Netherlands Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Netherlands Advertising Market Overview:

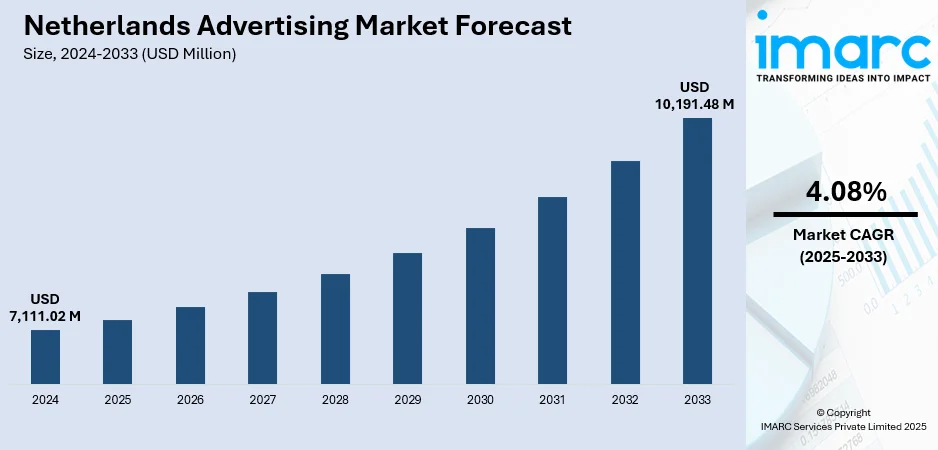

The Netherlands advertising market size reached USD 7,111.02 Million in 2024 The market is projected to reach USD 10,191.48 Million by 2033, exhibiting a growth rate (CAGR) of 4.08% during 2025-2033. The market continues to evolve, driven by rapid digital transformation, shifting consumer behavior, and increasing investments in innovative marketing strategies. Traditional formats remain relevant, but digital channels are gaining dominance, especially in urban and tech-savvy regions. Regional differences mirror differences in digital uptake and consumer interaction. The market forecast is optimistic, fueled by technological innovation and innovative integration in campaigns, increasing the Netherlands advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,111.02 Million |

| Market Forecast in 2033 | USD 10,191.48 Million |

| Market Growth Rate 2025-2033 | 4.08% |

Netherlands Advertising Market Trends:

Tech‑Fueled Trade Promotion and Advertising Practices

In January 2025 the Netherlands implemented updated trade‑promotion policies emphasizing locally tailored campaigns to align with domestic consumer habits, featuring trade promotion and advertising methods adapted to the local market. Recent benchmarks from national trade marketing guidance also reveal email open rates above 35 and click rates near 7 among Dutch audiences. That level of engagement shows that digital promotive outreach especially email remains a trusted way to reach business or consumer stakeholders, provided the content respects local preferences for clarity and relevance. Marketers are evolving campaign tactics to integrate trade fairs, digital newsletters, multilingual messaging, and culturally aligned visuals. The emphasis is on combining promotional sponsorships and targeted messaging that feel familiar yet fresh to local Dutch audiences. Programmatic email touchpoints and customised landing experiences now play a larger role. The Netherlands advertising market growth is being shaped by this continued prioritization of precision, localization, and direct‑to‑audience clarity in trade promotion strategies.

To get more information on this market, Request Sample

Regulatory Leadership in Advertising Policy

In September 2024, the Hague became the first city globally to legally ban outdoor advertisements promoting fossil fuel products or high‑carbon services such as air travel and cruise ships. This policy shift marks a clear signal that public advertising is now entangled with broader environmental responsibility, prompting marketers to recalibrate content strategies. By prohibiting ads tied to petroleum, aviation, diesel or cruise travel, the city reframes what is socially acceptable in public advertising. This development is reshaping media buying decisions in the Netherlands, nudging clients and agencies to avoid carbon‑intensive imagery in outdoor campaigns. As outdoor channels become more values‑driven, advertisers are rethinking placement, tone, and visuals to align with sustainability and emerging municipal norms. Planning teams now weigh not just reach but social impact, opting for content that reinforces public goals over commercial volume. Messaging that once would have landed in transit or street furniture is shifting to digital formats or softer messaging. In this evolving context, the Netherlands advertising market trends now must reflect evolving social and environmental expectations as much as commercial imperatives.

Enhanced Influencer Recognition & Compliance

In 2024, the Dutch Media Authority imposed its first fine for ambiguous influencer advertising labels. This was a turning point in the way the Netherlands handles influencer marketing. With the new rules, anyone posting paid-for content must make sure it's crystal-clear that it's an ad, either within the video or post itself, rather than just in the caption. That involves using transparent labels such as "advertisement" or "paid partnership" where they can be easily noticed. These standards no longer apply just to high-profile influencers. Freshly released updates specify that even minor accounts must uphold the same standards. For ad players, this involves rechecking each campaign to ensure it complies. Units are scrutinizing influencer collaborations more diligently, emphasizing transparency, clear communication, and legality. This change is transforming how brands collaborate with creators, less reach, more trust. Influencer marketing is no longer the "wild west" here in the Netherlands. It's a regulated industry now, and brands must handle it as sensitively as any other media channel.

Netherlands Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

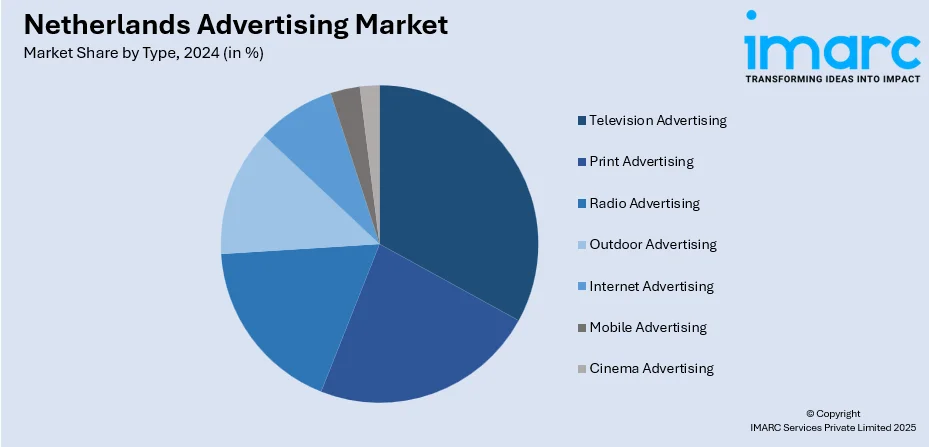

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Advertising Market News:

- June 2024: Techleap and Media. Monks have formed a strategic partnership rooted in the Netherlands, bringing together Techleap’s support for Dutch scale‑ups and Media. Monks’ global expertise in digital marketing and storytelling. This collaboration, championed by the Embassy of Dutch Creativity, empowers fast‑growing Dutch tech companies with tailored marketing and communications guidance. It aims to bridge the gap between nimble tech ventures and the advertising industry by establishing the best practices in digital growth strategies. Through this alliance, Dutch scale‑ups gain access to expert advertising support to fuel their expansion.

- September 2024: Schbang has acquired Amsterdam's Addikt, a Dutch design agency, to create a new unified entity, AddiktSchbang. The acquisition, Schbang's first major investment in the Netherlands, is its ambition to bring together Dutch design acumen with its own strengths in storytelling and technology. The expansion sees Schbang firmly expand its footprint in the Netherlands, poised to offer end-to-end marketing and design solutions to global clients from both Dutch and global hubs.

Netherlands Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands advertising market on the basis of type?

- What is the breakup of the Netherlands advertising market on the basis of region?

- What are the various stages in the value chain of the Netherlands advertising market?

- What are the key driving factors and challenges in the Netherlands advertising market?

- What is the structure of the Netherlands advertising market and who are the key players?

- What is the degree of competition in the Netherlands advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)