Netherlands Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Netherlands Agribusiness Market Overview:

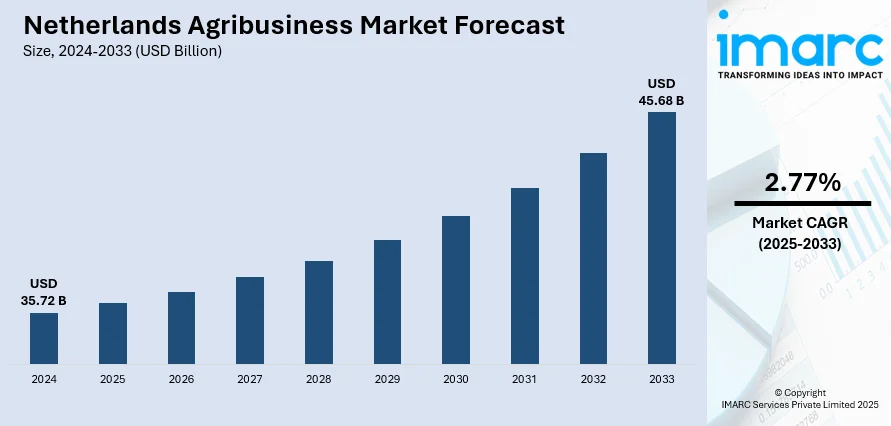

The Netherlands agribusiness market size reached USD 35.72 Billion in 2024. The market is projected to reach USD 45.68 Billion by 2033, exhibiting a growth rate (CAGR) of 2.77% during 2025-2033. The agribusiness sector is investing heavily in sustainable farming methods to cater to environmentally conscious consumers, ensuring supply chains remain resilient against climate challenges. Besides this, rising usage of advanced food processing technologies, which aid in improving product quality, shelf life, and export readiness, is contributing to the expansion of the Netherlands agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 35.72 Billion |

| Market Forecast in 2033 | USD 45.68 Billion |

| Market Growth Rate 2025-2033 | 2.77% |

Netherlands Agribusiness Market Trends:

Increasing food demand

Rising food demand is encouraging producers, processors, and exporters to expand capacity and adopt more efficient, high-yield practices. The Netherlands’ strategic role as a major global food exporter, despite its relatively small size, means that both domestic consumption and international orders are strongly influencing production trends. Population growth, urbanization, and changing dietary preferences are driving higher demand for fresh products, meat, dairy, and processed food items. Dutch farmers are increasingly adopting high-tech greenhouse systems, precision agriculture, and advanced logistics to meet year-round demand while maintaining product quality. Export markets, particularly in Europe and Asia, rely on the Netherlands for vegetables, flowers, dairy, and protein products, which is leading to continuous scaling and innovations in production processes. The agribusiness sector is also investing heavily in sustainable farming methods to cater to environmentally conscious consumers, ensuring supply chains remain resilient against climate challenges. The broadening of retail and e-commerce food channels is further expanding market reach, offering faster access to people. As per the Statistics Netherlands (CBS), retail sales in the food industry, including stores selling food, beverages, and tobacco, rose by 1.7% in May 2025 compared to May 2024. Online retail sales grew by 4.7% compared to 2024. Additionally, partnerships between producers, technology providers, and research institutes are fostering new developments in crop yield, food safety, and supply chain efficiency. This consistent rise in demand is strengthening the Netherlands’ position as a global agricultural powerhouse while supporting long-term agribusiness market growth.

To get more information on this market, Request Sample

Innovations in technology

Technological advancements are impelling the Netherlands agribusiness market growth. The country’s strong focus on greenhouse farming technology, automated climate control systems, and hydroponic cultivation methods is enabling year-round production with optimal resource use. Precision agriculture tools, including global positioning system (GPS)-guided machinery and sensor-based irrigation systems, help farmers maximize yields while reducing water, fertilizer, and pesticide consumption. Robotics and automated harvesting systems address labor shortages and ensure faster, more consistent crop handling. Advanced food processing technologies improve product quality, shelf life, and export readiness. Digital platforms and farm management software are enhancing supply chain transparency and traceability, meeting the growing demand for sustainable and ethical products. Biotechnology innovations, such as disease-resistant crop varieties, are further enhancing productivity and resilience. Companies are adopting artificial intelligence (AI) to improve yield prediction, pest detection, and resource allocation. In July 2025, DENSO CORPORATION purchased Axia Vegetable Seeds, a Netherlands-based vegetable seed breeding firm, dedicated to creating high-quality tomato seeds for greenhouses. By utilizing DENSO's image recognition and AI technologies, the two firms intended to reduce the development time for new seeds and introduce more valuable seeds to the market faster.

Netherlands Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

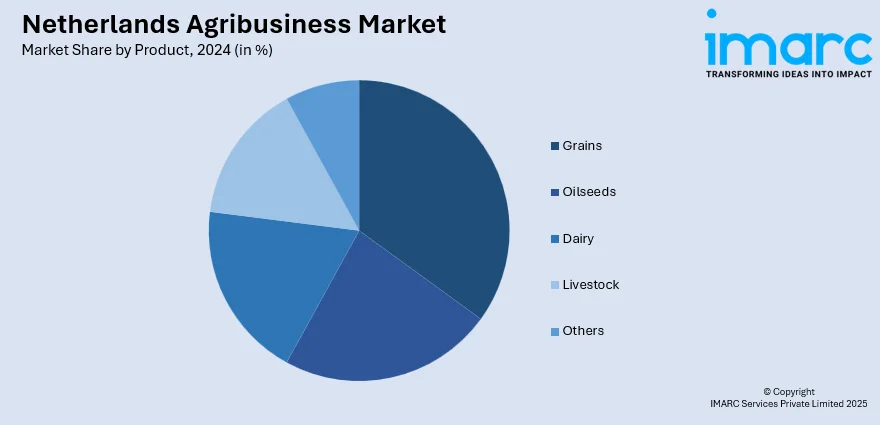

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Agribusiness Market News:

- In June 2025, a representative group from the Kingdom of Saudi Arabia, headed by the Vice Minister of Environment, Water and Agriculture, Eng. Mansour bin Hilal Al Mushaiti completed a trip to the Netherlands, resulting in the signing of 27 cooperation agreements worth SAR428 Million, which was roughly USD 114 Million. These agreements, engaging both public and private sector entities, concentrated on developing and localizing technologies for agriculture, water management, and environmental innovation. Important partnerships involved biotechnology, greenhouse technology, crop protection, and potato processing.

- In February 2025, the deputy commissioner of the Minnesota Department of Agriculture accompanied Minnesota Governor Tim Walz on a business development and trade mission to the Netherlands. Walz guided the trip, visiting Eindhoven, The Hague, Rotterdam, Amsterdam, and Delft, aiming to highlight the state as a premier location for agribusiness investment, create new partnership prospects, and enhance relationships.

Netherlands Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands agribusiness market on the basis of product?

- What is the breakup of the Netherlands agribusiness market on the basis of region?

- What are the various stages in the value chain of the Netherlands agribusiness market?

- What are the key driving factors and challenges in the Netherlands agribusiness market?

- What is the structure of the Netherlands agribusiness market and who are the key players?

- What is the degree of competition in the Netherlands agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)