Netherlands Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Netherlands Foreign Exchange Market Overview:

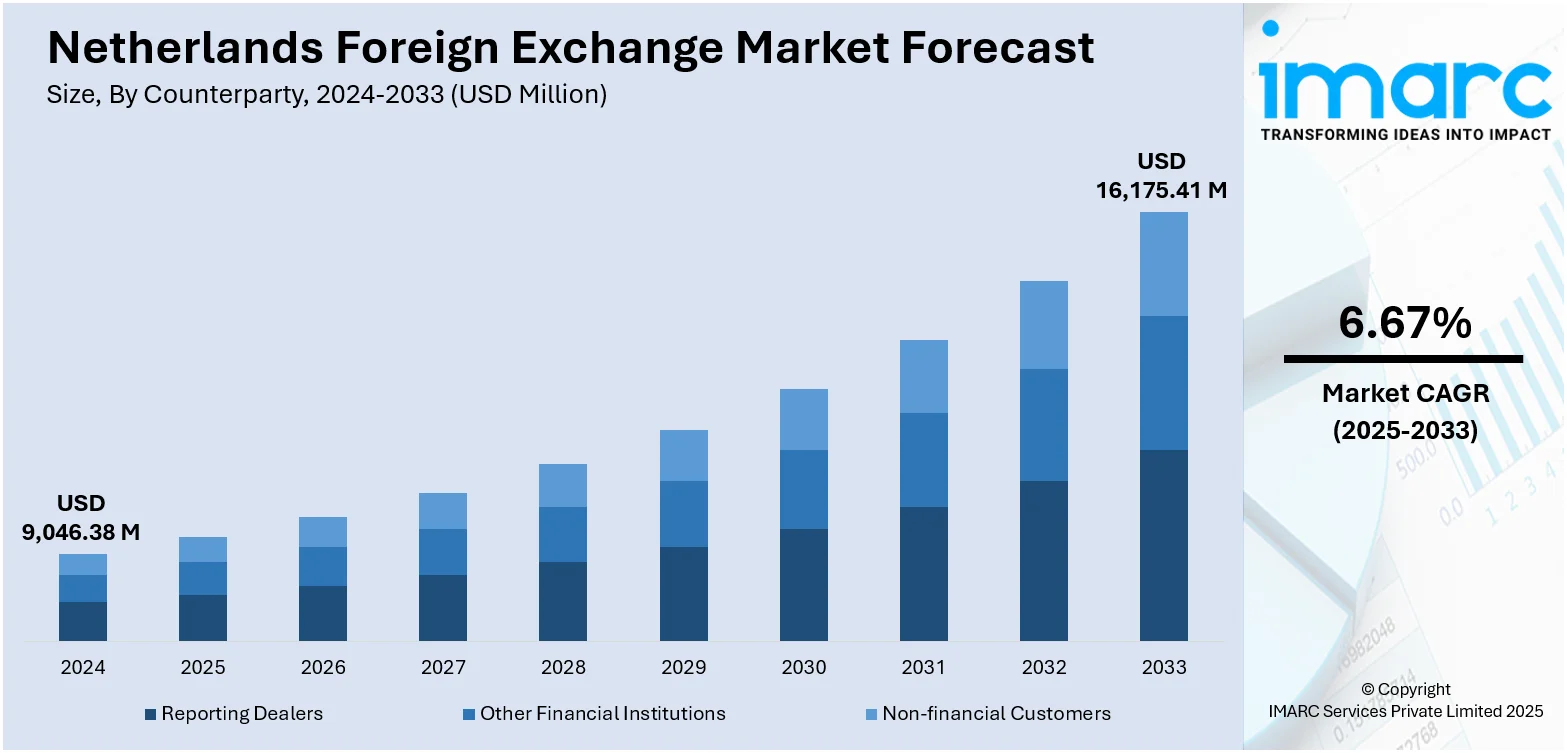

The Netherlands foreign exchange market size reached USD 9,046.38 Million in 2024. The market is projected to reach USD 16,175.41 Million by 2033, exhibiting a growth rate (CAGR) of 6.67% during 2025-2033. The market is fueled by the country's strong trade surplus, which necessitates frequent currency exchanges, particularly involving the euro, U.S. dollar, and emerging market currencies. Further, a robust financial services sector further supports high forex transaction volumes and institutional participation. Besides that, increased adoption of digital trading platforms and fintech innovations has enhanced accessibility and efficiency, which is a significant factor augmenting the Netherlands foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9,046.38 Million |

| Market Forecast in 2033 | USD 16,175.41 Million |

| Market Growth Rate 2025-2033 | 6.67% |

Netherlands Foreign Exchange Market Trends:

Digital Transformation and Algorithmic Trading Integration

The market is undergoing a paradigm shift with the integration of digital technologies and algorithmic trading platforms. Moreover, automated trading platforms that employ artificial intelligence (AI) and machine learning (ML) to make high-frequency, low-latency trades are being adopted by Dutch financial institutions. Such platforms can process enormous datasets, detect mispricing’s, and respond to market changes within milliseconds, improving trading accuracy and minimizing human error. Besides this, the growth of Application Programming Interfaces (APIs) and cloud infrastructure is further facilitating interconnectivity between liquidity providers, trading venues, and institutional investors has also been made possible. Apart from this, Amsterdam, established as a fintech EU financial technology hub, has drawn several forex-specialized fintech startups with smart execution platforms, risk management software, and real-time analytics dashboards. These technologies are also enhancing retail investor participation through the ease of access to currency markets via web and mobile interfaces.

To get more information on this market, Request Sample

Growing Role of Sustainable Finance and ESG-linked Currency Instruments

The increasing incorporation of environmental, social, and governance (ESG) criteria into financial products, including currency-linked instruments, is positively impacting the Netherlands foreign exchange market growth. Additionally, Dutch banks and institutional investors are actively engaging in sustainable finance by issuing green bonds and ESG-linked loans denominated in multiple currencies, thereby necessitating greater forex operations to hedge against currency risk. Also, currency swaps and forward contracts are frequently employed to manage the exposure tied to foreign-denominated sustainable investments. Additionally, the country's leadership in climate-focused initiatives and its alignment with the EU Green Deal are attracting international investors who seek ESG-compliant opportunities, leading to rising cross-border capital inflows and subsequent foreign exchange activity. The demand for ESG-oriented hedging tools is expected to continue influencing currency market volumes, driving innovation in sustainable financial instruments across multiple currency pairs within the Dutch forex ecosystem.

Increased Forex Market Participation from Dutch Exporters and SMEs

A growing trend in the market is the increasing participation of Dutch exporters and small to medium-sized enterprises (SMEs) in currency risk management and forex transactions. As a highly export-oriented economy, the Netherlands maintains substantial trade relationships with non-eurozone countries, making Dutch businesses vulnerable to currency fluctuations. SMEs, traditionally less active in hedging, are now becoming more engaged in forex markets due to heightened exchange rate volatility and global supply chain uncertainties. This shift is driven by greater awareness of currency exposure risks and the availability of tailored financial instruments such as forward contracts, options, and multi-currency accounts. Moreover, Dutch banks and fintech firms are responding with accessible hedging solutions, educational resources, and user-friendly platforms that cater specifically to the needs of SMEs. In addition to this, the government's support for digitalization in the business sector, combined with the Netherlands' robust trade infrastructure, has further facilitated this participation. As these enterprises expand into new international markets, their forex trading volumes contribute to the overall liquidity and diversification of the market.

Netherlands Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

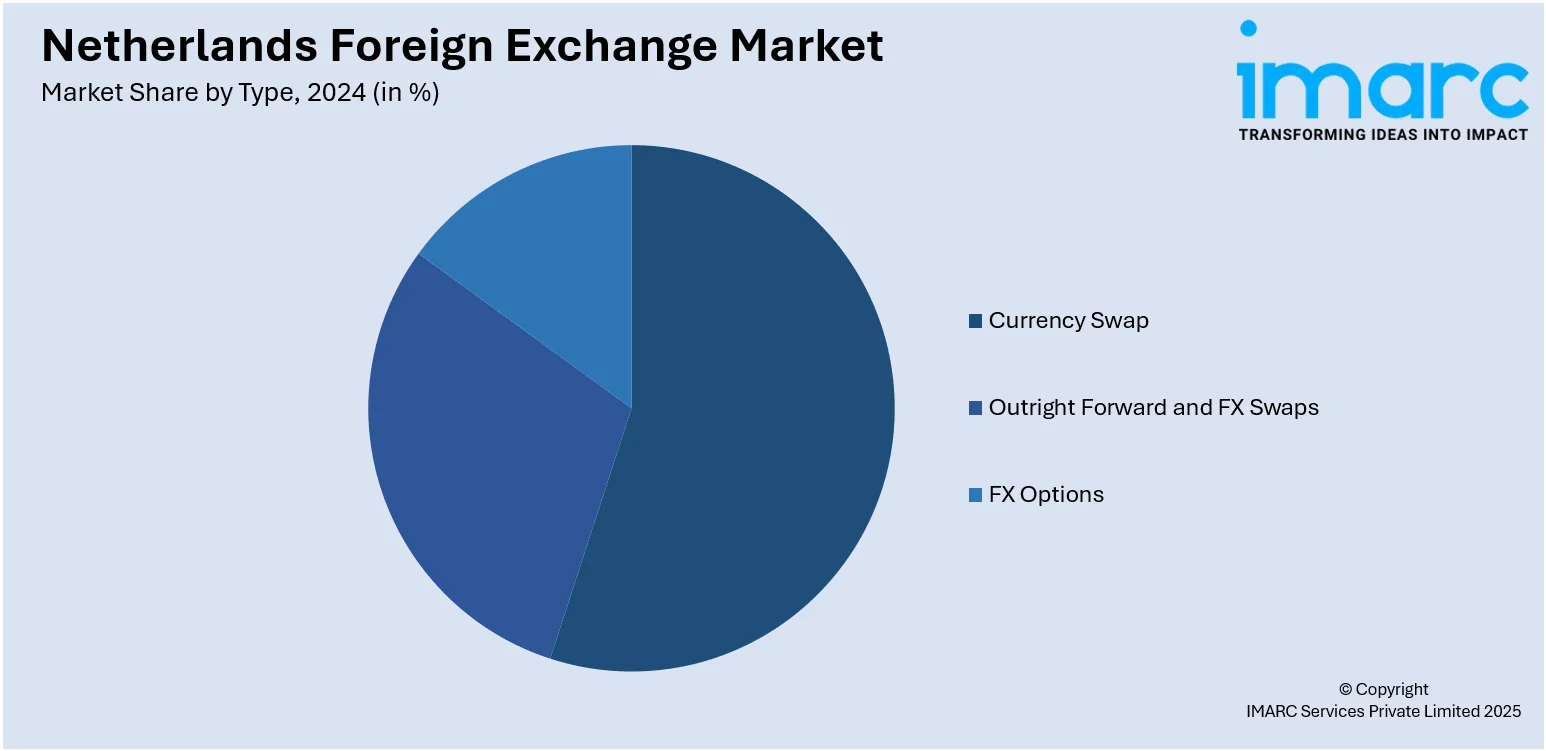

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Foreign Exchange Market News:

- June 2025: ABN AMRO announced its successful transition from a third-party participant to a direct settlement member of CLS Bank’s foreign exchange clearing network. This advancement was facilitated by CGI through the implementation of its CLS Manager solution, which strengthens control, automates processes, and enhances the monitoring and reconciliation of FX settlements. ABN AMRO completed its first successful CLS settlement in May 2025, a move expected to significantly reduce foreign exchange settlement risk and improve operational efficiency for both the bank and its clients.

- October 2024: Travelex introduced an FX home-currency delivery pilot in the Netherlands, targeting customers in the Randstad region who order EUR 600 or more in foreign cash. Eligible households receive complimentary home delivery, adding to Travelex’s existing click‑and‑collect pre‑trip service. The initiative follows the success of its UK model and reflects Travelex’s strategy to cater to pre‑travel currency needs with greater convenience.

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands foreign exchange market on the basis of counterparty?

- What is the breakup of the Netherlands foreign exchange market on the basis of type?

- What is the breakup of the Netherlands foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Netherlands foreign exchange market?

- What are the key driving factors and challenges in the Netherlands foreign exchange market?

- What is the structure of the Netherlands foreign exchange market and who are the key players?

- What is the degree of competition in the Netherlands foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)