Netherlands Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Netherlands Meat Market Overview:

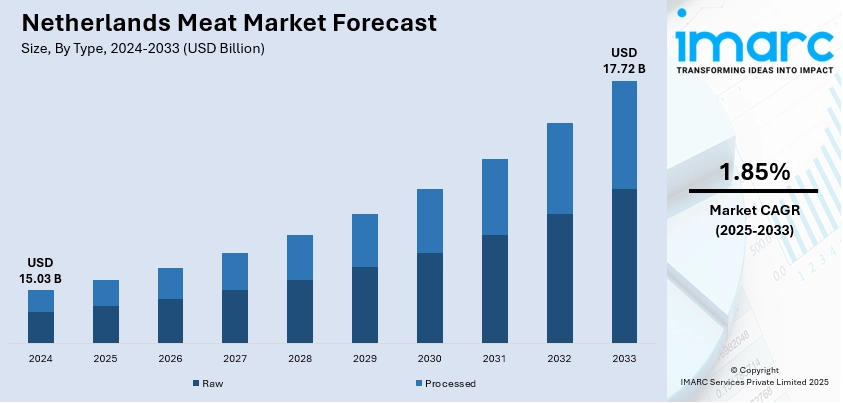

The Netherlands meat market size reached USD 15.03 Billion in 2024. The market is projected to reach USD 17.72 Billion by 2033, exhibiting a growth rate (CAGR) of 1.85% during 2025-2033. The meat market is driven by rising demand for sustainable and ethical production, with consumers favoring animal welfare and eco-friendly practices. Technological advancements, including precision farming and lab-grown meat innovation, enhance efficiency and support alternative protein growth. Additionally, growing health awareness leads consumers to choose leaner meats and reduce processed meat intake, prompting producers to offer healthier, nutrient-enriched options thereby strengthening the Netherlands meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.03 Billion |

| Market Forecast in 2033 | USD 17.72 Billion |

| Market Growth Rate 2025-2033 | 1.85% |

Netherlands Meat Market Trends:

Growing Demand for Sustainable and Ethical Meat Production

The Netherlands meat market is evolving as consumer awareness of sustainability and animal welfare continues to grow. In 2024, Dutch protein intake remained 60% animal-based and 40% plant-based, with only a modest shift from previous years, despite plant-based options comprising 38% of online supermarket assortments. This indicates a growing, but gradual, transition toward ethical and sustainable protein consumption. Certifications like Beter Leven (Better Life) play a significant role in guiding consumers toward higher welfare products. Environmental concerns especially regarding livestock-related emissions are prompting investment in greener supply chains and practices like regenerative agriculture and reduced packaging waste. EU regulations and national campaigns also bolster the push for responsible meat production. As sustainability becomes a key purchasing factor, companies that adopt transparent and ethical practices gain a market edge. This shift is redefining product development, pricing strategies, and consumer segmentation in the Netherlands market industry.

To get more information on this market, Request Sample

Technological Advancements in Meat Processing and Alternatives

Technology plays a crucial role in shaping the Netherlands meat market trends, both in traditional meat processing and in the growth of alternatives. Netherlands companies are leaders in precision farming, automation, and smart logistics, which improve production efficiency and reduce costs. Meanwhile, innovations in food technology have led to a surge in plant-based and cultured meat options. Firms like Mosa Meat and Meatable are pioneering lab-grown meat, positioning the Netherlands as a global hub for alternative proteins. Consumer interest in high-tech meat substitutes aligns with environmental and health concerns, further supporting this shift. Supermarkets and restaurants increasingly stock these alternatives, integrating them into mainstream diets. At the same time, advancements in cold chain management, traceability tech, and artificial intelligence (AI)-driven supply forecasting enhance meat safety and freshness. These innovations modernize the market, support sustainability goals, and attract investment from both public and private sectors.

Health and Nutrition Awareness Among Consumers

Health consciousness is a powerful driver in the Netherlands meat market. Consumers are scrutinizing meat for its nutritional value, fat content, and impact on long-term health. Red and processed meats, linked to health risks like heart disease and cancer, face declining demand, while leaner options such as chicken and turkey gain popularity. Public health campaigns and changing dietary guidelines encourage reduced meat consumption and the inclusion of plant-based proteins. This shift pushes producers to reformulate products with lower sodium, healthier fats, and cleaner labels. Functional meats enriched with nutrients like omega-3 or reduced cholesterol are also gaining ground. Health trends are especially pronounced among younger and urban populations, who seek convenience without compromising wellness. In response, foodservice providers and retailers are expanding their offerings to include healthier, portion-controlled meat options. This dynamic is reshaping product portfolios and marketing strategies thus contributing to the Netherlands meat market growth.

Netherlands Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

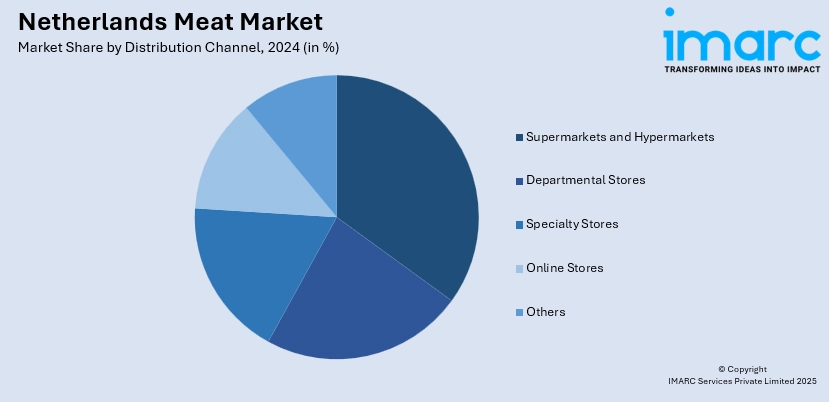

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Meat Market News:

- In January 2025, The Dutch government invested €25M to establish two open-access scale-up facilities for cultivated meat and precision fermentation, reinforcing its leadership in sustainable protein. Developed through a public-private partnership, the hubs—Nizo’s BFF in Ede and Cultivate at Scale in Maastricht—will support startups with affordable infrastructure for R&D and production. Backed by the National Growth Fund and other partners, these facilities aim to accelerate market access and innovation in cellular agriculture.

- In September 2024, Lidl Netherlands launched a hybrid minced meat product blending 60% beef with 40% pea protein, priced 33% lower than regular beef and cutting CO2 emissions by 37.5%. This move supports Lidl’s goal to boost plant-based protein sales to 60% by 2030. Alongside the launch, Lidl permanently reduced prices on plant-based staples to match or undercut animal-based alternatives, making sustainable choices more accessible to consumers.

Netherlands Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands meat market on the basis of type?

- What is the breakup of the Netherlands meat market on the basis of product?

- What is the breakup of the Netherlands meat market on the basis of distribution channel?

- What is the breakup of the Netherlands meat market on the basis of region?

- What are the various stages in the value chain of the Netherlands meat market?

- What are the key driving factors and challenges in the Netherlands meat market?

- What is the structure of the Netherlands meat market and who are the key players?

- What is the degree of competition in the Netherlands meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)