Netherlands Office Furniture Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, and Region, 2026-2034

Netherlands Office Furniture Market Overview:

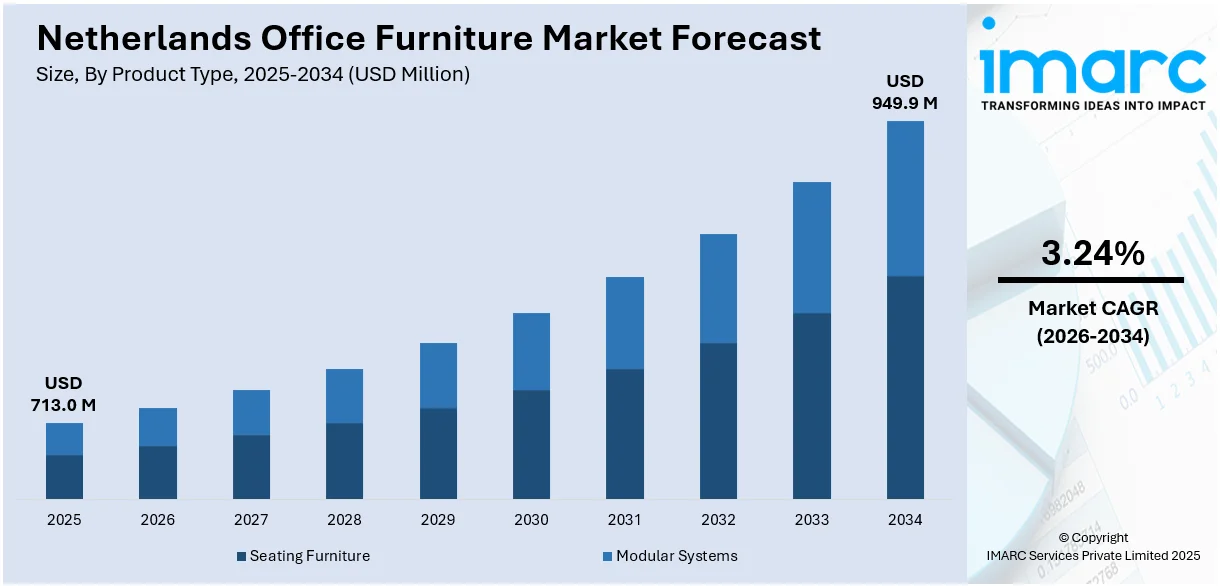

The Netherlands office furniture market size reached USD 713.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 949.9 Million by 2034, exhibiting a growth rate (CAGR) of 3.24% during 2026-2034. The need for agile workspaces in the Netherlands is constantly increasing due to the heightened use of hybrid working patterns. Moreover, the heightened emphasis on sustainability within the Netherlands is positively influencing the market. This trend, along with the focus on employee comfort and well-being at the workplace, is expanding the Netherlands office furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 713.0 Million |

| Market Forecast in 2034 | USD 949.9 Million |

| Market Growth Rate 2026-2034 | 3.24% |

Netherlands Office Furniture Market Trends:

Growing Need for Flexible Workspaces

The need for agile workspaces in the Netherlands is constantly increasing due to the heightened use of hybrid working patterns. Businesses are now more and more relying on office furniture solutions that can be flexibly configured to suit both in-office as well as remote workers. This is inspiring organizations to invest in furniture with flexible layouts, modular configurations, and ergonomic solutions. The changing work environment is catalyzing the demand for office furniture that fosters collaboration, productivity, and employee welfare. As companies shift towards more interactive office spaces, furniture makers are modifying their designs to achieve this new demand, making workplaces adaptive and effective. In addition, the growing emphasis on designing spaces that foster creativity and employee engagement is impacting the market growth. The continuous transformation of workplace design is a major driver of the Netherlands office furniture market. Moreover, Innumerable individuals are working from home and are looking for appropriate office furniture you set up their own home office. The home working allowance was implemented by the Dutch government in January 2022. The objective was to reimburse workers for costs associated with remote work. Originally established at €2.00 in 2022. Subsequently, it shifted to €2.15 daily in 2023, and the allowance rose to €2.35 in 2024. As of January 1, 2025, it is now set at €2.40 each day.

To get more information on this market Request Sample

Rising Focus on Ergonomics and Employee Well-Being

The focus on employee comfort and well-being at the workplace is constantly fueling the Netherlands office furniture market growth. As more companies become aware about the ill effects of slouching posture and hours of sitting, companies are giving more importance to ergonomically designed furniture in order to maintain employee health. This trend encompasses the use of adjustable desks, ergonomic chairs, and specialized accessories that encourage improved posture and minimize the likelihood of musculoskeletal disorders. Subsequently, office furniture makers are constantly evolving, incorporating new ergonomically advanced features in their product offerings. Businesses also look to long-term gains like enhanced productivity as well as lowered absenteeism, which in turn is driving demand for ergonomic solutions. Employee health and productivity will continue to be a key driver in influencing the Netherlands office furniture market, with organizations increasingly looking for ways to provide healthy, comfortable workspaces.

Sustainable and Eco-Friendly Materials

Increased focus on sustainability within the Netherlands is positively influencing the market. Organizations are constantly searching for furniture solutions that are manufactured from sustainable, recyclable, and environment friendly materials in response to heightened environmental consciousness. There is a significant shift towards utilizing sustainably sourced wood, recycled metal, and non-toxic coatings in furniture manufacturing. In addition, as the environment becomes increasingly regulated, companies are prioritizing furniture that meets sustainability standards to further their corporate social responsibility initiatives. Manufacturers of office furniture in the Netherlands are adapting by incorporating greener production methods, using renewable resources, and minimizing waste generation in production. This continued movement toward eco-friendly office furniture is impelling the market growth, as people and companies alike turn to sustainable solutions. In 2025, The Good Plastic Company, located in the Netherlands, announced its plans to redirect plastic waste from oceans and landfills by developing a material known as Polygood, suitable for use in furniture like tables, countertops, walls, and flooring. It has also recently collaborated with global architectural firm Gensler to broaden its range into more elegant designs.

Netherlands Office Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, material type, distribution channel, and price range.

Product Type Insights:

- Seating Furniture

- Modular Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seating furniture and modular systems.

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes wood, metal, plastic and fiber, glass, and others.

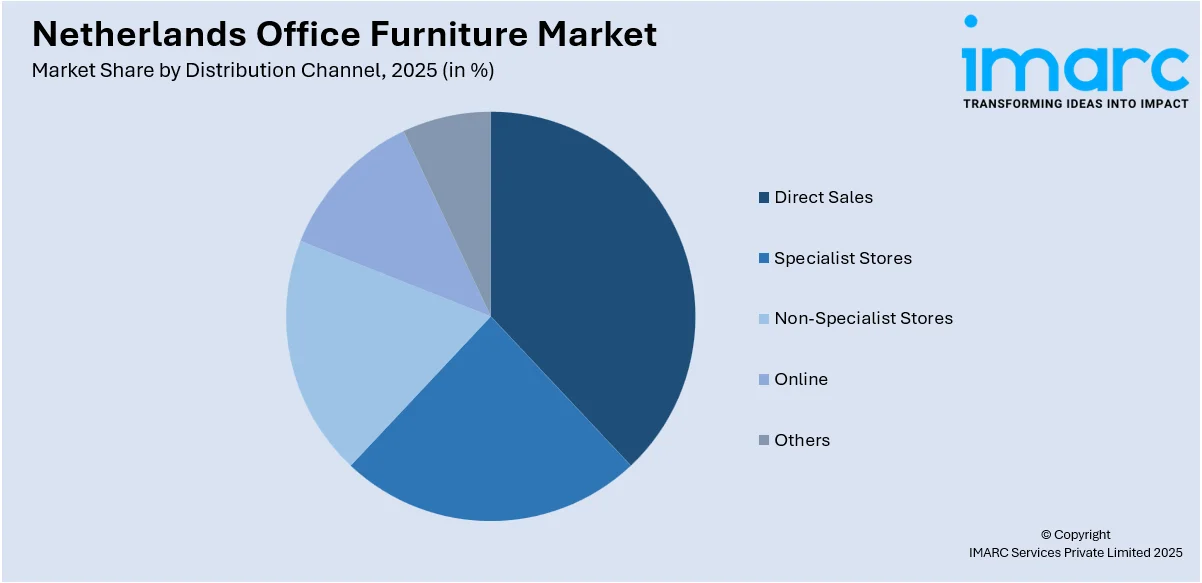

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Specialist Stores

- Non-Specialist Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, specialist stores, non-specialist stores, online, and others.

Price Range Insights:

- Low

- Medium

- High

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low, medium, and high.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Office Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating Furniture, Modular Systems |

| Material Types Covered | Wood, Metal, Plastic and Fiber, Glass, Others |

| Distribution Channels Covered | Direct Sales, Specialist Stores, Non-Specialist Stores, Online, Others |

| Price Ranges Covered | Low, Medium, High |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands office furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands office furniture market on the basis of product type?

- What is the breakup of the Netherlands office furniture market on the basis of material type?

- What is the breakup of the Netherlands office furniture market on the basis of distribution channel?

- What is the breakup of the Netherlands office furniture market on the basis of price range?

- What is the breakup of the Netherlands office furniture market on the basis of region?

- What are the various stages in the value chain of the Netherlands office furniture market?

- What are the key driving factors and challenges in the Netherlands office furniture market?

- What is the structure of the Netherlands office furniture market and who are the key players?

- What is the degree of competition in the Netherlands office furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands office furniture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands office furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)