Netherlands Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Province, 2025-2033

Netherlands Animal Health Market Overview:

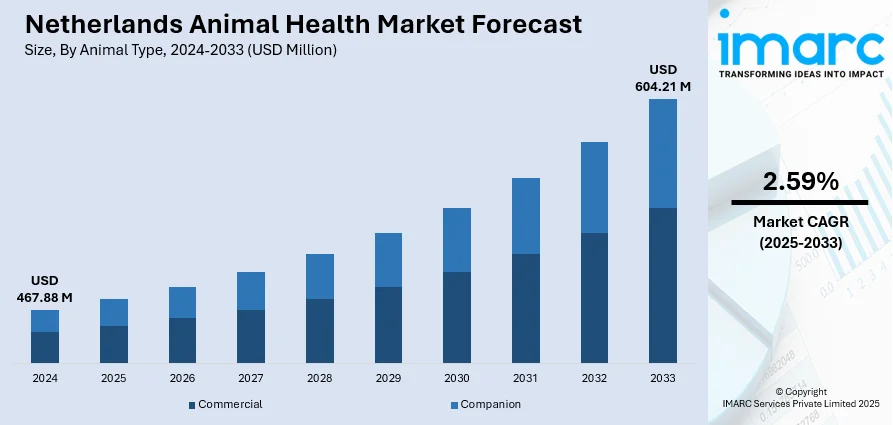

The Netherlands animal health market size reached USD 467.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 604.21 Million by 2033, exhibiting a growth rate (CAGR) of 2.59% during 2025-2033. At present, the growing demand for animal protein is positively influencing the market in the Netherlands. Additionally, advances in diagnostic equipment, data analysis, and precision agriculture are changing farmers' approaches to animal well-being monitoring and management. Apart from this, the implementation of stringent laws and regulations related to animal welfare is expanding the Netherlands animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 467.88 Million |

| Market Forecast in 2033 | USD 604.21 Million |

| Market Growth Rate 2025-2033 | 2.59% |

Netherlands Animal Health Market Trends:

Increased Demand for Animal Protein

The growing demand for animal protein is positively influencing the market in the Netherlands. With consumer trends focusing on high-protein diets, the need for meat, milk, and eggs is increasing, calling for healthier livestock to ensure sustainable production. The rising demand creates an imperative for better animal health since healthier animals translate to greater production levels and less waste. In turn, agribusinesses and farmers are investing more in veterinary products like disease management solutions, nutritional supplements, and vaccines to ensure their herds' health and productivity. The Netherlands, being a top agricultural producer in Europe, is significantly impacted by the trend and is therefore an important market for animal health products. Further, the focus of the nation on sustainable agricultural practices is promoting the practice of preventative medicine and management systems that are controlling disease outbreaks, thus strengthening the market growth. In 2025, the government in the Netherlands took a major step in fighting Avian Influenza (bird flu) by initiating a trial vaccination initiative on commercial layer farms. This program seeks to safeguard poultry against the highly pathogenic avian influenza (HPAI) virus, which has led to significant losses in the global poultry sector.

To get more information on this market, Request Sample

Technological Advances in Animal Health

The implementation of advanced technologies in animal well-being is emerging as a key driver of market. Advances in diagnostic equipment, data analysis, and precision agriculture are changing farmers' approaches to animal well-being monitoring and management. Wearable technology, automated health monitoring equipment, and genetic screening enable farmers to remotely monitor their livestock's well-being in real-time, which results in more effective and focused treatment. Such breakthroughs not only facilitate early disease detection but also maximize the use of resources for improved overall productivity and sustainability. In the Netherlands, where agriculture is a vital industry, the uptake of such technologies benefits farm efficiency while minimizing the use of conventional antibiotics, driving the demand for alternative treatments and all-encompassing health solutions in the animal health industry.

Government Regulations and Animal Welfare Concerns

Government rules revolving around animal health and welfare are propelling the Netherlands animal health market growth. The nation is renowned for having strict animal welfare legislation, with emphasis being placed on maintaining high levels of care for farm animals. The regulations encourage farmers to use preventive healthcare measures and invest in animal health products that lead to the control of diseases and improved overall welfare. Moreover, public awareness about the ethical treatment of animals has been on the rise, putting pressure on the farm industry to meet more stringent welfare standards. The Netherlands, for its part, has embraced several EU guidelines and projects on the reduction of antibiotic use in farming, which is facilitating a move towards vaccines, probiotics, and other non-antibiotic therapies. Thus, this regulatory system drives the demand for cutting-edge animal health products, especially ones that correspond to the increased emphasis on animal welfare and sustainable agriculture. In 2024, the European Commission sanctioned a €700M sustainability program by the Dutch government to reimburse farmers who willingly shut down livestock operations. The €700M support fund targeted the advancement of a more sustainable food system, facilitating a fair transition for livestock farmers in specific regions of the Netherlands and contributing to enhancing environmental quality. The initiative will continue until October 1, 2029, targeting small and medium-sized farmers in priority regions identified by Dutch provinces, which include peatlands, sandy terrains, and river valleys, in addition to areas surrounding the EU's Natura 2000 network of conservation zones.

Netherlands Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

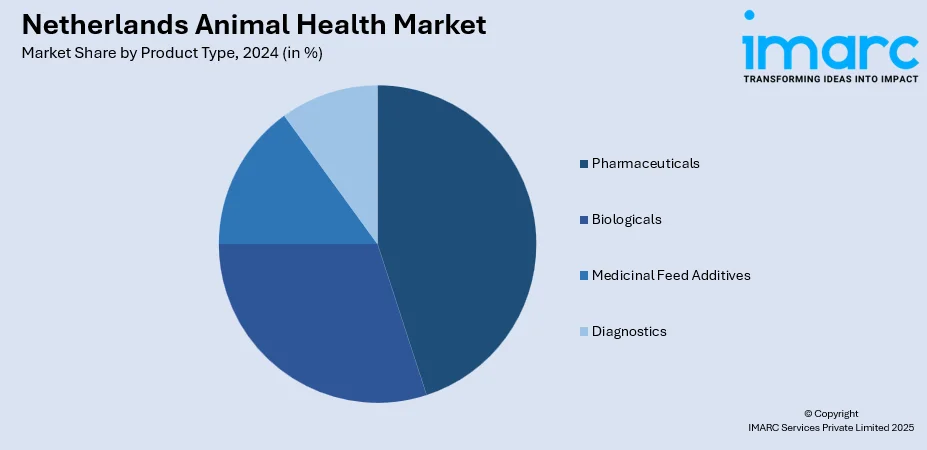

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands animal health market on the basis of animal type?

- What is the breakup of the Netherlands animal health market on the basis of product type?

- What is the breakup of the Netherlands animal health market on the basis of province?

- What are the various stages in the value chain of the Netherlands animal health market?

- What are the key driving factors and challenges in the Netherlands animal health market?

- What is the structure of the Netherlands animal health market and who are the key players?

- What is the degree of competition in the Netherlands animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)