Netherlands Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

Netherlands Bottled Water Market Overview:

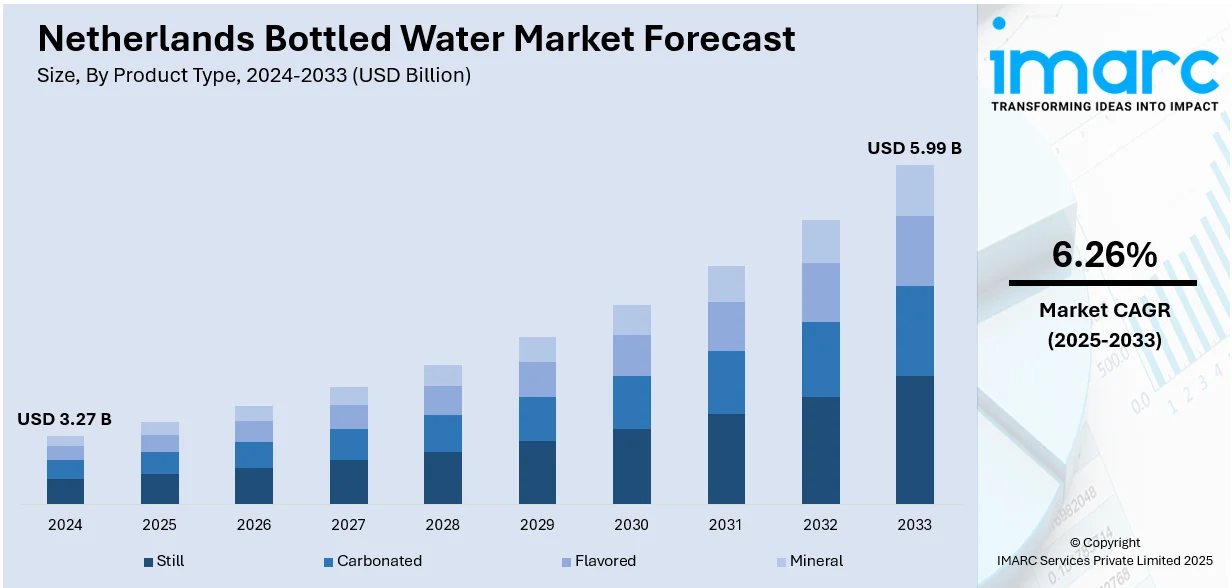

The Netherlands bottled water market size reached USD 3.27 Billion in 2024. Looking forward, the market is expected to reach USD 5.99 Billion by 2033, exhibiting a growth rate (CAGR) of 6.26% during 2025-2033. The market is witnessing substantial growth mainly driven by growing health consciousness, rising environmental awareness, and a shift away from sugary beverages. Local and international brands compete through innovation, eco-friendly initiatives, and diverse product offerings, shaping the competitive landscape of the Netherlands bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.27 Billion |

| Market Forecast in 2033 | USD 5.99 Billion |

| Market Growth Rate 2025-2033 | 6.26% |

Netherlands Bottled Water Market Trends:

Growing Focus on Sustainable Packaging

Increasing environmental consciousness among consumers in the Netherlands is significantly influencing the future of the bottled water sector. As worries about plastic waste and carbon emissions grow, the demand for eco-friendly packaging options is expanding. Companies within the Netherlands are progressively investing in recycled PET (rPET), biodegradable materials, and lightweight packaging to lessen their environmental impact. Many brands are also investigating refillable systems and promoting recycling through deposit-return initiatives. These efforts align with the country's ambitious sustainability objectives and the expectations of consumers for eco-friendly products. Packaging innovation has become essential; it is now a competitive imperative that boosts brand credibility and fosters customer loyalty. This transition toward more sustainable packaging is not only aiding businesses in adhering to regulatory requirements, but it is also acting as a significant driver for Netherlands bottled water market growth, especially among environmentally aware urban consumers.

To get more information on this market, Request Sample

Refillable and Reusable Bottle Culture Shaping Packaging Innovation

The increasing use of refillable and reusable bottles in the Netherlands is impacting the way bottled water brands design their products with a focus on sustainability. Consumers are showing a preference for durable, eco-friendly options over single-use plastics, leading companies to reconsider traditional packaging approaches. This shift is supported by the nation's strong commitment to circular economy principles and government initiatives aimed at reducing waste. For instance, starting April 1, 2023, the Dutch government broadened its deposit return system to encompass aluminum and steel beverage cans, with the goal of improving recycling efforts. Consumers will be charged a €0.15 deposit, which can be refunded at designated collection points. This initiative aims to combat packaging pollution and encourage a circular economy. Consequently, brands are developing packaging that works with refill stations, providing incentives for bottle returns, and collaborating with public spaces to enhance access to refillable water options. These changes not only lessen environmental impact but also appeal to eco-conscious consumers looking for long-term, cost-effective choices. The trend toward refillable solutions is transforming the bottled water experience, fostering customer loyalty and promoting responsible consumption while guiding the industry toward a more sustainable and resource-efficient future.

Netherlands Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

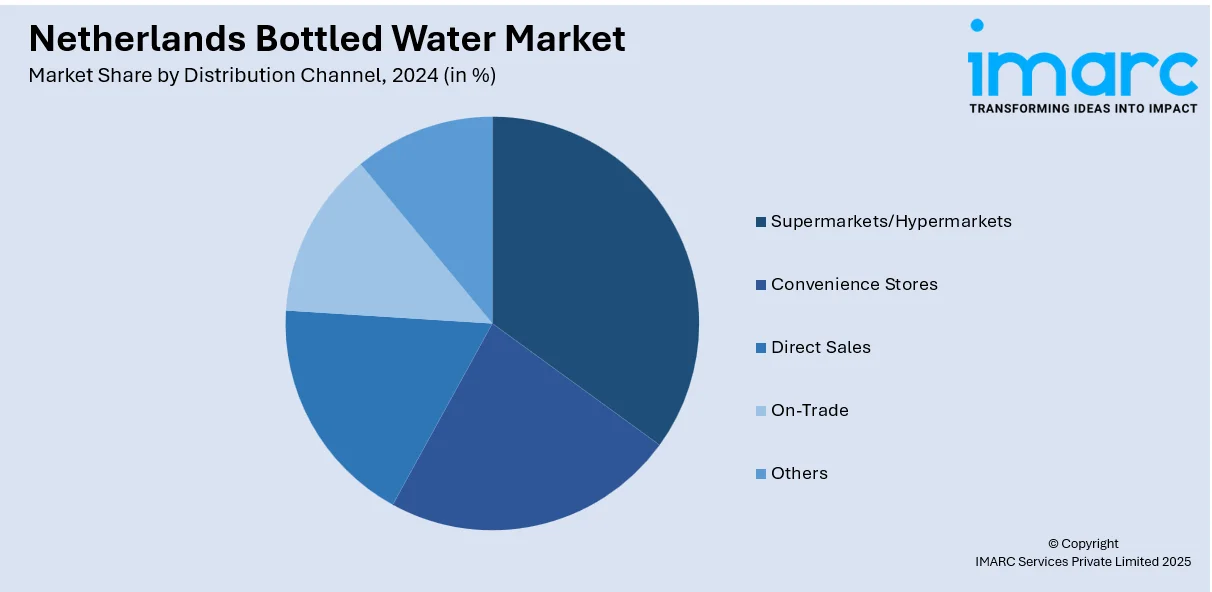

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes PET bottles, metal cans, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Bottled Water Market News:

- In May 2025, Netherlands-based Avantium partnered with the Bottle Collective to integrate its plant-based polymer, polyethylene furanoate (PEF), into dry molded fiber bottle technology. This collaboration aims to improve sustainability and barrier performance, with involvement from global brands and a commitment to advancing sustainable packaging solutions using renewable resources.

- In April 2025, SEA Water announced the launch of its 750ml glass bottle, available in still and sparkling varieties, set to hit restaurants and cafés across the Netherlands in May 2025. The eco-friendly design promotes reuse, eliminating single-use waste while sourcing high-quality water from the North Sea using renewable energy.

Netherlands Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands bottled water market on the basis of product type?

- What is the breakup of the Netherlands bottled water market on the basis of distribution channel?

- What is the breakup of the Netherlands bottled water market on the basis of packaging type?

- What is the breakup of the Netherlands bottled water market on the basis of region?

- What are the various stages in the value chain of the Netherlands bottled water market?

- What are the key driving factors and challenges in the Netherlands bottled water market?

- What is the structure of the Netherlands bottled water market and who are the key players?

- What is the degree of competition in the Netherlands bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)