Middle East Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Country, 2025-2033

Middle East Fintech Market Size and Share:

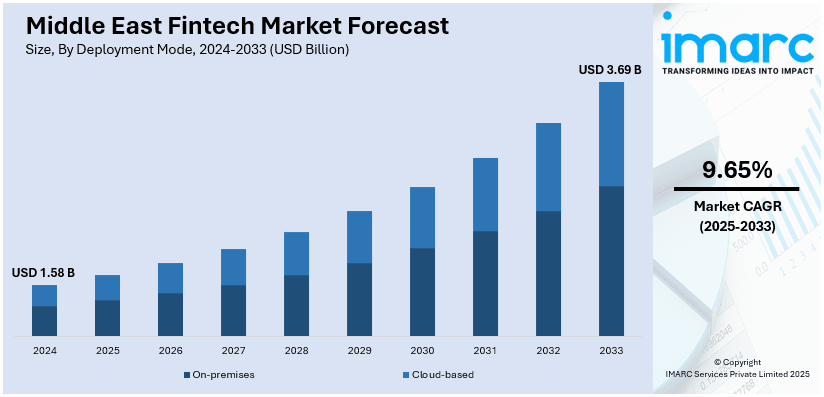

The Middle East fintech market size was valued at USD 1.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.69 Billion by 2033, exhibiting a CAGR of 9.65% from 2025-2033. The market is primarily driven by the rising consumer demand for digital financial solutions, rapid technological advancements, increasing investments in fintech startups, supportive government policies, expanding internet penetration, a growing preference for cashless transactions, and strategic collaborations between financial institutions and tech firms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.58 Billion |

| Market Forecast in 2033 | USD 3.69 Billion |

| Market Growth Rate (2025-2033) | 9.65% |

The market is majorly driven by the increased access to financial resources across the region, where both governments and private establishments are striving for the unbanked population through mobile banking and digital wallets. The widespread adoption of advanced technologies, including AI and blockchain, is also propelling the innovative development of tailored fintech products toward unique needs. For instance, On April 3, 2024, First Abu Dhabi Bank (FAB) collaborated with Microsoft to create AI-powered banking capabilities. FAB will use Microsoft's Azure AI services to create an AI Innovation Hub that will help it enhance its product offerings and streamline operations in retail, corporate, and investment banking sectors. In addition, the strong startup ecosystem, powered by accelerators, incubators, and venture capital, further incubates fintech innovation.

Additionally, the increasing e-commerce and digital trade resulting in an unprecedented need for efficient and secure gateways is fueling the market. Apart from these factors, the region's demographic is predominantly young and techno-friendly, hastening the adoption of digital financial services. Global events also put a spotlight on the region's fintech potential, attracting international attention and fostering cross-border collaborations. For instance, industry reports specify that on December 16, 2024, Money20/20, a leading global fintech event, will take its first Middle East edition in Riyadh, Saudi Arabia, from the 15th through to September 17, 2025. The conference will be the focal point for bringing together global leaders, innovators, policymakers, and investors who will review, share, and play their part in marking the future of payments and the financial services landscape.

Middle East Fintech Market Trends:

Regulatory Support and Innovation

Regulatory frameworks play a crucial role in influencing the Middle East fintech market share as they support and encourage innovations in the sector. Most of the governments in the region, including the UAE, Saudi Arabia, and Bahrain, have set up regulatory sandboxes and are issuing licenses to fintech companies to promote competitiveness. Such policies lower barriers to entry for fintech companies and give them a controlled environment in which to test new technologies. This friendly environment enables fintech companies to easily acquire considerable market share while also responding to the needs of an increasingly tech-inclined citizenry. On May 4, 2024, Saudi Arabia's fintech market has grown extensively, with USD 1 billion invested in the country's domestic fintech firms. Initiatives such as the Fintech Saudi launched in April 2018 by the Saudi Central Bank and Capital Markets Authority play a pivotal role in this growth.

Growing Consumer Demand for Digital Financial Services

The market for Fintech in the Middle East is also influenced by changes in consumer behavior towards more digital and contactless financial services. Consumers in the Middle East boast one of the highest penetration rates for smartphones around the globe and increasingly require faster, more secure, and convenient ways of payment and investment through online banking platforms. The youth comprise a substantial majority of the population, hence their willingness to shift to more digital-first financial services. Moreover, government policies to develop more digital finances further fuel Middle East fintech market growth. For instance, on November 28, 2024, an industry journal reported that the Central Bank of Iran is to develop the Digital Rial. The initiative aims to modernize the banking system and strengthen international financial cooperation. Governor Mohammad Reza Farzin unveiled the ACU-MIR system, an alternative to SWIFT, facilitating transactions with countries like India and Pakistan. Additionally, the pandemic accelerated digital transformation in the region, promoting digital wallets, peer-to-peer payments, and cryptocurrency adoption.

Increasing Foreign Investment and Strategic Partnerships

Increasing foreign investment and cross-border partnerships are the factors that shape the Middle East fintech market overview. Global fintech companies find the Middle East a highly attractive market due to its untapped potential, high-income demographics, and favorable regulatory frameworks. Foreign investments are being made into both established fintech players and startups, enabling them to scale their operations and develop advanced technologies. Partnerships are key drivers in technological innovations in areas such as AI, blockchain-based solutions, and robo-advisors. Strategic alliances between international and regional players further amplify the fintech ecosystem by providing access to global expertise and resources. For instance, on June 7, 2024, Oman's leading Islamic bank, Bank Nizwa, formed digital partnerships with Omantel and Oman Data Park (ODP) to enhance the fintech landscape of the country. These partnerships are expected to integrate banking services into Omantel's mobile network and use ODP's infrastructure to support Bank Nizwa's operations in advancing Islamic fintech solutions and driving digital transformation in Oman's financial sector.

Middle East Fintech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Middle East fintech market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on deployment mode, technology, application, and end user.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises remains a leading deployment option for Middle Eastern fintech companies, especially for institutions like banks and financial services companies. The regulatory strictures, enhanced control over sensitive data, and cybersecurity issues as reasons behind the preference for on-premises. Local infrastructure deployment ensures compliance with data sovereignty laws, especially for countries like Saudi Arabia and the UAE. Moreover, on-premises deployment allows for better customization, allowing organizations to fit their systems into unique operational requirements. Although there are higher upfront costs and maintenance issues, this mode is widely preferred for its reliability, operational control, and security protocols.

The adoption of cloud-based deployment is gaining popularity in the Middle East fintech landscape as digital transformation and the region's innovation are on the rise. Government investments in cloud infrastructure and the implementation of favorable government initiatives create a favorable ecosystem for cloud adoption. Cloud solutions enable fintech firms to scale operations, reduce costs, and launch services faster, thereby meeting the growing demand for digital payments, lending platforms, and blockchain-based solutions. The flexibility to integrate artificial intelligence (AI), machine learning (ML), and advanced analytics makes cloud-based models highly appealing in the market.

Analysis by Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Programming Interface (API) is an important segment that drives innovation in the Middle Eastern fintech sectors, allowing fluid integration between financial institutions and third-party service providers. Country-specific open bank initiatives, which are being established in countries like Bahrain and the United Arab Emirates, utilize APIs to cooperate and improve client experiences. Such APIs allow these fintech entities to provide customized applications such as one-touch real-time payment processing or automated lending and investment platforms for their clients. They also facilitate compliance by allowing access to the regulatory sandboxes. With the high growth rate of APIs, innovations can be developed at faster rates with reduced barriers for new entrants to push competition in the market.

Artificial Intelligence (AI) is changing the shape of fintech market trends in the Middle East through smarter decision-making, more customer-friendly experience, and operational efficiency. Banks and other fintech companies are utilizing AI for advanced data analytics, fraud detection, credit scoring, and personalized advice on financial matters. AI-based chatbots and virtual assistants are gaining momentum in addressing customer enquiries as well as simplifying transactions. The governments and financial institutes are actively investing in AI research and deployment, aligning with regional strategies like the UAE's AI Initiative. Its applications are enhancing service quality and also contribute to the scalability and security of digital financial ecosystems.

Blockchain technology is driving innovation in the Middle East fintech sector by making financial transactions clear, secure, and efficient. The governments and regulators in the region are embracing blockchain for digital identity verification, secure payment systems, and smart contract implementation. Blockchain is most impactful in cross-border payments by solving issues like high costs and delays. It has a decentralized nature that encourages trust and reduces dependency on intermediaries, making it a preferred technology for emerging fintech solutions. It also opens the possibility of novel financial instruments, given the growth of cryptocurrencies and tokenization.

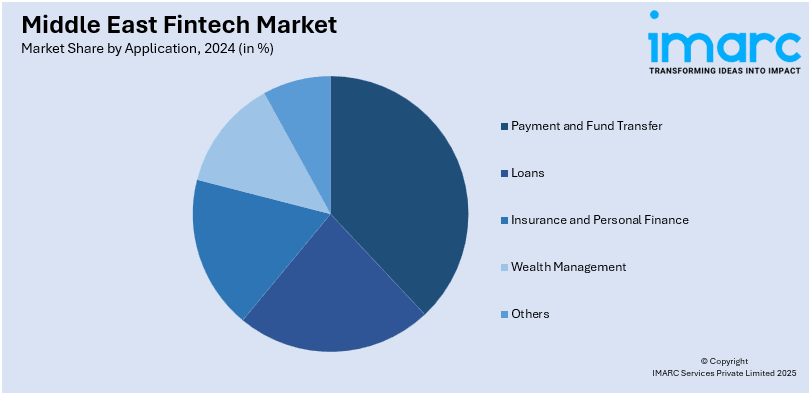

Analysis by Application:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Payment and fund transfer applications are at the top of the fintech spectrum in the Middle East. The young, tech-savvy population, coupled with increasing smartphone penetration, leads to a rise in digital wallets, peer-to-peer transfer apps, and QR code payments. Governments actively promote cashless economies, as reflected in Saudi Arabia's Financial Sector Development Program and the UAE's cashless payment initiatives. These applications reduce the costs of transactions and enable real-time transfers. Thereby, fintech addresses the unbanked and underbanked. The focus on secure and efficient digital payment systems highlights their pivotal role in financial inclusion and economic growth.

Loan applications are transforming credit access in the Middle East by streamlining the borrowing process and expanding opportunities for individuals and businesses. Fintech platforms use alternative data and advanced algorithms to assess creditworthiness, allowing for quicker loan approvals for underserved segments such as SMEs and startups. Digital lending platforms, microfinance solutions, and BNPL services driven by development in e-commerce and entrepreneurial activity are on the rise. As governments encourage SME growth as part of economic diversification plans, loan-focused fintech applications are positioned to address financing gaps and drive economic development.

Insurance and personal finance applications are also emerging as significant aspects of the evolving fintech market in the Middle East. The availability of digital platforms has made insurance more accessible with customized products, instant policy issuance, and hassle-free claim processing. Insurtech solutions are becoming popular in the region to bridge the low insurance penetration rates. Personal finance apps empower users to manage their budgets, track expenses, and invest, thus cultivating a culture of financial literacy. These tools respond to a growing demand for transparency and convenience in financial planning. With government support for digital transformation and the rise of AI-driven advisory services, fintech solutions in insurance and personal finance are poised to play a significant role in enhancing financial inclusion and consumer empowerment.

Analysis by End User:

- Banking

- Insurance

- Securities

- Others

Middle East banks are using fintech innovations to improve customer experience and efficiency. Traditional banks are embracing digital banking solutions, open banking frameworks, and advanced technologies to remain competitive. Fintech partnerships allow banks to offer personalized financial products, faster payment processing, and seamless loan services. Financial inclusion and the associated growth of mobile money and digital wallets have made them imperative for reaching large, still unbanked populations, particularly in rural settings. Digitization has also been promoted through encouragement by governments via regulatory frameworks and incentives. With banks evolving into more digital-first service providers, the fintech landscape in the region is also experiencing growth.

Middle Eastern insurance companies embrace fintech solutions to solve low penetration rates and the need for efficient processes. Insurtech platforms are transforming the industry, offering digital-first insurance models with quick policy issuance and real-time claim settlements. Tailored products, such as microinsurance and usage-based insurance, are targeting diverse consumer needs, including expatriates and low-income groups. The implementation of artifical intelligence (AI) and machine learning (ML) enables an insurer to evaluate risks as well as limit fraud accurately. A rise in fintech innovations combined with increasing insurance awareness is pushing companies to enhance their reach by providing better accessible services to individual customers and corporate customers.

The securities sector in the Middle East is witnessing a transformation driven by fintech solutions that enhance trading efficiency, transparency, and accessibility. Digital platforms are facilitating easier access by retail investors to the stock markets, thus democratizing investment opportunities. Blockchain is increasingly being adopted for secure trading, tokenization of assets, and simplification of compliance processes. The government's emphasis on economic diversification is increasing capital markets and providing an opportunity for fintech firms to innovate in robo-advisors and algorithmic trading. These technologies appeal to tech-savvy investors and also attract market participants from across the globe, which increases regional liquidity.

Analysis by Country:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Saudi Arabia is leading the Middle East fintech market as it constitutes the largest economy and with technologically advanced features. The Vision 2030 program plays an important role in creating an environment for thriving startups and fintech companies. The regulatory frameworks implemented by the Saudi Central Bank and the Capital Market Authority facilitate innovations. The young and tech-savvy population and high smartphone penetration result in increased digital payments and neo banking. Moreover, the government's focus on economic diversification resulted in investments in fintech, which further supports market growth in the region.

Turkey is the important gateway between Europe, the Middle East, and Asia, so it is a prominent player in the fintech landscape of the region. The advanced banking sector in the region provides a solid ground for fintech innovations in various segments, such as digital wallets, payment systems, and blockchain. Also, support from regulators, including the Central Bank of Turkey and BRSA, supports the market growth. In addition, Turkey has strong entrepreneurial ambitions and a healthy startup ecosystem, which makes it a natural leader in the Middle East fintech market.

Israel is a global center for fintech innovation in the Middle East market. Israel is very strong in technologies in cybersecurity, blockchain, and artificial intelligence (AI) that are necessary for fintech innovation. The region boasts a highly skilled workforce and an entrepreneurial culture supported by active venture capital and government funding. Fintech companies from Israel are in the main areas of payments, lending, and regtech, thereby attracting many international partnerships and investments. The innovative and tech-driven solutions place Israel as a significant region in the Middle East market.

The United Arab Emirates (UAE) is one of the central hubs for fintech in the Middle East due to the region's strategic location, favorable business environment, and strong government support. Cities like Dubai and Abu Dhabi host leading financial centers, including the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), which provide comprehensive regulatory frameworks for fintech innovation. The UAE's goal of becoming a cashless economy and its focus on technologies like blockchain and digital payments facilitate growth in the sector. Initiatives like FinTech Hive and regulatory sandboxes attract global fintech companies to the UAE and foster regional collaboration, making it a cornerstone of the Middle East fintech market.

Iran has immense potential in the Middle East fintech market due to its huge, young population and increasing internet penetration. Despite facing international sanctions and economic challenges, Iran's fintech sector is developing, particularly in mobile payments, digital wallets, and P2P lending. The country's regulatory frameworks to support fintech growth further support the market. Geopolitical as well as financial constraints limit its integration into a broader regional fintech ecosystem, but its internal market experiences lucrative opportunities for development and growth.

Iraq is an emerging region in the market, with the country's intention to intends to modernize its economy. Low banking penetration and a high reliance on cash create huge opportunities for fintech companies to fill gaps in financial inclusion. Mobile payment platforms and digital wallets are emerging as key solutions, especially as internet access improves. The government has shown interest in supporting technological advancements to enhance economic growth and stability. The young population and awareness of digital finance make Iraq grow in the Middle East fintech market.

Qatar is one of the growing regions in the Middle East fintech market. Its National Vision 2030 strategy and large investments in digital transformation are pushing the country forward. The implementation of favorable regulatory policies by the Qatar Central Bank encourages innovations in the sector. The highly digitally savvy public, coupled with high penetration rates of smartphones in the region, results in rapid expansion in mobile banking and electronic payment. Regional partnerships and hosting global events are also significant growth-inducing factors for the market in the region.

Kuwait is emerging as a significant player in the Middle East fintech market as it builds upon its well-developed banking sector and digital transformation projects. The government and the Central Bank of Kuwait (CBK) are making concerted efforts to modernize the financial ecosystem by providing regulatory frameworks and initiatives. Fintech adoption in Kuwait's commitment to innovation and strategic location within the Gulf Cooperation Council (GCC) make it an important contributor to the Middle East fintech market.

Oman's fintech market is transforming and developing further through government initiatives and interest in digital transformation. Digital payments and mobile banking are the most prominent growth areas, catering to the country's low banking penetration and financial inclusion. Oman focuses on economic diversification through increasing investments in technology further supporting the market growth in the region. Also, Oman's efforts at building a strong digital infrastructure reflect promising growth prospects in the region.

Jordan has become a regional hub for innovation and entrepreneurship and significantly contributes to the Middle East fintech market. Its tech-savvy population and strong ICT sector provide a foundation for growth in the fintech market. The government initiatives to develop mobile wallets, remittances, and microfinance solutions cater to the needs of a largely unbanked population. Furthermore, the region's strategic location and highly educated workforce attract regional and international investors. A strong commitment to fostering a dynamic fintech ecosystem makes the country a notable player in the region.

Bahrain is the leading fintech hub in the Middle East due to its forward-thinking regulatory environment and strong financial sector. Bahrain FinTech Bay is a key innovation hub that supports the growth of fintech by providing resources and fostering collaboration. The main areas that the country focuses on are digital payments, Islamic fintech, and blockchain-reflecting its desire to stay competitive in the market. With a small but highly connected population, Bahrain leverages its agility and openness to position itself as a center for fintech innovation in the market.

Competitive Landscape:

The competitive landscape of the market is characterized by rapid growth and increased innovation. A large proportion of young people with high smartphone penetration are fueling the demand for digital financial services. Governments are promoting fintech ecosystems through supportive regulations and initiatives for the diversification of economies. The dominant solutions in payment, digital banking, and lending platforms encounter intense competition from local startups and international entrants. Fintech hubs such as Dubai and Riyadh emerge with strong infrastructure and funding opportunities. Strategic partnerships between fintech companies, traditional financial institutions, and technology providers enable access to wider customer bases and improve technological capabilities. For instance, on December 16, 2024, Mastercard and Jeel announced a strategic partnership to develop next-generation, AI-powered digital solutions to target the non-banking financial institutions (NBFI) market in Saudi Arabia. The collaboration will work to speed up the roll-out of services like Mastercard's Card-as-a-Service (CaaS) and Bank-as-a-Fintech (BaaF) offerings into the market and facilitating quicker market entry for fintech companies. The new initiative is bound to boost the digital economy by making available to its consumers a greater choice of bundled digital financial products.

The report provides a comprehensive analysis of the competitive landscape in the Middle East fintech market with detailed profiles of all major companies.

Latest News and Developments:

- September 6, 2024: Saudi fintech platform Hakbah announced a partnership with Tawuniya Insurance to provide complete life insurance to its customers for their periods of savings under Jameya. This agreement will be one step toward greater financial security for Saudi citizens, aligning with Saudi Vision 2030 to enhance national savings rates and encourage greater financial inclusion.

- November 1, 2024: India and Saudi Arabia have agreed to collaborate in sectors such as fintech, new technologies, energy efficiency, clean hydrogen, textiles, and mining to strengthen trade and investment ties. The announcement followed the second meeting of the Economy and Investment Committee under the India-Saudi Strategic Partnership Council, co-chaired by India's Commerce Minister Piyush Goyal and Saudi Energy Minister Abdulaziz bin Salman Al-Saud. Bilateral trade between the two countries was at USD 43 billion for the fiscal year 2023-24, with more than 2,700 Indian companies operating in Saudi Arabia and Saudi direct investments in India totaling USD 3.22 billion from April 2000 to June 2024.

- December 12, 2024: Quantix Technology Projects LLC, part of Astra Tech, acquired USD 500 Million through asset-backed securitization funding provided by Citi. The funding will bolster the growth of Quantix's CashNow consumer lending platform and strengthen Astra Tech's Ultra app ecosystem, which provides services such as payments, cross-border transfers, and financing solutions to over 150 million users globally.

- December 16, 2024: Abu Dhabi Islamic Bank's ADIB Ventures partnered with Lean Technologies to enhance financial innovation following the UAE's introduction of Open Finance. This collaboration enables ADIB to offer tailored digital banking solutions to fintech companies and corporate clients, utilizing Lean's platform for automated payouts, reconciliation, and account verification.

Middle East Fintech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East fintech market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Middle East fintech market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Financial technology, known as fintech, refers to innovative technology-driven solutions that enhance and automate financial services. It encompasses applications such as digital payments, online banking, peer-to-peer lending, cryptocurrency platforms, insurance tech, and investment apps. Fintech aims to improve financial inclusivity, streamline processes, and offer personalized user experiences by leveraging technologies like blockchain, artificial intelligence, and big data analytics

The Middle East Fintech market was valued at USD 1.58 Billion in 2024.

IMARC estimates the Middle East fintech market to exhibit a CAGR of 9.65% during 2025-2033.

The key factors driving the Middle East fintech market are the increasing digital transformation, growing smartphone penetration, and rising demand for cashless payments. Government support for financial innovation, the adoption of blockchain, and expanding fintech startups also contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)