Mining Chemicals Market Size, Share, Trends and Forecast by Product Type, Mineral Type, Application, and Region, 2025-2033

Mining Chemicals Market Size and Share:

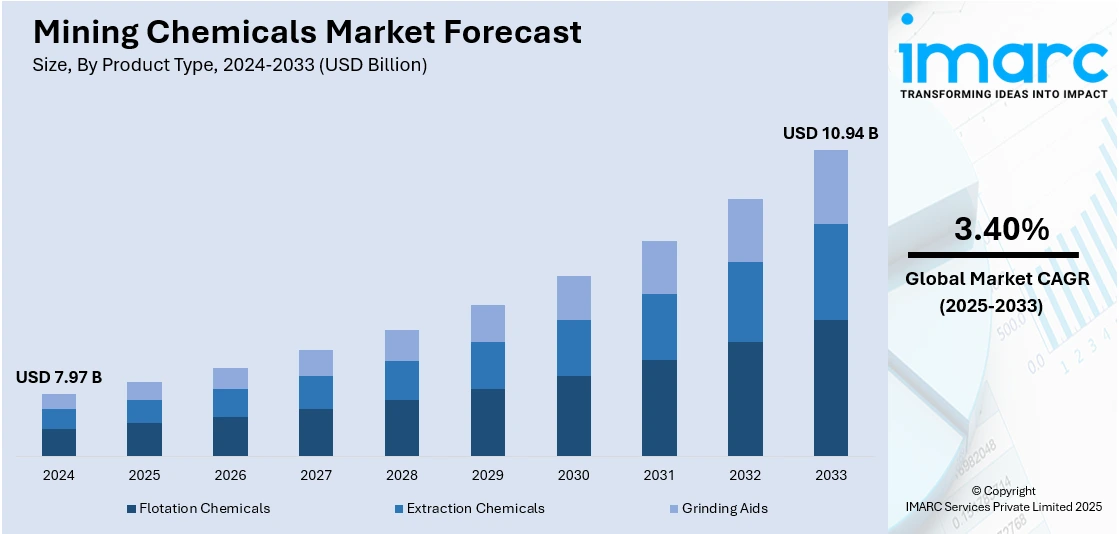

The global mining chemicals market size was valued at USD 7.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.94 Billion by 2033, exhibiting a CAGR of 3.40% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 40.8% in 2024. At present, the growing demand for specialty chemicals that support environmental compliance by reducing harmful waste and pollution is positively influencing the market. Besides this, increasing mining activities are contributing to the expansion of the mining chemicals market share.

|

Report Attribtue

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.97 Billion |

|

Market Forecast in 2033

|

USD 10.94 Billion |

| Market Growth Rate 2025-2033 | 3.40% |

At present, rising demand for metals and minerals is motivating mining companies to expand operations, creating the need for effective chemical processing. As ore grades are declining, more chemicals are required to extract valuable materials efficiently. Companies are also focusing on improving recovery rates and reducing operational costs, driving the demand for advanced reagents. Besides this, environmental concerns are encouraging the use of eco-friendly and low-toxicity chemicals. Growth in sectors like construction, electronics, and renewable energy is catalyzing the demand for mined resources. Apart from this, technological advancements lead to better chemical formulations that enhance performance.

The United States has emerged as a major region in the mining chemicals market owing to many factors. Increasing demand for metals like copper, gold, and lithium is offering a favorable mining chemicals market outlook. Declining ore quality in some regions is leading to higher use of chemicals to ensure effective extraction. Rising focus on domestic mineral production, especially for critical materials employed in electronics and clean energy, is further stimulating the market growth. In addition, environmental regulations are encouraging companies to adopt safer and more sustainable chemical solutions. Technological advancements are also enabling the utilization of more effective and specialized chemicals in mining operations. Apart from this, the ongoing shift towards automation and process optimization is promoting the employment of high-performance mining chemicals. As per industry reports, approximately 60% of all US companies and almost 85% of large enterprises adopted automation in 2024. Approximately 65% of companies stated that automation was a key priority.

Mining Chemicals Market Trends:

Growing demand for specialty chemicals

Increasing demand for specialty chemicals is positively influencing the market. These chemicals improve recovery rates and processing efficiency, helping mining companies extract minerals from low-grade ores. Specialty chemicals also support environmental compliance by reducing harmful waste and pollution. They include flotation agents, dispersants, and pH modifiers that enhance separation and purification processes. As mining operations are becoming more complex, specialty chemicals continue to provide customized performance to meet specific challenges. The rise in demand for rare earth elements and battery metals is creating the need for advanced chemicals tailored to these minerals. Specialty chemicals also aid in minimizing operational costs by improving process speed and reducing energy usage. The versatility of specialty chemicals makes them essential in modern mining, significantly propelling the growth of the market. The global specialty chemicals market size reached USD 780.3 Billion in 2024 and is forecasted to expand at a CAGR of 3.23% during 2025-2033, as per the IMARC Group.

Increasing mining activities

Rising mining activities are stimulating the market growth. As mining operations are expanding to meet the high demand for metals and minerals, the need for effective reagents and processing agents is increasing. For example, in January 2024, Coal India Limited. (CIL) unveiled a new initiative aimed at extracting essential minerals, including lithium. In this project, CIL planned to acquire a block from the government for exploration purposes. More mining projects mean higher utilization of flotation chemicals, leaching agents, and grinding aids to improve recovery rates. Rising exploration and production are also leading to more chemical use in waste management and environmental protection. Mining companies are investing in chemicals that enhance efficiency, reduce costs, and support sustainable practices.

Rising need to control greenhouse gas (GHG) emissions

The increasing need to control GHG emissions is impelling the mining chemicals market growth. As per a 2022 report from Carbon Brief, emissions from mining and resource extraction led to damages close to USD 3 Trillion each year. Mining companies are adopting mining chemicals that reduce energy usage during processing, helping lower carbon emissions. Green mining chemicals help minimize waste and pollution, supporting environmental regulations and corporate sustainability goals. These chemicals improve process efficiency, allowing mines to produce more with less energy and fewer emissions. The focus on reducing the carbon footprint is encouraging innovations in biodegradable and less toxic mining reagents. Additionally, stricter government policies worldwide are enabling mining firms to employ cleaner chemical products. This demand for greener alternatives is increasing investments in research and development (R&D) activities related to sustainable mining chemicals.

Mining Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mining chemicals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, mineral type, and application.

Analysis by Product Type:

- Flotation Chemicals

- Collectors

- Depressants

- Flocculants

- Frothers

- Dispersants

- Extraction Chemicals

- Diluents

- Extractants

- Grinding Aids

Grinding aids held 28.7% of the market share in 2024. They improve the efficiency of the grinding process, which is a critical step in mineral processing. These chemicals aid in reducing energy utilization by decreasing the resistance between particles during grinding, allowing mills to operate more smoothly and effectively. Grinding aids increase the throughput of grinding mills, helping mining companies process more ore in less time. They also refine the quality of the final product by preventing particle agglomeration and enhancing the liberation of minerals. As energy costs are rising, the use of grinding aids is becoming important to lower operational expenses. Grinding aids are widely employed across various minerals, including base metals, precious metals, and industrial minerals, making their demand consistent and high. Additionally, advancements in grinding aid formulations lead to better performance and environmental benefits.

Analysis by Mineral Type:

- Base Metals

- Non-metallic Minerals

- Precious Metals

- Rare Earth Metals

Base metals account for 32.6% of the market share. They are used extensively in construction, manufacturing, transportation, and electronics. Metals like copper, zinc, lead, and nickel are in high demand worldwide, especially in infrastructure and industrial applications. Mining of base metals requires various chemicals for flotation, leaching, and separation processes, increasing the use of mining reagents. As base metals are often extracted from complex or low-grade ores, efficient chemical processing is becoming essential to maximize recovery. The ongoing growth in electric vehicles (EVs), renewable energy, and power transmission is further driving the demand for base metals, particularly copper and nickel. Base metals are also mined in large volumes, creating the need for continuous chemical supply to maintain processing efficiency. Countries in both developed and developing regions are expanding base metal production, contributing to steady chemical demand.

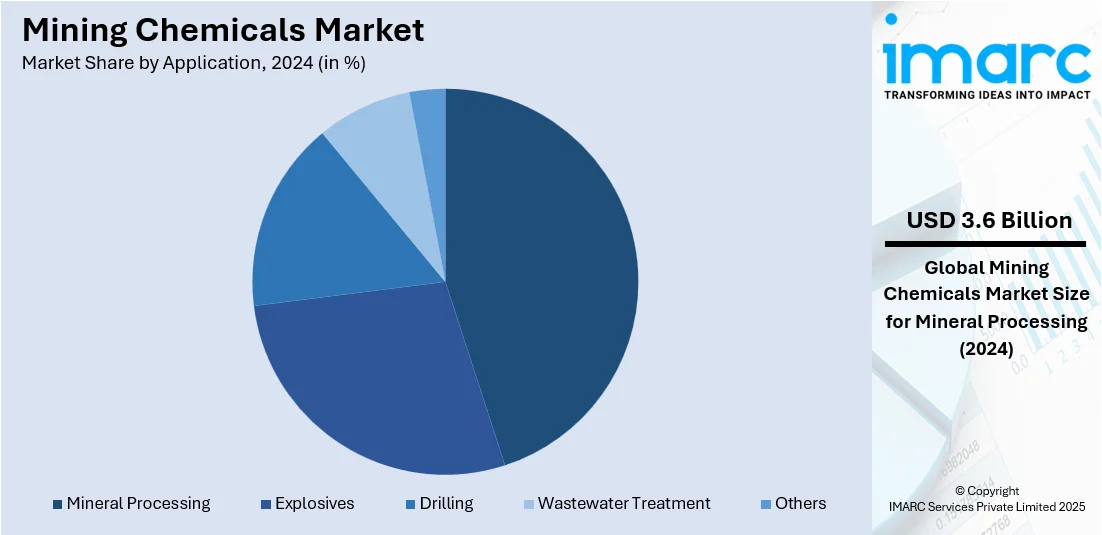

Analysis by Application:

- Mineral Processing

- Explosives

- Drilling

- Wastewater Treatment

- Others

Mineral processing holds 44.9% of the market share. It is a key stage in extracting valuable minerals from ores, requiring a wide range of specialized chemicals. It uses flotation agents, collectors, depressants, frothers, and dispersants to separate and purify minerals efficiently. This step directly affects the recovery rate and quality of the final product, making chemical performance critical. As ore grades are declining, the need for more effective mineral separation is growing, increasing reliance on chemical solutions. Mineral processing is widely employed across mining operations for copper, gold, iron, and rare earth metals, making it the largest application segment. It also supports environmental goals by reducing waste and improving resource optimization. In addition, advancements in chemical formulations make mineral processing more cost-effective and efficient. According to the mining chemicals market forecast, with the rise in demand for high-purity metals in electronics and renewable energy, the importance of precise mineral processing will continue to grow.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 40.8%, enjoys the leading position in the market. The region has a high concentration of mining activities, especially in countries like China, India, and Australia, which extract large volumes of coal, iron ore, copper, and rare earth elements. As per industry reports, India's GDP from mining rose to 1013.49 INR Billion in Q1 2025, up from 824.88 INR Billion in Q4 2024. Rapid industrialization and urbanization activities are driving the demand for metals and minerals, boosting mining operations and the need for chemical processing. The presence of abundant natural resources is supporting continuous exploration and extraction. Government agencies in the region are investing in infrastructure and energy projects, further catalyzing the demand for mined materials and related chemicals. Local chemical manufacturers offer cost-effective products, making mining operations more economical. The growing demand for lithium and other battery metals, particularly for EVs and electronics, is also strengthening the market.

Key Regional Takeaways:

United States Mining Chemicals Market Analysis

The United States holds 77.50% of the market share in North America. The market is primarily driven by the growing demand for minerals and metals, including gold, copper, and lithium, as industries, such as electronics, automotive, and construction, continue to expand. The increasing need for these raw materials, combined with the rapid development of EVs, which require critical metals like lithium and cobalt, is leading to higher mining activities. For instance, in January 2020, the Lisbon Valley Mining Co. revealed plans for the broadening of the mine life of its Lisbon Valley copper mine in Utah. The proposal was first registered in October 2019 and could possibly enhance the life of the mine by nearly 26 years. Additionally, the growing focus on sustainable mining practices is catalyzing the demand for eco-friendly mining chemicals, such as biodegradable flotation reagents and non-toxic solvents, to decrease environmental impacts. Innovations in mining chemicals that improve the efficiency of mineral extraction, reduce energy utilization, and refine the quality of mined products are further fueling industry expansion. Other than this, the ongoing investments in the modernization of mining infrastructure and the introduction of automated technologies in mining operations are also contributing to the rise in the use of specialized chemicals.

Europe Mining Chemicals Market Analysis

In Europe, the growth of the market is largely fueled by the ongoing shift towards automation and digitalization within the mining industry. Technological advancements, such as real-time monitoring systems and automated processing, are increasing the efficiency of mining operations, requiring specialized chemicals for optimal performance. Moreover, the rising focus on recycling and urban mining in the region, which aims to recover valuable metals from electronic waste, is further contributing to the demand for mining chemicals. The region’s well-established mining industry, combined with advancements in mineral processing technologies, is also supporting continued market growth. For instance, in 2022, according to Eurostat, the mining and quarrying sector in the European Union achieved a net turnover of € 173.6 Billion, reflecting a rise of nearly 70% compared to 2021. Europe's emphasis on lowering reliance on imported raw materials is also encouraging exploration and mining activities within the region, further catalyzing the demand for mining chemicals. Additionally, increasing need for high-quality, processed materials with fewer impurities in industries like aerospace and high-end manufacturing is motivating mining companies to adopt more advanced chemical solutions that improve mineral purity.

Asia-Pacific Mining Chemicals Market Analysis

In the Asia-Pacific region, the market is expanding due to the ongoing industrialization activities in nations like India, and China. These nations are major producers and users of minerals, such as coal, copper, and iron ore, driving the demand for mining chemicals employed in extraction and processing. For instance, in 2024-25, coal production in India hit 1047.69 Million Tons, registering a growth of 11.71% in comparison to 2023-24 at 997.83 Million Tons, as per the Indian Ministry of Coal. The increasing need for rare earth metals, which are essential for electronics, renewable energy, and EV production, is further fueling industry expansion. Additionally, government initiatives to comply with stringent environmental standards are significantly influencing the market, promoting the employment of safer and more efficient chemicals. Innovations in mineral processing technologies and the growing demand for high-purity minerals are also creating the need for specialized chemicals to enhance ore recovery and decrease energy utilization in mining operations.

Latin America Mining Chemicals Market Analysis

The Latin America market is experiencing robust growth owing to the region’s abundant natural resources, which is driving the demand for mining chemicals in the extraction and processing of key metals, such as copper, gold, and lithium. As per recent industry reports, in 2023, the ‘lithium triangle’ of Argentina, Bolivia, and Chile possessed the greatest lithium resources worldwide, with 49.9 Million Metric Tons, holding 58% of all identified lithium resources on Earth. The growing demand for these minerals, particularly for use in electronics, renewable energy, and EVs, is boosting mining activities across Latin America. Besides this, the expansion of private and public investments in mining infrastructure, combined with the rising demand for high-quality mineral output, is further promoting the employment of innovative mining chemicals.

Middle East and Africa Mining Chemicals Market Analysis

In the Middle East and Africa region, the market is significantly influenced by the rising exploration of untapped mineral resources across the region. For instance, Saudi Arabia's untapped mineral resources were anticipated to be worth USD 2.5 Trillion, a notable increase from USD 1.3 Trillion, according to a 2024 report by the Natural Resource Governance Institute. Moreover, the Kingdom also planned to broaden the mining sector's share of the country's GDP from USD 17 Billion to USD 75 Billion by 2035. Consequently, as mining operations are expanding across the region, the demand for specialized chemicals to handle complex ore types and improve extraction efficiency is growing. The region’s increasing focus on local production and reducing dependency on imported materials is also creating the need for mining chemicals tailored to regional conditions.

Competitive Landscape:

Key players are developing advanced and efficient chemical formulations that improve mineral recovery and reduce environmental impact. These companies are investing in R&D activities to offer customized solutions tailored to specific mining processes. They are also supporting sustainability by promoting eco-friendly and biodegradable chemicals. Key players are expanding their distribution networks, ensuring timely supply and technical support across major mining regions. They are forming partnerships with mining companies to provide on-site services and optimize chemical usage. By focusing on cost-effective and high-performance products, they help mining firms improve productivity and lower operational costs. Their efforts in educating customers and providing after-sales support are further strengthening their market influence. As industry leaders, they are setting trends and moving the entire mining chemicals market forward. For instance, in February 2024, Orica announced that it would acquire US-based Cyanco for USD 640 Million, significantly expanding its mining chemicals business. This purchase would increase Orica's sodium cyanide production capacity to approximately 240,000 Tons per annum, enhancing its service to the gold mining industry across North America and other regions.

The report provides a comprehensive analysis of the competitive landscape in the mining chemicals market with detailed profiles of all major companies, including:

- AECI Limited

- Arrmaz Products Inc. (Arkema S.A.)

- BASF SE

- Betachem (Pty) Ltd

- Clariant AG

- Dow Inc.

- Dyno Nobel (Incitec Pivot Limited)

- Ecolab Inc.

- Orica Limited

- Sasol Ltd.

- Solvay S.A.

- Zinkan Enterprises Inc.

Latest News and Developments:

- May 2025: BASF announced that it would be intensifying its focus on mining chemicals by integrating its leaching program into ongoing surfactant research and relocating worldwide R&D activities to Houston, Texas. This strategic move aimed to enhance copper hydrometallurgy and flotation processes. Additionally, BASF was set to decentralize technical support for solvent extraction and electrowinning and advance flotation reagents under brands like Lupromin and Luproset.

- January 2025: Super Copper Corp. announced the establishment of a new ‘Material Science and Technology Division’ to broaden the company’s scope beyond mining exploration and into cutting-edge chemical technologies for the mining sector worldwide. This new branch was dedicated to creating chemical-based solutions that would assist mining industries in improving environmental sustainability, lowering hazardous chemical waste produced during operations, and refining metal recovery procedures.

- November 2024: Solenis completed the acquisition of BASF's flocculants division for use in mining. With this agreement, Solenis was able to provide a wider range of goods and services to meet the various demands of the mining chemicals sector and focus on sustainable and creative solutions.

Mining Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Mineral Types Covered | Base Metals, Non-metallic Minerals, Precious Metals, Rare Earth Metals |

| Applications Covered | Mineral Processing, Explosives, Drilling, Wastewater Treatment, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AECI Limited, Arrmaz Products Inc. (Arkema S.A.), BASF SE, Betachem (Pty) Ltd, Clariant AG, Dow Inc., Dyno Nobel (Incitec Pivot Limited), Ecolab Inc., Orica Limited, Sasol Ltd., Solvay S.A. and Zinkan Enterprises Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mining chemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mining chemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mining chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mining chemicals market was valued at USD 7.97 Billion in 2024.

The mining chemicals market is projected to exhibit a CAGR of 3.40% during 2025-2033, reaching a value of USD 10.94 Billion by 2033.

Mining companies are focusing on improving productivity and reducing costs, which is leading to greater use of chemicals that enhance recovery rates and operational efficiency. The ongoing shift towards sustainable and environment friendly mining practices is further driving the demand for green chemicals that minimize environmental impact. Technological advancements in chemical formulations are also supporting the market growth by offering more targeted solutions.

Asia-Pacific currently dominates the mining chemicals market, accounting for a share of 40.8% in 2024, driven by abundant mineral resources, strong mining activity, rising industrial demand, and increasing investments in infrastructure projects. Low-cost production and increasing need for metals like lithium and copper are positively influencing the market.

Some of the major players in the mining chemicals market include AECI Limited, Arrmaz Products Inc. (Arkema S.A.), BASF SE, Betachem (Pty) Ltd, Clariant AG, Dow Inc., Dyno Nobel (Incitec Pivot Limited), Ecolab Inc., Orica Limited, Sasol Ltd., Solvay S.A., Zinkan Enterprises Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)