Netherlands ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Province, 2025-2033

Netherlands ATM Market Overview:

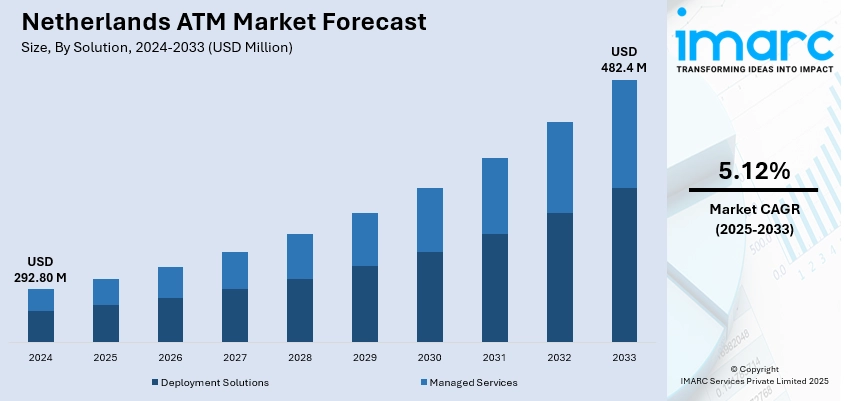

The Netherlands ATM market size reached USD 292.80 Million in 2024. The market is projected to reach USD 482.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.12% during 2025-2033. The market is expanding with increased adoption of contactless payments and digital banking services. The demand for efficient, secure transaction methods continues to drive growth. Moreover, technological advancements and a focus on cashless solutions further strengthen the Netherlands ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 292.80 Million |

| Market Forecast in 2033 | USD 482.4 Million |

| Market Growth Rate 2025-2033 | 5.12% |

Netherlands ATM Market Trends:

Increased ATM Network Expansion in the Netherlands

The ATM industry in the Netherlands has posted consistent growth over the past few years with increasing demand for cash availability driving expansion in urban as well as rural areas. The Netherland ATM market growth is significantly driven by the rising demand for easy access to cash among residents and tourists. Even as consumer reliance on cash remains stable, banks and other financial institutions persist in investing in establishing new ATM locations. Moreover, technology developments in ATMs have also made significant contributions to market expansion. Enhanced security technologies like biometric authentication and anti-skimming devices have added to the confidence of consumers using ATMs and hence their adoption. In addition, mobile banking and contactless payments have brought about multi-functional ATMs that are capable of serving an increased number of customer needs. Besides enabling cash withdrawal, these terminals also have the facilities for deposits, payments, and account management, improving the user experience. As the Netherlands became a financial hub for innovation, ATMs are becoming more convenient and useful for day-to-day financial transactions. Boosting Cashless Transactions in the Netherlands.

To get more information on this market, Request Sample

Increasing Cashless Transactions in the Netherlands

The past few years have witnessed a profound transformation toward cashless transactions in the Netherlands, which has had a significant impact on the overall ATM market. The growing preference for digital payments using mobile wallets, contactless cards, and other electronic systems fuels this trend. With more individuals making payments using smartphones, ATMs are transforming to accommodate these shifts. While cash continues to be a vital component of the financial system, ATMs demand has stabilized in some markets, particularly in high-performing cities with high adoption of mobile payments. Additionally, the push towards a cashless world has caused banks to maximize their ATM networks by cutting back on the number of cash-dispensing machines and emphasizing machines that provide other banking services. In reply, some banks have started equipping ATMs with additional functionalities that allow them to perform more than plain cash withdrawals, like offering cryptocurrency transactions or cardless access for particular customers. This is a symptom of the general trend toward improving the customer experience in accordance with the latest, technology-influenced payment trends in the Netherlands.

Netherlands ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

The report has provided a detailed breakup and analysis of the market based on the screen size. This includes 15" and below and above 15".

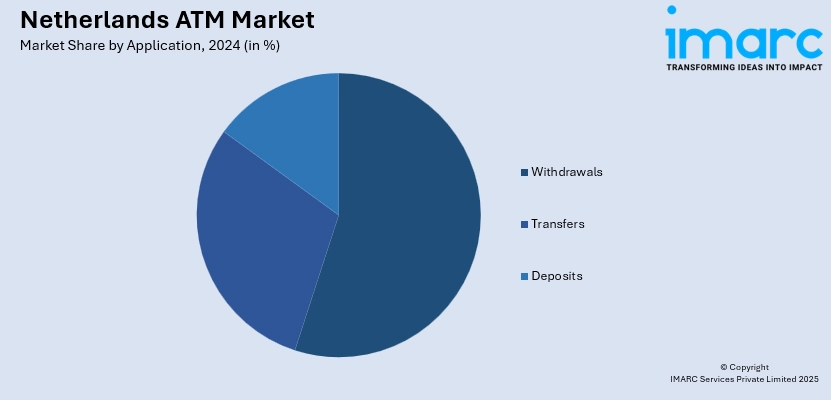

Application Insights:

- Withdrawals

- Transfers

- Deposits

The report has provided a detailed breakup and analysis of the market based on the application. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands ATM Market News:

- January 2025: Diebold Nixdorf expanded its partnership with Geldmaat, providing managed ATM services for over 1,800 ATMs in the Netherlands. This collaboration enhanced ATM availability, reliability, and efficiency, driving operational improvements and boosting the Netherlands ATM market by delivering modern, user-friendly cash access solutions.

- November 2024: Travelex partnered with NCR Atleos to refresh its ATM technology, replacing over 600 ATMs across eight countries, including the Netherlands. This upgrade introduced features like contactless cash withdrawals and enhanced customer experiences, significantly improving the Netherlands ATM market by boosting convenience and operational efficiency.

Netherlands ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands ATM market on the basis of solution?

- What is the breakup of the Netherlands ATM market on the basis of screen size?

- What is the breakup of the Netherlands ATM market on the basis of application?

- What is the breakup of the Netherlands ATM market on the basis of ATM type?

- What is the breakup of the Netherlands ATM market on the basis of province?

- What are the various stages in the value chain of the Netherlands ATM market?

- What are the key driving factors and challenges in the Netherlands ATM market?

- What is the structure of the Netherlands ATM market and who are the key players?

- What is the degree of competition in the Netherlands ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands ATM market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)