits a broad spectrum of applications, including wearable tech, medical devices, and IoT sensors. Additionally, devices using batteries in this capacity range can operate longer without requiring frequent charging or battery replacement, thereby offering a seamless user experience.

Breakup by Rechargeability:

- Primary Battery

- Secondary Battery

Secondary battery holds the largest share in the market

A detailed breakup and analysis of the market based on the rechargeability has also been provided in the report. This includes primary battery and secondary battery. According to the report, secondary battery accounted for the largest market share.

Secondary batteries occupy the largest application segment within the micro battery market as they are more cost-effective compared to primary (non-rechargeable) batteries and can be recharged and used multiple times. Moreover, secondary batteries contribute less waste than disposable batteries, aligning with global efforts to reduce environmental impact. The increasing adoption of secondary batteries are anticipated to positively impact the micro battery market outlook.

Breakup by Application:

- Consumer Electronics

- Medical Devices

- Smart Packaging

- Smart Cards

- Wearable Devices

- Wireless Sensor Nodes

- Others

Consumer electronics hold the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes consumer electronics, medical devices, smart packaging, smart cards, wearable devices, wireless sensor nodes and others. According to the report, consumer electronics accounted for the largest market share.

The consumer electronics sector stands as the largest market segment owing to the pervasive use of micro batteries in a myriad of devices that have become integral to modern life. Moreover, the increasing utilization of consumer electronics such as smartphones, laptops, tablets, and wearables is also contributing to the segment’s growth. These devices demand compact yet potent power sources to function effectively, making micro batteries an ideal choice. Significant volume growth in smartphone adoption is expected to create a demand for micro batteries in the smartphone industry. Moreover, the appliances and consumer electronics industries are expected to reach US$ 21.18 Billion by 2025, in India, according to the Indian Brand Equity Foundation. Such rapid adoption of smart phones and other consumer electronics will continue to propel the growth of the segment in the coming years.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest micro battery market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific is leading the micro battery market as the region is home to several of the world's leading consumer electronics manufacturers. Countries like China, Japan, and South Korea are powerhouses in producing smartphones, wearables, and other tech gadgets that extensively utilize micro batteries. Besides this, the increasing deployment of 5G connectivity across the region is driving the incorporation of connected car features in vehicles, supporting market growth. According to Ericsson, 5G will account for nearly 40% of mobile subscriptions in India by the end of 2027, with 500 million subscribers. Such development factors will increase the demand for micro batteries in the sector. Moreover, the micro battery market forecast indicates that the collaborations between numerous semiconductor firms and various end-users of semiconductors are also contributing to the region’s growth. For instance, in January 2023, Geely Technology Group and GTA Semiconductor signed a strategic cooperation agreement for comprehensive cooperation in automotive chip development, manufacturing, market application, and talent training. The two companies will also focus on the coordinated development of the automotive chip industry and promote major domestic semiconductor technology breakthroughs.

Competitive Landscape:

The report has provided a comprehensive analysis of the micro battery market overview and competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Duracell Inc. (Berkshire Hathaway)

- ITEN

- Maxell Ltd.

- Murata Manufacturing Co. Ltd.

- Panasonic Corporation

- Renata SA (The Swatch Group)

- Seiko Instruments Inc. (Seiko Group Corporation)

- TDK Corporation

- Ultralife Corporation

- Varta AG (Montana Tech Components)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Micro Battery Market Recent Developments:

- March 2024: CORE SWX announced its new V-mount and Gold-mount NANO X Micro Batteries featuring a first first-of-its-kind NexCore casing compound, crafted from robust polycarbonate. Embedded within the NexCore battery shell, the patent-pending EmLEd display is claimed to herald a new era of resilient battery design.

- October 2023: Ensurge Micropower signed an agreement for its solid-state lithium micro battery technology that extended its growing roster of strategic partnership engagements into the medical device industry. The company’s micro battery can help transform wearable or portable medical device design by providing a safe, reliable, energy-dense power source.

Micro Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Thin Film Battery, Printed Battery, Solid State Chip Battery, Button Batteries |

| Capacities Covered | Below 10mAh, Between 10 mAh to 100 mAh, Above 100 mAh |

| Rechargeabilities Covered | Primary Battery, Secondary Battery |

| Applications Covered | Consumer Electronics, Medical Devices, Smart Packaging, Smart Cards, Wearable Devices, Wireless Sensor Nodes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Duracell Inc. (Berkshire Hathaway), ITEN, Maxell Ltd., Murata Manufacturing Co. Ltd., Panasonic Corporation, Renata SA (The Swatch Group), Seiko Instruments Inc. (Seiko Group Corporation), TDK Corporation, Ultralife Corporation, Varta AG (Montana Tech Components), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the micro battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global micro battery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the micro battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The micro battery market was valued at USD 594.4 Million in 2024.

The micro battery market is projected to exhibit a CAGR of 18.08% during 2025-2033.

The micro battery market is driven by the increasing demand for smaller, energy-efficient power sources in consumer electronics, wearables, and medical devices. The growth of the Internet of Things (IoT) and the rise of electric vehicles also contribute to market expansion. Additionally, the push for sustainable energy solutions further accelerates innovation in micro battery development.

Asia Pacific currently dominates the market, driven by increasing deployment of 5G connectivity across the region.

Some of the major players in the micro battery market include Duracell Inc. (Berkshire Hathaway), ITEN, Maxell Ltd., Murata Manufacturing Co. Ltd., Panasonic Corporation, Renata SA (The Swatch Group), Seiko Instruments Inc. (Seiko Group Corporation), TDK Corporation, Ultralife Corporation, Varta AG (Montana Tech Components), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)