Middle East Specialty Chemicals Market Size, Share, Trends and Forecast by Type and Country, 2026-2034

Middle East Specialty Chemicals Market Size and Share:

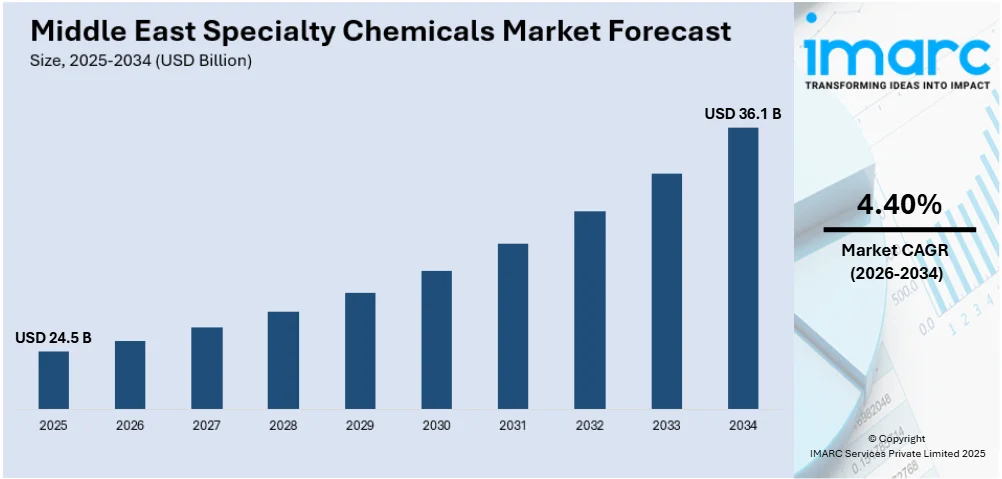

The Middle East specialty chemicals market size was valued at USD 24.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 36.1 Billion by 2034, exhibiting a CAGR of 4.40% during 2026-2034. This growth is driven by economic diversification strategies, such as Saudi Arabia's Vision 2030 and the UAE's Vision 2021, which aim to reduce reliance on oil revenues by investing in sectors like construction, automotive, pharmaceuticals, and manufacturing. Apart from this, large-scale infrastructure projects and a regional shift toward sustainable, eco-friendly chemical solutions are boosting the Middle East specialty chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 24.5 Billion |

|

Market Forecast in 2034

|

USD 36.1 Billion |

| Market Growth Rate 2026-2034 | 4.40% |

The market is primarily driven by the region’s expanding industrial base and economic diversification efforts. Governments across the Gulf Cooperation Council (GCC) are investing heavily in non-oil sectors such as construction, water treatment, and manufacturing, creating robust demand for high-performance chemical solutions. The construction boom, particularly in the UAE and Saudi Arabia, has spurred the use of specialty chemicals like concrete admixtures, adhesives, and sealants, essential for ensuring building durability and energy efficiency. These investments are part of larger national visions such as Saudi Vision 2030, which seeks to reduce economic dependence on oil. Additionally, supportive regulatory frameworks and rising public-private partnerships are attracting international players, accelerating innovation and local production capacity within the specialty chemicals domain.

To get more information on this market Request Sample

Environmental concerns and resource constraints, especially water scarcity, are also crucial factors driving the Middle East specialty chemicals market growth. Countries like Saudi Arabia and the UAE are significantly investing in water treatment technologies, including desalination and wastewater reuse, which rely on chemicals such as antiscalants, coagulants, and disinfectants. Moreover, the oil & gas sector, a traditional stronghold in the region, continues to consume large volumes of specialty chemicals for processes like drilling, refining, and enhanced oil recovery. For instance, as per industry reports, the Middle East is accelerating petrochemical investments, with Saudi Arabia and the UAE launching major projects to capitalize on low-cost feedstocks and regional growth. Saudi plans include two mega-complexes in Jubail, while the UAE’s ADNOC and OMV aim to form Borouge Group International, set to become the 4th-largest polyolefins producer globally. The combination of environmental pressures, industrial growth, and the need for operational efficiency continues to push the market forward, establishing specialty chemicals as a strategic sector for regional development.

Middle East Specialty Chemicals Market Trends:

Expansion in Construction and Infrastructure Projects

The rapid urbanization and infrastructure development across the Middle East are major factors fueling demand in the specialty chemicals market. According to the UAE government, the construction sector is expected to grow by 6.2% annually until 2025. Large-scale government-backed initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s ongoing smart city projects are accelerating the need for high-performance construction materials. Specialty chemicals used in concrete admixtures, protective coatings, sealants, and adhesives are essential for enhancing structural durability and ensuring long-term performance in extreme climatic conditions. These chemicals also support sustainable building practices, aligning with environmental regulations. As countries continue to invest in infrastructure, airports, metros, and industrial zones, the demand for innovative specialty chemical solutions is projected to grow steadily, reinforcing this sector as a critical driver of market expansion.

Advancing Water Treatment Technologies

The Middle East’s arid climate and chronic water scarcity have led to a significant rise in demand for advanced water treatment solutions. The Saudi Ministry of Environment, Water, and Agriculture has estimated that by 2025, the region will require $20 billion in investments for water treatment infrastructure. Specialty chemicals play a pivotal role in desalination processes, wastewater treatment, and industrial water purification, especially in sectors like oil & gas, power generation, and agriculture. Countries such as Saudi Arabia, the UAE, and Qatar are heavily investing in desalination plants and wastewater reuse facilities, driving demand for biocides, scale inhibitors, coagulants, and membrane cleaners. Technological advancements have enabled the development of more efficient and environmentally sustainable chemicals, improving process reliability and water recovery rates. This focus on sustainable water management is expected to maintain robust Middle East specialty chemicals market outlook.

Strengthening Oil & Gas Sector Demand

The oil & gas industry remains a cornerstone of the Middle East economy, and it significantly drives the demand for specialty chemicals. According to a 2023 report by IHS Markit, the Middle East oil & gas sector will see $300 billion in investments over the next five years, which will increase the demand for performance-enhancing chemicals. With continued exploration, production, and refining activities, especially in Saudi Arabia, the UAE, and Kuwait, there is growing need for chemicals such as corrosion inhibitors, demulsifiers, and enhanced oil recovery agents. These chemicals are crucial in improving operational efficiency, extending asset life, and meeting stringent environmental regulations. The shift toward petrochemical diversification and investment in downstream capabilities further amplifies the consumption of specialty chemicals. As countries in the region seek to maximize output and reduce environmental impact, specialty chemical applications in oil & gas operations are expected to witness consistent and long-term growth.

Middle East Specialty Chemicals Industry Segmentation:

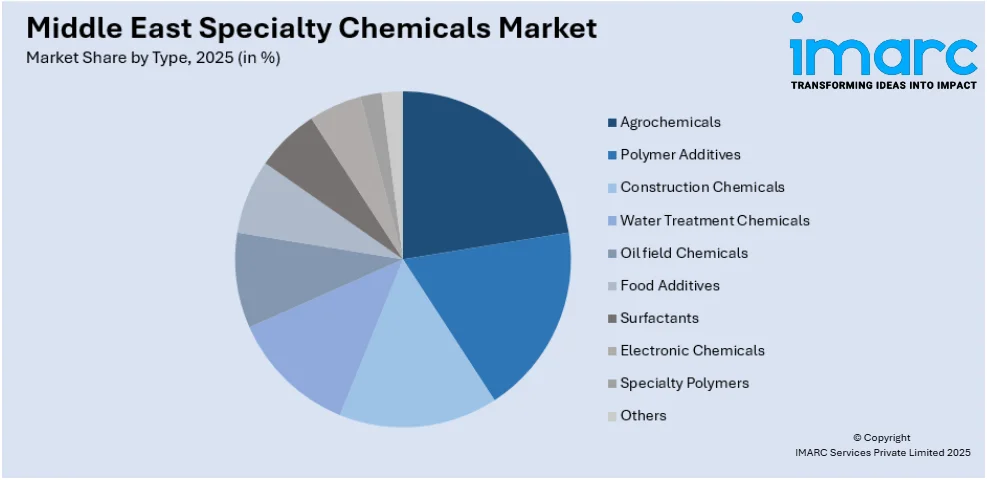

IMARC Group provides an analysis of the key trends in each segment of the Middle East specialty chemicals market, along with forecast at the regional and country levels from 2026-2034. The market has been categorized based on type.

Analysis by Type:

Access the Comprehensive Market Breakdown Request Sample

- Agrochemicals

- Polymer Additives

- Construction Chemicals

- Water Treatment Chemicals

- Oil field Chemicals

- Food Additives

- Surfactants

- Electronic Chemicals

- Specialty Polymers

- Others

The agrochemicals market in the Middle East is growing as nations prioritize food security and agricultural efficiency. Government initiatives in modern farming and climate-controlled agriculture are boosting demand for fertilizers and crop protection chemicals. These products are vital for cultivating crops in arid environments with scarce fertile land. Saudi Arabia and the UAE are at the forefront, investing heavily in agri-tech and sustainable farming innovations.

Rising demand in packaging, automotive, and consumer goods sectors is propelling growth in polymer additives. These additives—such as stabilizers, flame retardants, and plasticizers—enhance material durability and functionality. Environmental concerns are driving a shift toward eco-friendly, biodegradable solutions. The UAE and Saudi Arabia lead this market, supported by robust petrochemical and plastics industries.

Construction chemicals are gaining momentum due to landmark projects like NEOM and the Red Sea Project. There’s growing need for products such as admixtures, sealants, and waterproofing agents to support complex infrastructure builds. Urban development and smart city initiatives are key factors sustaining market growth. Environmental regulations are also spurring adoption of energy-efficient and sustainable chemical products.

Analysis by Country:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Saudi Arabia stands as the leading market for specialty chemicals in the Middle East, driven by rapid industrialization and Vision 2030 reforms. Massive infrastructure ventures like NEOM are significantly increasing demand for construction and performance chemicals. Its robust petrochemical sector underpins the expansion of polymer additives and industrial chemicals. Additionally, targeted investments in modern agriculture are accelerating growth in the agrochemicals segment.

Turkey plays a pivotal role as a bridge between Europe and the Middle East, with a specialty chemicals market supported by its expanding industrial base. Rising needs in textiles, automotive, and construction sectors are key growth drivers. Government initiatives favoring innovation and exports are boosting industry competitiveness. Environmental regulations are also encouraging a shift toward more sustainable chemical solutions.

Israel benefits from its advanced research ecosystem and innovation in agricultural technologies, making it a leader in agrochemicals and biotech-based specialty chemicals. The country emphasizes sustainable practices and technological innovation. Its strong pharmaceutical and electronics sectors create additional demand for high-purity specialty chemicals. Collaboration between startups and multinational chemical companies is accelerating market development.

United Arab Emirates is emerging as a major player in the regional specialty chemicals space, aligned with its broader economic diversification strategy. The booming construction sector, supported by smart city projects, drives strong demand for related chemical products. Its strategic logistics infrastructure and free zones make it a re-export center for the region. The UAE’s focus on green innovation is also boosting demand for eco-friendly and bio-based chemicals.

Competitive Landscape:

The Middle East specialty chemicals market forecast indicates a mix of global players and regional manufacturers projected to further compete for market share through innovation, strategic partnerships, and capacity expansion. Companies are investing in research and development to formulate application-specific products tailored to regional demands in construction, water treatment, agriculture, and oil & gas. For instance, in October 2024, Mstack, a U.S.-based specialty chemicals platform, raised $40M in Series A funding to expand globally across the Middle East, Latin America, and Asia. The investment will support R&D, geographic growth, and innovation in sectors like oil and gas, coatings, water treatment, and home care, with plans to enter agrochemicals and pharmaceuticals. Mstack offers a tech-driven platform that streamlines sourcing, testing, and delivery, serving as a resilient, cost-effective solution amid global supply chain disruptions. The growing trend of localizing production to reduce dependency on imports has led to the establishment of manufacturing hubs within the region. Competitive dynamics are also shaped by joint ventures between foreign investors and local entities, enabling technology transfer and market access. Additionally, sustainability and regulatory compliance are becoming key differentiators, as companies increasingly align their product offerings with environmental standards and circular economy goals.

The report provides a comprehensive analysis of the competitive landscape in the Middle East specialty chemicals market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: KFUPM launched a research project to enhance green hydrogen feasibility using solar-powered water splitting and methanol conversion. It aims to reduce energy input, avoid CO₂ emissions, and produce valuable byproducts like formate and formic acid, aiming to scale industrial production and support Saudi Arabia’s green hydrogen ambitions.

- March 2025: Aramco launched Saudi Arabia’s first CO₂ Direct Air Capture test unit, developed with Siemens Energy, to remove 12 tons of CO₂ annually. The pilot aims to test next-gen capture materials, reduce costs, and explore scalable deployment. Captured CO₂ is intended for producing sustainable fuels and specialty chemicals, supporting net-zero goals.

- February 2025: AquaChemie inaugurated a cutting-edge chemical facility in KEZAD, enhancing the UAE’s local manufacturing, storage, and blending capabilities. Serving major clients like ADNOC, the plant supports supply chain resilience, reduces import dependence, and aligns with national industrial goals.

- February 2025: Saudi Arabia launched the King Salman Automotive Cluster, creating major opportunities for local specialty chemicals, including plastics, rubber, and battery materials. The initiative is expected to boost domestic demand for polymers, enable battery value chain localization, and encourage innovation in the steel and aluminum sectors.

Middle East Specialty Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Agrochemicals, Polymer Additives, Construction Chemicals, Water Treatment Chemicals, Oil field Chemicals, Food Additives, Surfactants, Electronic Chemicals, Specialty Polymers, Others |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Middle East specialty chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Middle East specialty chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Middle East specialty chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Middle East specialty chemicals market was valued at USD 24.5 Billion in 2025.

The Middle East specialty chemicals market is projected to exhibit a CAGR of 4.40% during 2026-2034, reaching a value of USD 36.1 Billion by 2034.

Key factors driving the Middle East specialty chemicals market include rapid industrialization, growth in construction and oil & gas sectors, rising demand for water treatment solutions, and increasing investment in manufacturing. Technological advancements and supportive government initiatives further boost regional production capacity, contributing to the Middle East specialty chemicals market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)