Netherlands Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Province, 2025-2033

Netherlands Health and Wellness Market Overview:

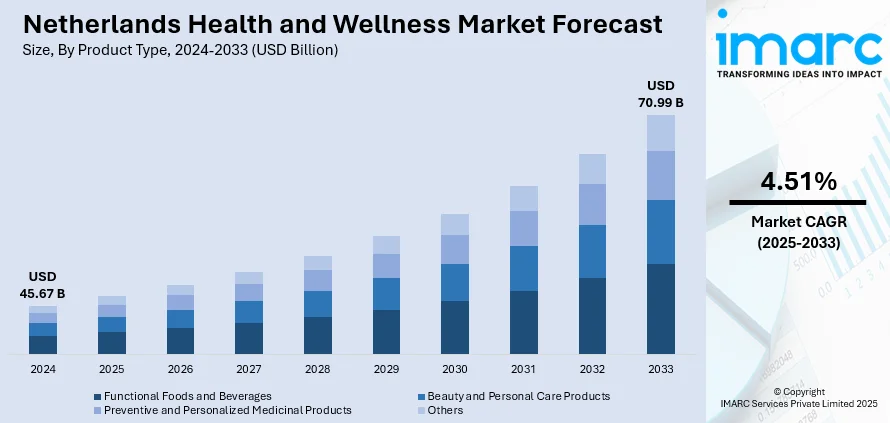

The Netherlands health and wellness market size reached USD 45.67 Billion in 2024. Looking forward, the market is expected to reach USD 70.99 Billion by 2033, exhibiting a growth rate (CAGR) of 4.51% during 2025-2033. The market is fueled by increasing consumer concern for preventive healthcare, an uptick in demand for plant-based and organic food products, and high government promotion of sustainable lifestyles. The country's strong digital infrastructure also supports easy access to telehealth and wellness technologies across the board. Green and active mobility-focused urban planning encourages comprehensive well-being. Advancements in personalized diet and environmentally sustainable food production appeal strongly to Dutch consumers, further contributing to consistent expansion in the Netherlands health and wellness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 45.67 Billion |

| Market Forecast in 2033 | USD 70.99 Billion |

| Market Growth Rate 2025-2033 | 4.51% |

Netherlands Health and Wellness Market Trends:

Sustainable Nutrition and Plant-Based Innovation

In the Netherlands, sustainability and plant-based eating have become the hallmark themes in the health and wellness sector. Dutch consumers are keen on products that support environmental agendas and ethical sourcing, and thus plant-based versions of dairy, meat, and seafood staples are common in many families. Industry surveys indicate that the percentage of people in the Netherlands who identify as "vegetarian" or "vegan" is stable at about 20%, however, many stakeholders believe that by marketing plant-based proteins to the general public, there is potential to improve their presence in the diet. Hence, domestic firms are testing new formulations like algae-based protein beverages, oat-based yogurts mixed with Dutch-cultivated berries, and cashew and amaranth-based vegan cheese products. The innovations tap into the Netherlands' rich research heritage in agriculture and greenhouse production methods, marrying nutrition with sustainable agriculture practices. Amsterdam, Utrecht, and Rotterdam supermarkets have large plant-based offerings, while farmers' markets display innovative vegan options in addition to conventional products. Additionally, cafés and juice bars are offering clean-label, functional plant-based bowls and elixirs, addressing nutrition, gut health, and energy balance.

To get more information on this market, Request Sample

Mental Well-Being and Preventive Urban Health

Mental health has come into focus in the Netherlands, reflecting international awareness with distinctly Dutch characteristics influenced by local culture and city layout. Amsterdam, Eindhoven, and Groningen cities are increasing mental well-being services ranging from mindfulness centers and stress-coaching to nature therapy in city parks and green zones. Cities deliberately integrate parks and wellness trails into urban planning, furthering public access to mental health-promoting spaces. Companies and municipal governments partner on citywide health programs like "healthy office" accreditation, yoga offered by employers near canals, and work-life balance-based mindfulness programs that merge heritage culture. Wellness festivals in spaces like Utrecht's botanical garden feature workshops in nature therapy and creative arts to spotlight the importance of creativity and outdoor spaces in mental resilience. Digital technologies, such as Dutch-language wellness apps for meditation and mood tracking, leverage these efforts by supporting behavior change in daily habits. These strategies show a distinctive Netherlands model of mental well-being: preventive, accessible, and combined with high-quality urban living, which further contributes to the Netherlands health and wellness market growth.

Tech-Enabled Personalized Health and Telemedicine

The Netherlands is quickly adopting technology to enable personalized health and wellness, leveraging its highly developed digital infrastructure and centralized healthcare system. Telemedicine platforms are now the norm in cities like The Hague, Maastricht, and Arnhem, with virtual consultations, remote physiotherapy, and personalized nutrition planning. Wearable health monitors and connected apps are integrated into national wellness initiatives enabling individuals to monitor vitals, activity, and stress, with resulting feedback loops connected to Dutch healthcare providers. This integration enables population-scale preventive care and chronic disease management in urban and regional populations. At the same time, Dutch startups are using genetic testing and microbiome analysis to provide individually customized dietary and exercise plans to consumers, who value individualized relevance. Genetic knowledge is more and more being tapped by nutrigenomics firms for tailoring supplement and food suggestions based on regional diets and genetic susceptibilities. This convergence of preventive medicine, data-driven knowledge, and virtual delivery marks a contemporary, precision-oriented age in the Netherlands' health and wellness industry one that espouses personalization, innovation, and accessibility under the umbrella of public good.

Netherlands Health and Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and functionality.

Product Type Insights:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes functional foods and beverages, beauty and personal care products, preventive and personalized medicinal products, and others.

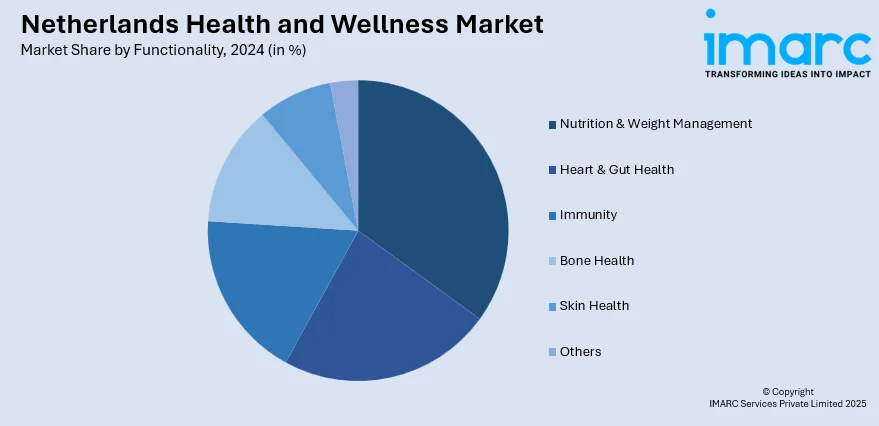

Functionality Insights:

- Nutrition & Weight Management

- Heart & Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

A detailed breakup and analysis of the market based on the functionality has also been provided in the report. This includes nutrition & weight management, heart & gut health, immunity, bone health, skin health, and others.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Health and Wellness Market News:

- In April 2024, Tezman Holding, a diverse holding company marking its 76th anniversary, revealed the establishment of Nutrafine Health, a fresh nutraceutical venture in the Netherlands. We met with Selim Tezman, Executive Board Member of Tezman Holding, to talk about the launch, Nutrafine Health’s goals, and the future plans of Tezman Holding.

Netherlands Health and Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition & Weight Management, Heart & Gut Health, Immunity, Bone Health, Skin Health, Others |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands health and wellness market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands health and wellness market on the basis of product type?

- What is the breakup of the Netherlands health and wellness market on the basis of functionality?

- What is the breakup of the Netherlands health and wellness market on the basis of province?

- What are the various stages in the value chain of the Netherlands health and wellness market?

- What are the key driving factors and challenges in the Netherlands health and wellness market?

- What is the structure of the Netherlands health and wellness market and who are the key players?

- What is the degree of competition in the Netherlands health and wellness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands health and wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands health and wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)