Netherlands EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Province, 2025-2033

Netherlands EdTech Market Overview:

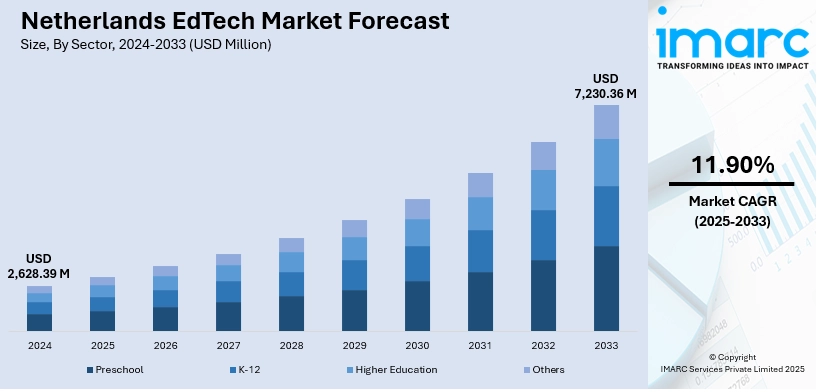

The Netherlands EdTech market size reached USD 2,628.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,230.36 Million by 2033, exhibiting a growth rate (CAGR) of 11.90% during 2025-2033. Digital-first education policies, high internet penetration, strong public investment, demand for flexible lifelong learning, and widespread device access are some of the factors contributing to Netherlands EdTech market share. Universities promote tech adoption, startups innovate in adaptive learning, and corporate training needs support for ongoing growth across education and professional sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,628.39 Million |

| Market Forecast in 2033 | USD 7,230.36 Million |

| Market Growth Rate 2025-2033 | 11.90% |

Netherlands EdTech Market Trends:

Growth in Professional e-Learning and Cross-Border Expansion

In the Netherlands, digital platforms focused on continuing professional education are attracting investor interest and scaling rapidly. Providers with long-standing experience are expanding their offerings across Europe while maintaining a strong base in the Dutch market. These platforms deliver certified, high-quality courses in various fields, appealing to professionals seeking flexible upskilling. With capital backing, there’s increased momentum toward mergers and partnerships, especially in regulated learning areas. The aim is to consolidate fragmented markets, enhance recurring revenue streams, and broaden access to digital learning tools for working professionals. This shift reflects a wider move toward lifelong learning models that go beyond traditional academic routes, aligning with the evolving needs of Europe’s workforce and changing employer expectations. These factors are intensifying the Netherlands EdTech market growth. For example, in April 2024, Reducate EdTech Group, rooted in the Netherlands, secured minority investment from All Seas Capital to support its European expansion. Originating from E-WISE, founded in 1999 in the Netherlands, Reducate specializes in online professional education. It offers regulated e-learning courses across 40+ professions and serves over 175,000 professionals. The funding would strengthen its position in the Dutch market and beyond, while targeting new partnerships within the continuing professional education sector.

To get more information on this market, Request Sample

Focus on Lifelong Learning and Sector-Specific Specialization

Digital education in the Netherlands is shifting toward lifelong learning tailored to working professionals. Instead of broad, general-purpose platforms, there’s growing demand for specialized tools that cater to specific fields such as healthcare, law, finance, and education. These platforms prioritize compliance, certification, and regularly updated content that meets strict professional standards. Their growth is driven by increasing regulation across industries and the need for up-to-date skills in fast-changing environments. Companies that have built trust and recurring engagement over the years are becoming central to this shift. They operate with structured subscription models, often through employer partnerships, making it easier for professionals to access training without interrupting work. These platforms don’t just offer content, they build long-term relationships through consistent quality, responsive updates, and personalized learning paths. The Netherlands has become a key launchpad for these services, thanks to its strong digital infrastructure and high professional education standards. Expansion across Europe is following a model that begins with market-tested tools developed locally, then grows through partnerships or acquisitions in neighboring countries with similar regulatory demands.

Netherlands EdTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and provincial levels for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

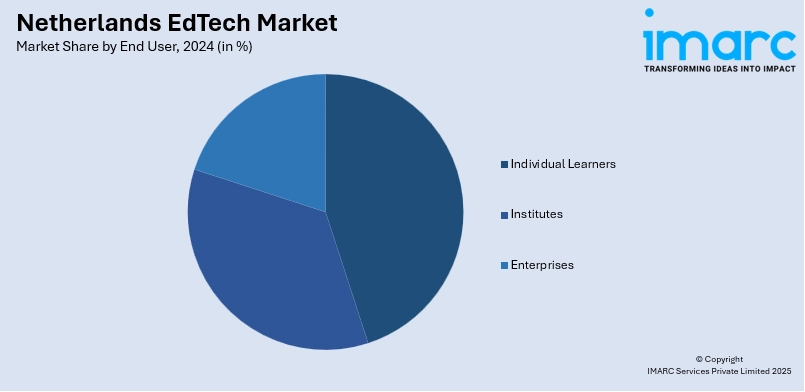

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands EdTech Market News:

- In June 2025, Swedish startup Gimi and Dutch bank ABN Amro launched a financial literacy app for children aged 7–13 in the Netherlands. Developed in 90 days, the co-branded app uses open banking to let kids manage money safely while learning key finance skills. ABN Amro users get free access to Gimi’s Superskills Pro lessons, making it the first European bank to offer an educational finance tool tailored for families.

Netherlands EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands EdTech market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands EdTech market on the basis of sector?

- What is the breakup of the Netherlands EdTech market on the basis of type?

- What is the breakup of the Netherlands EdTech market on the basis of deployment mode?

- What is the breakup of the Netherlands EdTech market on the basis of end user?

- What is the breakup of the Netherlands EdTech market on the basis of province?

- What are the various stages in the value chain of the Netherlands EdTech market?

- What are the key driving factors and challenges in the Netherlands EdTech market?

- What is the structure of the Netherlands EdTech market and who are the key players?

- What is the degree of competition in the Netherlands EdTech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands EdTech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands EdTech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands EdTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)