Naphtha Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Naphtha Price Trend, Index and Forecast

Track real-time and historical naphtha prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Naphtha Prices January 2026

| Region | Price (USD/KG) | Latest Movement |

|---|---|---|

| Northeast Asia | 1.09 | 3.8% ↑ Up |

| Europe | 0.65 | 3.2% ↑ Up |

| Middle East | 0.58 | Unchanged |

| North America | 0.53 | -1.9% ↓ Down |

Naphtha Price Index (USD/KG):

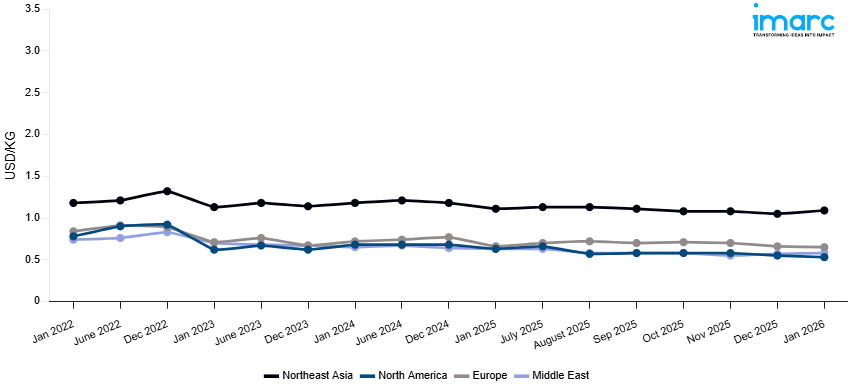

The chart below highlights monthly naphtha prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: Northeast Asia witnessed notable price pressures. The region experienced sustained downward pressure primarily driven by weakened demand from downstream petrochemical sectors, particularly in China, where new capacity additions created oversupply conditions. Steam cracker margins remained compressed across major production hubs including, Japan, South Korea, and Taiwan, leading to reduced naphtha consumption for ethylene production. Supply-side dynamics showed improved availability as regional refineries operated at higher utilization rates following maintenance completion in earlier quarters. Cost structure benefits emerged from stabilized crude oil prices, though international shipping costs remained elevated due to ongoing logistics challenges in key trade routes. Port congestion issues persisted at major terminals, including Shanghai and Busan, adding handling delays and storage costs. The region's industrial recovery showed signs of moderation, with automotive and electronics sectors reducing their derivative demand for naphtha-based feedstock.

Europe: The upward trend was influenced by stronger demand from the petrochemical sector, particularly in ethylene and propylene production, as manufacturers sought to replenish inventories after subdued activity earlier in the year. On the supply side, maintenance turnarounds at major European refineries constrained availability, amplifying upward pressure on prices. Additional cost components, including elevated shipping tariffs from the Middle East and higher port handling charges, further contributed to pricing strength. Currency fluctuations, particularly the euro’s depreciation against the US dollar, added to import costs for non-regional players. Rising energy costs linked to geopolitical instability in Eastern Europe also created a ripple effect in logistics and compliance expenses.

Middle East: Naphtha prices in the Middle East reflected a quarterly increase. The modest rise was primarily driven by robust export demand from Asia, especially China and India, where naphtha continues to serve as a key petrochemical feedstock. On the supply side, Saudi Arabia and the United Arab Emirates maintained steady output levels, supported by strong crude throughput. However, heightened shipping rates through the Suez Canal, coupled with insurance premiums tied to regional geopolitical tensions, raised transaction costs for Middle Eastern exporters. Domestically, consumption remained limited as most production was directed toward the export market, keeping local availability stable. Currency stability in the Gulf region mitigated some import-export volatility, but higher global crude oil benchmarks provided a cost-push factor.

North America: North America demonstrated modest price appreciation driven by improved regional demand fundamentals and supply optimization. The region experienced strengthening demand from petrochemical sectors, particularly in the US Gulf Coast, where ethylene production margins improved, supporting increased naphtha consumption for feedstock applications. Canadian oil sands production stability contributed to consistent regional supply availability, while US shale oil output maintained steady naphtha yields from light crude processing. Supply chain conditions benefited from reduced maintenance activities at major refineries following extensive turnarounds in previous quarters. Cost structures showed mixed influences, with natural gas price stability supporting processing economics while crude oil price fluctuations created margin variability.

Naphtha Price Trend, Market Analysis, and News

IMARC's latest publication, “Naphtha Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the naphtha market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of naphtha at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents a detailed naphtha price trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting naphtha pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Naphtha Industry Analysis

The global naphtha industry size reached USD 180.38 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 230.27 Billion, at a projected CAGR of 2.75% during 2026-2034. The market is driven by expanding petrochemical production for plastics manufacturing, increasing demand from gasoline blending operations, growing solvent applications in industrial processes, and emerging bio-naphtha initiatives supporting sustainable fuel transitions across global markets.

Latest developments in the naphtha industry:

- July 2025: Haldia Petrochemicals Limited. (HPL) is a contemporary Petrochemical Complex that uses naphtha as its main feedstock. HPL ranks as the second biggest producer of polyethylene in India, boasting a total capacity of 700 KTA. The firm has started a Rs. A capex plan of 5,500 crore for an integrated OCU-Phenol project, featuring a total capacity of 560,000 TPA of phenol and acetone.

- June 2025: In a significant action indicating a long-awaited overhaul of South Korea's petrochemical sector, Lotte Chemical Corp. and HD Hyundai Co. are in final discussions to merge their naphtha cracking center (NCC) activities at the Daesan petrochemical facility. This partnership is a direct reaction to severe market pressures, mainly arising from aggressive oversupply by Chinese manufacturers and the resulting financial burden on local companies.

- April 2025: Aramco entered into an agreement with Chinese state-owned Sinopec to construct and incorporate a 1.8mn t/yr mixed-feed ethylene steam cracker and a 1.5mn t/yr aromatics complex into the 400,000 b/d Yasref refinery. This type of integration would generally channel naphtha to the petrochemical facilities and shift it away from the gasoline blending pool, traders noted.

- February 2025: ExxonMobil acquired multiple deliveries of naphtha for its recently opened petrochemical facility in southern China, according to Reuters. The facility, located in the Dayawan Petrochemical Industrial Park in Huizhou, Guangdong province, is among the rare large petrochemical plants in China that are entirely owned by a foreign investor, aimed at manufacturing premium petrochemical products. The ExxonMobil facility is scheduled to get a naphtha shipment of 55,000 metric tons (489,500 barrels). The chemical facility will manufacture performance polymers utilized in packaging, automotive, agricultural, and hygiene and personal care consumer products.

- October 2024: QatarEnergy entered into an important long-term naphtha supply contract with Shell International Eastern Trading Company, a unit of Shell based in Singapore. The contract, lasting 20 years, includes the provision of up to 18 million tons of naphtha to Shell, with shipments scheduled to start in April 2025.

Product Description

Naphtha is a volatile, flammable liquid hydrocarbon mixture derived from crude oil refining processes, occupying a critical position as an intermediate petroleum product in the global energy and chemicals value chain. This light petroleum fraction exhibits excellent volatility characteristics and serves as a fundamental building block for the petrochemical industry worldwide. Naphtha's primary industrial applications include steam cracking feedstock for ethylene and propylene production, gasoline blending component for octane enhancement, and solvent applications in various chemical processes. The petrochemical sector utilizes naphtha extensively for producing plastics, synthetic fibers, and rubber, while its role in gasoline formulation enhances fuel performance and environmental compliance, making it indispensable for modern industrial operations and transportation fuel systems.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Naphtha |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Naphtha Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of naphtha pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting naphtha price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The naphtha price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The naphtha prices in January 2026 were 1.09 USD/Kg in Northeast Asia, 0.65 USD/Kg in Europe, 0.58 USD/Kg in the Middle East, and 0.53 USD/Kg in North America.

The naphtha pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for naphtha prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)