Netherlands Mental Health Market Size, Share, Trends and Forecast by Disorder, Service, Age Group, and Region, 2025-2033

Netherlands Mental Health Market Overview:

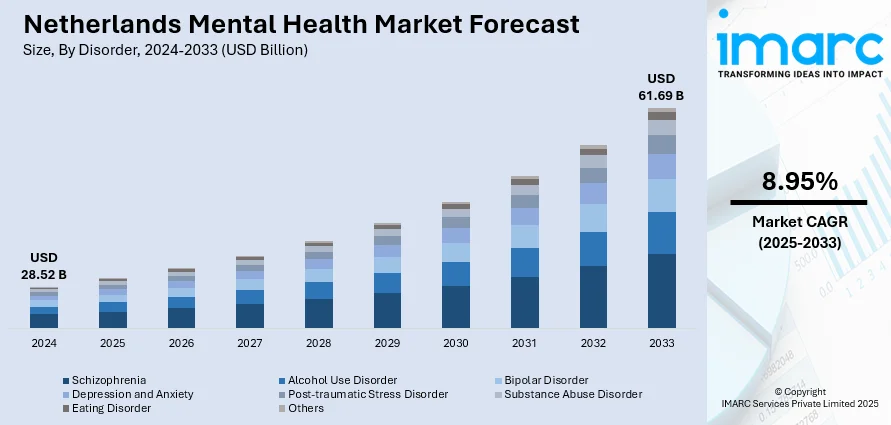

The Netherlands mental health market size reached USD 28.52 Billion in 2024. The market is projected to reach USD 61.69 Billion by 2033, exhibiting a growth rate (CAGR) of 8.95% during 2025-2033. The market is driven by the country's strong healthcare system, with high-quality provision and a strong focus on the rights of patients. Recognition of the need to prioritize mental health has created increased public awareness and decreased stigma. Including mental health treatments in primary care environments also enhanced early intervention and access. Developments in digital health technologies, including telepsychiatry and mental health applications, have increased the accessibility of services, further contributing to the growth of Netherlands mental health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.52 Billion |

| Market Forecast in 2033 | USD 61.69 Billion |

| Market Growth Rate 2025-2033 | 8.95% |

Netherlands Mental Health Market Trends:

Digital Transformation in Mental Health Care

The Netherlands excels at creating a broad digital spectrum of technological applications for mental health services. Project ENYOY is one such initiative, furthering peer-moderated and digital transdiagnostic treatment options for adolescents with developing mental health concerns. Such programs as ENYOY could fill this space in-between child-adolescent and adult psychiatry, ending waiting lists and creating access. Supportive of this, the Dutch government invests in telehealth infrastructure and collaborates with research institutions; thus, it creates a nurturing environment for innovation in mental health services.

To get more information on this market, Request Sample

Integration of Mental Health Services into Primary Care

There has been a strong push in the Netherlands to integrate primary care with mental health services. General practitioners (GPs) today have a central role in the management of mental health as gatekeepers and care coordinators. This integration is backed by guidelines and models that enable GPs and mental health professionals to work collaboratively, delivering a complete package of care to the patient. The integration has also been bolstered with the introduction of mental health nurses in general practices, providing timely and accessible mental health care, and further contributing to the Netherlands mental health market growth.

Public Awareness Campaigns and Cultural Shifts

There is a shift in cultural attitudes towards mental health in the Netherlands, with growing public awareness and acceptance. Self-measurement and self-reflection campaigns such as "HowNutsAreTheDutch" are helping to decrease stigma and increase understanding. A point of view is represented by organizations such as Stichting MIND, whose role is to champion mental health and organize campaigns such as "Blue Monday" to increase awareness and decrease stigma. These initiatives help have a freer conversation about mental illness, creating a positive atmosphere for those in need of assistance.

Netherlands Mental Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the province and regional levels for 2025-2033. Our report has categorized the market based on disorder, service, and age group.

Disorder Insights:

- Schizophrenia

- Alcohol Use Disorder

- Bipolar Disorder

- Depression and Anxiety

- Post-traumatic Stress Disorder

- Substance Abuse Disorder

- Eating Disorder

- Others

The report has provided a detailed breakup and analysis of the market based on the disorder. This includes schizophrenia, alcohol use disorder, bipolar disorder, depression and anxiety, post-traumatic stress disorder, substance abuse disorder, eating disorder, and others.

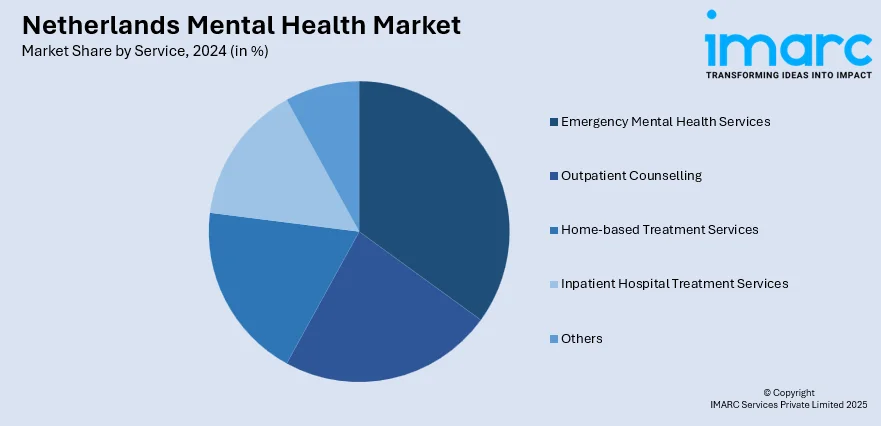

Service Insights:

- Emergency Mental Health Services

- Outpatient Counselling

- Home-based Treatment Services

- Inpatient Hospital Treatment Services

- Others

A detailed breakup and analysis of the market based on the service has also been provided in the report. This includes emergency mental health services, outpatient counselling, home-based treatment services, inpatient hospital treatment services, and others.

Age Group Insights:

- Pediatric

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes pediatric, adult, and geriatric.

Region Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major country markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Mental Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Disorders Covered | Schizophrenia, Alcohol Use Disorder, Bipolar Disorder, Depression and Anxiety, Post-Traumatic Stress Disorder, Substance Abuse Disorder, Eating Disorder, Others |

| Services Covered | Emergency Mental Health Services, Outpatient Counselling, Home-Based Treatment Services, Inpatient Hospital Treatment Services, Others |

| Age Groups Covered | Pediatric, Adult, Geriatric |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands mental health market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands mental health market on the basis of disorder?

- What is the breakup of the Netherlands mental health market on the basis of service?

- What is the breakup of the Netherlands mental health market on the basis of age group?

- What is the breakup of the Netherlands mental health market on the basis of region?

- What are the various stages in the value chain of the Netherlands mental health market?

- What are the key driving factors and challenges in the Netherlands mental health market?

- What is the structure of the Netherlands mental health market and who are the key players?

- What is the degree of competition in the Netherlands mental health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands mental health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands mental health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands mental health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)