Netherlands Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Netherlands Diaper Market Overview:

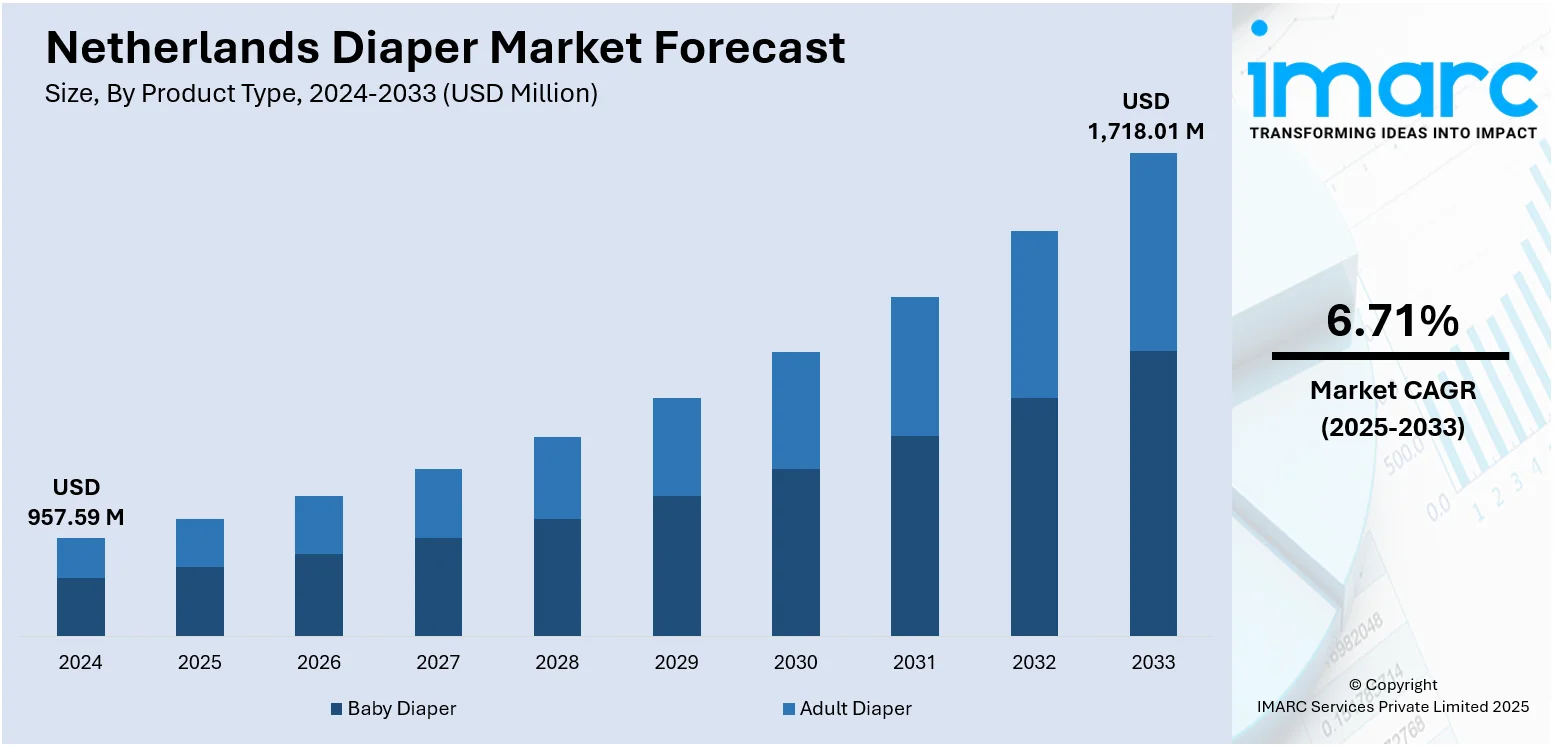

The Netherlands diaper market size reached USD 957.59 Million in 2024. The market is projected to reach USD 1,718.01 Million by 2033, exhibiting a growth rate (CAGR) of 6.71% during 2025-2033. The industry is fueled by higher birth rates, environmental awareness and demand for green products, and technological advancements. Online shopping growth, better disposable income, and rising awareness of baby care are also key factors. All these have contributed positively to the Netherlands diaper market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 957.59 Million |

| Market Forecast in 2033 | USD 1,718.01 Million |

| Market Growth Rate 2025-2033 | 6.71% |

Netherlands Diaper Market Trends:

Demand for Eco-Friendly Diapers

Among the leading trends that impact the Netherlands diaper industry is the rising consumer trend toward eco-friendly and sustainable diapers. With growing environmental awareness, parents are increasingly turning to biodegradable or cloth diapers as they help minimize waste. Sustainability is deeply ingrained in Dutch culture, further stimulating the trend towards greener products. For instance, as per industry reports, the Netherlands faces 400 million kilos of diaper waste annually, most of which is incinerated, harming the environment. The government’s new Extended Producer Responsibility (EPR) decision requires producers to take responsibility for recycling diaper waste. The goal is to recycle 12.5% of diaper waste by 2028, totaling 110 kilotons. This transition towards a circular economy offers significant environmental benefits. Brands are responding by incorporating natural materials, recyclable packaging, and creating diapers that minimize environmental impact. This trend is also supported by government policies encouraging sustainability, influencing both product offerings and consumer behavior. As a result, eco-consciousness is becoming a major factor in the Netherlands diaper market growth.

To get more information on this market, Request Sample

Technological Innovations in Diaper Design

Technological innovation is another major trend fueling the Netherlands diaper market growth. Today's diapers are no longer merely absorbent; they now have many additional features like wetness indicators, skin care technologies, and adjustable fit for comfort. These technologies enhance the overall quality of the diaper, satisfying customers' demands for convenience and function. Moreover, the inclusion of advanced materials increases the effectiveness of the diaper to manage moisture, minimize irritation, and provide longer dryness duration. Such innovation is increasingly being a center of attraction for top diaper companies operating in the Netherlands, thereby driving overall Netherlands diaper market growth as consumers opt for higher-quality and more comfortable options. For instance, in February 2025, Ontex launched its Dreamshields® technology for baby diapers in Europe, offering enhanced leakage protection, comfort, and sustainability. The innovation includes features like a unique channel design, SeconDRY® system, and 360° protection. Dreamshields® reduces CO2 emissions and plastic use, providing both performance and environmental benefits for families.

Netherlands Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diapers, training diapers, cloth diapers, swim pants, and biodegradable diapers) and adult diaper (pad type, flat type, and pant type).

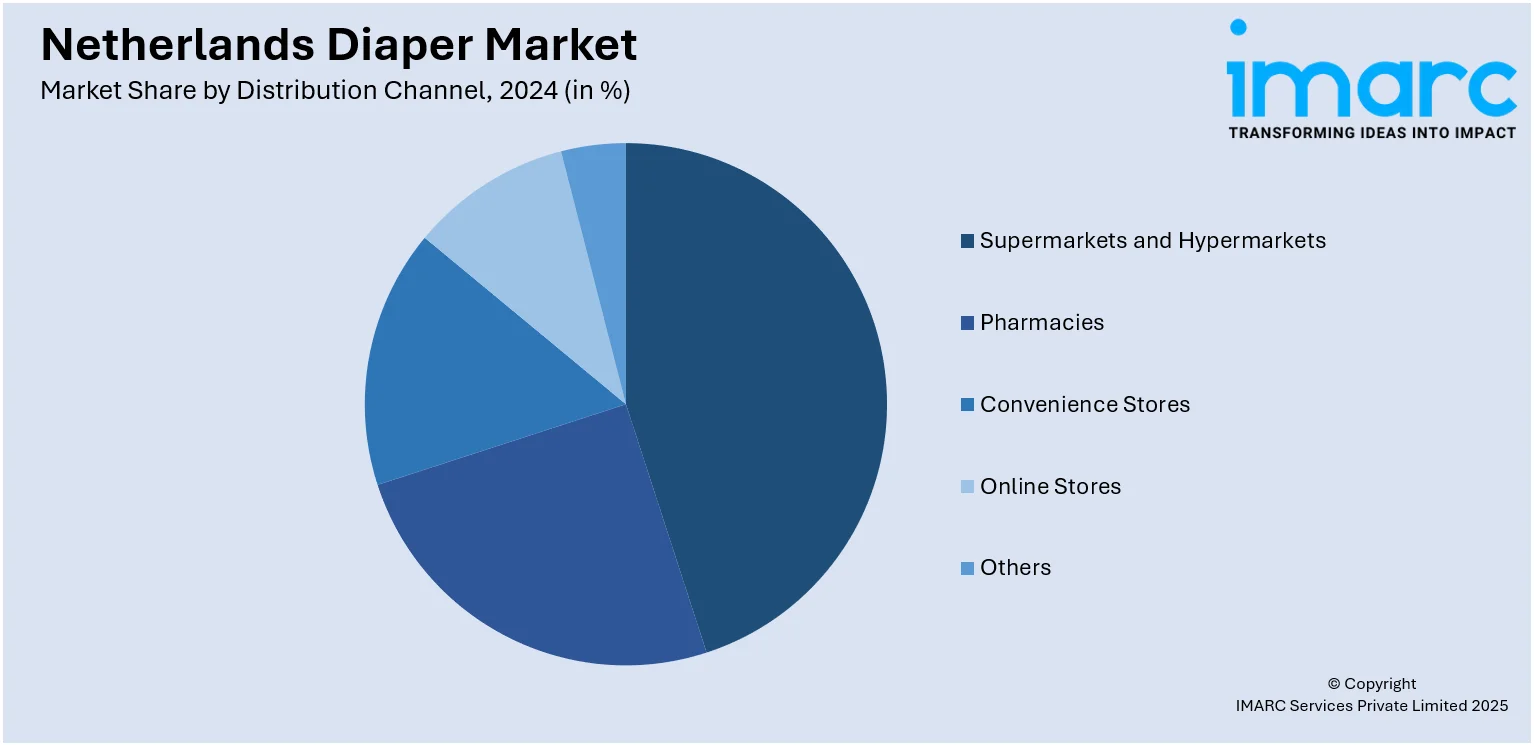

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Diaper Market News:

- In May 2025, Ontex Group NV launched a new 360° anti-leak protection system for baby diapers, providing comprehensive leak coverage from all angles. The innovation targets newborn sizes, featuring added barriers, a navel cutout for healing, and a channeled absorbent core. This new product reflects Ontex's commitment to comfort, safety, and reliability.

- In May 2025, GreenCore Solutions launched its TreeFree Diaper™ in Europe, marking a milestone in its Retail Private Label Program. The diapers, produced entirely in Europe, cater to rising eco-conscious consumer demand and comply with upcoming EU regulations. The innovation eliminates tree pulp, offering a sustainable, tariff-resistant alternative with full supply chain transparency via the PATH+ program.

Netherlands Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands diaper market on the basis of product type?

- What is the breakup of the Netherlands diaper market on the basis of distribution channel?

- What is the breakup of the Netherlands diaper market on the basis of region?

- What are the various stages in the value chain of the Netherlands diaper market?

- What are the key driving factors and challenges in the Netherlands diaper market?

- What is the structure of the Netherlands diaper market and who are the key players?

- What is the degree of competition in the Netherlands diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)