Mono Ethylene Glycol Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Mono Ethylene Glycol Price Trend, Index and Forecast

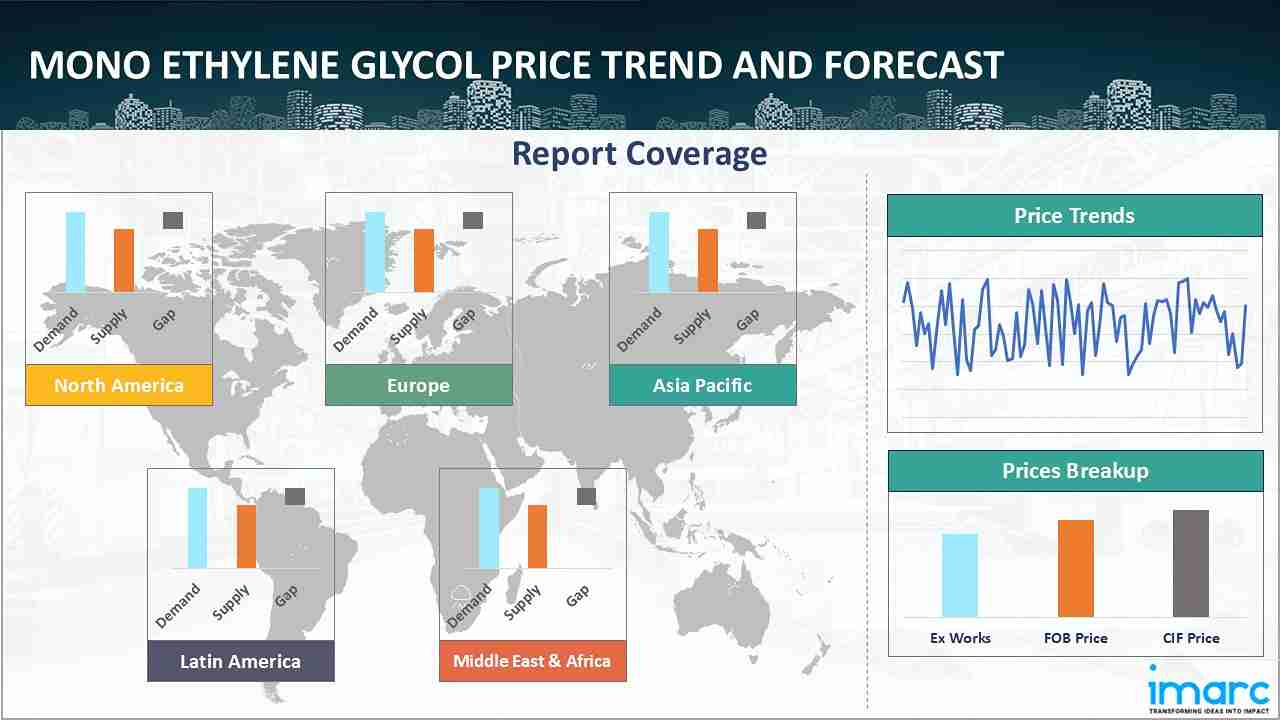

Track the latest insights on mono ethylene glycol price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Mono Ethylene Glycol Prices Outlook Q3 2025

- USA: USD 513/MT

- China: USD 580/MT

- Germany: USD 630/MT

- Saudi Arabia: USD 584/MT

- Brazil: USD 565/MT

Mono Ethylene Glycol Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the mono ethylene glycol prices in the USA reached 513 USD/MT in September. The decline in prices was mainly driven by moderate domestic demand from downstream polyester and antifreeze industries amid reduced manufacturing activity in the automotive sector. Feedstock ethylene prices showed limited fluctuation, while logistical and freight rates remained steady. Additionally, increased inventories from earlier quarters and lower export volumes to Asia dampened market sentiment.

During the third quarter of 2025, the mono ethylene glycol prices in China reached 580 USD/MT in September. Prices rose slightly as downstream polyester producers ramped up production before the holiday season. However, market growth was constrained by an oversupply of domestically produced MEG and increased imports from the Middle East. Raw material costs for ethylene remained stable, and domestic logistics costs improved with declining crude oil freight rates. Despite cautious consumer sentiment, steady textile exports supported demand.

During the third quarter of 2025, the mono ethylene glycol prices in Germany reached 630 USD/MT in September. A price correction occurred due to subdued demand from the European textile and packaging industries. High inventory levels from Q2 and reduced consumption by downstream polyester resin manufacturers pressured suppliers to reduce prices. Energy costs across Europe moderated slightly, easing production costs but failing to stimulate demand recovery. Additionally, fluctuating Euro exchange rates and competitive imports from Asia influenced domestic pricing trends.

During the third quarter of 2025, the mono ethylene glycol prices in Saudi Arabia reached 584 USD/MT in September. Prices saw marginal improvement due to steady export demand from Asian markets and limited domestic consumption fluctuations. Feedstock ethylene availability remained stable, while production facilities operated efficiently, maintaining steady output levels. Strong crude oil fundamentals provided cost support for derivative products, including MEG.

During the third quarter of 2025, the mono ethylene glycol prices in Brazil reached 565 USD/MT in September. Prices declined modestly amid weaker domestic demand from the automotive and plastic packaging sectors. Feedstock cost stability and limited industrial activity restrained significant price movements. However, logistical inefficiencies, including port congestion and increased inland freight costs, partially offset the price decline. Import dependence from North American and Asian suppliers exposed local buyers to global pricing pressures.

Mono Ethylene Glycol Prices Outlook Q2 2025

- USA: USD 525/MT

- China: USD 572/MT

- Indonesia: USD 528/MT

- Saudi Arabia: USD 576/MT

- Brazil: USD 580/MT

During the second quarter of 2025, the mono ethylene glycol prices in the USA reached 525 USD/MT in June. In the United States, mono ethylene glycol prices in Q2 2025 were influenced by fluctuations in ethylene feedstock costs, which were impacted by varying natural gas prices and planned maintenance at Gulf Coast crackers. The polyester and antifreeze sectors showed mixed demand, affecting offtake patterns. Additionally, disruptions in rail transport and port congestion on the East Coast influenced inventory management and supply consistency across key regions.

During the second quarter of 2025, mono ethylene glycol prices in China reached 572 USD/MT in June. In China, mono ethylene glycol pricing was shaped by uneven downstream demand from the polyester and packaging sectors amid fluctuating export orders. Domestic production faced constraints due to turnaround activities at several coal-to-glycol units. Feedstock ethylene prices remained volatile due to refinery outages and shifting import volumes. Environmental regulations and operating rate adjustments also added to cost variability across integrated production facilities.

During the second quarter of 2025, the mono ethylene glycol prices in Indonesia reached 528 USD/MT in June. In Indonesia, mono ethylene glycol prices were impacted by rising raw material costs linked to volatile naphtha prices and limited regional ethylene availability. The local polyester fiber sector showed inconsistent output levels, affecting offtake volume. Import dependency for upstream chemicals, coupled with shipping delays and exchange rate fluctuations, contributed to overall cost pressures. Government fuel policy adjustments further influenced production economics for glycol manufacturers.

During the second quarter of 2025, the mono ethylene glycol prices in Saudi Arabia reached 576 USD/MT in June. In Saudi Arabia, pricing trends were influenced by ethylene availability, with some volatility resulting from maintenance activities at key petrochemical complexes. Mono ethylene glycol production remained linked to the performance of integrated facilities in Jubail and Yanbu, while export demand from Asian markets fluctuated. Shipping costs and availability of containerized cargo space also influenced export pricing structures during the quarter.

During the second quarter of 2025, the mono ethylene glycol prices in Brazil reached 580 USD/MT in June. In Brazil, mono ethylene glycol prices were shaped by feedstock cost variations and logistical inefficiencies at major ports, which affected import timelines. Domestic demand from the plastics and textile sectors remained uneven, and buyers adjusted procurement strategies accordingly. Currency fluctuations against the US dollar influenced the landed cost of imports, while regional supply competition from other Latin American countries affected negotiation dynamics with local distributors.

Mono Ethylene Glycol Prices Outlook Q1 2025

- USA: USD 516/MT

- China: USD 591/MT

- Indonesia: USD 517/MT

- Saudi Arabia: USD 561/MT

- Brazil: USD 592/MT

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing mono ethylene glycol prices.

Europe Mono Ethylene Glycol Price Trend

Q3 2025:

During Q3 2025, the mono ethylene glycol price index in Europe witnessed a downward adjustment amid sluggish industrial output and subdued consumer demand. High inventories, coupled with weaker polyester resin production, suppressed price momentum. Energy costs moderated slightly but remained significant in production economics. Imports from Asia and the Middle East created competitive pricing pressure across European markets, particularly in Germany and France. Additionally, logistic costs and compliance requirements under EU environmental frameworks maintained operational expenses.

Q2 2025:

As per the mono ethylene glycol price index, European prices maintained high levels due to finite supplies. Production output was hampered by maintenance plans at refineries. Overall consumption did not significantly increase in spite of these supply-side issues, especially in the agricultural input segment. The market remained solid due to stable usage and limited availability. As a result, sustained supply pressures and steady downstream demands supported the mono ethylene glycol market's steady trajectory throughout the time frame.

Q1 2025:

As per the mono ethylene glycol price index, due to shifting demand and tightening supply conditions, the market in Europe had an upward price trend. Moreover, prices slightly declined at the start of January due to sluggish downstream demand from the PET industry. However, as the month went on, a price recovery was brought about by disruptions in U.S. production and a hike in the cost of ethylene oxide. Rising demand from industries like PET packaging and bottled beverages drove a continuous price increase in February.

This analysis can be extended to include detailed mono ethylene glycol price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Mono Ethylene Glycol Price Trend

Q3 2025:

During Q3 2025, the mono ethylene glycol price index in North America showed a mild downward correction. Industrial slowdowns in the automotive and construction sectors softened demand. Ample domestic supply and limited export opportunities constrained pricing growth. Freight and terminal storage costs were stable, but currency strength of the USD limited export competitiveness. Feedstock ethylene costs remained steady, reducing cost-push inflation. The overall sentiment in the North American MEG market was cautious, reflecting supply stability and moderate demand contraction across major consumption sectors.

Q2 2025:

As per the mono ethylene glycol price index, in North America, mono ethylene glycol prices in Q2 2025 were influenced by ethylene feedstock cost volatility, which reflected fluctuations in natural gas pricing and periodic shutdowns at major crackers along the Gulf Coast. The demand from the polyester and automotive antifreeze sectors was uneven, with buyers adjusting offtake in response to inventory levels. Railcar availability and port delays further affected regional distribution efficiency and cost structures.

Q1 2025:

The market saw consistent price rises and usually followed a positive trajectory. Due to production difficulties brought on by strong winter storms in the Gulf Coast, which primarily affected Texas, and an increase in the cost of ethylene oxide (EO), prices spiked in January. February saw a slight improvement in production, but planned maintenance at important plants continued to have an effect on the market. Despite poor demand from the downstream PET sector, prices steadied at higher levels by March, when the majority of facilities had returned to normal operations.

Specific mono ethylene glycol historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Mono Ethylene Glycol Price Trend

Q3 2025:

During Q3 2025, MEG prices in the Middle East and Africa experienced marginal increases supported by strong export activity and efficient petrochemical operations in key producing nations. Steady crude oil benchmarks sustained ethylene feedstock prices, bolstering MEG production margins. Export routes to Asia remained active with favorable freight conditions. In African markets, demand growth in packaging and construction supported stable pricing.

Q2 2025:

As per the mono ethylene glycol price chart, in the Middle East and Africa, pricing was impacted by feedstock availability and operational schedules at integrated petrochemical complexes in Saudi Arabia. Planned maintenance activities reduced output intermittently, while export volumes to Asian and African markets shifted in response to freight market conditions. Geopolitical factors and container availability also influenced international shipping timelines, while domestic downstream demand showed moderate variability tied to industrial activity.

Q1 2025:

As per the mono ethylene glycol price chart, due to supply limitations and seasonal variations in demand, the market showed a mixed price trend. Strong local inventories and steady output caused prices to modestly decrease in January, but by the middle of the month, maintenance shutdowns at important facilities constricted supply, which caused prices to rise again. Global demand swings and logistical limitations impacted market momentum during the quarter. Saudi Arabia's exports increased in spite of maintenance efforts, which helped to keep prices stable.

In addition to region-wise data, information on mono ethylene glycol prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Mono Ethylene Glycol Price Trend

Q3 2025:

During Q3 2025, MEG prices across the Asia Pacific region displayed mixed trends. China and India saw slight price increases driven by textile and packaging sector demand, while South Korea experienced price moderation due to inventory accumulation. Stable ethylene availability and improved port logistics supported supply continuity. However, subdued export sentiment and regional competition kept pricing growth minimal. Overall, the region reflected balanced fundamentals with steady-to-mild upward pricing tendencies.

Q2 2025:

In the Asia Pacific region, mono ethylene glycol pricing was driven by shifting demand from the polyester and packaging sectors, particularly in China and India, where production levels varied in response to both domestic consumption and export orders. Feedstock ethylene availability remained inconsistent due to refinery maintenance across China and South Korea. Import-dependent countries like Indonesia and Thailand faced elevated costs due to freight rate volatility and currency pressures.

Q1 2025:

In Q1 2025, the market had a mixed performance. Due to tight supply conditions brought on by delayed plant restarts in Southeast Asia and the Middle East, prices rose in the first part of the quarter. The PET industry's demand stayed constant, while rising crude oil prices contributed to price increases. But in March, there was a turnaround as prices fell as a result of decreased demand from the polyester and PET industries. MEG prices were under pressure to fall due to a decline in global crude oil prices and poor consumer mood.

This mono ethylene glycol price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Mono Ethylene Glycol Price Trend

Q3 2025:

During Q3 2025, the Latin American MEG market recorded a slight downward movement. Weak industrial consumption in Brazil and Argentina, combined with currency depreciation, affected import parity pricing. Feedstock cost stability and steady imports from North America balanced the supply situation. However, rising inland transport and port handling charges added cost pressure. Market sentiment remained bearish amid subdued demand recovery across major consuming sectors.

Q2 2025:

In Latin America, mono ethylene glycol prices were affected by high dependency on imports, with Brazil facing port congestion and delays that disrupted supply continuity. The downstream plastics and textile sectors operated with moderate demand, leading to cautious procurement. Fluctuations in the Brazilian real against the US dollar influenced the landed cost of glycol, while regional sourcing competition intensified negotiation dynamics among distributors and importers.

Q1 2025:

As per the mono ethylene glycol price index, the market demonstrated resiliency as prices rose in January and February before leveling down in March. The U.S. Gulf Coast's supply problems, which limited export availability and constrained worldwide supply, were a major factor in the price spike. Due to elevated expenses and U.S. manufacturing shutdowns, prices increased in Brazil. Moreover, prices were maintained even after demand from the PET industry remained muted due to fewer imports and better regional logistics.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Mono Ethylene Glycol Price Trend, Market Analysis, and News

IMARC's latest publication, “Mono Ethylene Glycol Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the mono ethylene glycol market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of mono ethylene glycol at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed mono ethylene glycol prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting mono ethylene glycol pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Mono Ethylene Glycol Industry Analysis

The global mono ethylene glycol market size reached USD 28.61 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 39.36 Billion, at a projected CAGR of 3.61% during 2026-2034. The market is primarily driven by the rising consumption in polyester fiber, packaging, and automotive coolant applications, increasing urbanization, industrial production, and infrastructure expansion.

Latest News and Developments:

- February 2025: UPM Biochemicals, a subsidiary of the Finnish forest industry group UPM, plans to commence integrated commercial operations at its biorefinery located in Leuna, eastern Germany, in 2025. The biorefinery, designed with an annual capacity of 220,000 tons, will utilize sustainably sourced solid wood to manufacture bio-based monoethylene glycol (bio-MEG) and renewable functional fillers (RFF).

- June 2024: Technip Energies and Shell Catalysts & Technologies revealed a technology transfer settlement that speeds up the commercialization of Technip Energies’ Bio-2-GlycolsTM technology for producing bio-based mono ethylene glycol (MEG) from glucose.

Product Description

Mono ethylene glycol (MEG) is a colorless, odorless, and slightly viscous liquid with a high solubility for water, alcohols, and other organic compounds. Structurally, it consists of two hydroxyl groups, making it a diol.

Primarily produced through the hydration of ethylene oxide in high temperature and pressure, MEG comprises low freezing point, high boiling point, and hygroscopic nature. These qualities make it highly beneficial in applications involving solvent action, moisture retention, and thermal stability.

It serves as a key ingredient in the production of polyester fibers and resins like polyethylene terephthalate (PET), which is a pioneer in textile and packaging industries. Its utilization in the automotive industry on account of its ability to decrease the freezing point of aqueous solutions while increasing their boiling points, underscores its versatility in various applications.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Mono Ethylene Glycol |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Mono Ethylene Glycol Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of mono ethylene glycol pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting mono ethylene glycol price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The mono ethylene glycol price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)