Netherlands Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Province, 2025-2033

Netherlands Duty-Free and Travel Retail Market Overview:

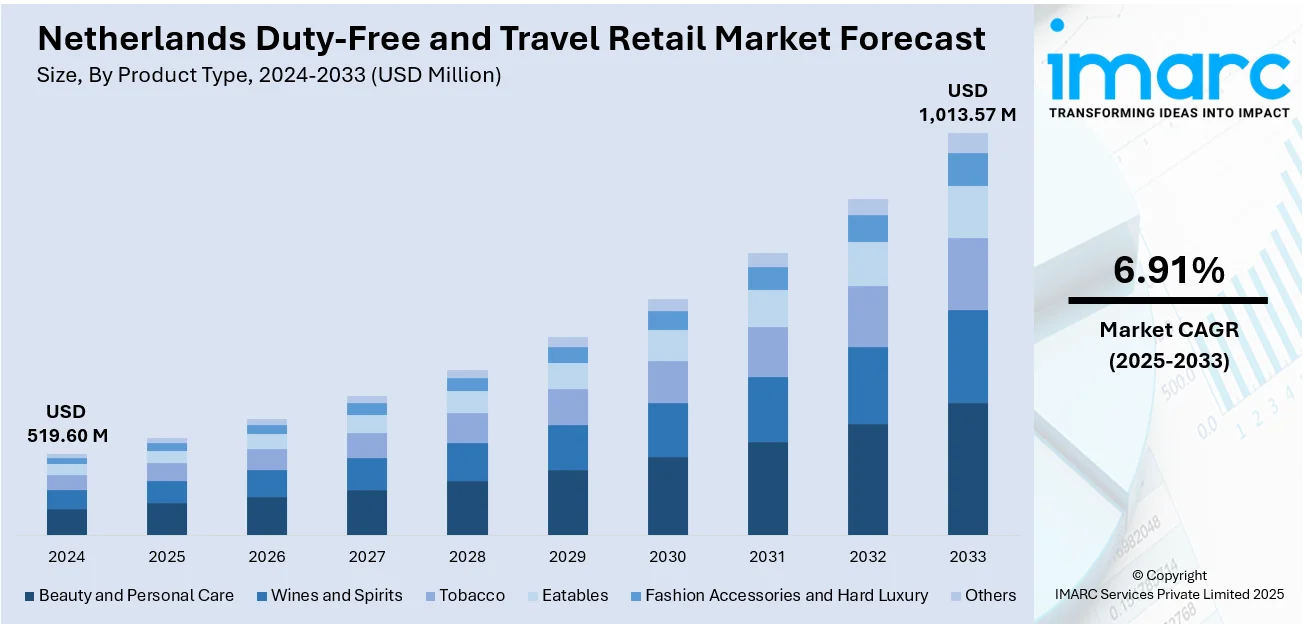

The Netherlands duty-free and travel retail market size reached USD 519.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,013.57 Million by 2033, exhibiting a growth rate (CAGR) of 6.91% during 2025-2033. Rising international passenger traffic through Schiphol and regional airports, expanding airport retail space, adoption of omnichannel pre‑order and click‑and‑collect services, premiumization of product range, and tourists’ growing demand for local specialties are some of the factors contributing to the Netherlands duty-free and travel retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 519.60 Million |

| Market Forecast in 2033 | USD 1,013.57 Million |

| Market Growth Rate 2025-2033 | 6.91% |

Netherlands Duty-Free and Travel Retail Market Trends:

Shifting Retail Strategies in Travel Hubs

Over the past few years, Netherlands has seen a noticeable push toward upgrading airport retail infrastructure, especially in Cairo, Hurghada, and Sharm El Sheikh. Government-backed modernization efforts and private-sector partnerships are driving a reshaped retail experience inside terminals. Retailers are no longer just selling perfumes and liquor; they’re carving out space for premium fashion, electronics, and gourmet products to meet the expectations of international tourists and wealthy Gulf travelers. There’s also a rising emphasis on architectural aesthetics and local cultural elements in store layouts to create a more immersive environment. The duty-free retail footprint is expanding not only in terms of floor space but also digital touchpoints, including click-and-collect services for outbound travelers. These developments align with Netherlands’s broader strategy to strengthen its position as a regional tourism hub and to monetize passenger traffic more effectively, particularly from European and Asian routes that now see higher frequencies. These factors are intensifying the Netherlands duty-free and travel retail market growth. For example, in December 2024, Lagardère Travel Retail secured the duty-free contract at Amsterdam Schiphol Airport, gaining a 70% stake in the new operating company, with Schiphol retaining 30%. The deal includes over 20 stores across core categories like cosmetics, liquor, and tobacco. Once approved by regulators, the venture would expand Lagardère’s European footprint and enhance retail experiences through redesigned, traveler-focused spaces.

To get more information on this market, Request Sample

Rising Focus on Passenger Experience in Airport Retail

Airports in the Netherlands are redefining duty-free and travel retail by putting greater emphasis on the traveler’s experience. Instead of traditional store layouts and static product displays, retail operators are now prioritizing interactive environments that align with how people move through and use airport spaces. There’s a growing shift toward personalized offerings, seamless digital integration, and faster, more intuitive shopping flows. Retail areas are being designed to reduce friction and maximize comfort, blending convenience with curated product selections that cater to international tastes and last-minute impulse buying. Cosmetics, liquor, and tobacco remain central, but they’re now packaged in modern, aesthetic displays that reflect lifestyle branding more than simple utility. New ventures are also incorporating sustainable practices and locally influenced design elements to deepen passenger connection with the location. These upgrades aren't just cosmetic; they’re backed by data on consumer behavior and traveler psychology, shaping store formats to meet changing expectations. The direction is clear: success in this space increasingly depends on understanding and responding to the mindset of today’s airport customer rather than just managing inventory.

Netherlands Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and provincial levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Duty-Free and Travel Retail Market News:

- In June 2025, Lagardère Travel Retail and Schiphol Group launched the Today Duty Free brand at Amsterdam Airport Schiphol. The new 1,500 sq m flagship store in Lounge 1 is the airport’s largest. It marks the first venture of their new joint operation (Lagardère 70%, Schiphol Group 30%), which now runs nearly 30 stores featuring liquor, tobacco, confectionery, perfumes, cosmetics, and sunglasses.

Netherlands Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands duty-free and travel retail market on the basis of product type?

- What is the breakup of the Netherlands duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Netherlands duty-free and travel retail market on the basis of province?

- What are the various stages in the value chain of the Netherlands duty-free and travel retail market?

- What are the key driving factors and challenges in the Netherlands duty-free and travel retail market?

- What is the structure of the Netherlands duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Netherlands duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)