Netherlands Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Netherlands Luxury Fashion Market Overview:

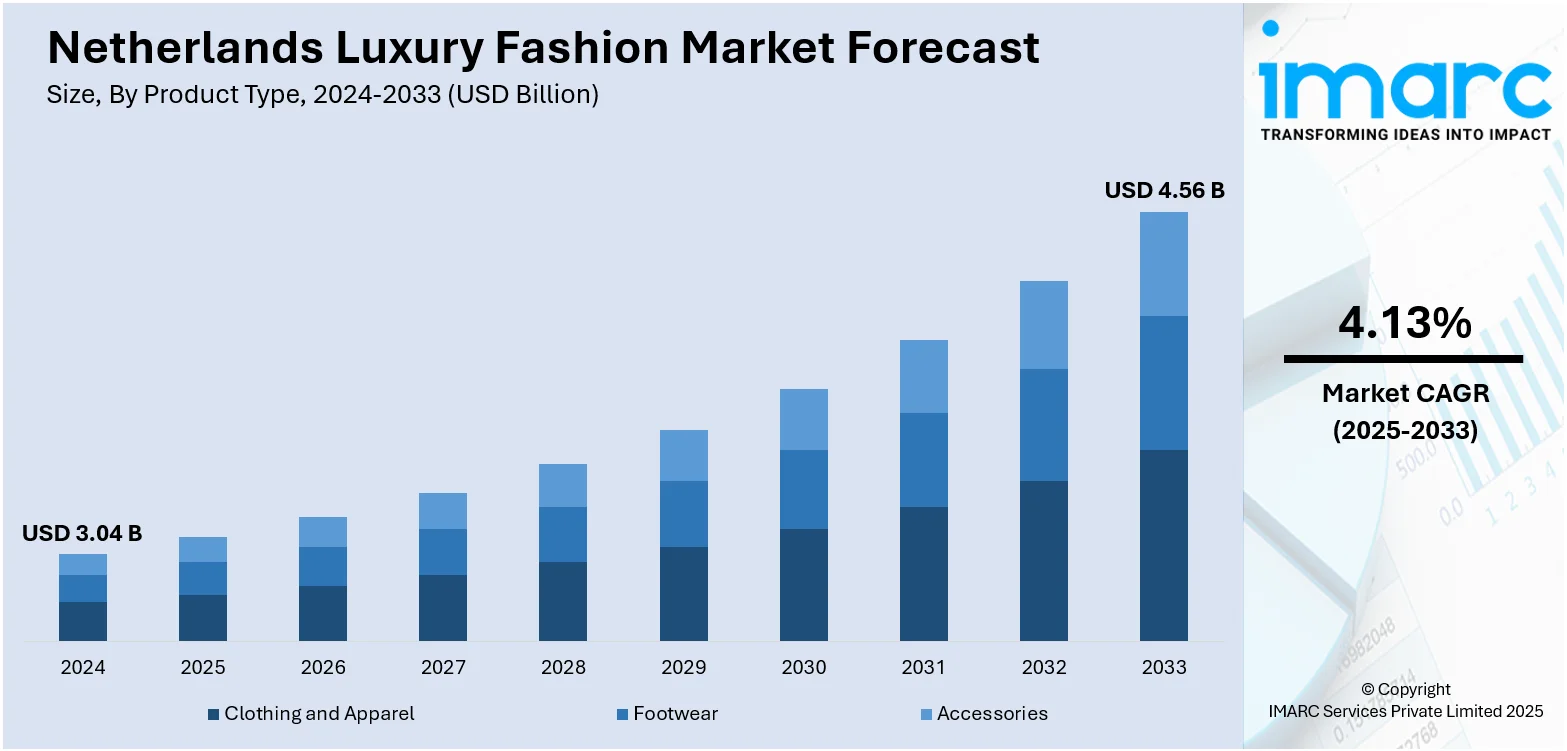

The Netherlands luxury fashion market size reached USD 3.04 Billion in 2024. The market is projected to reach USD 4.56 Billion by 2033, exhibiting a growth rate (CAGR) of 4.13% during 2025-2033. The market is fueled by high disposable income levels, a strong tourism sector, and a growing preference for premium goods among younger consumers. Further, the demand is supported by digital innovations and online platforms that enhance brand visibility and accessibility. Apart from this, strategic collaborations between global fashion houses and Dutch designers are strengthening local relevance and consumer engagement, which is a significant factor augmenting the Netherlands luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.04 Billion |

| Market Forecast in 2033 | USD 4.56 Billion |

| Market Growth Rate 2025-2033 | 4.13% |

Netherlands Luxury Fashion Market Trends:

Sustainability and Ethical Sourcing

Sustainability has become a central concern for luxury fashion consumers in the Netherlands. Increasing awareness around climate change, carbon emissions, and labor practices is influencing purchase decisions across high-income consumer segments. Moreover, Dutch consumers, particularly Millennials and Gen Z, are scrutinizing the origin of materials, the treatment of workers, and the lifecycle of products. As a result, brands are being compelled to adopt transparent sourcing methods, invest in traceability technologies, and obtain certifications. Apart from this, companies operating in the Dutch luxury space are integrating circular fashion principles, offering repair services, rental options, and resale platforms. Furthermore, implementation of favorable initiatives is also gaining attention, as they align with EU-wide regulatory trends. The Netherlands has set ambitious circular economy (CE) targets, including cutting raw material consumption by 50% by 2030 and achieving a fully circular economy by 2050. These goals have been refined over time, with the most recent update outlined in the National Circular Economy Program (NCPE) 2023–2030. The program focuses on four overarching objectives: reducing the use of raw materials, promoting the substitution of virgin materials, extending product lifespans, advancing high-quality material processing, and enhancing waste separation practices among citizens. The government's push for circular economy is putting additional pressure on brands to reduce waste and improve recyclability. Luxury labels that actively demonstrate environmental and ethical responsibility are seeing stronger brand loyalty and consumer trust in this increasingly value-driven market.

To get more information on this market, Request Sample

Digital Personalization and AI Integration

The integration of artificial intelligence (AI) and data analytics is reshaping the way luxury fashion is marketed and sold in the Netherlands. This trend is providing a boost to the Netherlands luxury fashion market growth. This technological shift aligns with the country's strong digital foundation. As per industry report, about 82.7% of its population possesses at least basic digital skills, the highest in the European Union—making the Dutch market highly receptive to digitally driven experiences. As a result, luxury brands are increasingly adopting AI-powered tools to meet the expectations of tech-savvy consumers. Personalized engagement is becoming a core differentiator, with AI enabling brands to deliver tailored recommendations, virtual styling support, and curated content based on real-time behavioral insights and purchase history. This level of customization is helping luxury labels build deeper relationships with their clientele, reinforcing brand loyalty in a market that values both innovation and exclusivity. Besides this, luxury retailers are also deploying virtual try-on features and 3D visualization to simulate the in-store experience digitally. Apart from this, back-end applications of AI, such as optimized inventory management and predictive analytics, are helping brands align their supply with demand, reducing overproduction and aligning with sustainability goals.

Netherlands Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

Distribution Channel Insights:

- Store-Based

- Non-Store Based

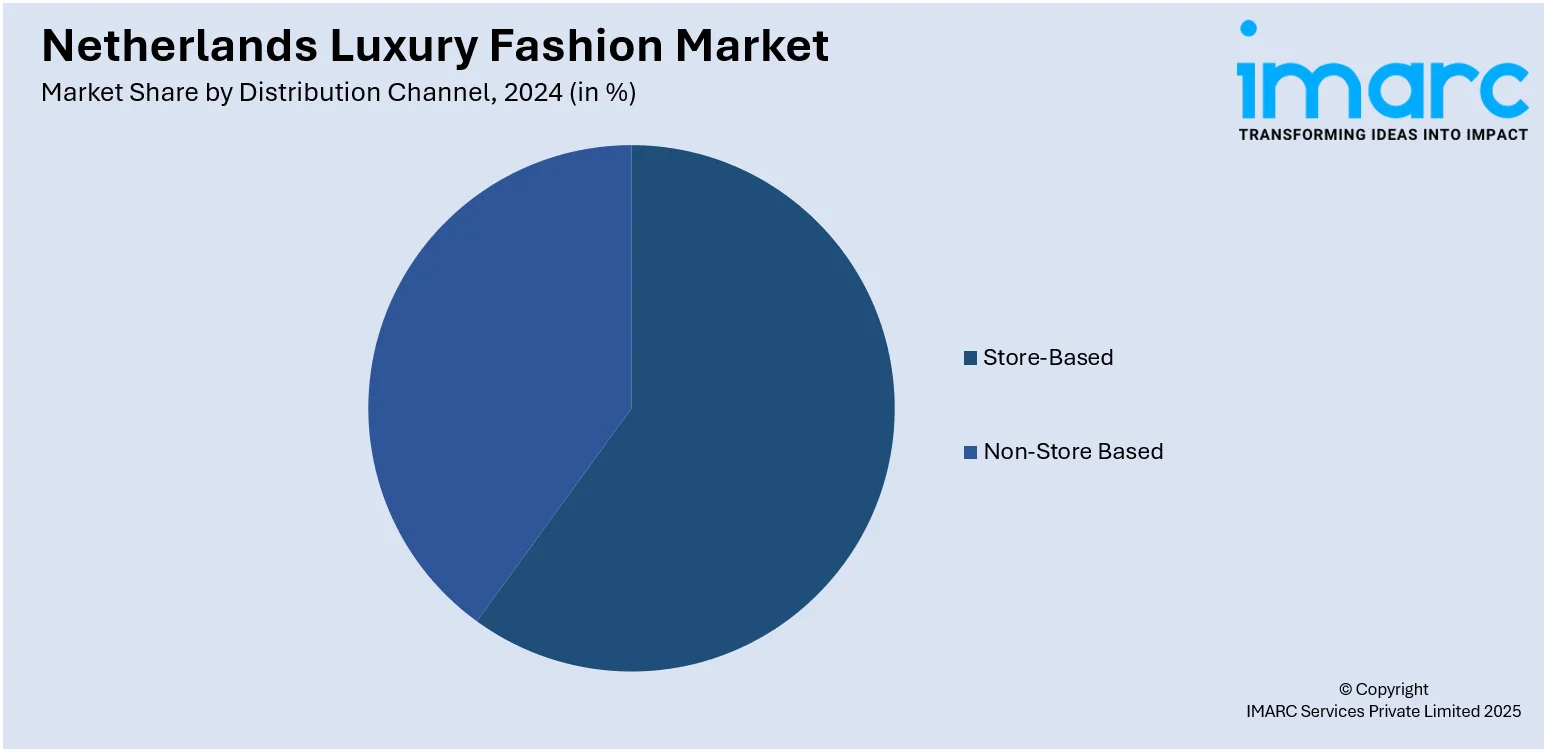

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Luxury Fashion Market News:

- July 2025: Perfect Moment, luxury skiwear and lifestyle label inaugurated a new European distribution hub in the Netherlands, consolidating its former warehouses in the UK and Hong Kong to optimize logistics. The partnership with Geodis is expected to slash delivery touchpoints from factory to customer, reducing costs and simplifying supply chain complexity. This restructuring enhances agility, accelerates delivery timelines, and strengthens the company’s operational foundation.

Netherlands Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands luxury fashion market on the basis of product type?

- What is the breakup of the Netherlands luxury fashion market on the basis of distribution channel?

- What is the breakup of the Netherlands luxury fashion market on the basis of end user?

- What is the breakup of the Netherlands luxury fashion market on the basis of region?

- What are the various stages in the value chain of the Netherlands luxury fashion market?

- What are the key driving factors and challenges in the Netherlands luxury fashion market?

- What is the structure of the Netherlands luxury fashion market and who are the key players?

- What is the degree of competition in the Netherlands luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)