Netherlands Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Netherlands Carbon Black Market Overview:

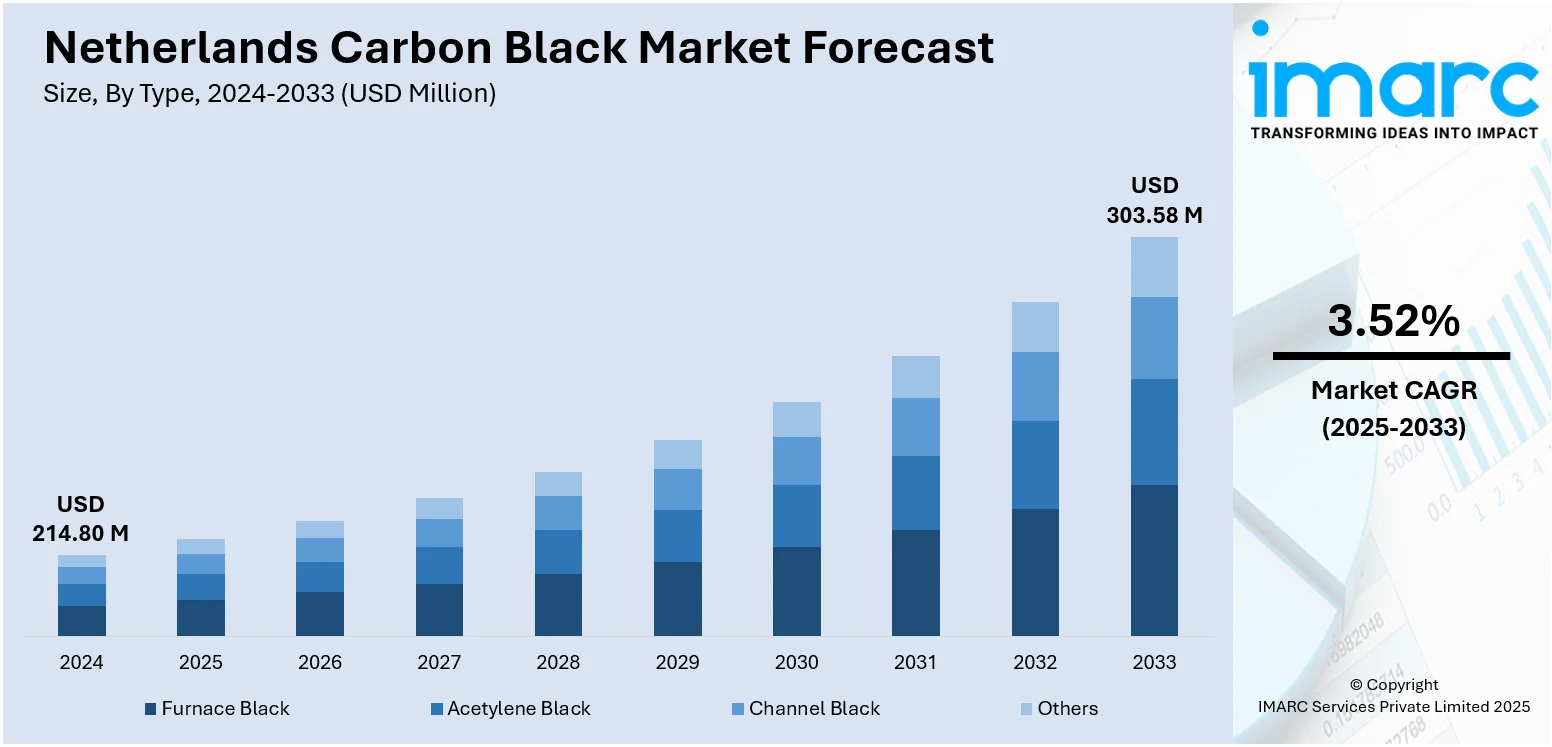

The Netherlands carbon black market size reached USD 214.80 Million in 2024. Looking forward, the market is projected to reach USD 303.58 Million by 2033, exhibiting a growth rate (CAGR) of 3.52% during 2025-2033. The market is driven by the Netherlands’ advanced recycling ecosystem, plastics manufacturing, and environmental engineering efforts. Carbon black demand is increasingly focused on sustainable tire recovery, smart agricultural films, and UV-stable pipe and packaging materials, which, along with high export demand, will continue expanding the Netherlands carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 214.80 Million |

| Market Forecast in 2033 | USD 303.58 Million |

| Market Growth Rate 2025-2033 | 3.52% |

Netherlands Carbon Black Market Trends:

Specialized Tire Manufacturing and Circular Economy Initiatives

The Netherlands, while not a major hub for primary tire production, plays a strategic role in tire innovations, distribution, and recycling across the EU. For instance, in January 2024, Bilfinger was awarded EPCm services for Circtec’s new tire recycling facility in Delfzijl, the Netherlands, which will be Europe’s largest commercial-scale end-of-life tire pyrolysis plant. The facility will process 200,000 tons of waste tires annually, about 5% of the 3.6 Million Tons generated in Europe, transforming them into recycled chemicals, marine fuels, and recovered carbon black. Carbon black is essential in retreaded and recycled tire applications, with Dutch companies leveraging circularity principles to reduce dependence on virgin rubber and filler inputs. Advanced pyrolysis facilities are emerging around Rotterdam and Eindhoven to recover carbon black from end-of-life tires, aligning with national waste-reduction goals and EU Green Deal priorities. These recycled carbon blacks are used in mid-range tire compounds and industrial rubber products, closing the material loop and reducing environmental impact. The country also supports testing and development of carbon-black-reinforced treads with low rolling resistance and enhanced durability, targeting freight and fleet vehicles operating on dense road networks. The Dutch carbon black demand is being shaped by a strong emphasis on reuse, secondary materials, and low-carbon sourcing strategies, all of which support Netherlands carbon black market growth.

To get more information on this market, Request Sample

High-Performance Plastics and Industrial Coatings

The Netherlands’ position as a European logistics and chemical processing hub supports diverse carbon black applications in thermoplastics, masterbatches, and protective coatings. Black polyolefins, pipe resins, and UV-stabilized films are widely used in packaging, agriculture, and infrastructure, benefiting from carbon black’s properties as both pigment and performance enhancer. Dutch chemical processors prioritize high-dispersion and low-contaminant carbon blacks that meet the needs of export-oriented industries and regulatory thresholds for food-contact safety and environmental compliance. Moreover, the country’s industrial coatings sector uses carbon black in corrosion-resistant paints, conductive films, and marine-grade sealants, driven by infrastructure renewal along coasts and inland waterways. These formulations demand consistent carbon black quality for gloss, hiding power, and thermal conductivity. As Dutch firms push toward water-based, low-VOC systems, specialty carbon blacks engineered for eco-compatible dispersions are gaining ground. Major events and conferences hosting key players are also aiding in creating new avenues for carbon black utilization. For instance, The European Carbon Black Summit (June 19-20, 2024) and Recovered Carbon Black Europe Conference (November 5-6, 2024) in in Amsterdam, Netherlands hosted global experts and leaders in the Netherlands to showcase innovations in sustainability, circularity, process improvement, and new applications for both traditional and recovered carbon black. Carbon black’s function as a conductive additive also plays a role in ESD-safe packaging, cable insulation, and transportation components, particularly in sectors like electronics and chemicals that dominate the Dutch industrial landscape. The result is a layered market where both standard and specialty carbon black grades are used to address material durability, compliance, and export competitiveness.

Netherlands Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

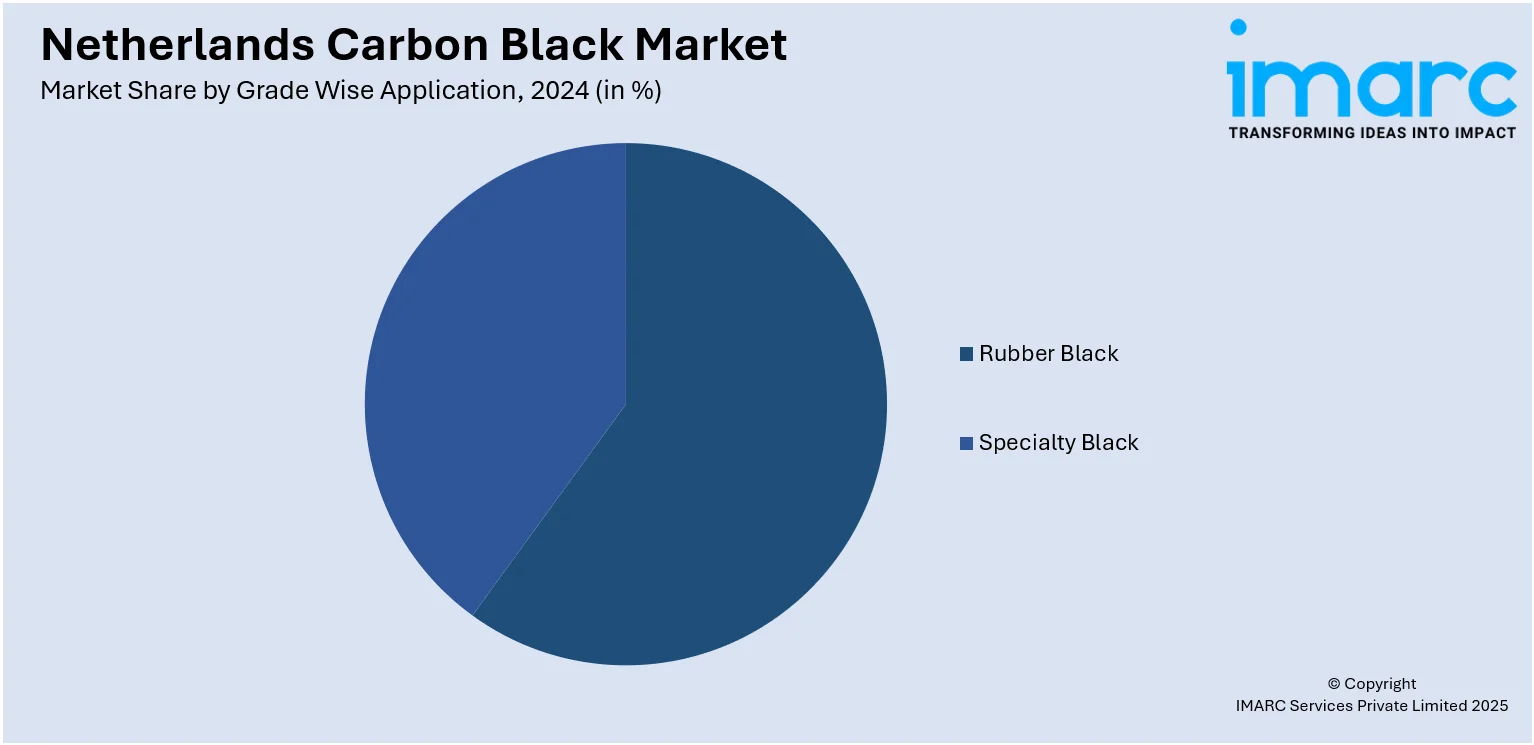

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands carbon black market on the basis of type?

- What is the breakup of the Netherlands carbon black market on the basis of grade wise application?

- What is the breakup of the Netherlands carbon black market on the basis of region?

- What are the various stages in the value chain of the Netherlands carbon black market?

- What are the key driving factors and challenges in the Netherlands carbon black market?

- What is the structure of the Netherlands carbon black market and who are the key players?

- What is the degree of competition in the Netherlands carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)