Netherlands Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Netherlands Insurtech Market Overview:

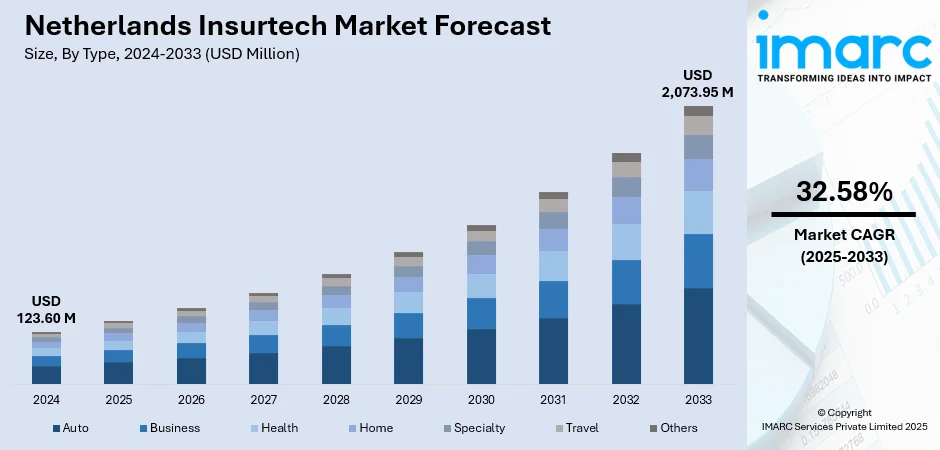

The Netherlands Insurtech market size reached USD 123.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,073.95 Million by 2033, exhibiting a growth rate (CAGR) of 32.58% during 2025-2033. Investment in the market is growing, supported by venture capital interest and technological innovation. Additionally, the strategic use of big data enables improved risk assessment, personalized offerings, and enhanced operational efficiency, is contributing to the expansion of the Netherlands Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 123.60 Million |

| Market Forecast in 2033 | USD 2,073.95 Million |

| Market Growth Rate 2025-2033 | 32.58% |

Netherlands Insurtech Market Trends:

Increased Investment and Venture Capital Interest

Investment in the Insurtech sector of the Netherlands is rising rapidly, driven by the growing enthusiasm from venture capital companies and private equity backers. The possibility of substantial profits and the swift rate of innovation in the insurance industry are drawing considerable investment. Investors are especially interested in startups that utilize new technologies to challenge conventional insurance frameworks. This rise in funding is enabling Insurtech firms to grow rapidly, enhance their technological capabilities, and expand their product range. In 2024, the Dutch insurance analytics firm Onesurance secured a seed funding round led by Curiosity VC to boost growth and enhance its AI-driven platform. The platform, used by insurers and brokers in Belgium and the Netherlands, aimed to enhance risk evaluation, forecast client turnover, and improve profitability monitoring. The extra funding enabled Onesurance to enhance operational efficiency and advance its global expansion. The growing investment in this sector is not only helping existing companies innovate but is also encouraging new entrepreneurs to enter the market, increasing competition and further accelerating innovation within the industry. This environment of sustained investment is fostering a thriving ecosystem for Insurtech firms in the Netherlands, positioning the country as a key hub for Insurtech innovation in Europe.

To get more information on this market, Request Sample

Data-Driven Decision Making

The ability to leverage big data is becoming a crucial factor impelling the Netherlands Insurtech market growth, as it enables insurers to enhance risk assessment, personalize offerings, and improve operational efficiency. Insurtech firms are utilizing large volumes of data to improve their risk evaluations, optimize pricing strategies, and provide more tailored insurance offerings. This data-focused method enables insurers to examine user patterns, market dynamics, and outside influences to provide precise, customized policies that address unique individual requirements. For instance, in 2025, Insurtech Ominimo secured its first external investment from Zurich Insurance Group, which acquired a 5% stake for €10 million, valuing the startup at €200 million. Already profitable, Ominimo plans to expand its AI-powered car insurance model from Hungary into the Netherlands. The company uses advanced data analytics to transform risk pricing and attract top-tier talent. This shift towards data-informed decision-making is transforming how insurers in the Netherlands create, advertise, and sell their offerings, departing from conventional frameworks. Data analytics enables companies to make informed decisions, allowing Insurtech firms to enhance operational efficiency, improve risk management, and better fulfill user expectations. With leading companies advancing innovation through the strategic application of big data, they are establishing new benchmarks for the development and delivery of insurance products in the Netherlands.

Netherlands Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

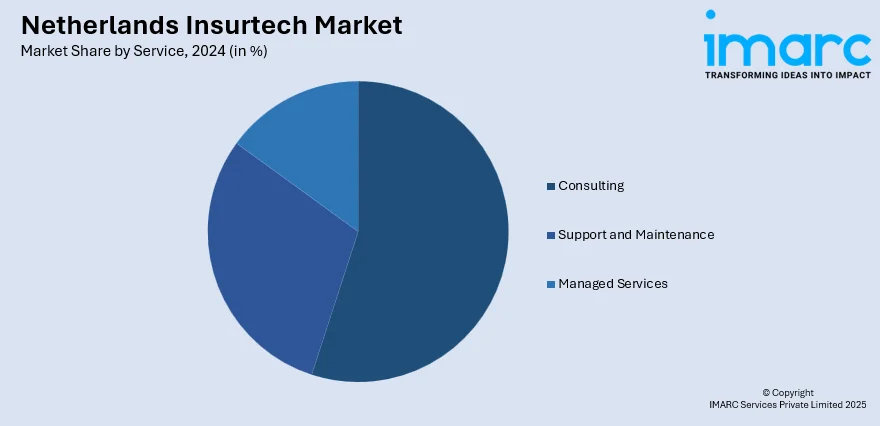

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Insurtech Market News:

- In May 2025, Amsterdam-based Insurtech startup MarvelX announced raising €5.4 million in funding led by EQT Ventures to launch ClaimOS MaX, an AI platform designed to automate and streamline insurance workflows. MarvelX aims to replace manual tasks with intelligent AI systems, improving efficiency, fraud detection, and client communication in insurance. The company focuses on transforming legacy systems to enhance decision-making and reduce operational costs for insurers.

- In August 2024, Swedish Insurtech EIR announced its expansion into the Netherlands, Finland, and Greece after achieving profitability. The company focused on creating innovative insurance solutions through partnerships.

Netherlands Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands Insurtech market on the basis of type?

- What is the breakup of the Netherlands Insurtech market on the basis of service?

- What is the breakup of the Netherlands Insurtech market on the basis of technology?

- What is the breakup of the Netherlands Insurtech market on the basis of region?

- What are the various stages in the value chain of the Netherlands Insurtech market?

- What are the key driving factors and challenges in the Netherlands Insurtech market?

- What is the structure of the Netherlands Insurtech market and who are the key players?

- What is the degree of competition in the Netherlands Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)