Mobile Gaming Market Size, Share, Trends and Forecast by Type, Device Type, Platform, Business Model, and Region, 2025-2033

Mobile Gaming Market Size and Share:

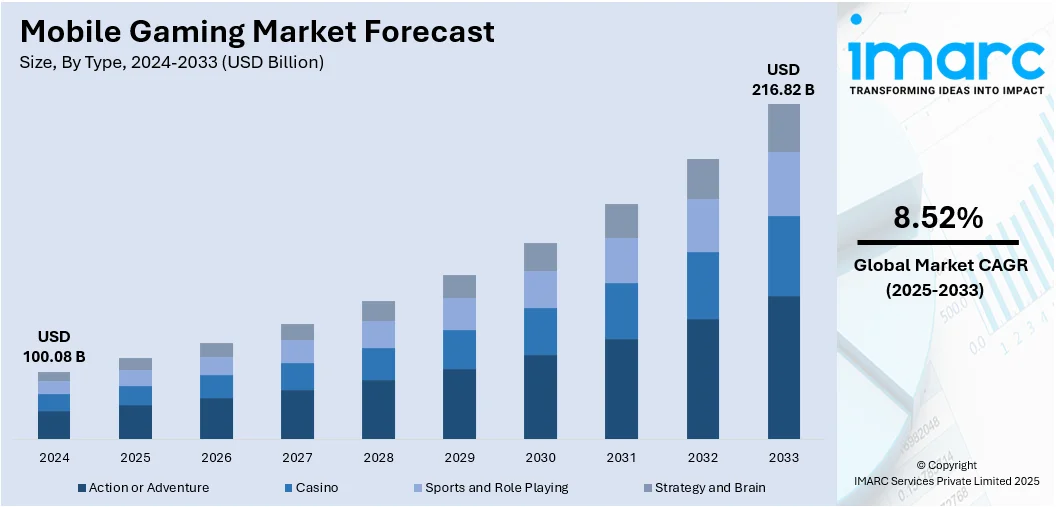

The global mobile gaming market size was valued at USD 100.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 216.82 Billion by 2033, exhibiting a CAGR of 8.52% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 58.9% in 2024. The market dominance is attributed to its large tech-savvy population, rapid smartphone adoption, and strong digital infrastructure. Continuous investment in advanced technologies, widespread high-speed internet access, and supportive government initiatives further strengthen Asia Pacific region’s leadership.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 100.08 Billion |

|

Market Forecast in 2033

|

USD 216.82 Billion |

| Market Growth Rate (2025-2033) | 8.52% |

The growing accessibility of high-speed internet and budget-friendly data plans enhances smooth online gaming experiences. Improved connectivity enables real-time multiplayer gaming, cloud-based gaming, and regular content updates, increasing the engagement of mobile gaming. This availability is broadening the user demographic, especially in developing markets with increasing digital frameworks. Additionally, the freemium approach, along with in-app purchases, provides free access to basic gaming while ensuring steady income via optional enhancements, virtual items, and rewards. This model promotes extended user involvement, enhances monetization prospects, and facilitates ongoing content creation, fostering market growth by appealing to both casual and committed gamers worldwide. Besides this, the ongoing advancement of high-performance smartphones featuring exceptional displays, quicker processors, and longer battery life is offering a favorable market outlook. These innovations facilitate immersive visuals, fluid gameplay, and the capacity to manage intricate games, which greatly improves the overall user experience and draws in a wider gaming audience globally.

To get more information on this market, Request Sample

The United States plays an essential role in the market, supported by the extensive access to high-speed internet and the swift deployment of 5G networks that facilitate uninterrupted online gaming. Reduced latency, quicker download speeds, and consistent connections improve multiplayer gaming and streaming platforms. Additionally, the introduction of mobile cloud gaming services, which allows immediate access to premium games without downloads or complicated configurations, is bolstering the market growth. This ease of use enhances user experience, lowers entry barriers, and increases participation. It similarly promotes increased conversion rates for publishers, speeding up user acquisition and market growth. In 2024, Samsung officially introduced its mobile cloud gaming platform in North America, officially ending the beta phase. The platform enabled immediate access to Android-native games on Galaxy devices without any downloads or configuration. It greatly enhanced user acquisition for publishers, presenting a 50% conversion rate from click to play.

Mobile Gaming Market Trends:

The proliferation of smartphones and tablets

The extensive use of smartphones and tablets is transforming the mobile gaming industry, fueled by the availability of devices featuring sophisticated hardware like high-resolution screens, multi-core processors, and dedicated GPUs. As per IBEF, smartphone deliveries in India grew by 3% compared to the previous year, with the total worth climbing by 12%, indicating a strong and developing mobile ecosystem in one of the biggest consumer markets worldwide. Data from the Consumer Affairs Journal of Consumer Research reveals that 97% of Americans, which is about 330.8 million individuals, possess a mobile phone, and nearly 90% have a smartphone. Americans typically spend 4 hours and 30 minutes using their phones each day and check them 144 times daily, with almost 57% considering themselves as ‘mobile phone addicts’. Moreover, mobile devices represent 59.5% of worldwide internet traffic, which further drives mobile gaming market figures and its ongoing growth.

The emerging technological advancements

The swift advancement of technological developments is driving mobile gaming to extraordinary heights of engagement and interaction. A sector report reveals that there are roughly 1.17 billion gamers online globally, underscoring the immense potential market for high-tech mobile games. In October 2023, Electronic Arts (EA) launched EA Sports FC Tactical, a mobile game that includes interactive simulation, turn-based strategic mechanics, and a lineup of more than 5,000 real players from top leagues like the Premier League, LALIGA EA SPORTS, Bundesliga, Ligue 1, and Serie A. Additionally, in April 2024, the National Football League (NFL), the NFL Players Association (NFLPA), and 2K released NFL 2K Playmakers, a tactile card-battling game for iOS and Android, created by Cat Daddy Games. These releases, combined with the expanding worldwide player community, are anticipated to greatly influence the mobile gaming market outlook in the coming years.

The incorporation of freemium and in-app purchases

The freemium model is emerging as a leading strategy in mobile gaming, providing users with free game access while creating significant income through in-app purchases. Developers leverage this model by offering buyable in-game items, power-ups, cosmetic upgrades, and improved features that enrich the gaming experience. This approach encourages sustained user involvement, as developers regularly roll out updates, events, and fresh content to maintain player engagement. Data from Business of Apps indicates that in-app purchases continue to be one of the most commonly used monetization strategies, with around 50% of non-gaming apps and 79% of gaming apps implementing it. In-app purchases account for 48.2% of overall mobile app revenue, while paid downloads contribute 37.8% and ad-based income makes up only 14%. Worldwide expenditure on in-app purchases has hit $380 billion, greatly fueling the expansion of mobile gaming market across various areas.

Mobile Gaming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mobile gaming market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, device type, platform, and business model.

Analysis by Type:

- Action or Adventure

- Casino

- Sports and Role Playing

- Strategy and Brain

The action or adventure segment flourishes with engaging gameplay, rapid mechanics, and visually stunning settings. It appeals gamers looking for captivating stories, tough quests, and immersive environments. The popularity of this segment stems from its capacity to deliver a cinematic and engaging gaming experience, frequently enhanced by sophisticated graphics and fluid controls.

The casino segment is driven by the increasing appeal of online gambling options, providing games like poker, slots, and blackjack in an easily accessible mobile format. Gamers are attracted to the excitement of luck, prizes, and digital currency systems that mimic actual casino settings. Safe payment options and appealing reward systems enhance the attractiveness of this sector.

The sports and role-playing segment merges competitive action with engaging narratives. Sports games engage players with lifelike simulations of well-known sports, interactive controls, and multiplayer options. Role-playing games (RPGs) emphasize character growth, engaging narratives, and tactical choices, attracting players who appreciate extensive advancement and personalization. The fusion of these genres generates a broad appeal, captivating both strategy-focused and experience-seeking players.

The strategy and brain segment serves players who are looking for intellectual challenges, critical thinking, and problem-solving. It features puzzle games, strategic planning titles, and resource management situations that challenge analytical abilities. The success of this segment stems from its capacity to provide enjoyable mental engagement while being attainable for every age group.

Analysis by Device Type:

- Smartphone

- Smartwatch

- PDA

- Tablet

- Others

Smartphone holds 83.6% of the market share attributed to their extensive availability, easy-to-use interfaces, and ongoing technological improvements. High-resolution screens, robust processors, and increased storage capabilities facilitate smooth gaming experiences with exceptional visuals and performance. The convenience of smartphones enables users to game at any time and in any place, greatly enhancing engagement levels. The incorporation of enhanced elements like fast connectivity, durable batteries, and effective cooling systems enhances the quality of gameplay. Moreover, the extensive variety of gaming apps available in app stores appeals to various tastes and abilities, drawing in a wide range of users. Cost-effective data plans and dependable network systems facilitate seamless online gaming, while frequent software updates enhance security and performance. These elements together enhance the dominance of smartphone as the favored device category in the market.

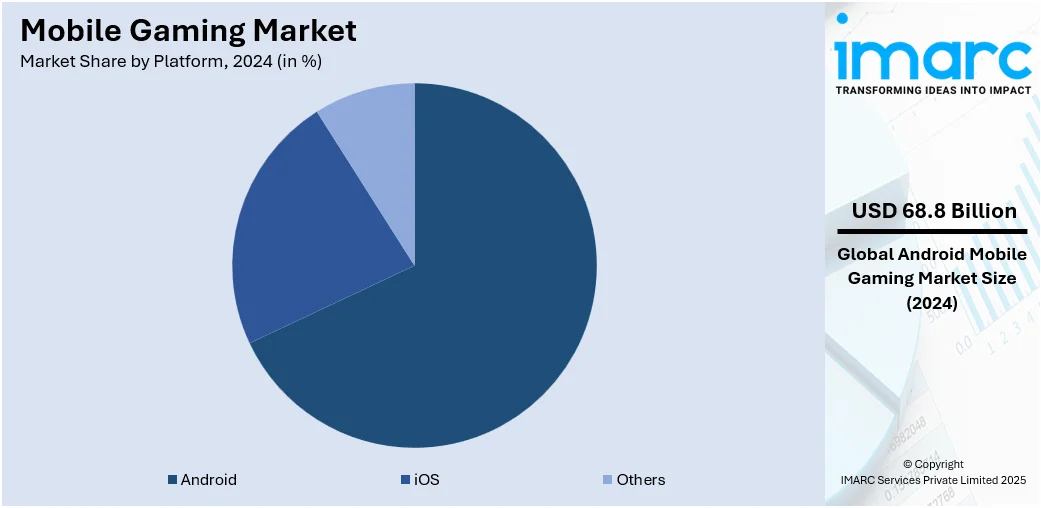

Analysis by Platform:

- Android

- iOS

- Others

Android represents the largest segment, accounting 68.7% market share, owing to its open-source nature, extensive device compatibility, and wide global user base. The platform’s flexibility allows developers to create a diverse range of gaming applications optimized for various hardware configurations, ensuring accessibility for all budget levels. Regular updates and enhancements to the Android operating system improve performance, security, and user experience, supporting high-quality gameplay. The availability of numerous app distribution channels, including the Google Play Store, increases market reach and visibility for developers. Additionally, Android devices offer powerful hardware specifications and customizable features that enhance gaming performance. The affordability and wide selection of Android-based smartphones and tablets further drive user adoption. With strong developer support, seamless integration of advanced technologies, and a growing ecosystem, Android continues to maintain its dominance as the leading platform in the mobile gaming market.

Analysis by Business Model:

- Freemium

- Paid

- Free

- Paymium

Freemium is a crucial segment in the market owing to its capability to offer games that are free to play and download, along with optional in-app purchases for virtual items, enhancements, or exclusive content. This method draws in a wide range of users by eliminating obstacles to participation while earning income from active users. It promotes regular gameplay, builds significant communities, and enables sustained monetization via ongoing content updates, events, and customization options.

The paid model requires an initial payment to access the complete game, typically aimed at users who favor ad-free experiences and high-quality content right away. It provides thoughtfully crafted gameplay, comprehensive feature sets, and eliminates in-app purchase pressure, appealing to users who appreciate quality and openness.

The free model features games that are completely free to play, lacking in-app purchases or advertisements, typically created for awareness initiatives, educational purposes, or brand involvement. Games in this segment emphasize reach and accessibility instead of revenue and are often employed by organizations to promote certain messages or public interest goals.

The paymium model combines elements of paid and freemium strategies by necessitating an upfront purchase while also providing in-app purchases. It attracts users ready to invest upfront for premium content while also allowing them to improve their experience with extra features. This model aims at a dedicated audience and generates dual revenue sources, including initial download charges and continuous microtransactions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia-Pacific region represented the largest market share at 58.9%, owing to its growing digital infrastructure, swift smartphone adoption, and rising affordability of high-performance devices. The area enjoys extensive internet access, bolstered by improvements in mobile networks and data services, enabling smooth entry to online gaming platforms. An expanding youth demographic with a strong preference for digital entertainment support the market growth. The increasing demand for localized content, backed by various languages and cultural tastes, boosts user involvement and loyalty. Substantial investments from leading firms in technology advancements and user experience enhancement further bolster the region's market standing. The Asia-Pacific region's market leadership is further solidified by targeted initiatives and collaborations that cater to local demands. For example, in 2025, Jio and Krafton India launched India’s first mobile gaming data pack for BGMI fans. Priced at Rs. 495/month, the Jio Gaming Pack offers 5G connectivity, exclusive BGMI rewards, and JioGames cloud gaming access. This marks a significant step in boosting India’s mobile-first gaming ecosystem.

Key Regional Takeaways:

United States Mobile Gaming Market Analysis

In North America, the market portion held by the United States was 87.50%, fueled by the rising use of 5G networks and the expanding appeal of cloud-based gaming experiences. By Q1 2025, North America achieved 314 million 5G connections, encompassing around 83% of its population. This extensive connectivity greatly improves real-time gaming and streaming performance. The area is witnessing a significant increase in user expenditure on in-game content, driven by improved graphics and engaging gameplay elements. The incorporation of augmented reality (AR) features is also enhancing user involvement, especially among Gen Z and millennial gamers. Furthermore, the increase in social and multiplayer elements is changing mobile games into avenues for digital interaction, expanding their attractiveness even more. The US enjoys a significant adoption of advanced smartphones and wearables, facilitating smooth and interactive gaming. Seasonal events and partnerships with entertainment franchises keep increasing in-game engagement and player retention. Moreover, the growing application of data analytics and machine learning (ML) allows developers to tailor gaming experiences and enhance monetization approaches. Furthermore, the rise of esports competitions on mobile platforms is drawing in both new players and viewers.

North America Mobile Gaming Market Analysis

The North America mobile gaming sector is driven by technological innovations, increased smartphone usage, and changing user habits. The availability of high-speed internet and advancements in mobile technology are enabling more engaging and immersive gaming experiences, enhancing user involvement. The extensive use of in-app purchases and subscription models are further improving monetization options for developers. Social elements and competitive play contribute to maintaining engagement, especially among younger, tech-oriented demographics. A significant example is Krafton’s revelation of Dark and Darker Mobile, scheduled for a soft launch in Canada and the US on February 4, 2025. This extraction RPG includes PvE and PvP dungeon modes, a Sidekick system, and five available classes, enabling players to explore, fight, and gather loot, highlighting the rising demand for intricate, captivating mobile games. The growing acceptance of gaming among various age demographics, the incorporation of cloud gaming, and regulatory backing for digital trade maintain a vibrant and profitable environment for mobile gaming in North America.

Europe Mobile Gaming Market Analysis

The mobile gaming market in Europe is consistently growing, supported by an increasing affinity for casual gaming within a varied audience. Women in Games states that 53% of Europeans engage in video gaming, with 75% of these players being adults and an average age of 31.4, highlighting a mature and active audience that values quality content. The growing fascination with interactive storytelling and narrative-driven games is inspiring developers to explore genre-blending formats that attract different age demographics. The area is also gaining from heightened investments in mobile game design education and independent game creation, fostering a diverse and vibrant content environment. Content tailored to specific languages and cultural subtleties is enhancing user engagement across Western and Eastern Europe. Mobile puzzle and strategy games are becoming increasingly popular because of their engaging and mentally challenging gameplay. Subscription models within apps are becoming more popular, while improved user interfaces and accessibility elements are making games more attractive. Europe's regulatory emphasis on digital wellness promotes games that have beneficial social and cognitive effects.

Asia Pacific Mobile Gaming Market Analysis

The mobile gaming market in the Asia Pacific is rapidly expanding, owing to the area's young demographic, increasing internet and mobile phone penetration, and rising digital proficiency. In India, for example, the Ministry of Statistics & Programme Implementation indicates that around 85.5% of households own at least one smartphone, enabling extensive access to mobile games. Players in this area are attracted to cutting-edge elements like live-streaming gameplay and instant multiplayer modes. Mobile games are becoming essential to everyday life, with brief gaming sessions preferred during commutes and breaks. The incorporation of gamification in non-entertainment fields like fitness and education is expanding the market reach. Features for in-app gifting and tipping boost community interaction and support for creators. The area is progressing in mobile gaming innovation, incorporating regional festivals and seasonal themes into game content, increasing cultural significance and enthusiasm. Cross-platform integration with PCs and consoles is also developing, enabling smooth transitions between devices.

Latin America Mobile Gaming Market Analysis

The mobile gaming industry in Latin America is expanding consistently, attributed to higher youth engagement and greater availability of mobile internet services. Reports about Brazil indicate a population of 218 million and an internet penetration rate of 84%, indicating robust digital interaction among crucial demographics. The increasing popularity of hyper-casual games demonstrates the demand for fast, easily accessible entertainment. In-game chats and friend challenges as social integration elements are fostering greater involvement within peer groups. Games focused on music and rhythm are becoming popular, bolstered by the area's deep cultural ties to music. Mobile-friendly digital payment solutions are simplifying revenue generation, even in regions with restricted banking systems. Besides this, local institutions are investigating game-based learning programs, which enhances the market's variety and growth prospects over time.

Middle East and Africa Mobile Gaming Market Analysis

The mobile gaming sector in the Middle East and Africa is growing, due to higher smartphone adoption and greater localization of game material. As per IMARC Group, Saudi Arabia’s smartphone market achieved 14.08 Million units in 2024 and is projected to expand to 18.52 Million units by 2033, indicating a CAGR of 3.09% starting from 2025. Trends focused on youth, like avatar personalization and competitive rankings, are promoting extended gameplay durations. Narrative-based games influenced by local folklore and themes enhance emotional involvement among players. The growth of mobile game streaming is cultivating new communities and content creators, enhancing the visibility of niche genres. Mini games in social media applications are boosting user engagement. Affordable mobile data access presents promising prospects for ongoing gaming uptake.

Competitive Landscape:

Major players in the industry are concentrating on broadening their influence through strategic collaborations, mergers, and acquisitions to enhance their portfolios and international presence. They are putting money into latest technologies, such as cloud gaming, AR, and artificial intelligence (AI), to improve user experience and involvement. Revenue generation is being enhanced through monetization tactics like subscription models, advertising, and in-app purchases. Businesses are focusing on user data analysis to tailor content and keep players engaged. Ongoing advancements in game design, compatibility across platforms, and features that foster community are highlighted to engage a varied audience and preserve a competitive advantage in this fast-expanding industry. In 2025, Apple launched its first dedicated gaming app during WWDC 2025. The app serves as a central hub across iOS, iPadOS, macOS, and tvOS, offering achievements, leaderboards, and game notifications. It also integrates Apple Arcade and supports third-party games, enhancing the overall mobile gaming experience.

The report provides a comprehensive analysis of the competitive landscape in the mobile gaming market with detailed profiles of all major companies, including:

- Activision Blizzard Inc.

- Electronic Arts Inc.

- Gameloft SE (Vivendi SE)

- GungHo Online Entertainment Inc.

- Kabam Games Inc

- Nintendo Co. Ltd

- Rovio Entertainment Oyj

- Supercell Oy (Tencent Holdings Ltd)

- Take-Two Interactive Software Inc.

- Ubisoft Entertainment SA

Latest News and Developments:

- July 2025: Bandai Namco revealed Jump+ Jumble Rush, a mobile game based on the Shonen Jump+ manga platform. Launching in fall 2025, it featured a unique manga panel-style tower offense system and characters from series like Dandadan and Kaiju No. 8, celebrating Shonen Jump+’s 10th anniversary with strategic crossover gameplay.

- July 2025: GRAVITY officially launched Ragnarok: Twilight in Taiwan, Hong Kong, and Macau. The mobile MMORPG introduced innovative features, including hero transformation and MVP dungeons. Positive beta feedback boosted anticipation. Available on major app stores, the game blended nostalgic elements with fresh mechanics, reinforcing GRAVITY’s presence in Asian markets.

- June 2025: The ICC issued an Expression of Interest for partners to develop a flagship mobile cricket game. Aiming to unify global cricket fandom digitally, the initiative involved all 12 Full Member Boards. It sought visionary developers to create a modern game that reflects the sport’s heritage and worldwide popularity.

- May 2025: Nazara-backed Fusebox Games globally launched Big Brother: The Game, a narrative-driven mobile title based on the reality TV show. Players created characters, formed alliances, and navigated challenges. Developed with Banijay Rights, the game offers an immersive, episodic experience aligned with Nazara’s global expansion strategy and IP-driven gaming model.

- February 2025: The Pokémon Company announced Pokémon Champions, a new battle-focused mobile and Switch game, during its Pokémon Presents event. Alongside the reveal of Pokémon Legends: Z-A, Champions promised competitive multiplayer gameplay, expanding the Pokémon franchise's mobile footprint and diversifying its offerings for casual and dedicated fans alike.

Mobile Gaming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Action or Adventure, Casino, Sports and Role Playing, Strategy and Brain |

| Device Types Covered | Smartphone, Smartwatch, PDA, Tablet, Others |

| Platforms Covered | Android, Ios, Others |

| Business Models Covered | Freemium, Paid, Free, Paymium |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Activision Blizzard Inc., Electronic Arts Inc., Gameloft SE (Vivendi SE), GungHo Online Entertainment Inc., Kabam Games Inc, Nintendo Co. Ltd, Rovio Entertainment Oyj, Supercell Oy (Tencent Holdings Ltd), Take-Two Interactive Software Inc., Ubisoft Entertainment SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mobile gaming market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mobile gaming market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mobile gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile gaming market was valued at USD 100.08 Billion in 2024.

The mobile gaming market is projected to exhibit a CAGR of 8.52% during 2025-2033, reaching a value of USD 216.82 Billion by 2033.

The mobile gaming market is driven by advancements in smartphone technology, increasing internet penetration, and widespread access to affordable data plans. Enhanced graphics, engaging gameplay, and social connectivity features attract a large user base. Additionally, the growing popularity of in-app purchases and digital payment systems further support consistent revenue growth and global market expansion.

Asia Pacific currently dominates the mobile gaming market, accounting for a share of 58.9%. The dominance of the region is attributed to its large tech-savvy population, rapid smartphone adoption, and strong digital infrastructure. Continuous investment in advanced technologies, widespread high-speed internet access, and supportive government initiatives further strengthen Asia Pacific region’s leadership.

Some of the major players in the mobile gaming market include Activision Blizzard Inc., Electronic Arts Inc., Gameloft SE (Vivendi SE), GungHo Online Entertainment Inc., Kabam Games Inc, Nintendo Co. Ltd, Rovio Entertainment Oyj, Supercell Oy (Tencent Holdings Ltd), Take-Two Interactive Software Inc., Ubisoft Entertainment SA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)