Netherlands Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033

Netherlands Cryptocurrency Market Overview:

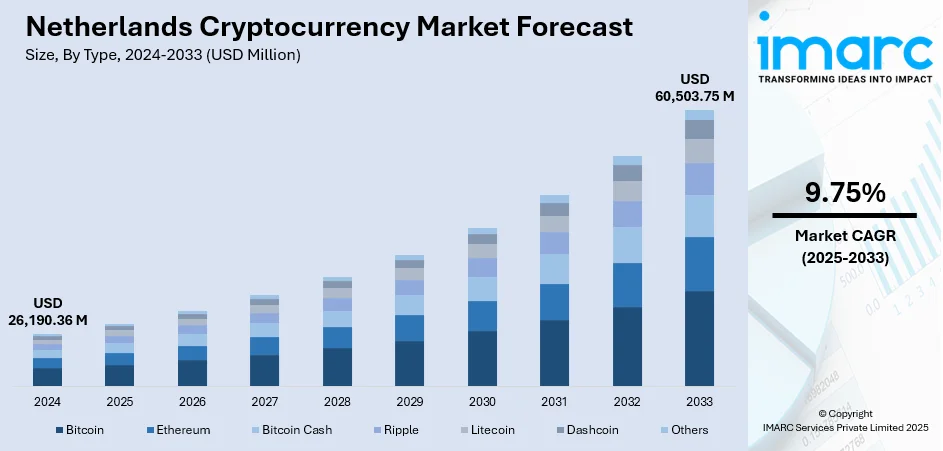

The Netherlands cryptocurrency market size reached USD 26,190.36 Million in 2024. The market is projected to reach USD 60,503.75 Million by 2033, exhibiting a growth rate (CAGR) of 9.75% during 2025-2033. Regulatory frameworks and tax guidelines are building investor confidence and attracting crypto businesses. In addition, user-friendly digital platforms are making trading accessible and efficient, boosting participation across numerous segments. These platforms offer features like real-time analytics and secure payments, appealing to both individuals and institutions. Besides this, increasing internet penetration is contributing to the expansion of the Netherlands cryptocurrency market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26,190.36 Million |

| Market Forecast in 2033 | USD 60,503.75 Million |

| Market Growth Rate 2025-2033 | 9.75% |

Netherlands Cryptocurrency Market Trends:

Supportive government policies

Supportive government policies are fueling the market growth in the Netherlands. The Dutch government is adopting a progressive stance, recognizing the potential of digital assets and blockchain technology in transforming the financial landscape. This approach is fostering a climate of trust and transparency, attracting startups, fintech firms, and institutional investors to engage in crypto-related ventures. Clear legal frameworks for crypto exchanges and wallet providers ensure that businesses can operate within defined rules, promoting stability in the market. The government also supports blockchain pilot projects across sectors, such as logistics, healthcare, and energy, demonstrating its commitment to long-term digital transformation. Financial regulators maintain open communication with industry stakeholders to refine guidelines and reduce regulatory uncertainty. Such collaboration enhances investor confidence and market participation. Educational initiatives are further supporting user awareness and responsible trading practices. Additionally, the Dutch government is introducing tax guidelines for crypto gains, helping individuals and businesses stay compliant while participating in the market. In October 2024, the Dutch government initiated a public discussion on a proposed legislation that would mandate crypto services to gather and disclose user information to tax authorities. The Dutch Ministry of Finance aimed to enhance transparency concerning cryptocurrency ownership and improve strategies to tackle tax evasion. By combining regulatory clarity with a pro-innovation outlook, the Netherlands is nurturing a robust and forward-thinking cryptocurrency ecosystem that continues to grow steadily, drawing both domestic and international attention.

To get more information on this market, Request Sample

Growing interest in digital trading platforms

Rising interest in digital trading platforms is bolstering the Netherlands cryptocurrency market growth. As more individuals and institutional investors are looking to diversify their portfolios, digital platforms offer seamless and convenient entry points into crypto trading. These platforms often provide intuitive interfaces, real-time analytics, automated trading features, and secure payment gateways, which simplify the trading experience for both beginners and seasoned traders. The ease of buying, selling, and managing cryptocurrencies from mobile devices is contributing to a surge in daily trading volumes. Additionally, features like low transaction fees, integration with banking services, and access to a wide variety of cryptocurrencies are attracting users seeking efficiency and choice. Increased media attention and peer influence are further accelerating this interest, driving the demand for reliable platforms. In response, many fintech companies and startups in the Netherlands are launching digital trading platforms with innovative features and compliance frameworks. In March 2024, Bybit cryptocurrency exchange introduced a crypto trading platform, Bybit.nl, in the Netherlands. The platform aimed to offer Dutch users opportunities for cryptocurrency trading and educational materials. People could instantly deposit, withdraw, trade, and engage in staking via the Bybit card on Bybit.nl. As more people are exploring crypto trading through digital gateways, market participation is rising, liquidity is improving, and the overall Dutch crypto ecosystem is strengthening.

Netherlands Cryptocurrency Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, process, and application.

Type Insights:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bitcoin, ethereum, bitcoin cash, ripple, litecoin, dashcoin, and others.

Component Insights:

- Hardware

- Software

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software.

Process Insights:

- Mining

- Transaction

The report has provided a detailed breakup and analysis of the market based on the process. This includes mining and transaction.

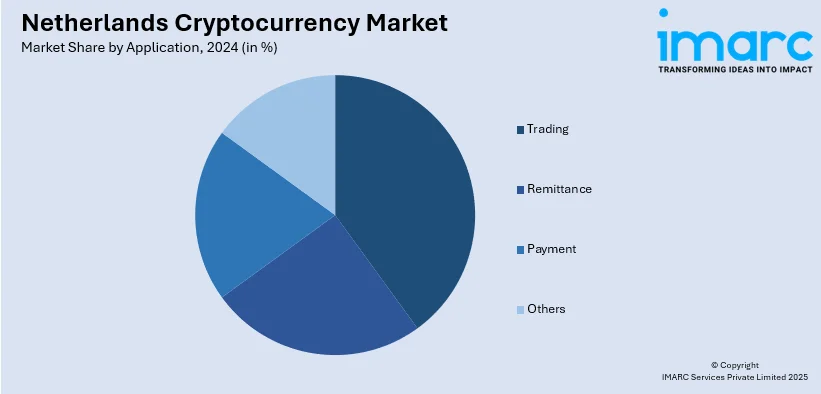

Application Insights:

- Trading

- Remittance

- Payment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes trading, remittance, payment, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Cryptocurrency Market News:

- In June 2025, Bitvavo became the most recent cryptocurrency exchange to receive a ‘Markets in Crypto-Assets (MiCA)’ license from the Dutch Authority for Financial Markets (AFM), established in the Netherlands. MiCA aimed to unify and oversee the cryptocurrency market in Europe, including France, emphasizing the safeguarding of investors, ensuring financial stability, and fostering innovations.

- In April 2025, Dutch neobank Bunq introduced a cryptocurrency trading platform that supported more than 300 cryptocurrencies, such as Bitcoin, Ethereum, and Solana. The service was accessible to Bunq users in the Netherlands, France, Spain, Ireland, Italy, and Belgium. It became available through Kraken, a major cryptocurrency exchange.

Netherlands Cryptocurrency Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bitcoin, Ethereum, Bitcoin Cash, Ripple, Litecoin, Dashcoin, Others |

| Components Covered | Hardware, Software |

| Processes Covered | Mining, Transaction |

| Applications Covered | Trading, Remittance, Payment, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands cryptocurrency market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands cryptocurrency market on the basis of type?

- What is the breakup of the Netherlands cryptocurrency market on the basis of component?

- What is the breakup of the Netherlands cryptocurrency market on the basis of process?

- What is the breakup of the Netherlands cryptocurrency market on the basis of application?

- What is the breakup of the Netherlands cryptocurrency market on the basis of region?

- What are the various stages in the value chain of the Netherlands cryptocurrency market?

- What are the key driving factors and challenges in the Netherlands cryptocurrency market?

- What is the structure of the Netherlands cryptocurrency market and who are the key players?

- What is the degree of competition in the Netherlands cryptocurrency market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands cryptocurrency market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands cryptocurrency market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands cryptocurrency industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)