Netherlands Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Netherlands Drones Market Overview:

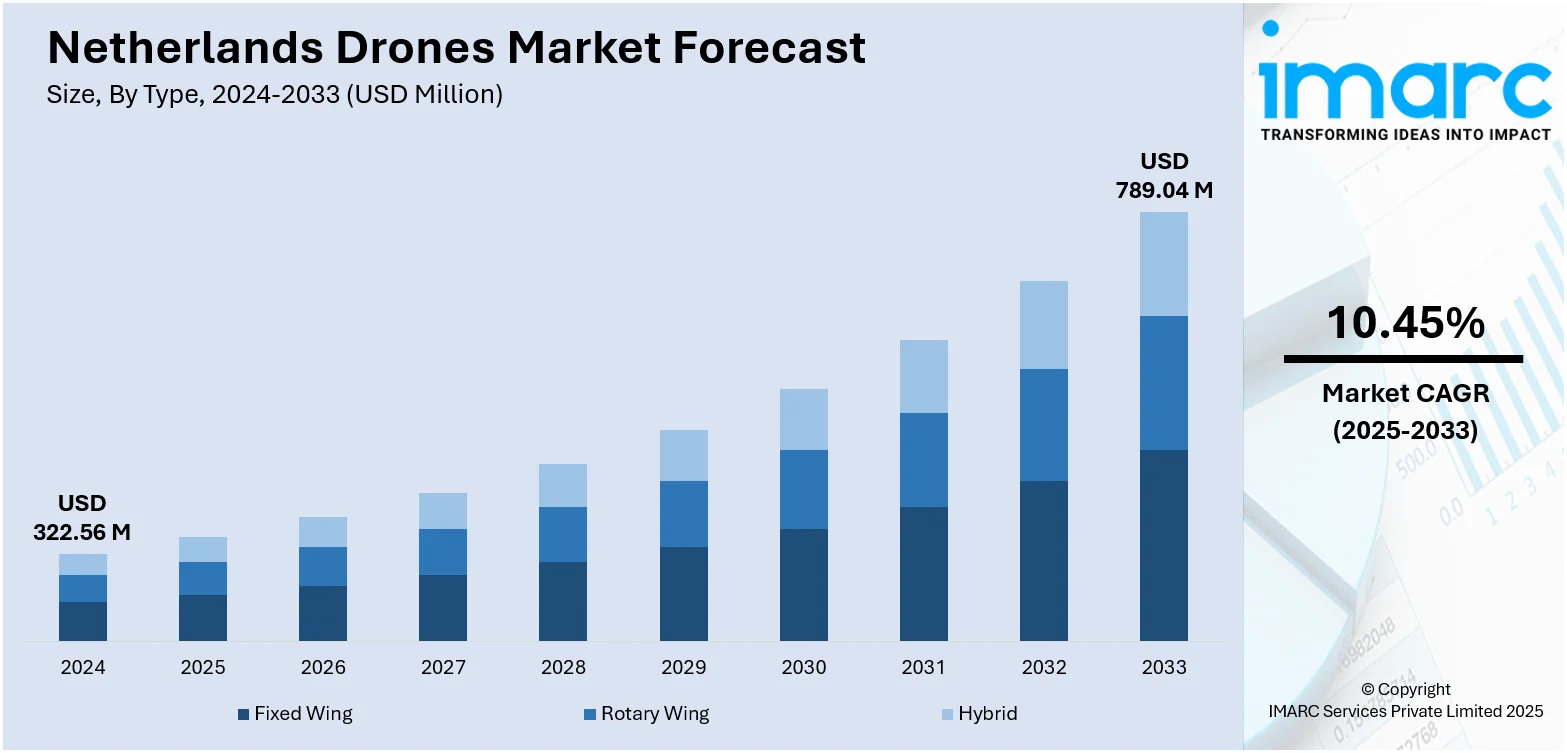

The Netherlands drones market size reached USD 322.56 Million in 2024. Looking forward, the market is expected to reach USD 789.04 Million by 2033, exhibiting a growth rate (CAGR) of 10.45% during 2025-2033. The market is fueled by high-end applications in precision agriculture, flood surveillance, city logistics, and wind turbine and solar panel inspection. Robust research infrastructure and an active pace of aerospace clusters and universities contribute to ongoing drone innovation. Congested cities enable last-mile delivery tests, while agricultural areas depend on drones for real-time crop and greenhouse monitoring. Sustainability emphasis in the Netherlands also encourages the deployment of drones in offshore wind farm maintenance and nature protection, further increasing the Netherlands drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 322.56 Million |

| Market Forecast in 2033 | USD 789.04 Million |

| Market Growth Rate 2025-2033 | 10.45% |

Netherlands Drones Market Trends:

Precision Agriculture and Water Management Innovations

The Netherlands is witnessing a significant trend in drone usage within its precision agriculture and water management industries. Due to the country's terrain, such as reclaimed polders, floating farms, and extensive network of dykes and canals, Dutch farmers are now more and more using drones to monitor soil salinity, manage irrigation in crops, and regulate greenhouse conditions. Greenhouse farmers in horticultural zones near Westland and Noord-Brabant apply drone-based sensors to monitor heat stress and the onset of disease in high-value crops such as tomatoes and cucumbers. Similarly, water boards managing flood-affected regions close to Rotterdam and Zeeland utilize drones for dyke examinations, bottom sediment analysis, and upkeep planning. Such region-specific intersection of farming productivity and watery resilience highlights the trend toward integrated drone solutions adapted to the Netherlands' local climate needs and agricultural ecosystems, which further supports the Netherlands drones market growth as well.

To get more information on this market, Request Sample

Urban Logistics, Last-Mile Delivery and Smart City Integration

Urban drone operations in the Netherlands are picking up speed as the nation tests out drone-based logistics and intelligent city structures. Amsterdam and Eindhoven are testing delivery drones for medical supply and parcel transport, tapping into the country's tight urban landscape and heavily regulated airspace corridors controlled by authorities. Companies are experimenting with drone corridors linking up dispatch centers and central urban hubs, minimizing travel distance and cutting emissions. These pilots frequently overlap with smart city infrastructure within The Hague and Utrecht, as drones supplement traffic surveillance, utility inspections, and environmental sampling. Seamless integration with the Netherlands' national unmanned traffic management system (UTM) facilitates smooth operations in shared airspace. The increasing synergy between urban development, logistics innovation, and regulations indicates a shift toward commercially viable integration of drones in high-density Dutch municipalities.

Sustainability, Research and Aerospace Cluster Synergies

The Netherlands is supported by robust aerospace and research clusters that catalyze drone innovation with a sustainability emphasis. With institutions such as Delft University of Technology and aerospace clusters in Noord-Holland, Dutch engineers are creating solar-powered and hydrogen-electric drones towards emission-free flight. Research activities are centered on swarm drone collaborations for environmental monitoring throughout the Wadden Sea and R&D on artificial intelligence filters for bird communities and coastal erosion. Netherlands-based drone companies are also testing modular drones for offshore wind farm inspections within the North Sea as part of the Netherlands' larger renewable energy infrastructure. Moreover, initiatives by environmental NGOs use drones to monitor wildlife migration and pollution within sensitive ecological areas such as the Delta Works area. This intersection of sustainability research, academic cooperation, and aviation technology solidly positions the Netherlands' drone industry along green and high-tech pathways.

Netherlands Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

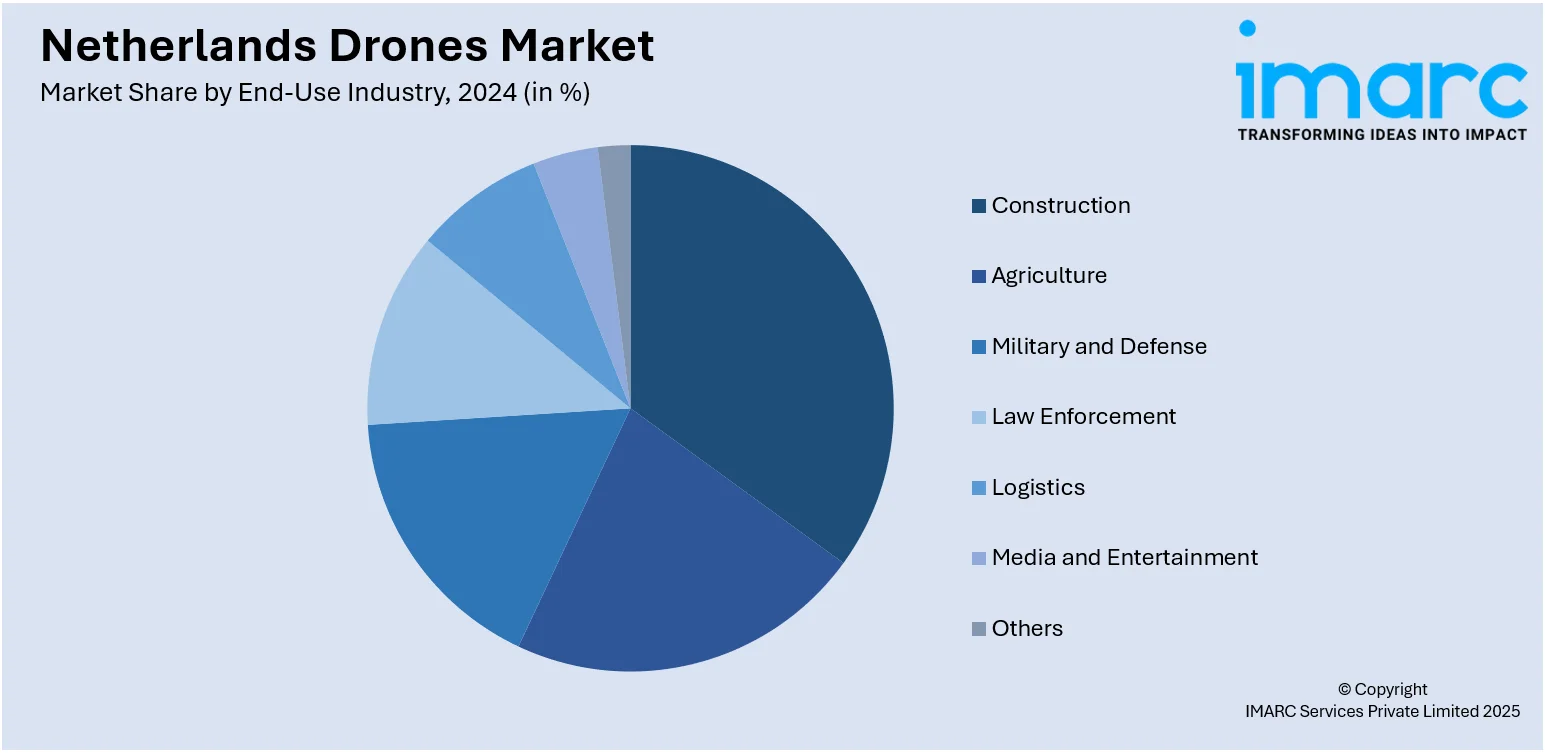

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Drones Market News:

- In June 2025, The Netherlands finalized agreements to manufacture 600,000 drones for the Ukrainian Armed Forces through the ‘Drone Line’ program, with deliveries scheduled to commence this year. These agreements are included in a new Dutch assistance package valued at more than €675 Million. The package additionally contains the shipment of 100 extra radar systems for UAV detection and gear for evacuating the injured.

- In June 2025, a drone facility for defense was inaugurated by The Royal Netherlands Aerospace Centre. This center aids the larger goal of the Dutch Ministry of Defence to be a leader in unmanned systems, in collaboration with industry and educational institutions. The defence minister, Ruben Brekelmans, attended to emphasize the significance of the Quick Response Drone Facility (QRDF) and to reinforce the goal of accelerating innovation.

Netherlands Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands drones market on the basis of type?

- What is the breakup of the Netherlands drones market on the basis of component?

- What is the breakup of the Netherlands drones market on the basis of payload?

- What is the breakup of the Netherlands drones market on the basis of point of sale?

- What is the breakup of the Netherlands drones market on the basis of end-use industry?

- What is the breakup of the Netherlands drones market on the basis of region?

- What are the various stages in the value chain of the Netherlands drones market?

- What are the key driving factors and challenges in the Netherlands drones market?

- What is the structure of the Netherlands drones market and who are the key players?

- What is the degree of competition in the Netherlands drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)