Military Radars Market Size, Share, Trends and Forecast by Product Type, Platform, Frequency Band, Dimension, Application, and Region, 2025-2033

Military Radars Market Size and Share:

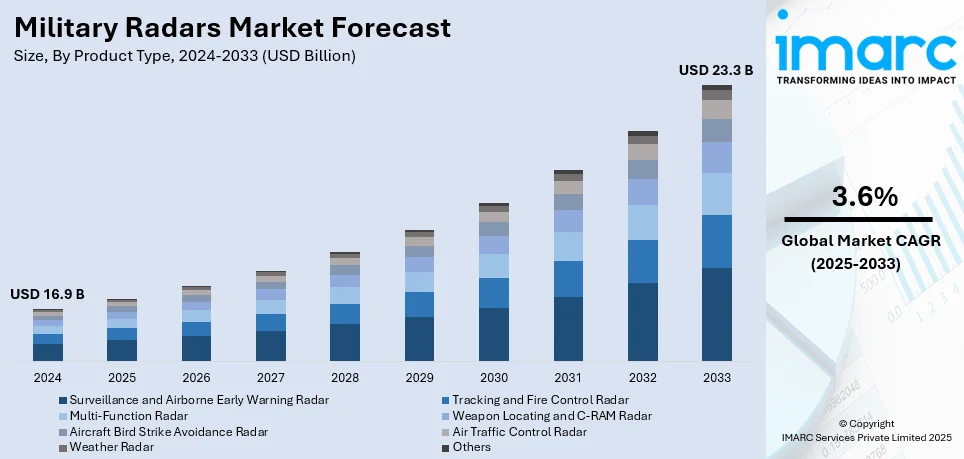

The global military radars market size was valued at USD 16.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 23.3 Billion by 2033, exhibiting a CAGR of 3.6% from 2025-2033. North America currently dominates the market, holding a market share of over 30.4% in 2024. The rising defense modernization programs, technological advancements, growing demand for space-based radar systems, and the escalating defense budgets are propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 16.9 Billion |

|

Market Forecast in 2033

|

USD 23.3 Billion |

| Market Growth Rate (2025-2033) | 3.6% |

The growing demand for national security and defense preparedness is a significant driver in the global market. As geopolitical tensions increase, nations are prioritizing investments in advanced radar systems to enhance defense capabilities. Military radars play a crucial role in surveillance, target tracking, and early threat detection, enabling armed forces to respond efficiently to threats such as ballistic missiles, UAVs, and enemy aircraft. Moreover, the growing need to modernize aging radar systems to address shifting challenges in electronic warfare, stealth technologies, and cyber threats is contributing to military radars market growth. For example, on February 10, 2025, the Louisiana National Guard's 1-141st Field Artillery Battalion upgraded its AN/TPQ-53 radar systems, ensuring improved reliability and operational readiness, which reflects broader trends in defense technology investments.

To get more information on this market, Request Sample

The United States is a key regional market and is experiencing growth driven by increasing geopolitical tensions and the need for enhanced security. Similarly, the ongoing efforts of the military to modernize radar capabilities for detecting emerging threats like hypersonic missiles and stealth aircraft further contribute to market expansion. For instance, on October 14, 2024, Honeywell secured a USD 103 Million contract with the U.S. Army for its Next-Generation APN-209 Radar Altimeter system, which replaces the legacy APN-209, offering enhanced reliability and flexibility. Furthermore, continual advancements in radar technology, including the integration of AI and machine learning, are improving operational efficiency and precision. Additionally, the growing defense budget and rising demand for surveillance capabilities in domestic and international operations influence the military radars market trends.

Military Radars Market Trends:

Rising Global Security Threats

The increasing global security threats, such as terrorism, regional conflicts, and geopolitical tensions, drive the demand for advanced radar technologies. For instance, terrorist-related deaths surged by 22% in 2024, reaching 8,300, the highest amount since 2017. In 2023, conflict zones were the site of more than 90% of terrorist acts and 98% of terrorism deaths. Also, from a majority of 234 countries and territories monitored by ACLED, 168 countries experienced at least one conflict in 2023. Military radars play a crucial role in surveillance, early warning systems, and threat detection, thereby strengthening the military radars market demand.

Increased Government Spending

Defense spending by governments worldwide influences the procurement of radar systems. For instance, according to an article published by the Stockholm International Peace Research Institute, overall international military expenses reached USD 2,443 Billion in 2023, up 6.8% in real terms from 2022. This was the most dramatic year-over-year increase since 2009. Also, Japan allocated USD 50.2 Billion to its military in 2023, 11% more than in 2022. Countries with expanding defense budgets allocate significant funds for radar technology to enhance national security, contributing to the military radars market share.

Technological Advancements

Rapid advancements in radar technology, including phased array radars, AESA (Active Electronically Scanned Array) radars, and digital signal processing, enhance radar capabilities such as range, accuracy, and target detection. The global audio DSP market size reached USD 16.9 Billion in 2024. Also, for instance, in May 2024, General Radar Corporation is a US-based company that develops and produces multi-mission Active Electronically Scanned Array (AESA) phased array radars with high resolution and extended range, launched the Radar-as-a-service to monitor airborne threats. These technological improvements attract investments and stimulate the military radar systems market revenue.

Military Radars Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global military radars market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, platform, frequency band, dimension, and application.

Analysis by Product Type:

- Surveillance and Airborne Early Warning Radar

- Tracking and Fire Control Radar

- Multi-Function Radar

- Weapon Locating and C-RAM Radar

- Aircraft Bird Strike Avoidance Radar

- Air Traffic Control Radar

- Weather Radar

- Others

Surveillance and airborne early warning radar stand as the largest component in 2024, holding around 36.0% of the market. According to the military radars market outlook, governments invest heavily in surveillance radar to monitor their airspace and maritime borders for threats such as unauthorized aircraft, ships, or potential security breaches. Moreover, AEW radar systems are integral to military operations, providing early detection and tracking of enemy aircraft and missiles. These systems enhance situational awareness and help in coordinating defensive and offensive maneuvers.

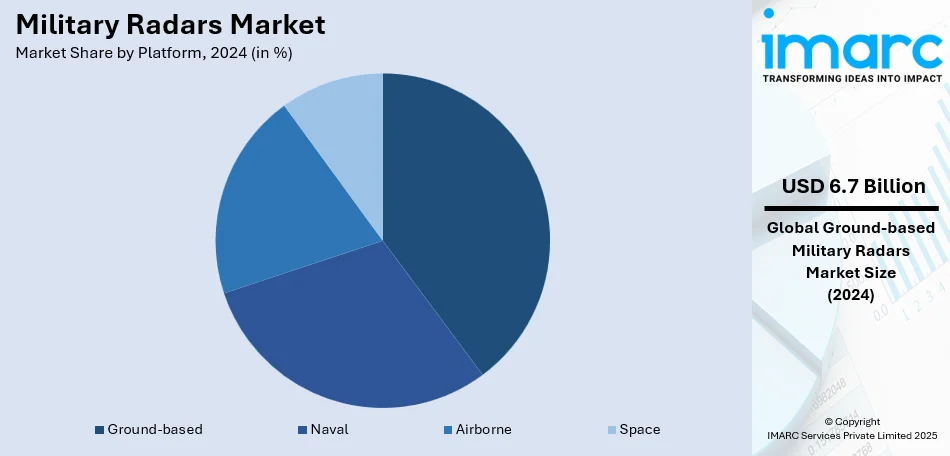

Analysis by Platform:

- Ground-based

- Naval

- Airborne

- Space

Ground-based leads the market with around 39.7% of market share in 2024. As per the overview of the military radars market, radar systems on ground are a core component of IADS, wherein several sensors and weapon systems are combined to offer a total defense system against airborne threats. Additionally, the development in radar technology, including digital signal processing, phased array antennas, and software-defined radars, is providing the impetus as it allows for better detection capabilities, less false alarm, and better target discrimination.

Analysis by Frequency Band:

- VHF/UHF Band

- L Band

- S Band

- C Band

- X Band

- Ku/Ka/K Band

X band leads the market with around 27.2% of market share in 2024. This is based on its finer balance of range, resolution, and weather penetration. Between the 8 GHz to 12 GHz range, X-band radars are suitable for high-resolution imaging, target tracking, and airborne fire control as well as missile guidance. They are highly reliable in rough weather conditions because they can be effective even there. X-band radars accommodate higher-order phase array and SAR technology, creating a greater degree of situational awareness. Their small size makes them deployable on multiple platforms, such as aircraft, ships, and ground systems, further establishing their dominance in contemporary military radar use.

Analysis by Dimension:

- 2D Radar

- 3D Radar

- 4D Radar

2D radar systems are widely used in military applications due to their ability to detect and track targets in two dimensions: azimuth and range. They provide essential situational awareness, allowing military forces to monitor and control air and ground spaces efficiently. Although they lack elevation data, 2D radars are often employed for surveillance, target acquisition, and fire control. Their simplicity and cost-effectiveness make them ideal for various military operations, particularly in environments where altitude information is not critical. The increasing demand for cost-effective solutions in defense is propelling the adoption of 2D radar technology in the market.

3D radar systems provide enhanced capabilities by adding a third dimension, i.e., elevation. This enables more accurate tracking and positioning of objects, improving detection of airborne threats like aircraft and missiles. In military applications, 3D radar plays a crucial role in air defense systems, surveillance, and early warning detection. The ability to track objects in three dimensions significantly boosts the effectiveness of military forces in detecting and intercepting threats. The growing need for precise and comprehensive situational awareness, coupled with technological advancements, is driving the integration of 3D radar systems into modern military infrastructure.

4D radar technology builds upon 3D radar by incorporating the dimension of time, offering real-time tracking of moving targets and their behavior. This advanced system allows military forces to track not only the location and altitude of objects but also their velocity and trajectory over time. 4D radar is particularly useful in complex battlefield scenarios, such as tracking fast-moving threats like missiles or drones. With enhanced precision and dynamic tracking capabilities, 4D radar is becoming increasingly valuable in missile defense systems, surveillance, and tactical military operations, driving its growing adoption in the defense sector.

Analysis by Application:

- Air and Missile Defense

- Intelligence, Surveillance and Reconnaissance

- Navigation and Weapon Guidance

- Space Situational Awareness

- Others

Air and missile defense radar systems play a critical role in military operations by detecting, tracking, and intercepting airborne threats, including enemy aircraft, missiles, and drones. These radars provide early warning, situational awareness, and the ability to target incoming threats, ensuring the protection of strategic assets and personnel. The increasing sophistication of enemy weaponry and the rise of missile threats have led to a growing demand for advanced radar systems capable of precise tracking and interception. The continuous development of air and missile defense radar technologies is essential to counter shifting threats, driving their adoption in defense markets worldwide.

Intelligence, surveillance, and reconnaissance (ISR) radars are vital for military forces to gather crucial information about enemy movements, locations, and activities. These radar systems provide real-time data, supporting decision-making processes and enhancing situational awareness on the battlefield. ISR radars, including synthetic aperture radar (SAR), are highly effective in detecting ground targets, even in challenging weather or low visibility conditions. As modern warfare becomes more complex and data-driven, the demand for ISR radar systems continues to rise, as they enable military forces to maintain superiority through enhanced reconnaissance and strategic intelligence gathering capabilities.

Navigation and weapon guidance radars are essential for ensuring the precision and accuracy of military operations. These radar systems assist in guiding missiles, drones, and other projectiles to their targets with minimal deviation. They enable precise navigation in both air and ground-based operations, reducing the risk of collateral damage. Advanced radar systems integrated into weapon platforms also provide feedback on the success of a mission, improving operational efficiency. As defense strategies evolve to include more autonomous and precision-guided technologies, the demand for advanced navigation and weapon guidance radar systems continues to grow, ensuring effective targeting and minimizing risks.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 30.4%. Ongoing military modernization efforts by countries, such as the United States and Canada, drive significant investments in radar technologies. These programs aim to upgrade existing radar systems, enhance capabilities, and integrate advanced technologies to maintain superiority in defense capabilities. Moreover, North America, particularly the United States, allocates substantial budgets to defense spending. For instance, the Stockholm International Peace Research Institute estimates that in 2023, US defense spending made up around 40% of all international military spending. Between 2022 and 2023, U.S. defense spending rose by USD 55 Billion. Radar systems are a critical component of these expenditures, as they are essential for air defense, missile defense, surveillance, and reconnaissance missions.

Key Regional Takeaways:

United States Military Radars Market Analysis

In 2024, the United States accounts for 84.70% of the North America military radar market and is driven by ongoing modernization efforts within the Department of Defense, focusing on enhancing surveillance, threat detection, and tactical awareness. With the U.S. artificial intelligence (AI) market reaching USD 31,807.6 Million in 2023, the integration of AI technologies into radar systems has become a pivotal trend. AI-driven radar technologies improve real-time data processing, decision-making, and target detection, enhancing overall operational effectiveness. The U.S. military's increasing reliance on advanced radar systems for air, ground, and maritime surveillance is vital for maintaining defense capabilities, especially in light of rising geopolitical tensions and the threat of cyber warfare. Furthermore, the expansion of autonomous systems, such as drones and unmanned vehicles, requires the creation of radars that can function in diverse environments. The rising need for advanced radar solutions is fueled by the growing requirements for homeland security, border safeguarding, and protection of essential infrastructure. As the U.S. keeps updating older radar systems and guaranteeing compatibility with NATO partners, funding for advanced radar technologies becomes essential. This push for innovation, driven by major breakthroughs in AI and machine learning, prepares the U.S. military radar market for continued growth in the years ahead.

Europe Military Radars Market Analysis

The European military radar market is fueled by various essential factors, such as increasing security worries stemming from regional conflicts and a changing threat environment. Nations such as the U.K., France, Germany, and Italy are focusing on improving radar systems to enhance surveillance, detection, and overall defense preparedness. AAG's report indicates that 32% of businesses in the UK experienced a cyber-attack or breach in 2023, with 59% of medium-sized firms and 69% of large firms reporting comparable events. These cyber threats highlight the increasing demand for radar systems equipped with integrated cybersecurity features to protect against electronic warfare and cyber risks. NATO's joint defense efforts boost the need for sophisticated radar technologies that guarantee cooperation among allied military units. The safeguarding of essential infrastructure and the necessity to address new threats like missiles and drones are additional important motivators. Moreover, the heightened emphasis on missile defense systems, particularly as a reaction to threats posed by Russia, drives the need for radar technologies that can track multiple targets in real time. As European nations advance their defense systems, the incorporation of advanced radar technologies alongside cybersecurity and countermeasure functions will be essential for enhancing defense activities.

Asia Pacific Military Radars Market Analysis

The Asia-Pacific (APAC) market is propelled by increasing defense expenditures, changing regional security dynamics, and technological progress. Nations such as China, India, Japan, and South Korea are focusing on improving radar systems to guarantee enhanced surveillance and detection abilities. As per the report, India possesses nearly 29 distinct classes of missiles across multiple categories, such as ballistic, cruise, air-to-air, and surface-to-air systems. Significantly, the Agni V, India’s farthest-range nuclear-capable ballistic missile that surpasses 5,000 km, illustrates the nation’s missile capabilities, heightening the demand for sophisticated radar systems for efficient tracking and interception. Regional conflicts, especially in the South China Sea and due to North Korea's missile developments, intensify the need for advanced radar technologies. The increasing use of radar systems for unmanned aerial vehicles (UAVs) and the incorporation of radar with anti-missile systems contribute to market expansion in the area, along with governments prioritizing local radar development.

Latin America Military Radars Market Analysis

The military radar market in Latin America is growing, fueled by increasing defense budgets and a heightened demand for better security. As nations in the area concentrate on upgrading military capabilities, radar systems are crucial for border security and counterinsurgency efforts. The cybersecurity market in Latin America, expected to expand at a CAGR of 7.30% from 2024 to 2032, emphasizes the demand for comprehensive radar systems that can address electronic and cyber threats. Investment in advanced radar technologies is increasing, as governments seek to safeguard critical infrastructure and enhance defenses against new security threats, such as cyber warfare.

Middle East and Africa Military Radars Market Analysis

The Middle East and Africa market is driven by increasing defense expenditure amid regional instability and security concerns. Reports indicate that 82% of companies in the Middle East and Türkiye encountered at least one cybersecurity incident from 2022 to 2024, with many experiencing several attacks. This highlights the increasing need for radar systems that can combat electronic and cyber warfare, in addition to fulfilling conventional defense functions like air and missile defense. Moreover, increasing geopolitical tensions and the risk of terrorism are driving investments in advanced radar technologies for air defense, border security, and surveillance activities.

Competitive Landscape:

The military radars market is very competitive, fueled by ongoing innovation and technological progress. Key companies spearhead the advancement of radar systems for aerial, terrestrial, and naval defense. Notably, on February 10, 2025, Indra obtained a contract with the German Armed Forces to provide a sophisticated space surveillance radar for the Luftwaffe, designed to safeguard satellites from space debris and potential threats. This advancement improves the security of space in Europe. Businesses in the industry utilize artificial intelligence (AI), machine learning, and digital signal processing to enhance radar functionality. Furthermore, specialized companies concentrate on areas such as electronic warfare and autonomous systems, as rising defense budgets and modernization initiatives heighten competition.

The report provides a comprehensive analysis of the competitive landscape in the military radars market with detailed profiles of all major companies, including:

- BAE Systems

- Elbit Systems Ltd

- Honeywell International Inc.

- Israel Aerospace Industries

- Leonardo DRS

- Lockheed Martin Corporation

- Northrop Grumman

- RTX Corporation

- Saab AB

- Thales Group

Latest News and Developments:

- October 2024: Numerica Corporation unveiled Spark, a multi-mission military radar designed for air and missile defense. Spark integrates wideband hemispheric sensing for Active Protection Systems (APS), short-range air defense (SHORAD), and counter-uncrewed aircraft systems (C-UAS). It detects a range of airborne threats, including RPGs, ATGMs, high-speed vehicle threats, and uncrewed aircraft systems. Utilizing advanced phased array technology and on-radar software, Spark offers full hemispheric coverage, enabling precise detection and tracking of top-attack threats.

- May 2024: To keep an eye on aerial threats, General Radar Corporation, a US-based inventor and manufacturer of multi-mission, high-resolution, long-range Active Electronically Scanned Array (AESA) phased array radars, introduced Radar-as-a-service.

- April 2024: The Defense Contract Management Agency (DCMA) launched its new Radars and Sensors Contract Management Office (CMO), consolidating six former offices to better align with military requirements. Navy Capt. Nicola Gathright, DCMA Eastern Regional Command, highlighted the collaborative planning since October 2023 and emphasized the opportunity for workforce growth through change. This CMO, the first of its kind as a systems command, will focus on contract management for radar and sensor systems.

- December 2023: SpaceX launched a Falcon 9 rocket carrying SARah 2 and 3 radar satellites for the German military.

- April 2022: Blighter Surveillance Systems introduced the A422 Deployable Radar System, a ground-based military radar designed for drone detection and perimeter defense. Ideal for rapid deployment in remote areas, the A422 excels in micro-UAV detection in urban environments. With a portable, modular mast for easy assembly and low power requirements, the system supports both mains and battery operation.

Military Radars Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Surveillance and Airborne Early Warning Radar, Tracking and Fire Control Radar, Multi-Function Radar, Weapon Locating and C-RAM Radar, Aircraft Bird Strike Avoidance Radar, Air Traffic Control Radar, Weather Radar, Others |

| Platforms Covered | Ground-based, Naval, Airborne, Space |

| Frequency Bands Covered | VHF/UHF Band, L Band, S Band, C Band, X Band, Ku/Ka/K Band |

| Dimensions Covered | 2D Radar, 3D Radar, 4D Radar |

| Applications Covered | Air and Missile Defense, Intelligence, Surveillance and Reconnaissance, Navigation and Weapon Guidance, Space Situational Awareness, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BAE Systems, Elbit Systems Ltd, Honeywell International Inc., Israel Aerospace Industries, Leonardo DRS, Lockheed Martin Corporation, Northrop Grumman, RTX Corporation, Saab AB, Thales Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the military radars market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global military radars market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the military radars industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The military radars market was valued at USD 16.9 Billion in 2024.

The military radars market is projected to exhibit a CAGR of 3.6% during 2025-2033, reaching a value of USD 23.3 Billion by 2033.

The key factors driving the global market include rising geopolitical tensions, increasing defense budgets, technological advancements, the demand for space-based radar systems, and the need for modernizing aging radar infrastructure to counter evolving threats like hypersonic missiles, stealth aircraft, and electronic warfare.

North America currently dominates the military radars market, accounting for a share exceeding 30.4%. This dominance is fueled by ongoing military modernization efforts, significant defense spending, and the integration of advanced radar technologies in the U.S. and Canada.

Some of the major players in the military radars market include BAE Systems, Elbit Systems Ltd, Honeywell International Inc., Israel Aerospace Industries, Leonardo DRS, Lockheed Martin Corporation, Northrop Grumman, RTX Corporation, Saab AB, and Thales Group, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)