Netherlands Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Component, Authentication, End User, and Region, 2025-2033

Netherlands Biometrics Market Overview:

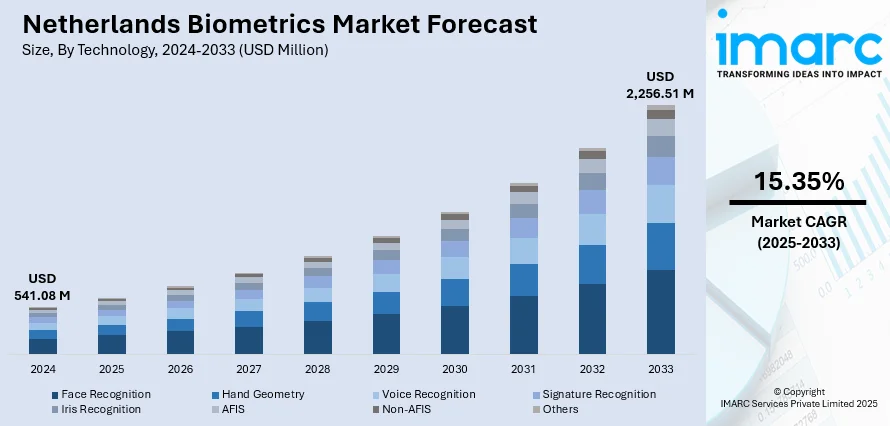

The Netherlands biometrics market size reached USD 541.08 Million in 2024. Looking forward, the market is expected to reach USD 2,256.51 Million by 2033, exhibiting a growth rate (CAGR) of 15.35% during 2025-2033. The market is fueled by innovative government take-up of e‑Gates and biometric identification, heightening border security and public service effectiveness. Privacy-aware customers motivate deployment of morally sound, consent-driven biometric solutions, especially for safe access in finance, healthcare, and transportation. Advanced innovation within fintech and digital identity offerings drives take-up by merging biometrics into digital payment systems and mobile applications. An ecosystem of research institutions, startups, and industry stakeholders also drives innovation of next‑generation modalities such as behavioral biometrics, further propelling the Netherlands biometrics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 541.08 Million |

| Market Forecast in 2033 | USD 2,256.51 Million |

| Market Growth Rate 2025-2033 | 15.35% |

Netherlands Biometrics Market Trends:

Government‑Driven Biometric Integration & Identity Security

The biometrics market in the Netherlands is dominated by robust government efforts to enhance identity security and facilitate immigration. Foreign residents are asked to provide biometric information such as fingerprints and passport photos by national immigration bodies during residence permit issuance, with the data being centrally and on smart‑document chips stored. This biometrics integration in official identity documents enables strong fraud prevention and easy verification between law enforcement, immigration, and social services. The state's drive towards automated border control is found in e‑gate deployment at major airports, where facial recognition technology speeds up entry and exit for authorized travelers. These state-led infrastructures increase security and efficiency while also committing to biometric uptake in the Netherlands to being firmly founded in public service modernization and regulatory trust frameworks.

To get more information on this market, Request Sample

Privacy Issues, Regulations & Employer Sensitivities

The Netherlands biometrics market growth is influenced by a strong culture of privacy consciousness and stringent data protection norms. With full force of GDPR enforcement in place, firms applying biometric systems, particularly within employee management, which have been under scrutiny regarding consent and legal basis. Employers have been pressed when seeking to apply fingerprint or face scanning for attendance or access, highlighting the fine line between workplace surveillance and employee freedom. In the consumer market, controversy continues around the collection and use of biometric information, so that organizations are doing so with caution and often turning to less sensitive solutions unless absolutely required. Meanwhile, public sector initiatives like smart city uses or payment systems using biometrics are being built with transparency, opt‑in platforms, and privacy‑first architecture. The privacy-minded culture of the Netherlands restrains market expansion yet stimulates prudent innovation as businesses and institutions focus on ethical deployment and user confidence.

Innovation, Industry Cooperation and Evolving Uses

The Netherlands' status as a tech‑leading country, with fintech, digital identity, and embedded systems as areas of excellence, spurs innovation in biometric solutions across industries. Financial institutions are increasingly considering using biometrics to authenticate payments and mobile security, and retail chains test out contactless access technologies to enhance customer experience. Academia, startups, and research institutions work intimately within this ecosystem, occasionally assisted by organizations that have their roots in the Netherlands and promote responsible biometrics innovation throughout Europe. Behavioral biometrics, which is also termed gait or typing behavior, is moving into applications such as fraud prevention for online services or adaptive user authentication. In HR and recruitment technology, a few employers are testing (contentiously) face-video screening to measure cultural fit or enthusiasm, although these are contentious and present concerns about algorithmic bias. Generally, the local innovation ecosystem promotes experimentation and intersection of AI, privacy design, and edge computing and is leading toward a future where biometrics is added on top of smart services, customized user engagement, and secure digital infrastructure.

Netherlands Biometrics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, functionality, component, authentication, and end user.

Technology Insights:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris Recognition

- AFIS

- Non-AFIS

- Others

The report has provided a detailed breakup and analysis of the market based on technology. This includes face recognition, hand geometry, voice recognition, signature recognition, iris recognition, AFIS, non-AFIS, and others.

Functionality Insights:

- Contact

- Non-contact

- Combined

The report has provided a detailed breakup and analysis of the market based on the functionality. This includes contact, non-contact, and combined.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Authentication Insights:

- Single-Factor Authentication

- Multifactor Authentication

The report has provided a detailed breakup and analysis of the market based on the authentication. This includes single-factor authentication and multifactor authentication.

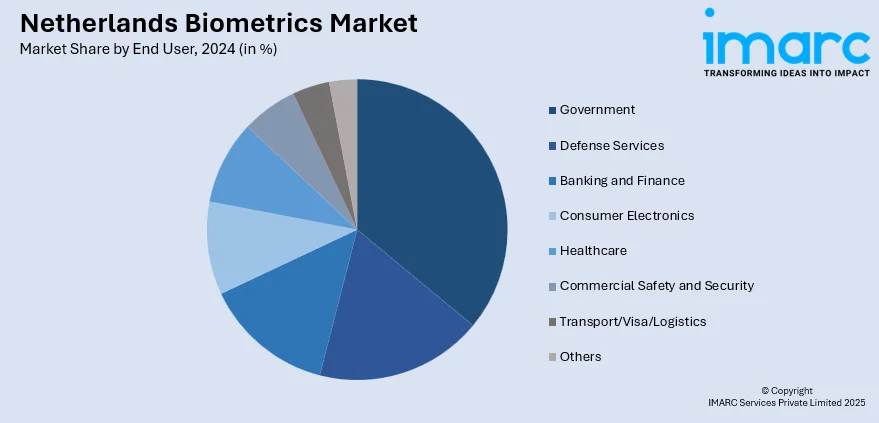

End User Insights:

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes government, defense services, banking and finance, consumer electronics, healthcare, commercial safety and security, transport/visa/logistics, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Biometrics Market News:

- In June 2025, The Netherlands declared the introduction of new identity documents for asylum seekers, Idemia Smart Identity, adhering to the ICAO specification for vertical IDs, in the latter half of the year. The IND in the Netherlands revealed new asylum seeker IDs this week, featuring a larger portrait image size to simplify manual identity verification. In September 2023, ICAO launched a new specification for TD1 travel documents featuring vertical layouts.

- In February 2025, the adoption of the Dutch national digital identity, DigiD, rose to over 550 million log-ins in 2024. The Netherlands aims to enhance digital services by allowing private-sector access to login options. This expansion aligns with the Digital Government Act (WDO), which mandates that both public and private providers offer additional login methods to ensure secure access to services for Dutch citizens and businesses.

Netherlands Biometrics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, Others |

| Functionalities Covered | Contact, Non-contact, Combined |

| Components Covered | Hardware, Software |

| Authentications Covered | Single-Factor Authentication, Multifactor Authentication |

| End Users Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands biometrics market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands biometrics market on the basis of technology?

- What is the breakup of the Netherlands biometrics market on the basis of functionality?

- What is the breakup of the Netherlands biometrics market on the basis of component?

- What is the breakup of the Netherlands biometrics market on the basis of authentication?

- What is the breakup of the Netherlands biometrics market on the basis of end user?

- What is the breakup of the Netherlands biometrics market on the basis of region?

- What are the various stages in the value chain of the Netherlands biometrics market?

- What are the key driving factors and challenges in the Netherlands biometrics market?

- What is the structure of the Netherlands biometrics market and who are the key players?

- What is the degree of competition in the Netherlands biometrics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands biometrics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands biometrics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands biometrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)