Netherlands Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, And Distribution Channel, and Region, 2025-2033

Netherlands Confectionery Market Overview:

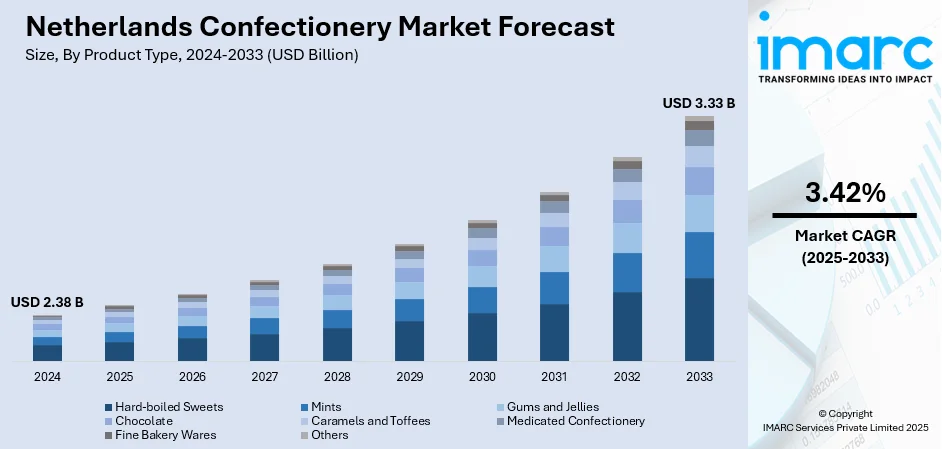

The Netherlands confectionery market size reached USD 2.38 Billion in 2024. The market is projected to reach USD 3.33 Billion by 2033, exhibiting a growth rate (CAGR) of 3.42% during 2025-2033. The market is influenced by expanding consumer demand for high-end, low-sugar, and plant-based confectionery sweets, coupled with increased health awareness and sustainable living. Flavor innovation, texture, and packaging innovation are increasing product attractiveness, while clean-label ingredients and sustainable sourcing are becoming decisive buying criteria. Moreover, expanding online shopping penetration is increasing market accessibility and visibility. These trends are impacting the Netherlands confectionery market share considerably.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.38 Billion |

| Market Forecast in 2033 | USD 3.33 Billion |

| Market Growth Rate 2025-2033 | 3.42% |

Netherlands Confectionery Market Trends:

Increase of Vegan and Plant-Based Confectionery

The trend of plant-based and vegan confectionery in the Netherlands has seen consistent growth, fueled by changing consumer attitudes towards ethical and sustainable consumption. Consumers who value health are looking for alternatives to conventional confectionery that fit into their food and lifestyle choices. Manufacturers are countering with new plant-based products that don't use animal-derived ingredients like gelatin and milk. They feature natural sweeteners, fruit extracts, and plant-based proteins for guilt-free pleasure without sacrificing flavor and texture. This also fits in with the increased demand for clean-label products that focus on simplicity and transparency in ingredients. The market is also experiencing a rise in confectionery products for flexitarians who are not vegan but care about sustainable and ethical food. This trend aligns with wider changes in consumer behavior throughout Europe and is supporting steady Netherlands confectionery market growth.

To get more information on this market, Request Sample

Functional and Low-Sugar Innovations

Confectionery consumers in the Netherlands are increasingly choosing products that promote health benefits in addition to indulgence. This has created increasing emphasis on functional ingredients like probiotics, vitamins, and fiber, which are increasingly being added to candies, chocolates, and gums. There is also an increasing trend towards low-sugar and sugar-free versions, driven by national initiatives to cut down on sugar and avoid lifestyle-affecting health problems. Natural sweeteners such as stevia and erythritol are widely employed in order to preserve taste while reducing calorie levels. Confectionery products marketed as ‘better-for-you’ are gaining traction among various age groups, including young adults and older consumers. In November 2024, Cargill invested €35 million to expand its chocolate coatings and fillings facility in Deventer, the Netherlands, with capacity enhancements intended to support rising demand for vegan and reduced‑sugar confectionery lines. These innovations reflect a shift in how sweets are perceived—from occasional treats to everyday snacks with added health value. As a result, functional and reduced-sugar offerings are becoming key growth segments within the evolving confectionery landscape of the Netherlands.

Digitalization and Personalization in Retail

The Netherlands confectionery industry is adopting digitalization to improve customer experience and interaction. Mobile apps and e-commerce websites are not only improving availability to a greater range of confectionery items but also allowing companies to deliver customized suggestions based on customer interests. QR code use, interactive packaging, and AR-powered promotions are being employed to provide engaging shopping experiences. Subscription offerings and Internet-only flavors are also becoming more popular, especially among young consumers who like convenience and novelty. In addition, data insights are enabling retailers to refine their products, enhance inventory control, and introduce targeted promotions. These developments underpin the overall Netherlands confectionery market trends of innovation, consumerism, and digital interaction. In all, digitalization is transforming the way confectionery is promoted and consumed, resulting in higher brand loyalty and more intimate customer relationships, which in turn is propelling the market growth.

Netherlands Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

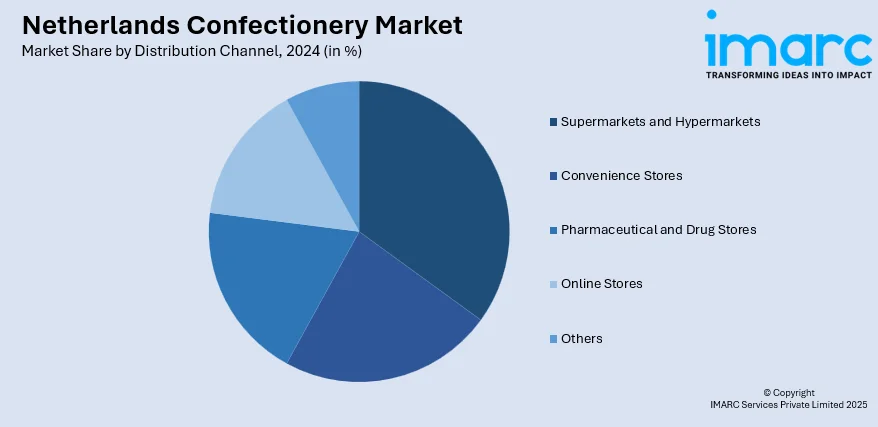

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Confectionery Market News:

- In July 2024, Dutch firm Primus Wafer Paper BV earned first place in the prestigious ISM New Product Showcase for its innovative ultra-thin potato-starch wafer sheets. These edible sheets, marketed under the "Yummy Super Sour" range, deliver intense flavors like apple and lemon and are designed to melt instantly on the tongue—offering a novel sensory experience in confectionery consumption.

Netherlands Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands confectionery market on the basis of product type?

- What is the breakup of the Netherlands confectionery market on the basis of age group?

- What is the breakup of the Netherlands confectionery market on the basis of price point?

- What is the breakup of the Netherlands confectionery market on the basis of distribution channel?

- What is the breakup of the Netherlands confectionery market on the basis of region?

- What are the various stages in the value chain of the Netherlands confectionery market?

- What are the key driving factors and challenges in the Netherlands confectionery market?

- What is the structure of the Netherlands confectionery market and who are the key players?

- What is the degree of competition in the Netherlands confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)