Mirror Coatings Market Size, Share, Trends and Forecast by Resin Type, Technology, Substrate, End User, and Region, 2025-2033

Mirror Coatings Market Size and Share:

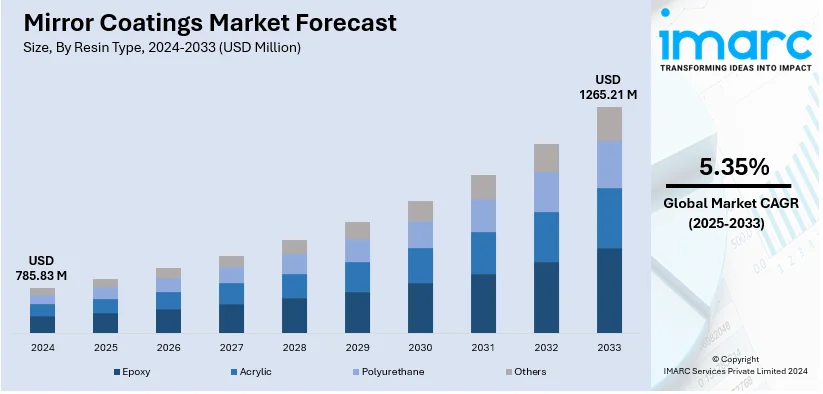

The global mirror coatings market size was valued at USD 785.83 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,265.21 Million by 2033, exhibiting a CAGR of 5.35% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.5% in 2024. There are several factors that are driving the market, which include the rising adoption of renewable energy sources, such as solar and wind power, increasing number of residential and commercial spaces, and the thriving automotive industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 785.83 Million |

|

Market Forecast in 2033

|

USD 1,265.21 Million |

| Market Growth Rate 2025-2033 | 5.35% |

The construction industry's rapid expansion is a significant driver of the mirror coatings market. In 2024, the global buildings construction market was valued at approximately USD 6.8 trillion and is projected to reach over USD 10.5 trillion by 2033, growing at a compound annual growth rate (CAGR) of around 4.9%. This growth is closely linked to the increasing use of mirror-coated glass in modern architecture, where it serves both aesthetic and functional purposes. Mirror coatings enhance the durability and longevity of glass surfaces by protecting them from chemical degradation and abrasion, thereby reducing maintenance costs. Similarly, India's construction industry has been growing, driven by urbanization and government initiatives. This surge in construction activities underscores the critical role of mirror coatings in contemporary building designs, contributing to the market's robust growth trajectory.

The U.S. mirror coatings market is emerging as a major disruptor, holding 80.00% of the total share. The market is primarily driven by the robust expansion of the construction industry. The U.S. construction sector is one of the largest globally, with more than 919000 construction establishments in the first quarter of 2023. This business also employs 8.0 million people and builds structures worth approximately $2.1 trillion each year. Mirror coatings are projected to be in high demand as the building and construction sector grows. Mirrors are widely used in various architectural settings, including hotels, beauty salons, restaurants, bars, elevators, gyms, and washrooms.

Mirror Coatings Market Trends:

Rising Adoption of Solar Power

According to the International Energy Agency (IEA), solar photovoltaic (PV) accounted for 75% of all global additions to renewable capacity in 2023. The market is expanding due to the increasing use of mirror coatings in concentrated solar power (CSP) systems. CSP systems utilize mirrors to concentrate sunlight onto an area that is small to produce heat, which in turn is converted into electricity. Mirror coatings extend mirrors' lifespan and increase their efficiency. Moreover, superior mirror coatings help to increase the reflectivity of the mirrors in CSP systems, allowing them to capture and direct more sunlight onto the central receiver. Moreover, mirror coatings offer a layer of defense that strengthens their resistance to wear, corrosion, and scratches. The global push towards renewable energy and reducing carbon emissions is catalyzing the mirror coatings demand.

Thriving Automotive Industry

In the automotive sector, mirror coatings are essential for prolonging the life and functionality of mirrors. Rain, dust, road debris, and extremely high and low temperatures are among the environmental stresses that automotive mirrors are subjected to. Mirror coatings offer a barrier of defense that increases the mirror's resilience by stopping physical deterioration like scratches and cracks. This is ensuring that automotive mirrors maintain their structural integrity over time. Besides this, the rising focus on improving the reflectivity of automotive mirrors and enhancing visibility for car drivers is propelling the mirror coatings market growth. Clear, reflective mirrors are essential for safe driving, especially in low-light conditions or harsh weather. People are increasingly purchasing vehicles owing to their improved living standards. According to an industrial report, around 88.3 million new vehicles are anticipated to be sold in 2024 worldwide.

Increasing Number of Residential and Commercial Spaces

The rising number of residential and commercial spaces is a key driver for the mirror coatings market. Mirrors are used more often in contemporary architecture and home design for both decorative and practical reasons. Mirrors are employed as ornamental elements in both residential and commercial buildings to improve the interiors' aesthetic appeal. When creating mirrors with exceptional reflectivity, clarity, and durability, high-quality mirror coatings are crucial. The growing popularity of stylish and customized solutions for living rooms, lobbies, bathrooms, and office spaces is offering a favorable mirror coatings market outlook. Furthermore, expansive glass facades with reflected qualities are a common feature of commercial areas, particularly in high-rise structures. Mirror coatings are employed in these buildings to improve energy efficiency through the reflection of sunlight. Additionally, mirror coatings offer ultraviolet (UV) protection, which helps to protect interiors from sunlight-related damage. The market is expanding because of the increasing emphasis on energy efficiency in residential and commercial buildings. According to Invest India, the Indian construction sector is predicted to generate USD 1.4 Trillion by 2025.

Mirror Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mirror coatings market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on resin type, technology, substrate, and end user.

Analysis by Resin Type:

- Epoxy

- Acrylic

- Polyurethane

- Others

Polyurethane dominates the market with almost 48.9% market share in 2024. Polyurethane coatings are famous for great resistance to wear and degradation. This makes them ideal for mirrors in applications where durability is a criterion. Polyurethane coatings ensure excellent surface smoothness, making the mirrors reflective. High reflectivity is important in both functional mirrors, including those used in automotive or solar applications. In line with this, these coatings help in providing strong resistance against environmental elements such as heat, moisture, UV rays, and chemicals.

Analysis by Technology:

- Nano Coatings

- Solvent-Based

- Water-Based

Solvent-based leads the market with around 44.9% of market share in 2024. Solvent-based coatings are very effective at improving the reflective qualities of mirrors because they have good adhesion, durability, and smooth finishes. They are a preferred option for applications in the automotive, architectural, and industrial sectors owing to their exceptional performance in harsh environments. Solvent-based coatings tend to dry faster than their water-based counterparts. Construction and automotive industries benefit from this rapid drying time. Additionally, these coatings can be applied to various types of mirrors which is providing a positive mirror coatings market forecast.

Analysis by Substrate:

- Silver

- Aluminium

- Others

Aluminum leads the market because of its exceptional reflecting qualities, aluminum is a particularly useful material for improving mirror performance. Its ability to reflect a large percentage of visible light makes it useful for solar power systems, vehicle mirrors, and architectural mirrors, among other applications. Aluminum is more cost-effective than other metals used in mirror coatings without sacrificing performance. Aluminum-coated mirrors are a popular option in a variety of industries, ranging from consumer items to large-scale solar projects, because of their cost advantage.

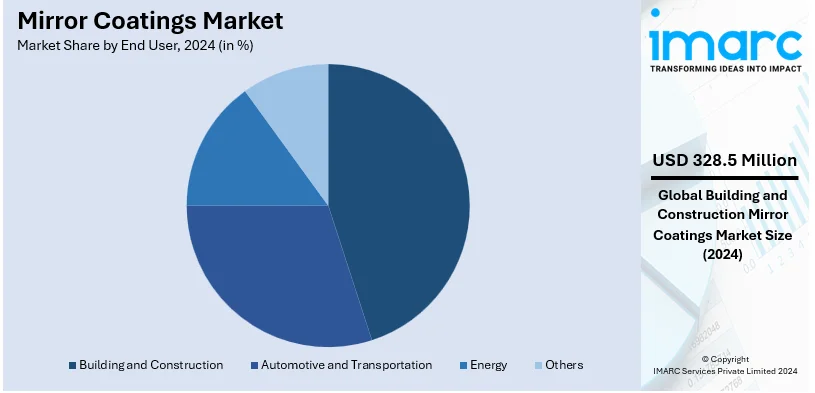

Analysis by End User:

- Building and Construction

- Automotive and Transportation

- Energy

- Others

Building and construction leads the market with around 41.8% of market share in 2024. Mirror coatings are frequently used in buildings and construction to provide a contemporary appearance. These coatings are applied to interior design elements such walls, ceilings, and ornamental fixtures to improve lighting and enhance the overall aesthetic appeal of spaces. In offices, hotels, shopping malls, mirrors are utilized in enhancing the energy efficiency of the premises by reflecting sunlight, heat absorption, and cooling expenses. The rising need for modern living spaces because of changing lifestyles of individuals is bolstering the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 45.5%. Rapid urbanization, along with rising population levels, in the Asia Pacific region are strengthening the market growth. This trend is leading to an increase in the demand for residential and commercial spaces. Moreover, the escalating demand for high-quality automotive mirrors having advanced coatings on account of the increasing vehicle production in the region is influencing the market positively. Apart from this, the region is investing in renewable energy, particularly solar power, which is contributing to the market growth. Furthermore, the rising utilization of coated mirrors in optical devices, sensors, and displays in the electronics and semiconductors industries is impelling the market growth. The IMARC Group claims that the Indian semiconductor market is anticipated to exhibit a CAGR of 9.5% during 2024-2032.

Key Regional Takeaways:

North America Mirror Coatings Market Analysis

The mirror coatings market in North America is driven by advancements in the construction and automotive sectors, coupled with the region's focus on energy efficiency and sustainability. The increasing adoption of mirror-coated glass in architectural projects enhances energy efficiency, reduces glare, and provides aesthetic appeal, making it a preferred choice for builders. Similarly, the booming automotive industry, especially with the rise of electric vehicles (EVs), has fueled demand for mirror coatings, which improve visibility, safety, and durability. Additionally, North America's commitment to renewable energy sources has bolstered the adoption of mirror coatings in solar power applications, such as concentrated solar power (CSP) systems. These coatings improve reflectivity and efficiency, aligning with the region's push towards clean energy solutions. Technological innovations, such as low-VOC and environmentally friendly coatings, also cater to the stringent regulatory standards in the U.S. and Canada.

United States Mirror Coatings Market Analysis

The U.S. mirror coatings industry is growing due to new demands in the automotive and construction industries and the growth in demand for electronics. The Automotive and Construction Sectors contributed an estimated 12.8 million vehicle sales to their contribution to the U.S. Department of Commerce by a report in 2023. The construction industry accounts for USD 1.8 Trillion in construction spending, which is pushing the demand in architectural application for mirror coatings. Energy efficient buildings are, therefore, emerging as a rising trend that further gives impetus to the growth of advanced low emissivity coating mirrors. For instance, PPG Industries and Sherwin-Williams are driving this trend of high performing coatings for the mirror, which provides good durability and aesthetic value. Technological advancements in nano-coatings are also fuelling growth in the sector.

Europe Mirror Coatings Market Analysis

The mirror coatings market is growing in Europe because of the rise in demand for energy-efficient building solutions and advanced automotive technologies. In 2023, the European Commission provided support for sustainable building technologies, particularly those focused on decarbonization. For example, the EU's Innovation Fund released USD 4.19 Billion to aid in the development of cutting-edge technologies, including energy-saving solutions for buildings. This has led to the increased adoption of energy-saving mirror coatings in commercial and residential buildings. Another industry that contributes to this demand is the automotive sector, with registrations over 12 million units in 2023 (as per an industrial report) and is expected to increase demand in advanced mirror coatings. Basf and AkzoNobel among others are working on mirror coatings that give high performances in energy savings. The EU's Green Deal is also emphasizing sustainability, and as a result, the region is propelling the market for such coatings forward.

Asia Pacific Mirror Coatings Market Analysis

The mirror coatings market is rapidly growing in Asia Pacific, which is being propelled by an increasingly developing automotive and construction sectors. Automotive sales in China have risen to more than 24 million units in 2023, as indicated by the China Association of Automobile Manufacturers, further increasing the demand for mirror coatings in the automotive sector. Another major factor is infrastructure spending in the region. According to India Brand Equity Foundation, India has dedicated a staggering amount of USD 133.86 Billion towards its infrastructure development in 2024. In turn, this will generate high demand for mirror coatings in architectural projects. Key players such as Nippon Paint and Kansai Paint are increasing production in this direction to fulfill the growing Asian demands. The demand is also towards smart mirror coatings, as Japan takes the lead to make its way through the sector.

Latin America Mirror Coatings Market Analysis

The Latin American market for mirror coatings is also gaining pace due to the increasing construction and automotive industries. According to National Transport and Logistics Observatory of Infra South America, transport infrastructure projects in Brazil have a total investment of USD 1.4 Billion in seven months of 2023, which will increase demand for the reflective coatings in the construction and transportation industries. Besides this, the government of Brazil revealed 172 investment projects in infrastructural development, including power distribution, urban mobility, and airports, to be undertaken for 2024, further elevating demand for high-performance mirror coatings in architectural and transport applications. Latin America is also adding an expansion to the automotive market in this region, considering 4.5 million vehicles by 2024 would be sold. During such times, the urban area requirement for energy-efficient and highly decorative mirror coatings is escalating and making the region a growth engine.

Middle East and Africa Mirror Coatings Market Analysis

The Middle East and Africa mirror coatings market will grow with expanding infrastructure projects and increasing demand from the automotive sector. The International Trade Administration predicts that the construction sector in Saudi Arabia will grow at 4.1% annually, which will create a need for advanced mirror coatings in architectural applications. As per an industrial report, with demand escalating in the Middle East-the automotive sector in the UAE alone noted as many as 225,390 new car registrations by 2023-it comes as no surprise that their demand for automotive mirror coating is growing. Top-end players like Jotun and AkzoNobel are riding on this success by offering high-quality coatings durable enough for mirrors. With increasing demand for more environmental-friendly and energy-saving products along with green building projects throughout the region, mirror coating with reflective and energy-conserving properties increases further in demand.

Competitive Landscape:

Top players are investing in research and development (R&D) activities to create new formulations of mirror coatings that enhance durability, reflectivity, and resistance to environmental factors. In addition, to meet the increasing demand, companies are expanding their production capacities by investing in new manufacturing plants or upgrading existing ones. Furthermore, leading companies are forming strategic alliances with architectural firms, automotive manufacturers, and solar energy companies to create tailored solutions and enhance their market reach. For example, on 6 June 2024, Diamon-Fusion International (DFI), a leading provider of protective glass coatings and restoration products, partnered with Glass.com, a premier destination for all things glass-related. Glass.com will retail DFI’s DIY consumer-leading products on their website, shop.glass.com. People visiting shop.glass.com will now have access to a wide range of DFI’s consumer coating and restoration solutions.

The report provides a comprehensive analysis of the competitive landscape in the mirror coatings market with detailed profiles of all major companies, including:

- Arkema S.A.

- CASIX (Fabrinet)

- Diamon-Fusion International Inc.

- Dynasil Corporation

- Edmund Optics Inc.

- FENZI S.p.A.

- Ferro Corporation

- Guardian Glass LLC (Koch Industries Inc.)

- Pearl Nano LLC

- The Sherwin-Williams Company

- Tianjin Xin Lihua Color Materials Co. Ltd (NBC)

- Vitro S.A.B. de C.V.

Latest News and Developments:

- April 2024: The Vera C. Rubin Observatory, which is under construction in Chile and supported by the U.S. National Science Foundation and the U.S. Department of Energy's Office of Science, achieved a major milestone with the successful coating of its largest mirror with silver.

- October 2023: Hind High Vacuum Advanced Technologies (HHVAT), a subsidiary of the Bengaluru-based HHV company that specialises in vacuum science and optics applications, has constructed a 2.5m telescoping mirror coater (TMC) at Gurushikhar Peak in Mount Abu, Rajasthan, India.

- July 2023: Zygo announced the launch of uniquely durable and repeatable salt fog silver coating. It can be applied to silver reflector optics used either in harsh marine salt spray environments or for optics exposed to extreme temperatures.

Mirror Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Epoxy, Acrylic, Polyurethane, Others |

| Technologies Covered | Nano Coatings, Solvent-Based, Water-Based |

| Substrates Covered | Silver, Aluminium, Others |

| End Users Covered | Building and Construction, Automotive and Transportation, Energy, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arkema S.A., CASIX (Fabrinet), Diamon-Fusion International Inc., Dynasil Corporation, Edmund Optics Inc., FENZI S.p.A., Ferro Corporation, Guardian Glass LLC (Koch Industries Inc.), Pearl Nano LLC, The Sherwin-Williams Company, Tianjin Xin Lihua Color Materials Co. Ltd (NBC), Vitro S.A.B. de C.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mirror coatings market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mirror coatings market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mirror coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Mirror coatings are specialized materials applied to the surface of mirrors or reflective substrates to enhance their performance, durability, and functionality. These coatings typically consist of thin layers of metals, metal oxides, or other compounds, designed to improve the reflective properties of the surface and protect it from environmental and physical damage.

The mirror coatings market was valued at USD 785.83 Million in 2024.

IMARC estimates the global mirror coatings market to exhibit a CAGR of 5.35% during 2025-2033.

There are several factors that are driving the market, which include the rising adoption of renewable energy sources, such as solar and wind power, increasing number of residential and commercial spaces, and the thriving automotive industry.

In 2024, polyurethane represented the largest segment by resin type, owing to their exceptional resilience to abrasion and deterioration.

Solvent-based leads the market by technology as they are very effective at improving the reflective qualities of mirrors because they have good adhesion, durability, and smooth finishes.

The aluminum is the leading segment by substrate because of its exceptional reflecting qualities, which makes it useful for solar power systems, vehicle mirrors, and architectural mirrors.

The building and construction is the leading segment by end user, as mirror coatings are frequently applied to interior design elements such as walls, ceilings, and ornamental fixtures.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global mirror coatings market include Arkema S.A., CASIX (Fabrinet), Diamon-Fusion International Inc., Dynasil Corporation, Edmund Optics Inc., FENZI S.p.A., Ferro Corporation, Guardian Glass LLC (Koch Industries Inc.), Pearl Nano LLC, The Sherwin-Williams Company, Tianjin Xin Lihua Color Materials Co. Ltd (NBC), Vitro S.A.B. de C.V., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)