Netherlands Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Netherlands Home Decor Market Overview:

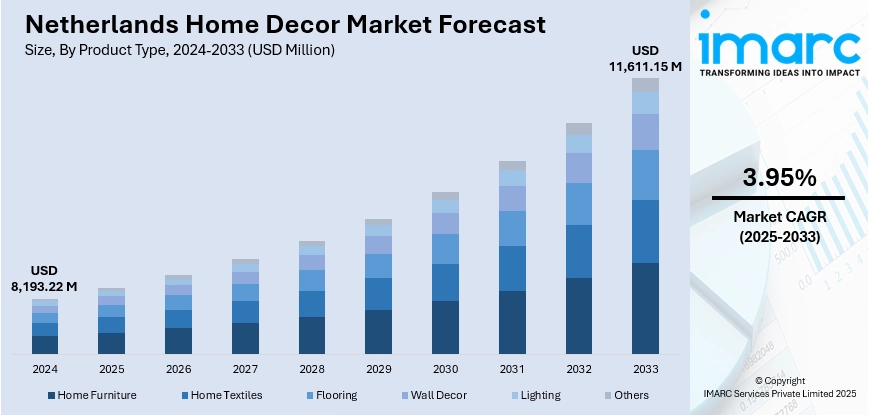

The Netherlands home decor market size reached USD 8,193.22 Million in 2024. The market is projected to reach USD 11,611.15 Million by 2033, exhibiting a growth rate (CAGR) of 3.95% during 2025-2033. Rising disposable incomes, rapid urbanization, and digital adoption are fueling demand for stylish, functional furnishings. In addition, growing consumer demand for sustainable, premium-quality products and personalized designs, along with rapid e-commerce expansion are playing a crucial role in propelling Netherlands home decor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,193.22 Million |

| Market Forecast in 2033 | USD 11,611.15 Million |

| Market Growth Rate 2025-2033 | 3.95% |

Netherlands Home Decor Market Trends:

Sustainable and Eco‑conscious Materials

Dutch consumers increasingly prioritize home furnishings crafted from recyclable, responsibly sourced, and low‑VOC materials. Sustainability is central, manufacturers frequently use FSC‑certified wood, recycled metals, or upcycled textiles to align with environmental values. The emphasis on "green living" lends Dutch brands a competitive edge, as noted in market reports highlighting consumer demand for eco‑friendly furniture. ECO‑certifications have become an influential purchasing criterion, with buyers placing trust in verified standards. Retailers, both online and offline, are showcasing product lines that meet these sustainability benchmarks, supported by eco‑labelling and transparent supply chains. This trend reflects broader European green policies and resonates strongly in the Netherlands’ context of high environmental awareness. For instance, in June 2025, Deli Home achieved 100% FSC and PEFC certification across its entire European wood-based product range, covering nearly 9,000 items from 300 suppliers. This milestone supports its net-zero ambitions and sustainability goals. The company remains committed to certified wood as the future of building.

To get more information on this market, Request Sample

Rise of Online and Omnichannel Retail

The Netherlands is experiencing a rise in online shopping for home décor and furniture, driven by convenience, broad product choices, and competitive pricing. Although the home furnishing sector saw a temporary drop in e‑commerce turnover, hybrid retail models combining digital with showroom experiences are regaining momentum. Major players like IKEA, Home24, and Beliani are investing in digital platforms, VR/AR visualization, and seamless click‑and‑collect services. This integration of online and offline channels enhances personalization, reduces returns, and improves customer satisfaction. The trend supports niche and design‑led brands to expand reach without heavy physical infrastructure investment, bolstering Netherlands home decor market growth. For instance, in July 2025, BOLTZE launched its Spring/Summer 2026 digital showroom, offering a 3D virtual tour with lifelike detail. Retailers can explore decorative items, seasonal themes, and stylish accessories anytime. The showroom supports quick decision-making and inspiration. It reflects BOLTZE’s commitment to efficiency and trend-driven merchandising for global B2B clients.

Netherlands Home Decor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/province levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes home furniture, home textiles, flooring, wall decor, lighting, and others.

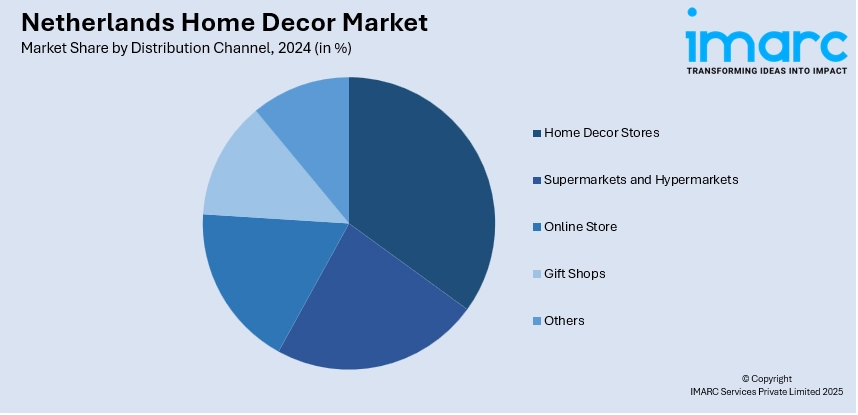

Distribution Channel Insights:

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home decor stores, supermarkets and hypermarkets, online store, gift shops, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Home Decor Market News:

- In July 2025, Dutch Interior relaunched iconic Dutch lifestyle brand Rivièra Maison, giving it a new future under its established home‑furnishings group. Dutch Interior will revive the brand through its strong domestic and international dealer network, intentionally foregoing ownership of the original Rivièra Maison stores.

- In January 2024, Signify introduced new Philips Hue products designed for flexible, personalized lighting and home security. The Dymera wall light offers independently controlled up-and-down beams for indoor and outdoor use. The pendant cord, made with bio-circular materials, complements Filament bulbs. Perifo track lighting connectors allow for custom layouts, including ceiling-to-wall setups. Updates also include expanded finishes for the Being ceiling light and new grip colors for the Go portable lamp. Philips Hue Secure adds smart cameras, sensors, and app-based alerts, integrating lighting with home security.

Netherlands Home Decor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands home decor market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands home decor market on the basis of product type?

- What is the breakup of the Netherlands home decor market on the basis of distribution channel?

- What is the breakup of the Netherlands home decor market on the basis of region?

- What are the various stages in the value chain of the Netherlands home decor market?

- What are the key driving factors and challenges in the Netherlands home decor market?

- What is the structure of the Netherlands home decor market and who are the key players?

- What is the degree of competition in the Netherlands home decor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands home decor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands home decor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands home decor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)