Military Aircraft Modernization and Retrofit Market Size, Share, Trends and Forecast by Aircraft Type, System Type, and Region, 2025-2033

Military Aircraft Modernization and Retrofit Market Size and Share:

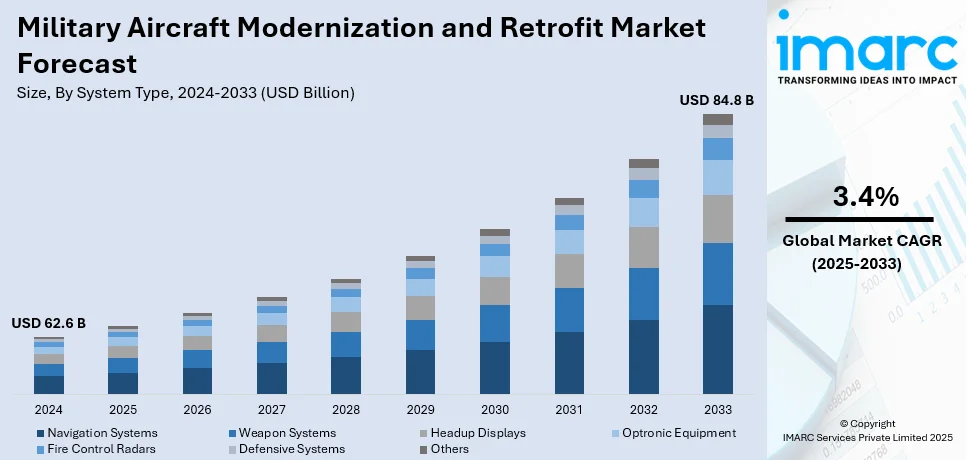

The global military aircraft modernization and retrofit market size was valued at USD 62.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 84.8 Billion by 2033, exhibiting a CAGR of 3.4% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.0% in 2024. The market is driven by increasing defense budgets, rising geopolitical tensions, and the need to maintain the operational readiness of aging fleets. Technological advancements enable cost-effective retrofitting with advanced avionics, precision weaponry, and cybersecurity solutions. The shift toward multi-role aircraft and enhanced survivability against changing threats is further propelling demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 62.6 Billion |

|

Market Forecast in 2033

|

USD 84.8 Billion |

| Market Growth Rate 2025-2033 | 3.4% |

The global market is primarily driven by the increasing geopolitical tensions and defense budgets prompting nations to enhance the operational efficiency of aging aircraft fleets. The growing need to integrate advanced avionics, precision weaponry, and communication systems is further accelerating market growth. Technological advancements in materials and systems have made retrofitting a cost-effective alternative to procuring new aircraft, appealing to governments seeking budget optimization. Additionally, the shift towards multi-role and versatile aircraft platforms is encouraging modernization programs. The rising importance of cybersecurity in military operations is also driving the demand for retrofits to ensure secure and resilient systems. On 9th May 2024, Accenture Federal Services received a 10-year, US 789 Million deal to help upgrade the cybersecurity capability of U.S. Navy maritime forces within the SHARKCAGE environment. Such an endeavor contributes to unifying the process of operating on all Navy networks under integrated hardware and software solutions across IT-21, ONENet, and Navy/Marine Corps Intranet. The tasks it will execute comprise system design and architecture, testing, production delivery, installation, and logistic support ashore and afloat for both SHARKCAGE systems. Moreover, these factors are fueling sustained investment in this market.

The United States stands out as a key regional market, primarily driven by the growing focus on maintaining air superiority and readiness for changing combat scenarios. The United States' aging aircraft fleet necessitates upgrades to extend service life and enhance performance capabilities. Along with this, increasing emphasis on integrating artificial intelligence, advanced sensor systems, and electronic warfare technologies is driving demand for modernization. Rising concerns over near-peer threats and the need to counter adversarial advancements further highlight the importance of retrofitting older platforms. Government initiatives, such as funding through defense budgets and long-term procurement programs, also support growth. Furthermore, the commitment to technological dominance and operational efficiency is positively influencing the modernization landscape in the U.S. market.

Military Aircraft Modernization and Retrofit Market Trends:

Technological Advancements in Military Aircraft Modernization

Modernization in military aircraft is increasingly technology driven. Legacy aircraft are being armed with highly capable cockpit systems, avionics, radar, and weaponry. For example, next-generation computer systems, advanced radar, improved weaponry, besides upgraded cockpit displays, have been added by BAE Systems to its Typhoon fighter jet. Upgrades on these aircraft not only increase the service life but also enhance their performance in high-contested environments. For instance, cutting-edge technologies in the use of Artificial Intelligence and machine learning will aim to enhance real-time analysis and decision-making about data during combat situations. In addition, technological updates will make legacy aircraft meet the demands of the mission, be it counterterrorism or air superiority. Given the efforts of defense contractors to continually innovate, aircraft modernization can be considered a basic strategy that makes military fleets stay competitive without the hefty investment of entirely new purchases. Additionally, according to an industrial report, the US Department of Defense has recently gained approval for an USD 886 Billion budget for fiscal year 2024, marking a 3% rise from 2023. These factors are catalyzing the market.

Geopolitical Factors Driving Aircraft Upgrades

The global geopolitical scenario of shifting trends has a huge place in military aircraft modernization and retrofit markets. Many countries are looking forward to upgrading their existing military aircraft fleets in search of strategic superiority in anticipation of growing tensions and emerging new threats. The requirement is growing due to an improved need for defense modernization in terms of surveillance capabilities, combat logistics, and their integration. In this view, collaboration between defense companies and governments has increased. For instance, the recent alliance between Embraer and Oliver Wyman on introducing its C-390 cargo aircraft into the U.S. defense market is just an example of strategic decisions taken by the company in that direction. This strategic association falls in line with another broad trend wherein defense majors are focusing on the integration of such advanced features as multi-role capability and improved efficiency. Furthermore, countries exposed to rising security threats prioritize updates so that their defense equipment will be able to combat emerging threats. Defense up-gradation will be among the highest priorities as long as the world remains volatile. Moreover, as per an industrial report, worldwide military expenditure reached USD 2443 Billion in 2023, an increase of 6.8% from 2022.

Economic Benefits of Aircraft Modernization

Economic factors are also the most important in deciding to modernize rather than acquire new aircraft. For most countries, the cost of buying new military aircraft is too high, and thus, modernization is the way out. Upgrading existing fleets helps defense forces extend the service life of their aircraft, improve operational capabilities, and remain competitive in modern warfare without incurring the significant capital expenditure of new acquisitions. This cost-effectiveness is quite attractive, especially when the defense budgets are increasingly under pressure. Furthermore, technological advancements are made at a very fast pace, thus even older aircraft can have the latest avionics, weaponry, and communication systems installed in them, hence bringing them up to current operational standards. Recent industrial reports indicate that the Department of Defense (DoD), in tight collaboration with the Government of Japan, revealed a strategy to enhance the positioning of U.S. tactical aircraft at various military bases in Japan. The modernization initiative, set to take place over the coming years, represents more than USD 10 Billion in capability investments aimed at reinforcing the U.S.-Japan Alliance, improving regional deterrence, and promoting peace and stability.

Military Aircraft Modernization and Retrofit Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global military aircraft modernization and retrofit market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on aircraft type and system type.

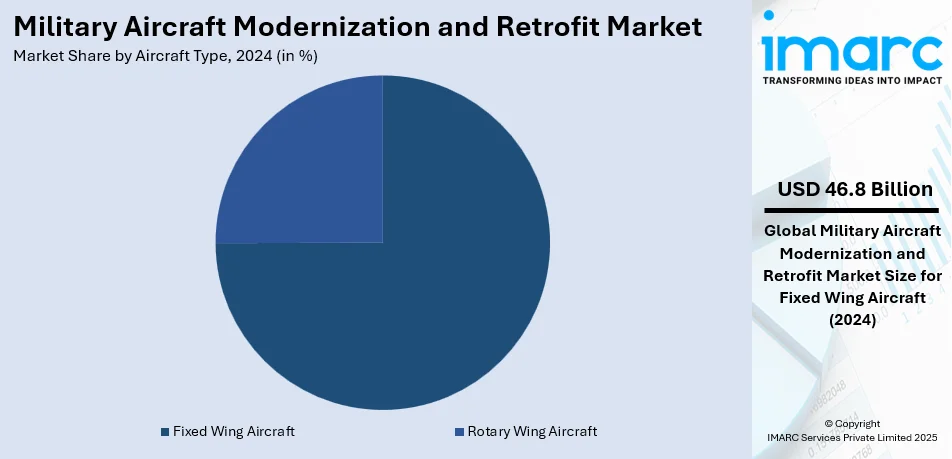

Analysis by Aircraft Type:

- Fixed Wing Aircraft

- Rotary Wing Aircraft

Fixed wing aircraft leads the market with around 74.8% of market share in 2024. Fixed-wing aircraft dominate the global military aircraft modernization and retrofit market, representing the largest segment due to their critical role in defense operations. These aircraft are extensively used for diverse missions, including combat, surveillance, transport, and training, making their modernization essential for maintaining operational effectiveness. The need to upgrade avionics, propulsion systems, and weaponry to keep pace with changing threats drives investments in this segment. Additionally, the adoption of advanced technologies such as stealth capabilities, precision targeting, and enhanced communication systems further supports retrofitting efforts. With many countries focusing on extending the lifespan of their aging fleets while improving performance, fixed-wing aircraft remain a priority for modernization programs, ensuring their relevance in modern military operations.

Analysis by System Type:

- Navigation Systems

- Weapon Systems

- Headup Displays

- Optronic Equipment

- Fire Control Radars

- Defensive Systems

- Others

Navigation systems lead the market with around 20.5% of market share in 2024. Navigation systems represent the largest system type segment in the global military aircraft modernization and retrofit market, driven by the critical need for precision and reliability in military operations. Modern combat scenarios require accurate navigation, even in GPS-denied environments, fueling demand for advanced technologies such as inertial navigation systems (INS), satellite-based augmentation, and integrated avionics. The increasing complexity of missions, including long-range strikes and multi-domain coordination, underscores the importance of upgrading navigation systems to ensure mission success and pilot safety. Governments and defense agencies are heavily investing in cutting-edge navigation solutions to enhance situational awareness and interoperability. These upgrades are pivotal in extending the capabilities of existing fleets, cementing navigation systems as a core focus in modernization initiatives.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.0%. Some of the factors driving the North America military aircraft modernization and retrofit market include significant growth in the aerospace and energy industries in North America which are considered to be the largest users of military aircraft modernization and retrofits. Additionally, the strong presence of companies in the region is driving innovation and growth in the military aircraft modernization and retrofit market. Moreover, North America has a strong research and development infrastructure, with many universities and research institutions conducting cutting-edge research in materials science and engineering, thereby further driving the military aircraft modernization and retrofit market.

Key Regional Takeaways:

United States Military Aircraft Modernization and Retrofit Market Analysis

In 2024, the US accounted for around 94.10% of the total North America military aircraft modernization and retrofit market. The U.S. military aircraft modernization and retrofit market is driven by the country's need to maintain its technological lead and air superiority. In 2023, the Congressional Budget Office estimated that the U.S. budgeted USD 772 Billion for military aircraft programs, which reflects an upgrade of the aging fleets with state-of-the-art avionics, stealth technology, and next-generation weapon systems. The F-35 modernization program is an example of this trend, with advanced computing and improved lethality ensuring that the country remains competitive. The Next-Generation Air Dominance program is another example of the strategic focus on future readiness by the U.S. Major defense contractors such as Lockheed Martin and Boeing are also key players in these developments, supported by strong government funding and research programs. Export opportunities to allied nations also increase the market's global standing. The U.S. also focuses on sustainability: the retrofitting of existing aircraft for efficiency secures long-term operational capabilities while keeping up with contemporary defense needs and, in turn, cuts procurement costs for new fleets.

Europe Military Aircraft Modernization and Retrofit Market Analysis

Europe's military aircraft modernization market is driven by obligations set by NATO, regional security considerations, and extending fleet capabilities. Modernization projects have remained an important part of defense expenditure; in 2024, NATO reported that defense spending by Europe totaled around USD 380 Billion. Germany has invested heavily in improving its Eurofighter Typhoon. Germany's Budget Committee has in November 2023 okayed the purchase of 15 Eurofighter Electronic Combat EK, which will come with Saab's transmitter location and self-protection systems and Northrop Grumman's Advanced Anti-Radiation Guided Missiles (AARGM). Germany will reportedly bring onboard AI-enabled cognitive electronic warfare, with Helsing and Saab Germany taking the lead in upgrading the future SEAD mission. This supports NATO's goals and puts Germany on the forefront of high-tech retrofitting. Joint European defense programs, such as the Tempest program, propel collaborative research and development in defense across the region. Companies such as Airbus and BAE Systems focus on integrating next-generation avionics and weapons systems. Further, EU policies for sustainable development push the need for sustainable retrofits, making them not only operationally efficient but also environmentally friendly.

Asia Pacific Military Aircraft Modernization and Retrofit Market Analysis

Asia Pacific military aircraft modernization is growing rapidly, with defense budgets and geopolitical tensions being the main drivers. China, for instance, has allocated USD 292 Billion to defense spending in 2022, with a considerable amount being spent on upgrading its fleet with advanced radar systems, stealth technologies, and improved weapon payloads, according to the Stockholm International Peace Research Institute. In India, it is upgraded through substantial investments in indigenization technology. Defence budget for 2023-24 for Indian Air Force has allocated INR 57,137 crore or USD 7 Billion towards modernization: the highest share in any of the armed forces. Projects such as the "Super Sukhoi" are efforts to upgrade Su-30MKI jets with Uttam Active Electronically Scanned Array (AESA) radar and advanced electronic warfare systems. Indigenous weaponry includes BrahMos supersonic cruise missiles and Astra air-to-air missiles, which reinforce the capability of a fleet. Regional efforts go beyond India as Japan, China, and South Korea build their next-generation fighter jet capacity while pursuing collaborative R&D efforts. These modernization efforts reflect the region's focus on self-reliance, operational efficiency, and regional defense competitiveness amid changing security challenges.

Latin America Military Aircraft Modernization and Retrofit Market Analysis

Latin America is witnessing a rise in its military aircraft modernization market, as Brazil leads investments in the air defense arena. With a USD 10.6 billion deal under its Growth Acceleration Program, Brazil is aiming to almost double the size of its Gripen fighter force. The government of Brazil signed a contract with Saab in 2014 for the purchase of 36 F-39 Gripen fighters at a cost of USD 5.04 Billion, and four more were added in 2022. By 2027, Brazil will have 40 Gripen fighters, thus becoming the most modern combat fleet in Latin America. Moreover, Brazil's military expansion includes the development of nine C-390 Millennium planes by Embraer, and a refueling version is under construction. Brazil's focus on leading-edge technologies and border surveillance and defense will be accompanied by public and private financing, which will give it more strength in regional security balances.

Middle East and Africa Military Aircraft Modernization and Retrofit Market Analysis

Military aircraft modernization in the Middle East and Africa is fuelled by intensifying regional security dynamics and the push for fleet efficiency. The defense budget in 2022 in Saudi Arabia has reached an all-time high of USD 75.01 Billion, with the major adjustments made for the modernization of aircraft fleets, including fighters and UAVs, to enhance operational readiness. Avionics retrofit programs, precision-guided munitions, and other fleet life extensions are also being funded in countries including the UAE, which enhances their air forces. African nations such as South Africa are extending the fleets with retrofits as they do not have funds for buying new systems. Denel and other defense contractors also play a crucial role by partnering with global players in defense. Modernization includes integrating AI and advanced surveillance to support diverse operations. The collaborative international programs ensure the transfer of technology and skill development for innovation in response to the unique challenges faced by the region's defense sectors.

Competitive Landscape:

The competitive landscape of the military aircraft modernization and retrofit market is marked by active participation from key players focused on technological innovation and strategic collaborations. Major defense contractors and system integrators are investing in research and development to deliver advanced upgrades, such as next-generation avionics, electronic warfare systems, and AI-enabled solutions. Companies are also forming partnerships with governments and militaries to secure long-term modernization contracts. Additionally, market leaders are exploring modular retrofit solutions to reduce downtime and enhance scalability. Enhanced focus on cybersecurity integration and interoperability has become a significant trend among players to meet modern defense requirements. These efforts reflect an industry-wide commitment to sustaining competitive advantage and addressing changing operational challenges in military aviation.

The report provides a comprehensive analysis of the competitive landscape in the military aircraft modernization and retrofit market with detailed profiles of all major companies, including:

- BAE Systems Plc

- Elbit Systems Ltd.

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Safran SA

- Thales Group

- The Boeing Company

Latest News and Developments:

- November 2024: Elbit Systems of America secured a contract from the U.S. Air Force to supply Wide-Angle Conventional Head-Up Display replacements for F-16 Block 40/42 aircraft, valued at up to USD 89 Million. The first order, worth over USD 57.5 Million, was delivered in September 2024. The work will be performed in Talladega, Alabama, through 2027.

- October 2024: Honeywell received a USD 103 Million contract from the U.S. Army for its Next-Generation APN-209 Radar Altimeter. The system has enhanced reliability, performance, and flexible integration options. Honeywell will look forward to extending this advanced technology to international customers in the future.

- October 2024: Safran Aircraft Engines has announced an investment of more than Euro 1 Billion (USD 1.05) in the development of its global MRO network for LEAP engines. The new facilities are to be located in Belgium, India, Mexico, Morocco, and France. The company aims to carry out 1,200 store visits by the year 2028. It will employ 4,000 people to support this expansion.

- October 2024: Boeing sold Thales a small defense-surveillance unit. This part of Boeing's efforts towards restructuring and focusing on its strengths, while Thales makes strategic moves to strengthen the defenses, especially surveillance capabilities among the military and security sectors, of the company.

- August 2024: BAE Systems was contracted by Boeing to replace the fly-by-wire flight control computers for the F-15EX Eagle II as well as F/A-18E/F Super Hornet. The common core electronics employed in the FCC improve aircraft flight control systems safety, reliability, and performance.

Military Aircraft Modernization and Retrofit Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Fixed Wing Aircraft, Rotary Wing Aircraft |

| System Types Covered | Navigation Systems, Weapon Systems, Headup Displays, Optronic Equipment, Fire Control Radars, Defensive Systems, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BAE Systems Plc, Elbit Systems Ltd., Honeywell International Inc., Israel Aerospace Industries Ltd., L3Harris Technologies Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Safran SA, Thales Group, The Boeing Company |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the military aircraft modernization and retrofit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global military aircraft modernization and retrofit market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the military aircraft modernization and retrofit industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The military aircraft modernization and retrofit market was valued at USD 62.6 Billion in 2024.

IMARC estimates the military aircraft modernization and retrofit market to exhibit a CAGR of 3.4% during 2025-2033, reaching a value of USD 84.8 Billion by 2033.

The market is driven by increasing defense budgets, rising geopolitical tensions, and the need to maintain the operational readiness of aging fleets. Technological advancements enable cost-effective retrofitting with advanced avionics, precision weaponry, and cybersecurity solutions, further increasing demand for modernization.

North America currently dominates the military aircraft modernization and retrofit market, accounting for a share exceeding 43.0%. This dominance is fueled by increasing defense budgets, technological advancements, and a strong research and development infrastructure in the aerospace and energy industries.

Some of the major players in the military aircraft modernization and retrofit market include BAE Systems Plc, Elbit Systems Ltd., Honeywell International Inc., Israel Aerospace Industries Ltd., L3Harris Technologies Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Safran SA, Thales Group, and The Boeing Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)