Netherlands Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Netherlands Electric Two-Wheeler Market Overview:

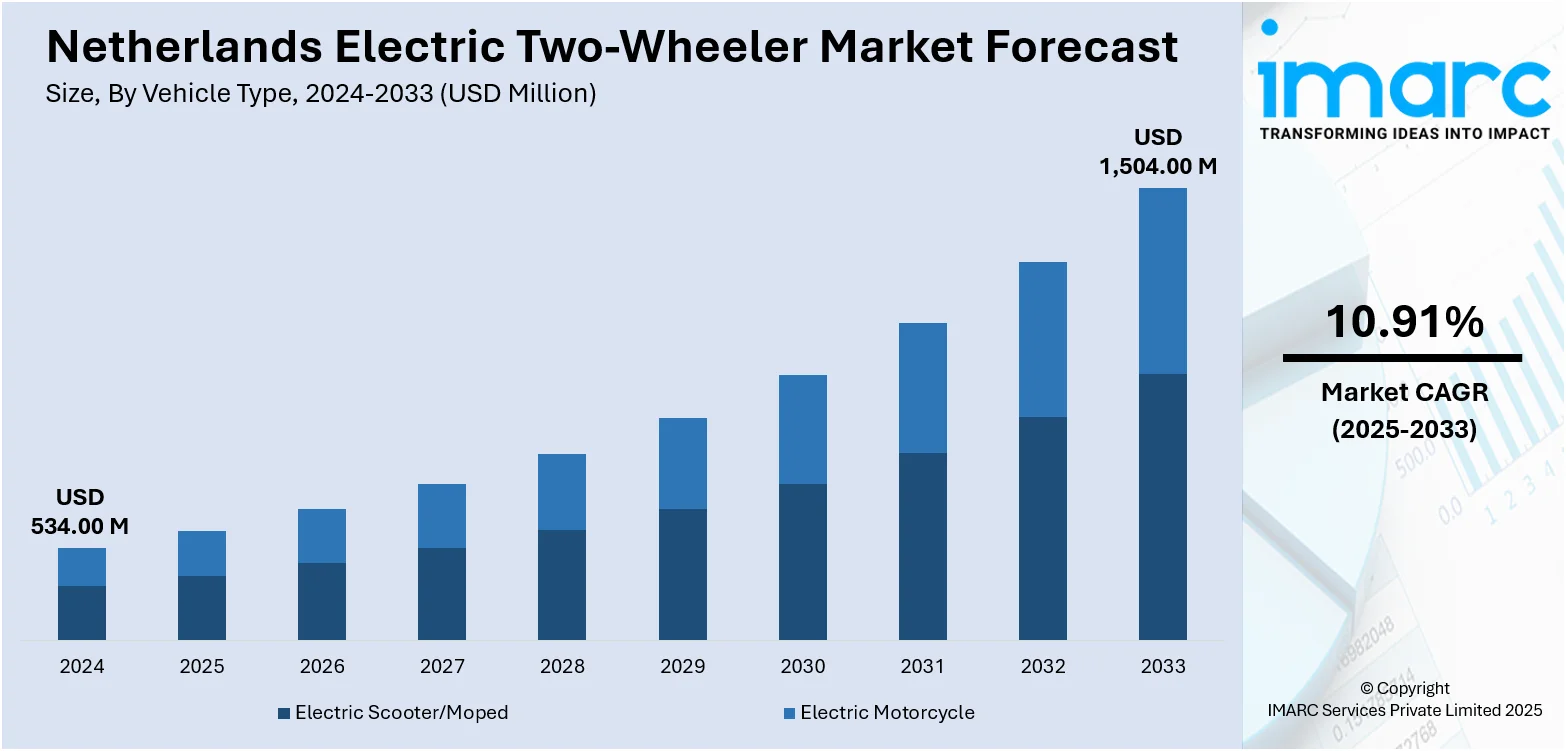

The Netherlands electric two-wheeler market size reached USD 534.00 Million in 2024. The market is projected to reach USD 1,504.00 Million by 2033, exhibiting a growth rate (CAGR) of 10.91% during 2025-2033. The market is gaining momentum owing to the implementation of favorable government incentives, including subsidies and tax exemptions, increasing environmental concerns, and stringent emission controls. The island's high-density city life and limited commuting distances favor electric scooters as a transportation solution for daily commutes. Furthermore, advances in battery technology and the growth of charging and battery-swapping facilities, spearheaded by players like Gogoro, increase convenience and consumer acceptance, thus Netherlands electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 534.00 Million |

| Market Forecast in 2033 | USD 1,504.00 Million |

| Market Growth Rate 2025-2033 | 10.91% |

Netherlands Electric Two-Wheeler Market Trends:

Cycling Culture & Urban Infrastructure

The Netherlands has a deep-rooted cycling culture, with around 22.8 million bicycles for just 17 million people—more bikes than residents. This high ownership rate reflects a national lifestyle centered around two-wheel transport, which now extends naturally to electric bikes and scooters. The country’s urban infrastructure is tailored to cyclists, featuring 35,000 km of dedicated bike paths, traffic-calming zones, and cyclist-priority systems. Combined with flat terrain, short travel distances, and dense urban planning, these factors make electric two-wheelers a practical and popular choice for commuting, shopping, and leisure. From a young age, Dutch citizens are accustomed to using bicycles daily, lowering the barrier to adopting electric alternatives. Moreover, cities prioritize cycling over car travel, reinforcing the shift toward cleaner, quieter transportation that aids the Netherlands electric two-wheeler market growth. This unique blend of cultural preference and purpose-built infrastructure provides a strong foundation for the rapid adoption of electric two-wheelers across the country.

To get more information on this market, Request Sample

Technological Advancements & Shared Mobility

As technology continues to improve, electric two-wheelers are becoming more attractive, reliable, and user-friendly. Modern electric bikes and scooters are lighter, faster, and easier to maintain than earlier models. Battery performance has improved significantly, allowing longer rides and faster charging. Smart features like app connectivity, GPS tracking, and anti-theft systems enhance user experience. These innovations not only make ownership more convenient but also reduce the hesitation many first-time users may have. Alongside this, shared mobility services have emerged across Dutch cities, offering electric bikes and scooters for rent. This gives people access without the need to purchase, which is especially appealing to tourists, students, and occasional users. As people grow more familiar with these services, comfort with the technology increases, encouraging more individuals to eventually switch to owning or frequently using electric two-wheelers as part of their daily routines.

Government Support & Sustainability Values

Another significant Netherlands electric two-wheeler market trend is the government support and sustainability values. The government actively promotes clean transportation, encouraging a shift from fuel-based to electric alternatives. Key measures include financial incentives like a tax-free bicycle mileage allowance of €0.19–€0.21 per kilometer and favorable tax treatment for company-provided bikes, making electric two-wheelers more affordable and appealing. This policy support aligns with widespread public awareness of environmental issues and a preference for eco-friendly mobility. As a result, electric bikes and scooters are increasingly embraced by individuals and businesses alike. Employers and delivery services are adopting electric models to meet sustainability targets, while urban planning favors non-car transport, reinforcing the shift. Together, government incentives, public values, and environmental goals create a powerful ecosystem that supports the growth of electric two-wheelers as a practical, clean, and socially responsible mode of transport across both personal and commercial sectors.

Netherlands Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped, and electric motorcycle.

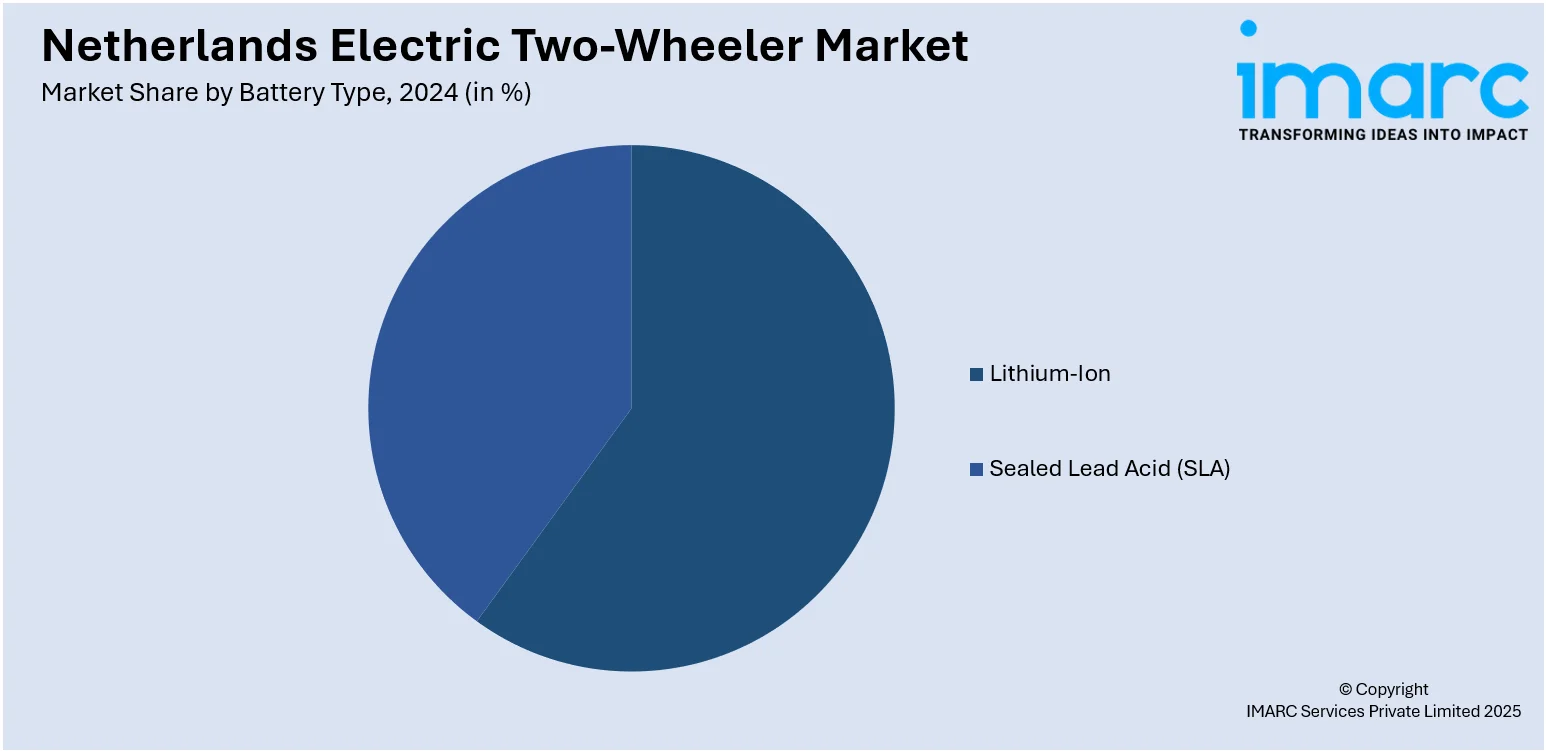

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion, and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable, and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type, and chassis mounted.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Electric Two-Wheeler Market News:

- In July 2025, The Selana Alpha become the first e-scooter legally approved for public roads and bike lanes in the Netherlands, marking a major milestone for micromobility. Developed by startup Selana, the scooter received RDW approval and its first blue license plate, classifying it as a light motor vehicle. This breakthrough follows six years of regulatory work, opening the door for broader e-scooter adoption in the Dutch transport landscape.

- In June 2025, Zero Motorcycles launched a pilot ‘Click & Collect’ program exclusively in the Netherlands, offering customers a new way to buy electric motorcycles. Shoppers can browse and purchase bikes and accessories online, then pick up their orders at a local Zero dealer—combining digital ease with expert service. The program maintains in-store buying as an option and marks the brand’s first initiative of this kind in Europe, blending convenience with trusted dealer support.

Netherlands Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Netherlands electric two-wheeler market on the basis of battery type?

- What is the breakup of the Netherlands electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Netherlands electric two-wheeler market on the basis of peak power?

- What is the breakup of the Netherlands electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Netherlands electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Netherlands electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Netherlands electric two-wheeler market?

- What are the key driving factors and challenges in the Netherlands electric two-wheeler market?

- What is the structure of the Netherlands electric two-wheeler market and who are the key players?

- What is the degree of competition in the Netherlands electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)