Nanosatellite and Microsatellite Market Report by Satellite Mass (Nanosatellite (1kg to 10kg), Microsatellite (10kg to 100kg)), Component (Hardware, Software and Data Processing, Space Services, Launch Services), Application (Communication, Earth Observation and Remote Sensing, Scientific Research, Biological Experiments, Technology Demonstration and Verification, Academic Training, Mapping and Navigation, Reconnaissance, and Others), End-Use Sector (Government, Civil, Commercial, Defense, Energy and Infrastructure, and Others), and Region 2025-2033

Market Overview:

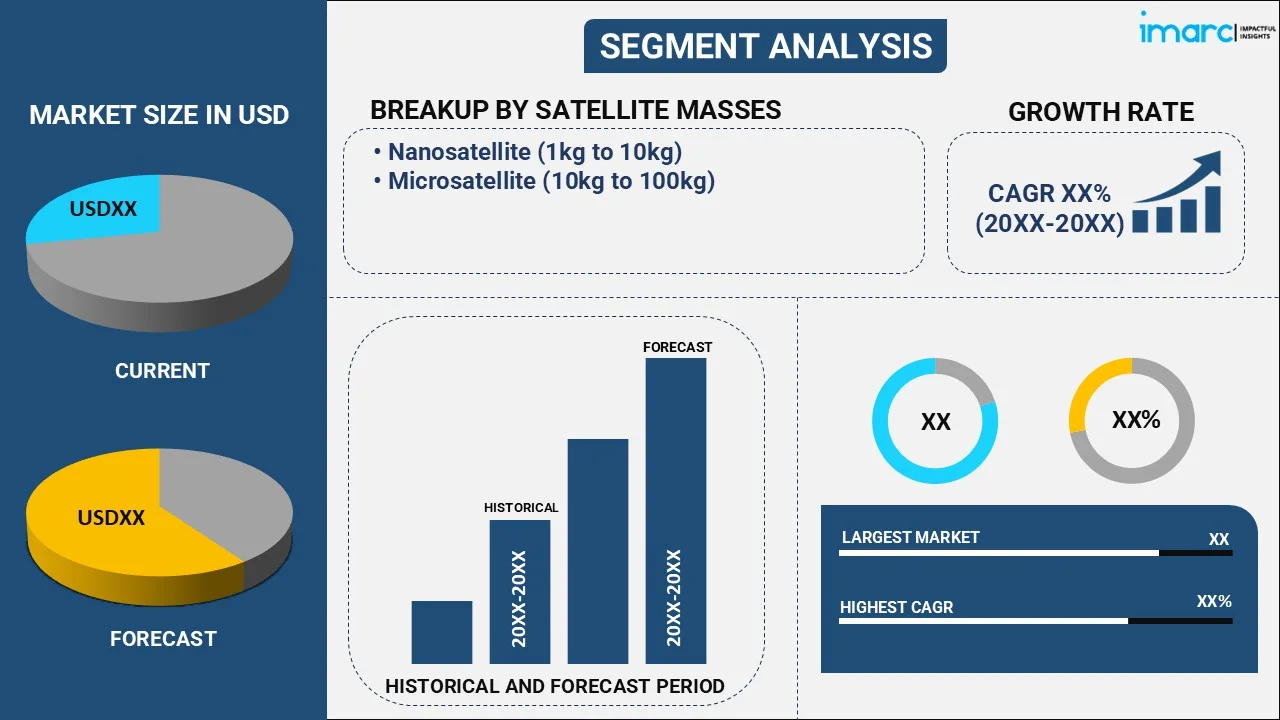

The global nanosatellite and microsatellite market size reached USD 3.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.2 Billion by 2033, exhibiting a growth rate (CAGR) of 15.58% during 2025-2033. The increased demand for Earth observation, rising penetration of IoT connectivity, growing space industry commercialization and constant technological advancements are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 14.2 Billion |

| Market Growth Rate (2025-2033) | 15.58% |

Nanosatellites, also known as CubeSats, are miniaturized satellites with a mass ranging from 1 to 10 kilograms. They typically have a cubic shape, with each side measuring 10 centimeters. Despite their small size, nanosatellites are equipped with various subsystems, such as power systems, communication systems, and onboard computers, enabling them to perform specific missions in space. Microsatellites, on the other hand, are slightly larger than nanosatellites, with a mass ranging from 10 to 100 kilograms. They have more advanced capabilities compared to nanosatellites due to their increased size and payload capacity. Microsatellites are often used for applications, such as Earth observation, remote sensing, and communication. They can carry more sophisticated instruments and sensors, allowing for higher-resolution data collection and transmission. Both nanosatellites and microsatellites offer several advantages over traditional larger satellites, including lower costs, faster development times, and the ability to launch multiple satellites simultaneously. Their compact size also allows for easier deployment and integration into existing satellite constellations. As a result, these small satellites have gained significant popularity in recent years, contributing to the growth and innovation of the space industry.

Nanosatellites and microsatellites offer a more cost-effective alternative to traditional large satellites. Their smaller size and simplified designs significantly reduce manufacturing, launch, and operational costs, making space exploration and communication more accessible to a wider range of organizations and countries. Additionally, there is a growing need for real-time Earth observation data for applications such as weather forecasting, disaster management, urban planning, and environmental monitoring. Nanosatellites and microsatellites provide a cost-effective solution to capture high-resolution imagery and collect data on a global scale. Other than this, with the rise of IoT, there is an increasing demand for satellite-based connectivity to support remote sensing, asset tracking, and communication in areas lacking terrestrial infrastructure. Nanosatellites and microsatellites can form constellations to provide global coverage and enable seamless IoT connectivity. Besides this, the space industry is experiencing a shift toward commercialization, with private companies entering the market and offering satellite-based services. Nanosatellites and microsatellites play a crucial role in this trend by enabling companies to deploy constellations and provide services such as broadband internet, Earth imaging, and data analytics. Moreover, rapid advancements in miniaturization, electronics, and communication technologies have enabled the development of more capable and efficient nanosatellites and microsatellites. This has opened up new possibilities for conducting various missions, including Earth observation, climate monitoring, telecommunications, and scientific research.

Nanosatellite and Microsatellite Market Trends/Drivers:

Cost Efficiency

Traditional large satellites require substantial financial investments in terms of manufacturing, launching, and operational expenses. In contrast, nanosatellites and microsatellites offer a significantly lower cost alternative. Their smaller size and simplified designs allow for reduced manufacturing complexity and lower material costs. Additionally, multiple small satellites can be launched together, sharing the launch costs, further minimizing down expenses. These cost advantages make space exploration and communication more accessible to startups, educational institutions, developing countries, and even individual researchers. The lower financial barrier encourages more organizations and individuals to participate in space-related activities, leading to a broader range of applications and increased innovation.

Increased Demand for Earth Observation

Nanosatellites and microsatellites provide an affordable means of capturing high-resolution imagery and collecting data on various environmental factors such as weather patterns, climate change, and natural disasters. This data is invaluable for applications such as weather forecasting, environmental monitoring, precision agriculture, urban planning, and disaster management. The ability to gather real-time data on a global scale enables better decision-making and resource allocation. The demand for timely and accurate Earth observation data continues to grow, driving the need for nanosatellites and microsatellites as cost-effective platforms for capturing such information.

Internet of Things (IoT) Connectivity

The proliferation of IoT devices and the need for global connectivity are driving the adoption of nanosatellites and microsatellites. IoT devices require reliable connectivity in areas where terrestrial infrastructure is limited or non-existent. Small satellites, when deployed in constellations, can provide comprehensive global coverage, facilitating seamless communication between IoT devices. Nanosatellites and microsatellites can serve as data relays, supporting applications such as asset tracking, remote sensing, environmental monitoring, and communication in remote or underserved regions. The ability to connect IoT devices worldwide through satellite networks opens up new possibilities for industries such as agriculture, transportation, logistics, and environmental monitoring. This demand for IoT connectivity is a key driver for the deployment of nanosatellite and microsatellite constellations.

Nanosatellite and Microsatellite Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nanosatellite and microsatellite market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on satellite mass, component, application and end-use sector.

Breakup by Satellite Mass:

- Nanosatellite (1kg to 10kg)

- Microsatellite (10kg to 100kg)

Nanosatellite (1kg to 10kg) dominate the market

The report has provided a detailed breakup and analysis of the market based on the satellite mass. This includes nanosatellite (1kg to 10kg) and microsatellite (10kg to 100kg). According to the report, nanosatellite (1kg to 10kg) represented the largest segment.

The compact size and reduced weight of nanosatellites offer significant cost advantages compared to larger satellites. The smaller size translates to lower manufacturing, launch, and operational costs. This cost efficiency has attracted a broader range of organizations and entities, including startups, educational institutions, and even individual researchers, who may have limited budgets but still require satellite capabilities for their missions. Additionally, advancements in miniaturization and electronics technology have significantly improved the capabilities of nanosatellites. These small satellites are now equipped with increasingly sophisticated subsystems, including powerful onboard computers, miniaturized sensors, and efficient communication systems. As a result, nanosatellites are now capable of performing a wide range of missions, from Earth observation and climate monitoring to scientific research and telecommunications. Moreover, the smaller size of nanosatellites allows for more efficient deployment and integration into existing satellite constellations. Multiple nanosatellites can be launched together, sharing a single launch vehicle and taking advantage of economies of scale. This enables the formation of constellations that provide enhanced coverage and data collection capabilities. The ability to launch and operate multiple nanosatellites simultaneously has made this segment the largest based on satellite mass, driving the growth and adoption of nanosatellite technology in various industries and research fields.

Breakup by Component:

- Hardware

- Software and Data Processing

- Space Services

- Launch Services

Hardware holds the largest share in the market

A detailed breakup and analysis of the market based on the component has also been provided in the report. This includes hardware, software and data processing, space services, and launch services. According to the report, hardware accounted for the largest market share.

The hardware component includes the physical components and subsystems of the satellite, such as the structure, power systems, propulsion, communication systems, and onboard computers. These hardware components are essential for the functionality and operation of the satellite. They enable communication with ground stations, data processing and storage, power generation and distribution, attitude control, and payload operations. Additionally, the hardware component of nanosatellites and microsatellites is a critical aspect of their miniaturization and compact design. Advancements in electronics and material science have made it possible to develop smaller, lighter, and more efficient hardware components. These advancements allow for the integration of multiple functionalities into a single compact package, reducing the overall size and weight of the satellite. Other than this, the hardware component of nanosatellites and microsatellites undergoes continuous innovation and improvement. As technology progresses, new hardware components with enhanced capabilities, higher reliability, and increased efficiency are being developed. This drives the demand for upgraded hardware components, resulting in a larger market share for the hardware segment.

Breakup by Application:

- Communication

- Earth Observation and Remote Sensing

- Scientific Research

- Biological Experiments

- Technology Demonstration and Verification

- Academic Training

- Mapping and Navigation

- Reconnaissance

- Others

Earth observation and remote sensing dominate the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes communication, earth observation and remote sensing, scientific research, biological experiments, technology demonstration and verification, academic training, mapping and navigation, reconnaissance, and others. According to the report, earth observation and remote sensing represented the largest segment.

The demand for accurate and up-to-date Earth observation data is increasing across various industries and sectors. Earth observation satellites provide valuable information for applications such as weather forecasting, climate monitoring, natural resource management, urban planning, and environmental monitoring. The ability to capture high-resolution imagery and collect data on a global scale allows for better decision-making, improved resource allocation, and more effective disaster management. Nanosatellites and microsatellites provide a cost-effective solution for Earth observation, enabling more frequent data acquisition and real-time monitoring. Additionally, the small size and reduced cost of nanosatellites and microsatellites make them ideal for deploying constellations. Constellations of small satellites offer advantages such as enhanced coverage, increased revisit rates, and improved data collection capabilities. These constellations are particularly useful for Earth observation and remote sensing applications, where a continuous stream of data is required for monitoring dynamic environmental changes.

Breakup by End-Use Sector:

- Government

- Civil

- Commercial

- Defense

- Energy and Infrastructure

- Others

Commercial holds the largest share in the market

A detailed breakup and analysis of the market based on the end-use has also been provided in the report. This includes government, civil, commercial, defense, energy and infrastructure, and others. According to the report, commercial accounted for the largest market share.

The commercial sector has witnessed a significant increase in the utilization of satellite-based services for various applications. Companies are leveraging nanosatellites and microsatellites to offer commercial services such as broadband internet, Earth imaging, weather forecasting, maritime tracking, and asset monitoring. These services cater to a wide range of industries, including telecommunications, agriculture, transportation, energy, and logistics. The cost-effectiveness and flexibility of small satellites make them an attractive option for commercial entities seeking to provide innovative services and solutions. Additionally, the commercial sector has experienced a wave of investment and private sector participation in space-related activities. Private companies are launching their own constellations of nanosatellites and microsatellites to offer services directly to consumers or to partner with other industries. Moreover, the commercial sector benefits from the scalability and versatility of nanosatellites and microsatellites.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market, accounting for the largest nanosatellite and microsatellite market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, Others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others); Latin America (Brazil, Mexico, Others); and the Middle East and Africa. According to the report, North America was the largest market.

North America has a strong presence of established space agencies and leading aerospace companies. The region is home to NASA, which has been at the forefront of space exploration and has actively promoted the use of small satellites for various missions. Additionally, North America has a robust private space industry, including companies such as SpaceX, Blue Origin, and Planet Labs. These companies have made significant investments in small satellite technology, launching their own constellations and providing commercial services. Moreover, the region has a strong demand for satellite-based services across various sectors, including telecommunications, agriculture, environmental monitoring, and defense. The region's advanced infrastructure, technological capabilities, and market size make it an attractive market for companies offering satellite-based solutions. Moreover, North America has a favorable regulatory environment for commercial space activities. Regulatory bodies, such as the Federal Communications Commission (FCC) and Federal Aviation Administration (FAA), have implemented policies to facilitate the deployment and operation of small satellites, fostering innovation and market growth.

Competitive Landscape:

Key players are focusing on developing advanced manufacturing capabilities to produce nanosatellites and microsatellites efficiently. They are investing in miniaturized and lightweight components, streamlined assembly processes, and quality control measures to ensure reliable and cost-effective satellite production. Additionally, numerous key players are deploying satellite constellations comprising nanosatellites and microsatellites. These constellations enable enhanced coverage, improved data collection, and higher revisit rates. Companies are also launching multiple satellites simultaneously to form constellations that cater to applications such as Earth observation, remote sensing, and global communication. Other than this, players in the market are continuously investing in research and development to advance satellite technologies. They are working on miniaturized sensors, more efficient power systems, advanced communication modules, and improved onboard computing capabilities. These technological advancements aim to enhance the performance, reliability, and capabilities of nanosatellites and microsatellites. Besides this, key players are forming strategic partnerships and collaborations to leverage their combined expertise and resources. This includes collaborations between satellite manufacturers, launch service providers, data analytics companies, and ground station operators. Such partnerships help in expanding market reach, accessing complementary capabilities, and providing end-to-end solutions to customers.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AAC Clyde Space

- Axelspace Corporation

- Berlin Space Technologies

- GomSpace

- ISISPACE Group

- L3harris Technologies Inc.

- Lockheed Martin Corporation

- Planet Labs Tb Inc.

- Spacequest Ltd.

- Spire Inc.

- Surrey Satellite Technology

- Tyvak Nano-Satellite Systems Inc.

Recent Developments:

- In April 2023, ACC Clyde Space SDAAS satellite, “EPICHYPER-1”, was successfully launched on SpaceX rocket. The satellite will deliver Earth observation data to Canadian company Wyvern Inc., under an exclusive Space Data as a Service (SDaaS) deal.

- Axelspace Corporation partnered with NorthStar Earth & Space, focusing on the provision of Space Situational Awareness (SSA) services using the GRUS satellites of the Earth Observation Platform called "AxelGlobe."

- The ISISPACE Group accomplished a significant milestone by launching 47 satellites as part of its ISILAUNCH38 mission. The launch took place on board a Falcon 9 rocket as part of the Transporter-6 mission.

Nanosatellites and Microsatellites Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Satellite Masses Covered | Nanosatellite (1kg to 10kg), Microsatellite (10kg to 100kg) |

| Components Covered | Hardware, Software and Data Processing, Space Services, Launch Services |

| Applications Covered | Communication, Earth Observation and Remote Sensing, Scientific Research, Biological Experiments, Technology Demonstration and Verification, Academic Training, Mapping and Navigation, Reconnaissance, Others |

| End-Uses Covered | Government, Civil, Commercial, Defense, Energy and Infrastructure, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AAC Clyde Space., Axelspace Corporation, Berlin Space Technologies, GomSpace, ISISPACE Group, L3harris Technologies Inc., Lockheed Martin Corporation, Planet Labs Tb Inc., Spacequest Ltd., Spire Inc., Surrey Satellite Technology, Tyvak Nano-Satellite Systems, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nanosatellite and microsatellite market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global nanosatellite and microsatellite market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nanosatellite and microsatellite industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global nanosatellite and microsatellite market was valued at USD 3.5 Billion in 2024.

We expect the global nanosatellite and microsatellite market to exhibit a CAGR of 15.58% during 2025-2033.

The rising application of nanosatellite and microsatellite across the civil, commercial, and defense sectors to conduct low-cost space missions, such as geolocation, signal monitoring, and communications, is primarily driving the global nanosatellite and microsatellite market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in disrupted supply chain of critical aeronautical parts and temporary halt in numerous manufacturing activities for nanosatellite and microsatellites.

Based on the satellite mass, the global nanosatellite and microsatellite market has been bifurcated into nanosatellite (1kg to 10kg) and microsatellite (10kg to 100kg). Currently, nanosatellite (1kg to 10kg) holds the majority of the total market share.

Based on the component, the global nanosatellite and microsatellite market can be categorized into hardware, software and data processing, space services, and launch services. Among these, hardware exhibits clear dominance in the market.

Based on the application, the global nanosatellite and microsatellite market has been segmented into communication, earth observation and remote sensing, scientific research, biological experiments, technology demonstration and verification, academic training, mapping and navigation, reconnaissance, and others. Currently, earth observation and remote sensing represents the largest market share.

Based on the end-use sector, the global nanosatellite and microsatellite market can be divided into government, civil, commercial, defense, energy and infrastructure, and others. Among these, the commercial sector currently accounts for the majority of the global market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Some of the major players in the global nanosatellite and microsatellite market include AAC Clyde Space., Axelspace Corporation, Berlin Space Technologies, GomSpace, ISISPACE Group, L3harris Technologies Inc., Lockheed Martin Corporation, Planet Labs Tb Inc., Spacequest Ltd., Spire Inc., Surrey Satellite Technology, Tyvak Nano-Satellite Systems, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)