Netherlands Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

Netherlands Animal Feed Market Overview:

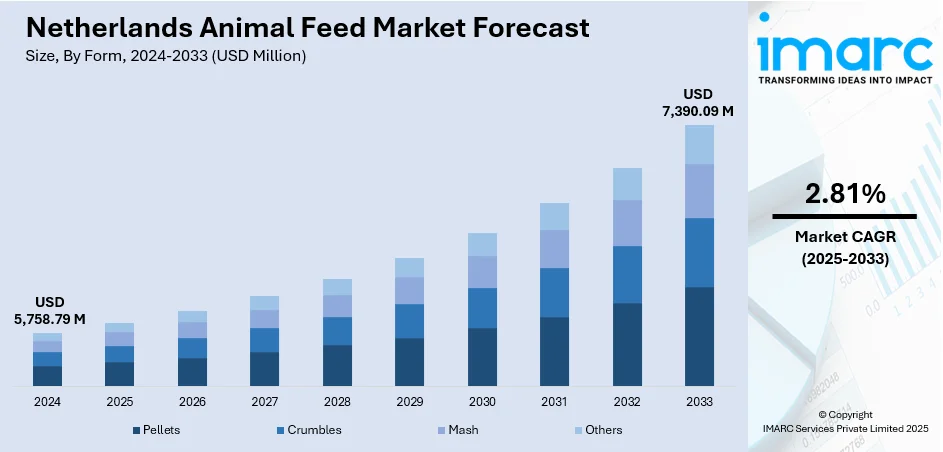

The Netherlands animal feed market size reached USD 5,758.79 Million in 2024. The market is projected to reach USD 7,390.09 Million by 2033, exhibiting a growth rate (CAGR) of 2.81% during 2025-2033. The market is expanding as producers adopt precision nutrition and sustainable additives to improve livestock health and feed efficiency. Advancements in feed technology and strong export activity continue to support Netherlands animal feed market share across poultry, swine, and dairy production segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,758.79 Million |

| Market Forecast in 2033 | USD 7,390.09 Million |

| Market Growth Rate 2025-2033 | 2.81% |

Netherlands Animal Feed Market Trends:

Rising Focus on Feed Innovation

The Netherlands animal feed market growth is being shaped by the need for more efficient, sustainable feed solutions. Producers are turning to advanced formulations that support animal health while minimizing environmental impact. There's been a noticeable shift toward precision feeding, where nutritional content is fine-tuned based on animal type, age, and purpose. This trend helps reduce waste and improves feed conversion rates. The adoption of additives such as enzymes, amino acids, and probiotics has also risen, aiming to improve digestion and immunity in livestock. As regulations tighten around antibiotic use, farmers are leaning toward alternatives that maintain productivity without risking resistance. The country’s strong agricultural research background and close collaboration between producers and universities are accelerating product development. Customized feed for poultry, swine, and cattle is also gaining traction, meeting specific dietary requirements more effectively. With Dutch livestock farms adopting high-tech solutions, demand for feed that matches these practices is increasing steadily. Sustainability goals across Europe are driving investments in low-emission and plant-based feed components, and Dutch manufacturers are among the early adopters. As innovation continues, the Netherlands is expected to maintain its role as a leader in high-quality feed production.

To get more information on this market, Request Sample

High Export Demand Supports Expansion

Exports are playing a major role in shaping the Netherlands’ animal feed market. Strong logistics, a central European location, and access to major ports give Dutch suppliers a solid advantage in international trade. Countries in Eastern Europe, the Middle East, and Southeast Asia increasingly depend on the Netherlands for consistent, high-quality feed, especially where local output doesn’t meet demand. This ongoing reliance has pushed Dutch producers to expand operations without compromising on quality or safety. Clear labeling, traceable ingredients, and compliance with international feed standards have built trust across borders. Many buyers now prefer Dutch products not only for quality but also for sustainability practices, including energy-efficient production and low-emission ingredients. Trade relationships within and outside the EU continue to boost market activity, with Dutch firms adjusting supply chains to meet specific requirements of various regions. Advanced production technologies make it possible to scale up quickly, keeping exports reliable. As the focus on food safety and transparency increases worldwide, Dutch feed makers are well-positioned to lead. The export momentum isn’t slowing, and it continues to be one of the most stable growth points in the overall market.

Netherlands Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

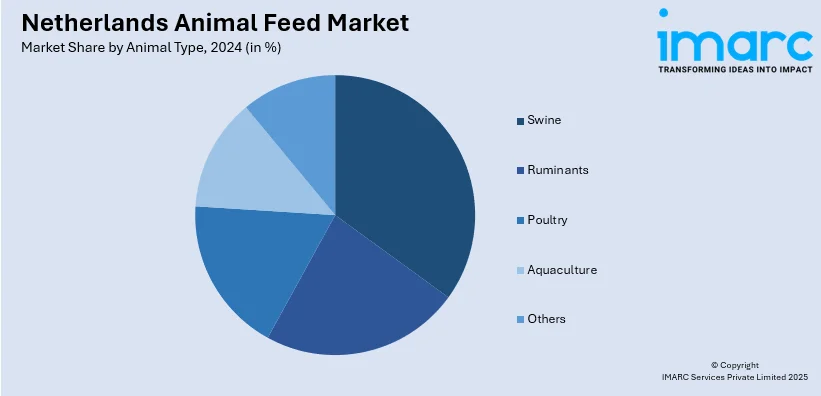

Animal Type Insights:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, turkeys, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Animal Feed Market News:

- October 2024: Nutreco opened the world’s first dedicated cell feed powder production facility in Boxmeer, Netherlands. This innovation supported sustainable protein production, enabling large-scale, cost-effective feed for cultivated protein cells, and marked a significant step in modernizing the Netherlands animal feed market.

- August 2024: Aerbio launched a pilot facility in the Netherlands to produce Proton, a single-cell protein feed for salmon and chickens. Using carbon dioxide and hydrogen, the process reduced carbon impact by up to 90%, supporting sustainable growth in the Netherlands animal feed market.

Netherlands Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands animal feed market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands animal feed market on the basis of form?

- What is the breakup of the Netherlands animal feed market on the basis of animal type?

- What is the breakup of the Netherlands animal feed market on the basis of ingredient?

- What is the breakup of the Netherlands animal feed market on the basis of region?

- What are the various stages in the value chain of the Netherlands animal feed market?

- What are the key driving factors and challenges in the Netherlands animal feed market?

- What is the structure of the Netherlands animal feed market and who are the key players?

- What is the degree of competition in the Netherlands animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)